Weekly Updates - Dec 11, 2022

Selected stock price news highlights of the week

By: Matthew Otto

As the second week has ended retail the trend of positive mixed results and judging firms on an individual basis contrary to a general market trend.

Lululemon athletica reported financial results for the third quarter of 2022

leading CEO Calvin McDonald to comment on their early holiday season success and stunning potential as a brand. Their ongoing achievements are attributed to innovative products, deep relationships with customers worldwide – plus hard work from teams around the globe! They look forward confidently due to their unique ‘Power of Three ×2 growth plan’.

With net revenue increasing 28% to $1.9 billion on a constant dollar basis and total comparable sales rising 25%. Comparable store sales also jumped 17%, while direct-to-consumer revenues increased 34%). Consequently, gross profit surged by 25% to reach over 1 billion dollars; however, margin decreased 130 basis points due primarily to higher product costs related to inflation pressures from supply chain constraints in China resulting from Covid pandemic. Income from operations rose 37 % compared to last year’s figures totaling approximately 352 million dollars.

Net revenue is forecasted to rise as much as 24% compared to previous years while also multiplying between $2.605 billion – $2.655 billion for Q4 alone with an additional 26% increase expected across 2021-2022 fiscal year increasing total revenues up to a whopping

$7.994 billion! Diluted EPS have been estimated at anywhere from around $4 to $10.

Wall Street Action

- Piper Sandler’s Abbie Zvejnieks raised the rating from $350 to $390 while maintaining an ‘Overweight’ opinion.

- UBS analyst Jay Sole adjusted his target upwards, increasing it from $395 to a still lower-than-average consensus of $390 while reiterating a ‘Neutral’ stance on the stock.

- Mark Altschwager at Baird bumped up with an Outperform – and upping the price target from $430 to $435.

- Goldman Sachs colleague Brooke Roach raised her price target from $383 to $431 and a Buy recommendation.

- Wells Fargo’s Ike Boruchow moved from $345 to $360, while preserving an Equal Weight.

- Alex Straton at Morgan Stanley lifted from $344 to $387.

- CitiGroup associate Paul Lejuez raised from $350 to $400 respectively.

- Raymond James expert Rick Patelupgraded upgraded his price target from $345 to $438 with an Overweight viewpoint.

- Stifel backstop Jim Duffy lifted his stock forecast from $400 to $450.

- Cowen’s John Kernan whose emphatic $535 to $542 foresight was additionally fortified when he reissued his own Outperform.

MongoDB delivered results in their third quarter of 2022

Reporting earnings of 23 cents per share and revenue that exceeded expectations at $333.6 million. This represented a 47% year-on-year increase, alongside the news that customer numbers had grown to 39,100 – greater than expected by analysts. Further details revealed cloud database service Atlas representing 63% of MongoDB’s total income for this period.

MDB third quarter of 2022 results have exceeded expectations, with adjusted net income coming in between 29 and 31 cents per share – a stark contrast to the prior guidance that foresaw a loss. Revenue also surpassed projections at around $1.26 billion instead of their expectation of $1.2 billion. CEO Dev Ittycheria noted this success was driven by greater engagement on Atlas as well as increased new business activity”

Wall Street Action

- Ittai Kidron downgraded the price target from $375 to $320 while maintaining an Outperform rating

- Sanjit Singh raised the target from $215 to $230 but maintained an Equal-Weight outlook.

- Goldman Sachs’ Kash Rangan also downgraded his projection from $380 to $325 while still recommending a Buy.

- Barclays analyst Raimo Lenschow increased the target to $240.

- Credit Suisse’s Phil Winslow decreased it to $305 with an Outperform recommendation.

- Mizuho’s Matthew Broome was more conservative, trimming expectations to $170 and maintaining a Neutral outlook.

- UBS’s Karl Keirstead suggested a target of $215 with a Buy rating.

SentinelOne report is not liked by Wall Street

With total revenue increasing 106% year-over-year to $115.3 million and annualized recurring revenue (ARR) also growing at a rate of 106%, ending October 31, 2022 at $487.4 million in ARR.. Additionally, customer count rose 55% over the prior period to 9250 customers – 827 had more than 100K in ARR – while dollar based net retention was 134%. According to CFO Dave Bernhardt: “We maintained our Rule of 60 again for Q3’2023 – this shows that tremendous top line growth can walk hand in hand with improved progress towards long term profitability targets.”

Wall Street Action

- Tal Liani from BAML: Reduced prediction from $35 to $28 while maintaining a “Buy” rating.

- Andrew Nowinski from Wells Fargo: Lowered target from an initial $23 to $18 with an “Overweight” rating.

- Roger Boyd from UBS: Cuts from $39 to $25, continuing at ‘Buy’.

- Trevor Walsh from JMP Securities: Altered from $42 to $36 while still advocating for a “Market Outperform” rating.

- Saket Kalia from Barclays: Pulled his price target from $20 to $18.

- Gray Powell from BTIG: Kept up appearances despite lowering forecasted values from $25 to $20.

- Rob Owens from Piper Sandler: Slashed his price target from $29 to $17 while keeping “Neutral” rating.

Gossamer has initial positive results with Seralutinib test run but not enough

Gossamer Bio announced on December 6th, 2022 that their clinical trial of Seralutinib for the treatment of pulmonary arterial hypertension (PAH) met its primary endpoint. The change in pulmonary vascular resistance (PVR) at week 24 achieved statistical significance with a P-Value of 0.0310. Additionally, there was an improvement in the secondary endpoint of change in 6-minute walking distance (6MWD), which numerically favored Seralutinib. Statistically significant improvements were also observed in NT-proBNP and echocardiography measures of cardiac structure and function. Furthermore, the results across per-specified subgroups consistently pointed to a positive outcome, including statistically significant placebo-adjusted improvements of 21% in PVR and 37 meters in 6MWD in patients with WHO functional class III PAH. Seralutinib was well tolerated overall, avoiding the higher frequency adverse events observed from Imatinib’s IMPRES Study.

While this is good news for Gossamer, analysts believe that Merck’s sotatercept drug still outperformed Gossamer’s in its own Phase 2 trial. According to Joseph Schwartz from SVB Securities, both Merck’s treatment and Gossamer’s reduced pulmonary vascular resistance similarly; however, Gossamer’s drug only achieved a decrease in pulmonary vascular resistance of 14.3%, while Merck’s treatment saw up to a 20-30% reduction in comparison. Even though Gossamer Bio has seen success with their seralutinib drug.

This news caused the stocks of Gossamer Bio to decline significantly due to analysts lowering their price target.

- Patrick Trucchio from HC Wainwright: Lowered his price target from $25 to $5 while maintaining a “Buy” rating.

- Paul Choi from Goldman Sachs: Lowered his price target from $22 to $10 while keeping a “Buy” rating.

- Eliana Merle from UBS: Lowered her price target from $19 to $8 while maintaining a “Buy” rating.

- Brian Cheng from JP Morgan: Downgraded his rating from “Neutral” to “Underweight”.

- Carter Gould from Barclays: Downgraded his rating from “Overweight” to “Equal-Weight” and lowered his price target from $18 to $2.

- David Hoang from SMBC Nikko: Downgraded his rating from “Outperform” to “Neutral” and lowered his price target to $3.

- Steven Seedhouse from Raymond James: Maintained an “Outperform” rating and dropped his price target from $15 to $5.

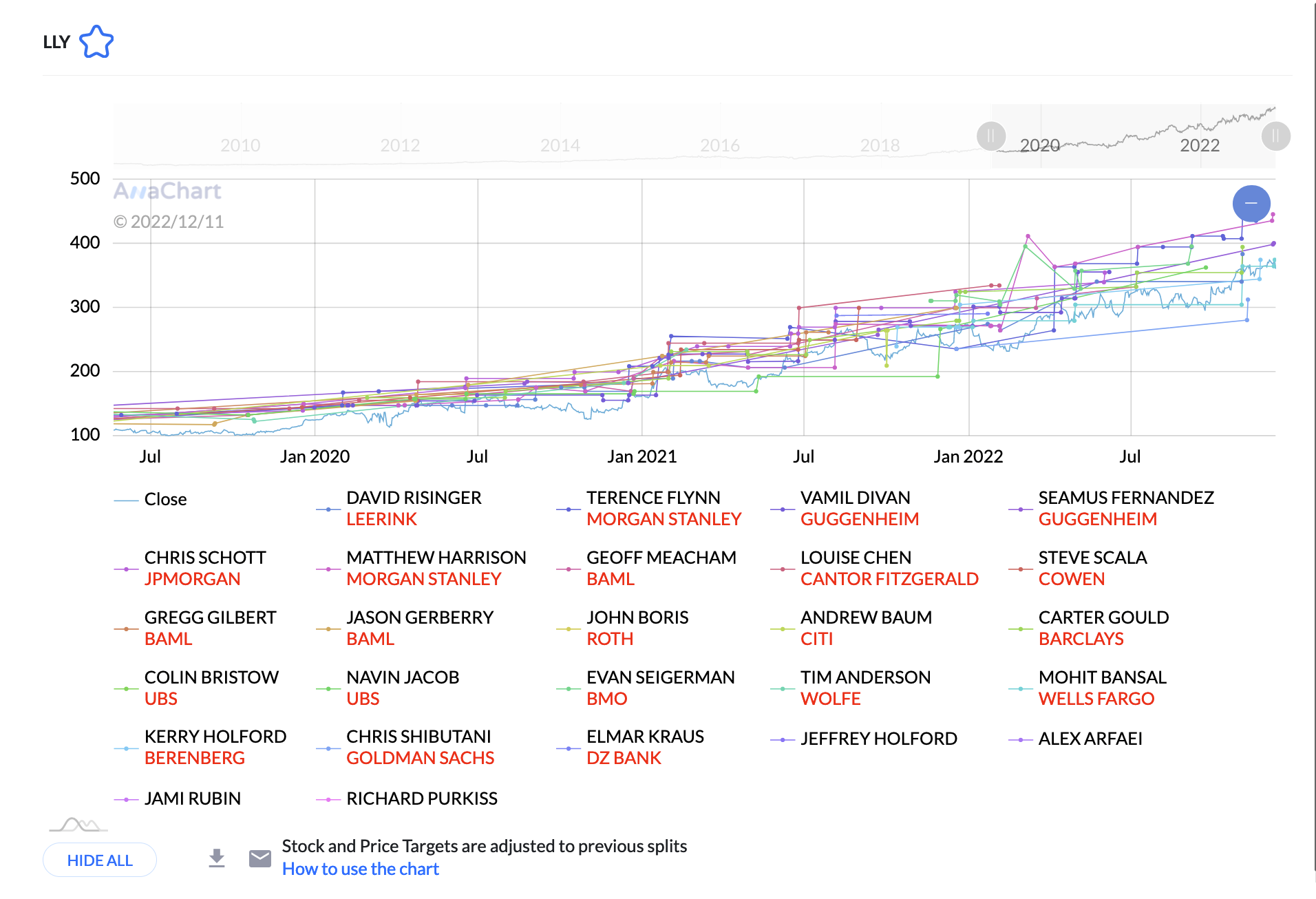

Lily sees positive initial results treating diabetes

LILY announced that the recently completed Phase III clinical trial of Jardiance® (empagliflozin) in children and adolescents with type 2 diabetes demonstrated a statistically significant improvement in their HbA1c levels compared to placebo. This is the first SGLT2 inhibitor to achieve this outcome in this vulnerable population, making it an important advancement for diabetes care. The safety profile of Jardiance was also found to be consistent with what has been seen in adults with type 2 diabetes, solidifying its position as a cutting-edge treatment option.

- Mohit Bansal from Wells Fargo: Gave an upgrade of $10, increasing his price target from $365 to $375 while maintaining an “Equal-Weight” rating.

- Seamus Fernandez from Guggenheim: Upgraded his target to $401 while still advocating a Buy”.

- Terence Flynn from Morgan Stanley: Proposed a strong increase from $436 to $446, keeping his “Overweight” rating.

- Trung Huynh from Credit Suisse: Upped his price target from $395 to a $400 with an “Outperform” evaluation.

- Steve Scala from Cowen: Increased his number by 40 points up to $430 with an “Outperform” outlook.