Daily Update - April 13, 2023

Selected highlights of the day:

By: Matthew Otto

Pfizer expands into China

Pfizer has signed a strategic cooperation agreement with Sinopharm Group in China, a $10 market cap firm, to seek approval to market 12 innovative drugs in China through 2025. The collaboration aims to accelerate the delivery of Pfizer’s new drugs to patients. The announcement was made by Sinopharm’s president Liu Yong during the signing event in Shanghai on Wednesday.

- Barclays analyst Carter Gould drops his price target on Pfizer to $43.00 from $44.00 with an Equalweight rating. AnaChart found the analyst sticking his stock forecast very close to the stock price since the beginning of 2022.

SoftBank departs from Ali Baba

SoftBank, an early investor in Alibaba, has sold around $7.2 billion worth of shares in the company this year, through prepaid forward contracts, according to regulatory filings. The sales will reduce SoftBank’s stake in Alibaba to less than 4%, down from around 25% at the beginning of last year.

This move comes as Alibaba splits itself into six units, a bid to unlock shareholder value and improve competition amid tough-on-tech regulators who have hammered valuations.

- No new stock forecasts have been released at this moment

Delta Air Lines reported a strong outlook for its second quarter

Despite missing expectations for adjusted earnings in the first quarter reporting earnings of 25 cents per share compared to analysts’ expectations of 29 cents per share. Additionally, the company’s revenue was $12.8 billion, while analysts expected $12 billion

Delta’s CEO, Ed Bastian, expressed confidence in the airline’s full-year guidance for revenue growth of 15% to 20% year over year, earnings of $5 to $6 per share, and free cash flow of over $2 billion.

Delta is the first major carrier to report this season, and its results and guidance are likely to shape sentiment towards the sector over the coming days.

Barron’s expressed an opinion that the spring and summer months are typically good for airlines, and demand this year looks strong, which could be positive for the industry. However, labor costs, pilot pay deals, and the impact of fuel prices will also be closely watched.

- Seaport analyst Daniel McKenzie has increased the price target on Delta Air Lines from $49.00 to $50.00 while maintaining a Buy rating on the stock which doesn’t come as anything surprising since the analyst has done so since starting to cover the stock ten years ago.

eToro teams up with Twitter

eToro has partnered with Twitter to provide real-time prices of cryptocurrencies, stocks, and other assets, as well as enabling users to trade those instruments. The trading data will be available through Twitter’s Cashtags feature, which allows users to interact with content around an asset by inserting a dollar sign in front of the ticker.

Users can now click through to eToro’s platform to see information about the asset and invest if they choose to do so. This move is expected to provide a more seamless trading experience for users on Twitter who are interested in trading and investing.

Meta invests in whats app to generate new revenue

Yahoo covered Meta Platforms’ launch of a payments feature on WhatsApp in Brazil that allows users to pay small businesses directly through the app. This feature could boost the company’s user growth and revenue.

The article addressed also that Meta is facing challenges in its ad revenue segment due to Apple’s privacy policies, and its metaverse ambitions have suffered due to decreasing user interest and macroeconomic conditions. Nevertheless, the company’s initiatives to refocus on its core businesses, invest in AI and new features, and build privacy-enhancing technologies and tools for advertisers could improve its long-term growth prospects.

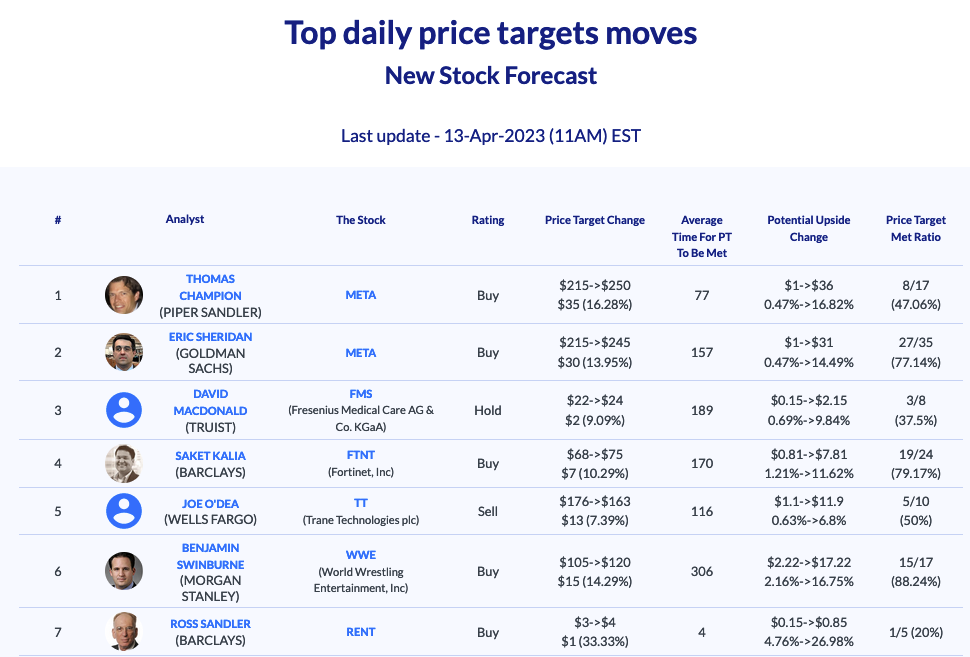

- Goldman Sachs analyst Eric Sheridan has increased his price target from $215.00 to $245.00, while keeping a Buy rating.

- Piper Sandler analyst Thomas Champion has also raised his price target from $215.00 but to $245.00 and a Buy rating.

- Morgan Stanley analyst Meta Marshall downgrades National Instruments

Both analysts have kept their price target above the stock price for their respective tenure of covering the stock.

Deutsche Bank weighs on Energy

Deutsche Bank analyst Corinne Blanchard has placed a ‘catalyst-buy call’ on shares of Enphase Energy, signaling that the company’s shares are poised to rise after a period of recent underperformance. Enphase makes technical power inverters for solar panels and is expected to post strong quarterly earnings.

- Blanchard rates Enphase shares as ‘Buy’ and has a $280 price target for the stock.

- Conversely, Blanchard has downgraded shares of solar panel maker First Solar to ‘Hold’ from ‘Buy’.

Blanchard had success with her previous price target call on First Solar in January this year when she raised her stock forecast from $180 to $225 two months before the stock picked up the call.