Daily Update - March 3, 2023

Selected highlights of the day

By: Matthew Otto

Marvell Technology

Has reported its financial results for the fourth quarter and fiscal year 2023. The company achieved a net revenue of $1.419 billion in Q4, growing by 6% year-on-year, above the midpoint of its guidance provided on January 11, 2023. However, the company reported a GAAP net loss of $(15) million or $(0.02) per diluted share for the quarter. In contrast, the non-GAAP net income for Q4 was $396 million, or $0.46 per diluted share. For the fiscal year 2023, the company’s net revenue was $5.920 billion, which grew by 33% YoY. The GAAP net loss for the fiscal year was $(164) million or $(0.19) per diluted share, while the non-GAAP net income for the fiscal year was $1.822 billion, or $2.12 per diluted share. The company’s Q1 financial outlook shows that it expects net revenue to be $1.300 billion +/- 5%, with a GAAP gross margin of 45.1% +/- 1%, and a non-GAAP gross margin of approximately 60%. The GAAP diluted loss per share is expected to be $(0.17) +/- $0.05 per share, while the non-GAAP diluted income per share is expected to be $0.29 +/- $0.05 per share.

Wall Street Reaction

- Susquehanna analyst Christopher Rolland has lowered his price target for Marvell Technology from $55 to $50 while maintaining a positive outlook.

- Raymond James analyst Srini Pajjuri has also decreased the price target from $54 to $50 while maintaining an outperform rating.

- Needham analyst Quinn Bolton maintained a buy rating.

- Rosenblatt analyst Hans Mosesmann has decreased the price target from $125 to $100 while maintaining a buy rating.

- Keybanc analyst John Vinh has lowered the price target from $65 to $60 while maintaining an overweight rating.

- Deutsche Bank analyst Ross Seymore keeps Marvell Tech with a buy rating and drops the price target from $55 to $50

- Credit Suisse analyst Chris Caso maintains Marvell Tech with an outperform rating and lowers his price target from $56 to $53.

ChargePoint

Has announced its financial results for the fourth quarter and full fiscal year 2023. Revenue in the 4th quarter surged to $153 million, up an impressive 93% compared to the same period of the year prior. Building upon these positive outings, ChargePoint saw its total fiscal year 2020 revenue reach $468 million; indeed, charging an increase of 94%. FY20 saw subscription revenue crossing the $100 million marker annually. Moreover, both chargePoint’s GAAP and non-GAAP gross profits recorded a boost in their respective QoQ figures by four and three percentage points respectively. This news is accompanied by ChargePoint officiating expected first quarter fiscal 2024 revenues’, ranging from 122 to 132 million dollars. Heralding even more news for fans of this prominent international player, the US Postal Service has graciously awarded its business partner Rexel Energy Solutions a contract that covers material instruments that include chargePoint chargers subscription licenses and premium warranty services.

ChargePoint expects revenue of $122 million to $132 million for the first fiscal quarter ending April 30, 2023. At the midpoint, this represents an anticipated increase of 56% as compared to the prior year’s same quarter.

- Needham analyst Chris Pierce set a Buy rating $14 price target.

Dell

- Simon Leopold, an analyst for Raymond James downgraded his price target from $50 to $45, but maintains an Outperform rating

Broadcom reported revenue of $8,915 million for the first quarter

Up 16 percent from the prior year period, with adjusted EBITDA of $5,678 million. The company also reported non-GAAP diluted EPS of $10.33 (topping the $10.17 Wall Street consensus estimate, according to FactSet) and GAAP diluted EPS of $8.80 for the first quarter, and announced a quarterly common stock dividend of $4.60 per share. Broadcom repurchased and eliminated 2.7 million shares for $1,521 million. The company issued second-quarter revenue guidance of approximately $8.7 billion, an increase of 8 percent from the prior year period, with second-quarter Adjusted EBITDA guidance of approximately 64.5 percent of projected revenue.

Broadcom’s second quarter fiscal year 2023 revenue guidance stands at approximately $8.7 billion, which demonstrates an 8 percent increase over the prior year period. Additionally, second quarter Adjusted EBITDA guidance is estimated at 64.5 percent of projected revenue.

- Wells Fargo analyst Aaron Rakers has maintained his Equal-Weight rating, but he raised his price target from $558 to $600.

- Rosenblatt analyst Hans Mosesmann recommended a Buy rating with a $775 price target.

- Susquehanna analyst Christopher Rolland has kept a Positive rating and has increased the price target from $685 to $690.

- Truist Securities analyst William Stein has maintained a Buy rating and bumped up his prediction from $659 to $700.

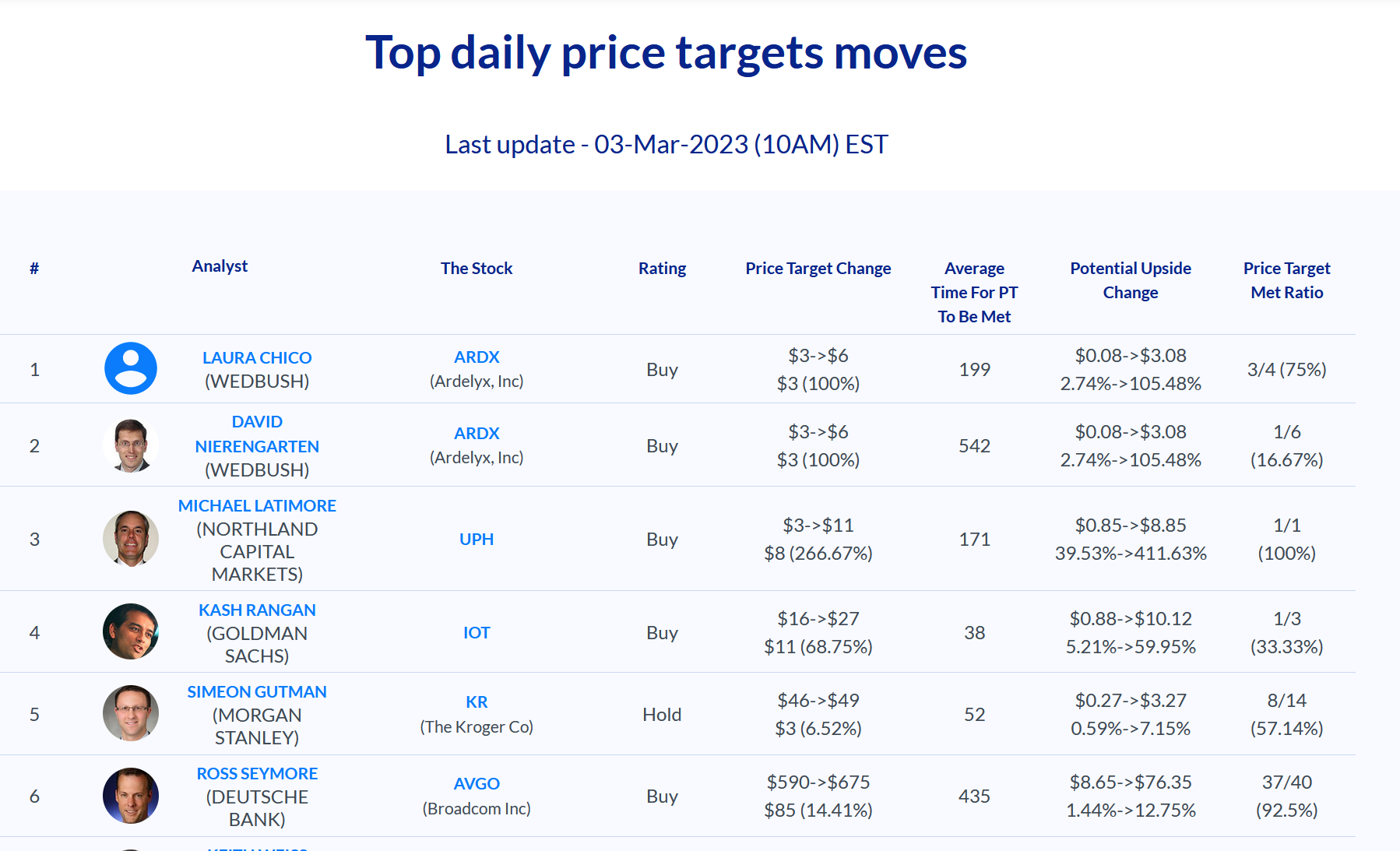

- Deutsche Bank analyst Ross Seymore stuck to his Buy call while increasing the price target from $590 to $675.

- Keybanc analyst John Vinh rounded out the look on Broadcom giving an Overweight rating alongside an upwards amended tag of $700 to $720.

C3.ai reported revenue of $66.7 million for the quarter

C3.ai announced that it exceeded its guidance range and beat Street consensus with its Q3 revenue of over $65 million. Subscription revenue made up 85.6% of the total revenue, earning $57 million. The company’s GAAP gross profit was $44.4 million, representing a 67% gross margin, while non-GAAP gross profit was $51 million, representing a 76% non-GAAP gross margin. C3.ai reported a GAAP net loss per share of $(0.57) and a non-GAAP net loss per share of $(0.06). The company had 236 customers and $789.8 million in cash reserves. Additionally, C3.ai established, renewed, and expanded its partnerships with various technology companies, including Google Cloud and AWS. They also announced C3 Generative AI for Enterprise Search, a tool that includes technology from OpenAI and will be incorporated into C3 AI Platform and C3 AI Applications in Spring 2023.

- JMP Securities Patrick Walravens has a Market Outperform and increased target price to $27 from $19.

- Piper Sandler Arvind Ramnani has a Neutral rating and updated target price of $23, up from $13.

Zscaler

Zscaler released its Q2 2023 financial results with 52% YoY revenue growth to $387.6 million, $493.8 million in calculated billings, and $1,111.9 million in deferred revenue, a 46% YoY increase. The net loss for the quarter was $57.5 million, down from $100.4 million last year. Zscaler’s recent business highlights include acquiring Canonic Security™ in February 2023, achieving a AA rating in the MSCI ESG Ratings assessment, and releasing new integrations with Zoom and Zscaler Digital Experience™ monitoring service. Zscaler forecasts a strong Q3 and full-year performance, expecting $396-398 million in Q3 revenue and $1.558-1.563 billion in FY 2023 revenue, along with other financial targets.

- BMO Capital analyst Keith Bachman is maintaining an Outperform, and has adjusted the price target from $145 to $133.

- Wells Fargo analyst Andrew Nowinski maintains his Overweight rating yet lowered his price target from $160 down to $156.

- Needham analyst Alex Henderson is standing by his earlier Strong Buy assessment while keeping an unchanged price target of $210.

TSLA

- Daiwa Capital analyst Jairam Nathan has bolstered support for Tesla by upgrading the company’s Outperform rating and raising the price target from $200 to $218.

- KGI Securities analyst Jennifer Liang took the opposite stance, downgraded the electric car maker from Outperform to Neutral, and setting her own price target at $196.