FAQ

What is AnaChart?

AnaChart offers a visual database of institutional analyst ratings and price targets, making it easy for users to understand relevancy of current stock opinions and past forecasts. It also provides summaries of overall sentiment and individual analyst views on a single page for convenient decision-making.

The platform ensures credibility and transparency by using a clear proprietary algorithm for sorting information. AnaChart focuses on building trust with users by promoting honest, results-driven dialogues by includeing articles and external links for further research and accuracy verification.

Unlike other platforms, AnaChart displays both current and previous price targets, and evaluates analysts on a per-stock basis, enhancing its stock analysis features and transparency.

Is the web version practical for mobile?

Mobile users can access up-to-date stock prices, ratings, analyst recommendations, and the top analyst for each stock, including the percentage of their accurate forecasts. However, for a comprehensive view of historical changes of analyst prediction comparisons, a computer is required.

What are the balloons when I hover over the stock chart and how I can I focus on them?

As analysts post their stock ratings and price targets, they leave a visible mark on the timeline. These balloons are also referred to as tool-tips. Members getting access to the articles links where that suggestion came from.

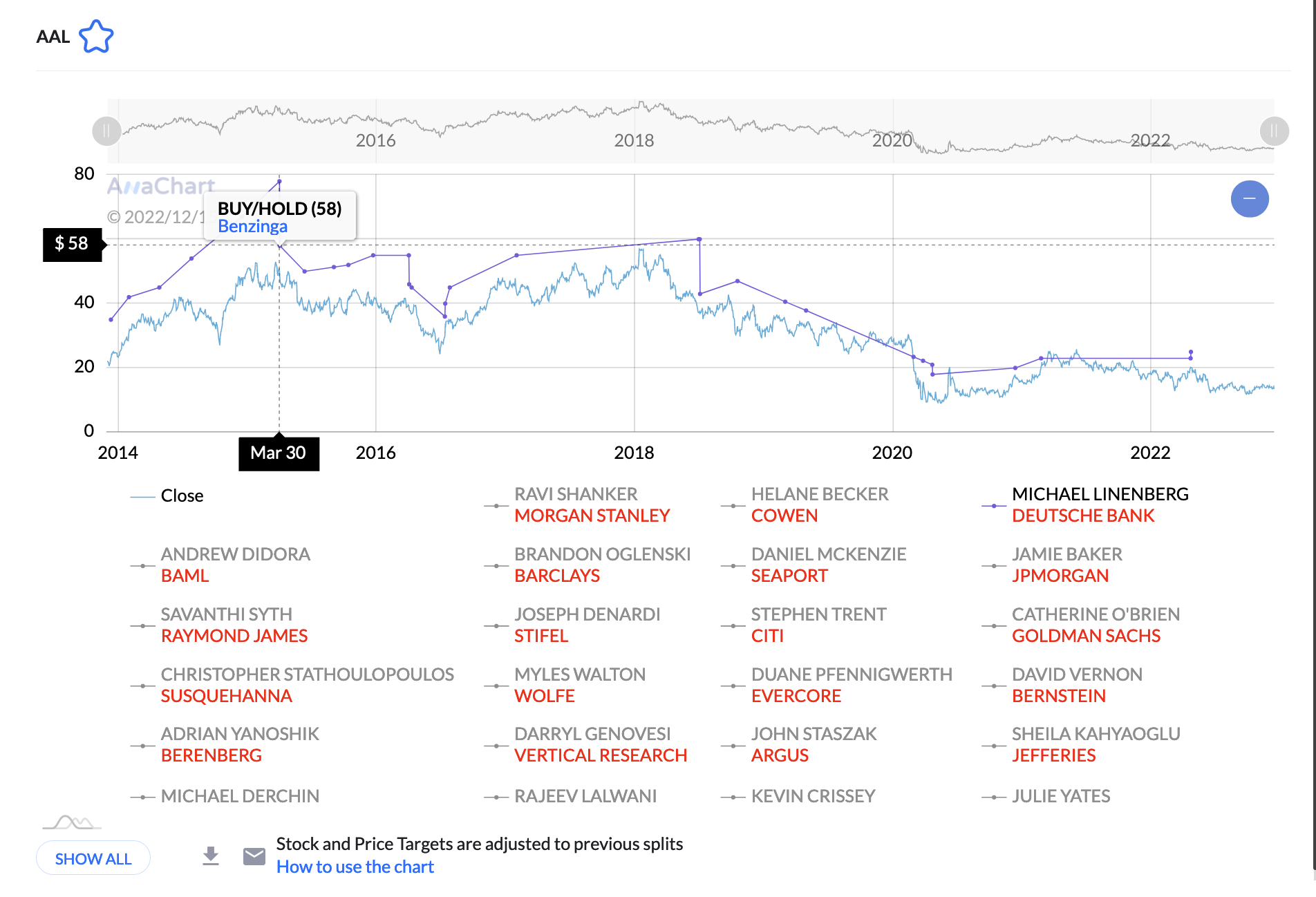

For example:

Michael Linenberg of Deutsche Bank shifted his outlook for American Airlines (AAL) on March 30, 2015: a Buy rating was downgraded to Hold, and the price target dropped from $78 to $58. This news item appears in its original context at Benzinga.com – simply click their link within AnaChart’s chart balloons and explore further insights outside our coverage scope.

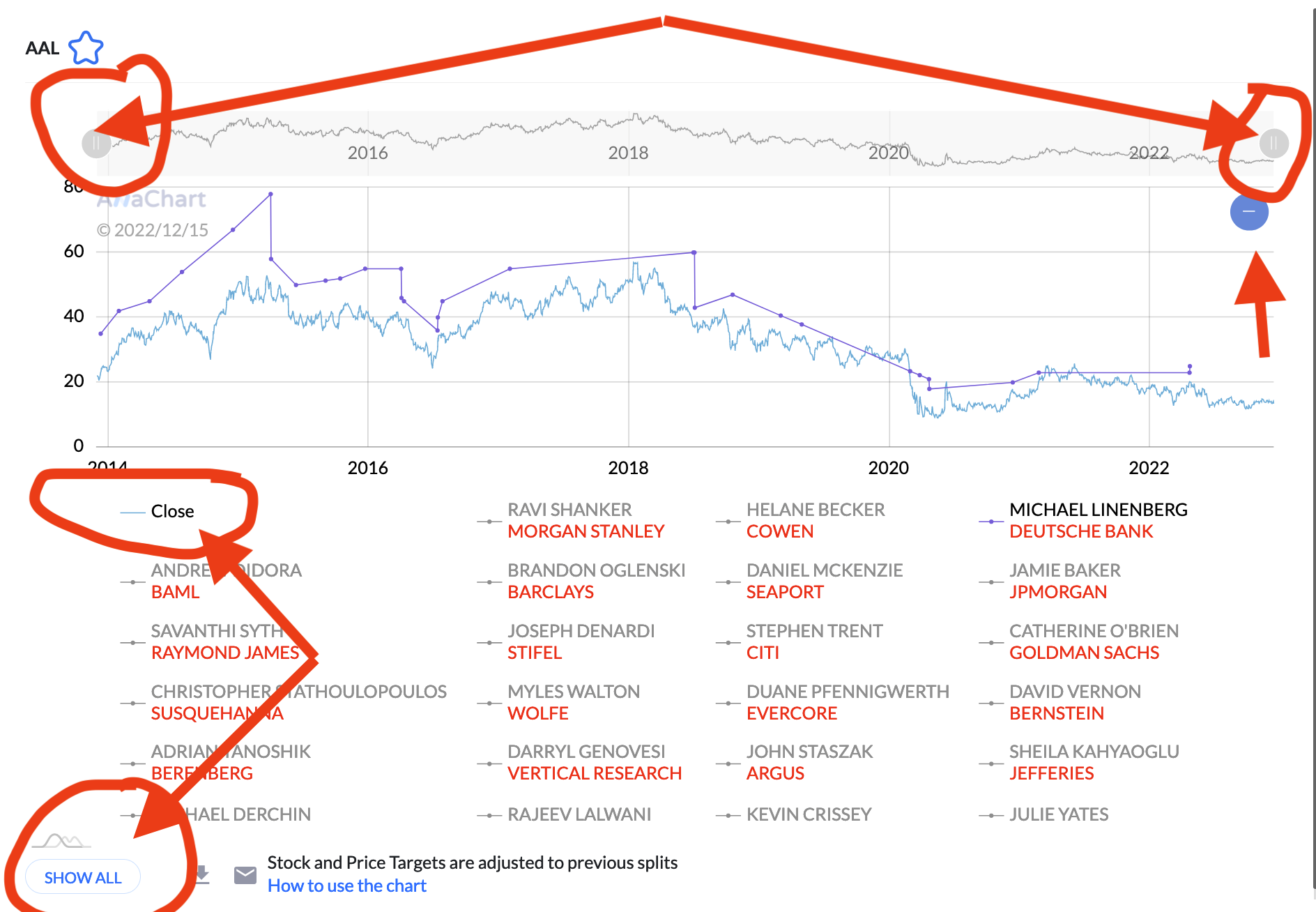

Having difficulty with zoning on the balloon? Try toggling off the stock prices and analyst lines, in a sea of analysts, if you want to focus on specific ones when investing in stocks yo will need to se these steps as well.

Another way to make the focus on the balloon is to zoom in, the blue button on the top right is always available at the top right to zoom out when are done.

What are the use cases for AnaChart?

Anachart provides the answers to critical questions essential for investors looking to gain a fuller understanding of stock performance and trends.

Discover which analysts are covering your stocks, as well as their average price targets relative to share prices. Follow recommendation changes over time, observe how analyst opinions have shifted in response to stock movements both positive and negative – uncovering who is truly driving change with their insights. Finally get an overall picture on market sentiment from multiple experts with varying levels of influence all at once — allowing you take informed decisions based on facts rather than guesswork.

How does AnaChart work?

Our analyst pages provide an wide range of information, including work history and average stock valuation metrics. You can also compare price targets to their materialization rate for any given stock – allowing you to assess the accuracy and relevancy of each analysts’ call. Furthermore, AnaChart gives access to data on how long it typically takes a target’s market value to reach its intended goal (the only platform that does that). All this knowledge is without any need to register or pay

Investing with precision just got easier for members of the advanced package— investors now have immediate access to a Performance Score for analysts who provide consistent and timely advice. The score is based on an easy-to-follow formula: the earlier and more accurately forecasts are realized, the higher its points value until that goal isn’t met, resulting in zero performance credit. Check out our video explanation to see in detail use how it works.

Our advanced package users have exclusive access to comprehensive stock charts featuring ratings, target prices and trendlines from each analyst. This allows you to quickly compare how the pros react differently when it comes down to price movement in any given stock – so whether their recommendations lead or lag behind can be easily assessed with one glance. Data is updated daily at Eastern Time for extra convenience. Check out our video demonstration of this powerful feature that is now accessible to retail investors.

How can I tell if the information displayed on the site is correct?

First, we have over 2o checks that we do to each item that we extract from the million plus of articles and snippets that are on the site.

Second, every price target/ rating that got public attention has a link attached to it. All you need to do is press on the link and check for yourself (if an item got published on two or more separate financial media outlets we will provide a link only to one of them).

How come other websites have more analysts on display?

AnaChart has a minimum set for quality screening purposes which is either two recommendations on at least one stock in the last two years or five recommendations for at least one stock without time limit. Other websites have no such criteria in order to inflate their numbers, so the difference shown is within analysts that posted one price or two price targets/ rating a few years ago.

How many duplicate coverage are there? As in same day, analyst, stock and recommendations but was covered in two or more different media outlet.

Out of one million records containing articles, snippets and databases there are about 200,000 duplicates.

If an analyst recommendation is covered by more than one outlet, which one gets the referring link?

The article that is longer will get the referring link as the go to rule.

What distinguishes the information displayed on AnaChart from that on other websites covering stock analysts?

The key differences between AnaChart and other websites covering stock analysts can be broken down into three main areas:

-

Basis of Performance Score:

- All other websites use stock analysts’ ratings to determine their scores, a method that is inherently subjective. AnaChart, however, calculates its performance score based on the actual price targets set by the respective analysts, which is a more absolute and measurable metric.

-

Aggregation of Analysts’ Scores:

- Other websites aggregate the scores of all analysts in their covered universe, regardless of their sectors of specialization. For instance, an analyst covering technology might be ranked alongside an analyst covering aviation. This is similar to ranking a restaurant as number 4,000 out of 8,000 available on Trip Advisor; knowing an analyst ranks in the 50th percentile or is number 3,247 in the ranking does not provide any useful insights.

- In contrast, AnaChart categorizes the performance score for each individual stock, allowing investors to identify which analysts have a better track record for each specific stock. This detailed approach is far more practical as it enables better decision-making by focusing on analyst performance on a stock-by-stock basis. This means that an analyst who excels in a specific stock won’t be overlooked simply because their average performance across all stocks doesn’t reveal anything meaningful.

-

Transparency and Comprehensiveness of Data:

- Many websites do not reveal their data sources (good luck with vetting), and often their information is limited to a single source. AnaChart, however, makes a concerted effort to collect every possible public new price target and rating and provides links to the original sources for further reading. Consequently, AnaChart stands unmatched as the most comprehensive and accessible source for stock analysts’ price targets and ratings.