Daily Update - March 21, 2023

Selected highlights of the day

By: Matthew Otto

Foot Locker’s profit forecast for fiscal year 2023 came in lower than expected

Foot Locker’s current adjusted earnings for the year are lower than what analysts were expecting. However, the company has projected growth in earnings at a percentage rate in the low- to mid-20s for fiscal years 2024 through 2026. Analysts have estimated earnings per share of $4.50 and $5.29 for fiscal years 2024 and 2025, respectively, which implies growth of 9.5% and 17.6% from the prior years.

The company’s new long-term growth strategy, the “Lace Up” plan, which is expected to be discussed at the Investor Day, involves expanding its sneaker line, opening new-format stores, and closing underperforming stores. In the fourth fiscal quarter, Foot Locker reported earnings of 97 cents per share, higher than the 51 cents per share expected by analysts, with revenue of $2.3 billion, more than the expected $2.15 billion.

- Wedbush analyst Tom Nikic is maintaining a Neutral rating.

- Credit Suisse analyst Michael Binetti set the price target at $62 and reiterated an Outperform rating.

- Evercore ISI Group analyst Omar Saad increased the price target from $145 to $220 and upgraded the rating from In-Line to Outperform.

- Guggenheim analyst Robert Drbul has his price target at $60 and reiterated a Buy rating.

- Barclays analyst Adrienne Yih increased the price target from $40 to $43 and maintained an Equal-Weight rating.

- Citigroup analyst Paul Lejuez raised the price target from $47 to $50 and upgraded the rating from Neutral to Buy.

- Telsey Advisory Group analyst Joseph Feldman is at $50 stock forecast and upgraded his rating from Market Perform to Outperform.

- Deutsche Bank analyst Gabriella Carbone maintains a Hold and raises the price target from $36 to $42.

- TD Securities analyst John Kernan keeps a Market Perform and raises the price target from $39 to $43.

Signature Bank exchanges owners

Much of Signature Bank of New York has been acquired by a subsidiary of New York Community Bancorp after the bank was shut down by regulators. Starting from Monday, Signature Bank’s 40 branches will operate under Flagstar Bank, a subsidiary of New York Community Bancorp, with all deposits assumed by Flagstar insured by the FDIC up to its limit of $250,000. The FDIC estimates that Signature’s failure has cost the Deposit Insurance Fund $2.5 billion. Flagstar purchased $38.4 billion of Signature’s assets, including $12.9 billion of loans purchased for $10.2 billion or a 21% discount. Following the deal, New York Community Bancorp stock jumped 41% to $9.23 on Monday morning. The FDIC received stock appreciation rights in New York Community Bancorp with a potential value of $300 million under the terms of the deal, and is also giving $25 billion cash to enable the bank to pay down its borrowings and enhance liquidity. Keefe, Bruyette analyst Christopher McGratty believes the deal will boost New York Community Bancorp’s earnings per share by 70% and secure its dividend.

- Credit Suisse analyst Moshe Orenbuch increased the price target from $10 to $11 and maintained a Neutral rating.

- DA Davidson analyst Peter Winter upgraded the rating from Hold to Buy and increased the price target by 62% to $11.5.

- JP Morgan analyst Steven Alexopoulos increased the price target from $9.5 to $10.5 and maintained a Neutral rating.

META

- Barron’s had quoted Edward Jones analyst David Heger has upgraded shares of Meta Platforms (formerly known as Facebook) from Hold to Buy, citing the company’s focus on improved operating efficiency and expense cuts, including trimming spending on the metaverse. The analyst believes that Meta’s ad revenue could stabilize and return to modest growth by the end of 2023, which, combined with the expense cuts, will increase the company’s earnings outlook.

- Loop Capital analysts led by Alan Gould also increased their price target on shares to $220 from $188 and maintained a Hold rating, citing possible upside for Meta if competitor TikTok gets banned.

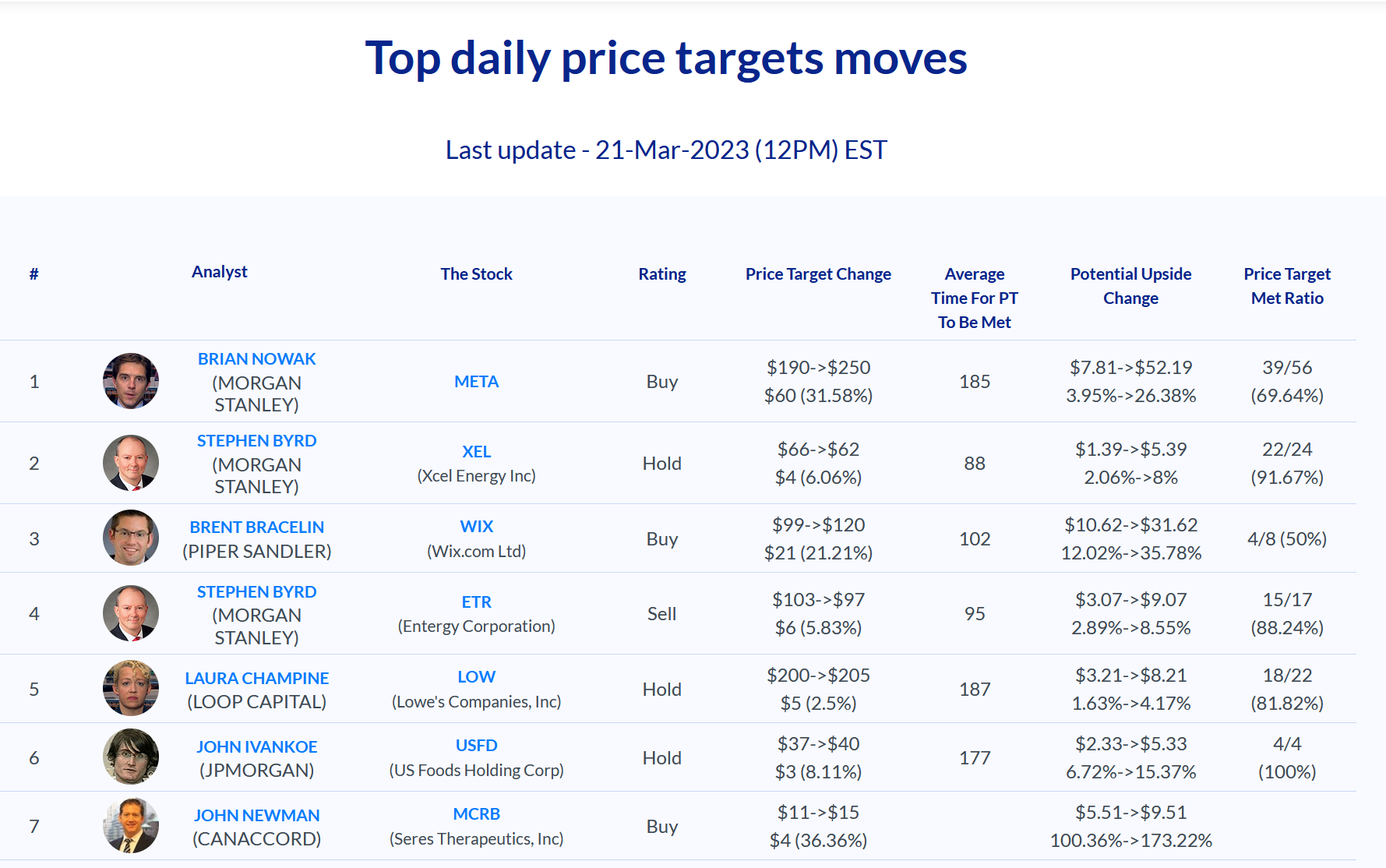

- Morgan Stanley analyst Brian Nowak has upgraded Meta Platforms (formerly known as Facebook) from Equal-Weight to Overweight and raised the price target from $190 to $250.

TSLA gets a vote of confidence

Moody’s has upgraded Tesla’s debt rating to Baa3 from Ba1, as it has demonstrated solid manufacturing efficiency and market leadership in the electric vehicle space, making the credit rating the lowest level for investment grade. However, the rating could have been higher, according to the ratings company, as Tesla’s scorecard-indicated outcome on a forward-looking basis remains A2. Moody’s attributed the gap between the scorecard-indicated outcome and Tesla’s current rating to “corporate governance challenges” and competition in the market, with CEO Elon Musk exercising considerable latitude. Nevertheless, the current rating is a vote of confidence from a financial market participant, which may give Tesla’s stock a small boost.

Zai Lab

Has announced that its partner Karuna Therapeutics has reported positive topline results from its Phase 3 EMERGENT-3 trial of KarXT in adults with schizophrenia. KarXT demonstrated a statistically significant and clinically meaningful 8.4-point reduction in Positive and Negative Syndrome Scale (PANSS) total score compared to placebo (-20.6 KarXT vs. -12.2 placebo; p<0.0001) at Week 5 (Cohen’s d effect size of 0.60). Karuna is on track to submit an NDA to the FDA in mid-2023, with a potential launch in the second half of 2024 in the United States, if approved. Zai Lab is on track to initiate a bridging study for the treatment of patients with schizophrenia in China in mid-2023.

- Wedbush analyst Laura Chico maintains an Outperform.

- JMP Securities analyst Jason Butler reiterates a Market Outperform and maintains a $323 price target.

On Holding

Has announced its financial results for the fourth quarter and full year of 2022. The company reported net sales of CHF 1,222.1 million, a gross profit margin of 56.0%, and net income of CHF 57.7 million, with an adjusted EBITDA margin of 13.5%. The company also reported fourth-quarter net sales of CHF 366.8 million, growing by 91.9% year-over-year, driven by an exceptional underlying full-price demand throughout the holiday season across regions and channels. ONON also announced the filing of its annual report on Form 20-F with the U.S. Securities and Exchange Commission for the year ended December 31, 2022. The company remains confident in achieving strong results in 2023, with an anticipated net sales of at least CHF 1.7 billion, a gross profit margin of approximately 58.5%, and an adjusted EBITDA margin of 15.0%.

The company anticipates a 61% year-over-year net sales growth rate in Q1 2023, and a full-year net sales growth rate of 39%, reaching at least CHF 1.7 billion. On’s gross profit margin is expected to expand towards its mid-term target of 60%, reaching approximately 58.5% in 2023.

- On Holding is maintained with an Outperform rating by Wedbush analyst Tom Nikic, which was upgraded to last week from neutral.