Daily Update - April 26, 2023

Selected stock price target highlights of the day:

By: Matthew Otto

This week is flooded with earnings reports, we chose to show four stocks that caught the most attention today by the professional analyst community.

Chipotle Mexican Grill

Reported strong financial results for the first quarter, beating earnings and revenue expectations. The company posted adjusted earnings of $10.50 a share and sales of $2.4 billion, a 17.2% year-over-year increase. Comparable restaurant sales were up 10.9%, better than forecasts for an 8.6% increase.

The company predicts that second-quarter and full-year comparable sales will grow in the mid to high-single digit percentage range. Chipotle plans to open between 255 and 285 new restaurants in 2023. The company’s results got a boost from price increases, which helped the company offset higher prices for labor and food inflation and as a result beat Wall Street expectations for profits and sales.

Chipotle expects mid-to-high single-digit sales growth for the second quarter and full year, higher than analyst expectations. The company’s base of higher-income customers continued to eat at Chipotle, while lower-income customers returned but not to the same extent as before. The company’s menu prices were about 10% higher in the first quarter versus last year, and will be about 5% higher in the second quarter.

Store-level operating margins rose to 25.6% from 20.7% a year ago, due in part to lower avocado costs and lower delivery expenses as delivery volumes fell. Net income was $291.6 million, or $10.50 per diluted share, beating analysts expectations of $248.4 million and $8.92.

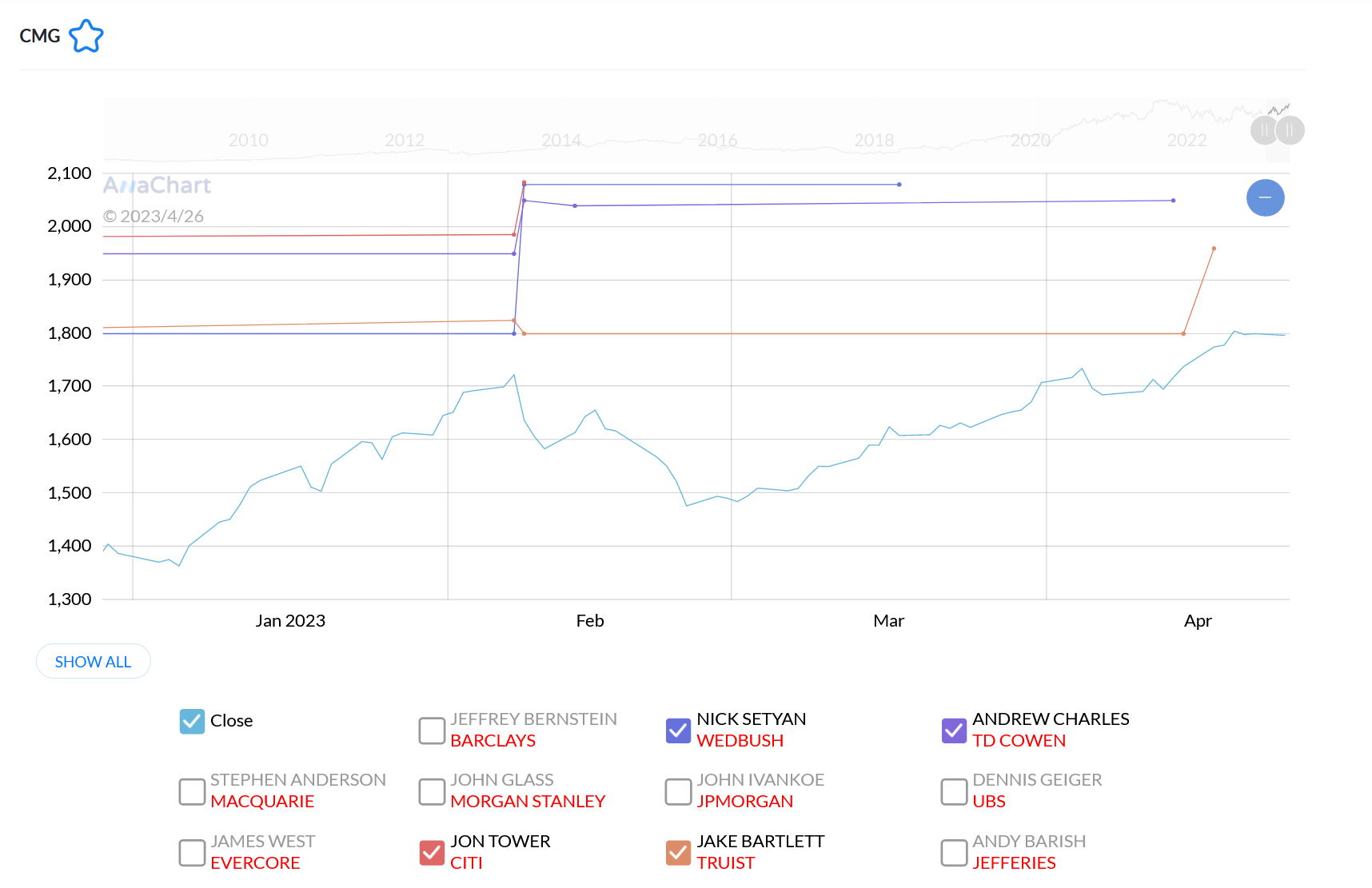

Wall Street Action

- BMO Capital analyst Andrew Strelzik boosted the price target to $1,950, up from $1,800.

- Truist Securities analyst Jake Bartlett hiked the price target to $2,270.

- Morgan Stanley analyst Brian Harbou lifted the price target to $1,910.

- RBC Capital analyst Christopher Carril increased the price target to $2,050.

- Credit Suisse analyst Lauren Silberman raised the price target to $2,200.

- Wells Fargo analyst Jon Tower upped the price target to $2,050.

- Citi analyst Gregory Badishkanian raised the price target to $2,240.

- JPMorgan analyst John Ivankoe elevated the price target to $1,750.Still being one of few that has his stock forecasts below the current Chipotle stock price.

- Baird analyst David Tarantino revised the price target to $2,200 and reiterated an Outperform rating.

- Raymond James analyst Brian Vaccaro raised the price target to $2,100 and maintained an Outperform rating.

- Credit Suisse analyst Lauren Silberman maintained an Outperform rating and increased the price target to $2,200.

- Stephens & Co. analyst Joshua Long boosted the price target to $2,000 and maintained an Overweight rating.

- Stifel analyst Chris O’Cull raised the price target to $2,100 and reiterated a Buy rating.

- Wedbush analyst Nick Setyan increased the price target to $2,200 and maintained an Outperform rating.

- Barclays analyst Jeffrey Bernstein upped the price target to $1,885 and maintained an Equal-Weight rating.

- TD Cowen analyst Andrew Charles lifted the price target to $2,200 and maintained an Outperform rating.

- Oppenheimer analyst Brian Bittner raised the price target to $2,050.

Perspective

Looking at the price target snapshot on Chipotle we see that analysts Nick Setyan, Andrew Charles, Jon Tower and Jake Bartlett had all successfully raised consistently their price targets in advance during 2023 while the stock rose

McDonald’s Corporation

Reported strong financial results for the first quarter ended March 31, 2023. Global comparable sales increased by 12.6%, which includes all segments. Consolidated revenues grew by 4%, and consolidated operating income rose by 10%. Diluted earnings per share were $2.45, reflecting an increase of 66%. Systemwide sales increased by 9% and digital systemwide sales in the top six markets reached nearly $7.5 billion for the quarter, representing almost 40% of their Systemwide sales.

McDonald’s reported better-than-expected earnings and sales in the first quarter of 2023, with earnings of $2.63 per share on sales of $5.9 billion. Comparable-store sales also grew by 12.6%, surpassing analysts’ estimates of 8.7%. Despite this success, McDonald’s executives are wary of economic headwinds and potential recession in the U.S. and Europe.

The company’s margins at company-operated restaurants were lower than expected at 13.5%, and management believes inflation will remain in the mid-to high single digits this year, with food and paper costs also expected to increase. Nevertheless, McDonald’s has positioned itself as a more affordable option in light of inflation and is gaining market share, particularly among value-conscious customers.

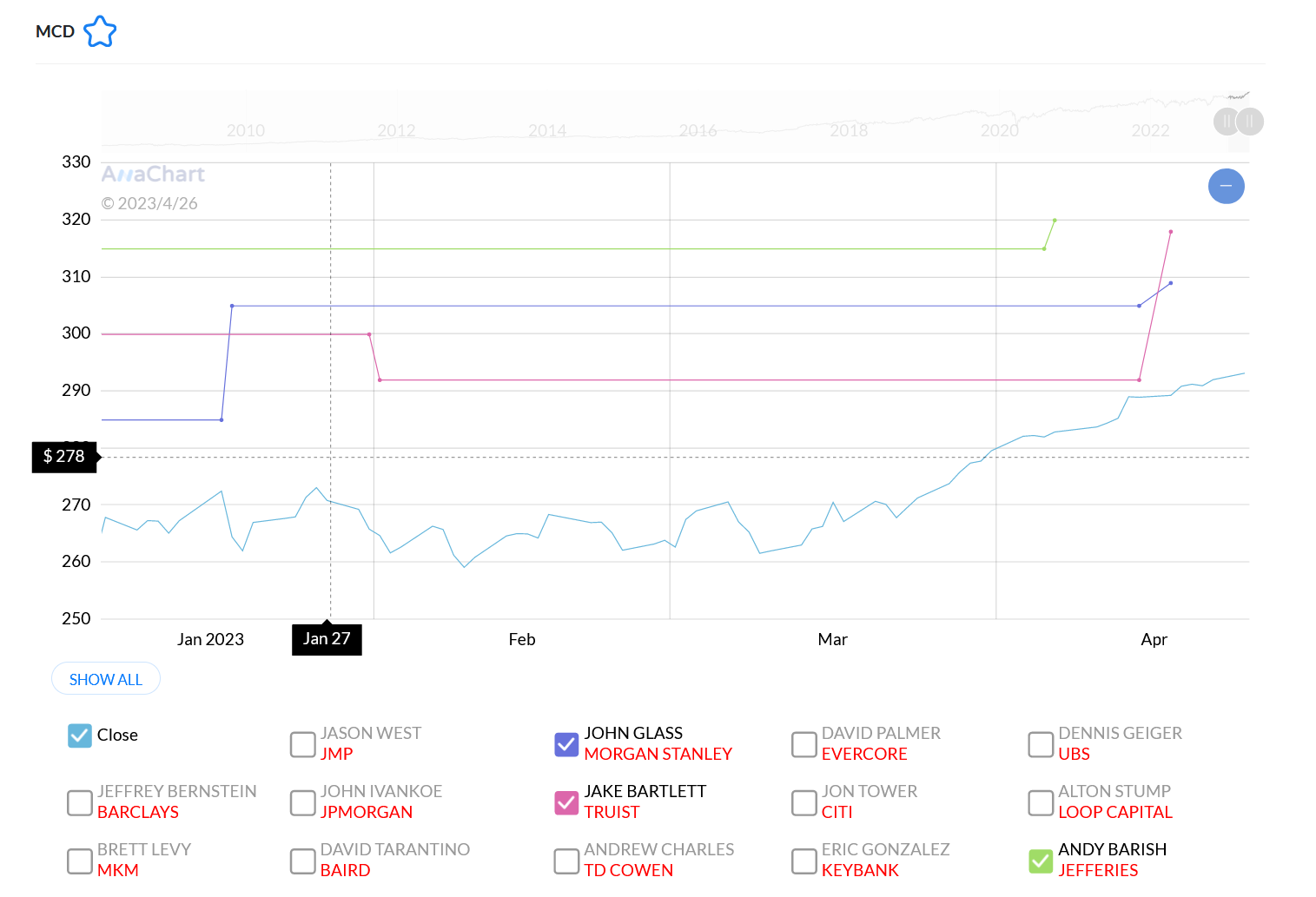

Wall Street Action

- BMO Capital analyst Andrew Strelzik maintains an Outperform rating and boosts the price target from $300 to $325.

- Baird analyst David Tarantino reaffirms an Outperform rating and lifts the price target from $312 to $320.

- Credit Suisse analyst Lauren Silberman retains an Outperform rating and elevates the price target from $300 to $320.

- Barclays analyst Jeffrey Bernstein upholds an Overweight rating and raises the price target from $310 to $330.

- Morgan Stanley analyst John Glass maintains an Overweight rating and increases the price target from $309 to $315.

- TD Cowen analyst Andrew Charles sustains an Outperform rating and raises the price target from $315 to $320.

- Keybanc analyst Eric Gonzalez maintains an Overweight rating and lifts the price target from $290 to $320.

- Wedbush analyst Nick Setyan upholds an Outperform rating and heightens the price target from $315 to $330.

- Guggenheim analyst Gregory Francfort maintains a Buy rating and raises the price target from $305 to $325.

- JPMorgan analyst John Ivankoe raises the price target to $284 for McDonald’s.

Looking at the price target snapshot from AnaChart we see that analysts John Glass, Jake Bartlett, and Andy Barish have been correct with their bullish stance on the MCD stock.

Microsoft

Reported better-than-expected results for its latest quarter, with revenue of $52.9 billion, up 7% from a year ago. Wall Street consensus revenue for the fiscal third quarter ended March 31 was $51 billion.

The growth in Azure, the company’s cloud unit, was a positive sign for IT spending, growing 31% on a currency-adjusted basis, better than most Wall Street estimates. For the fiscal fourth quarter,

Microsoft expects constant-currency growth of 26% to 27% for Azure, a little above the Wall Street consensus forecast of 25.8%. The company’s More Personal Computing unit also recorded sales of $13.3 billion, well above the company’s guidance range.

Another tidbit of news regarding MSFT is that Britain’s Competition and Markets Authority (CMA) has blocked Microsoft’s acquisition of video game publisher Activision Blizzard, citing concerns over the nascent cloud gaming market.

The CMA believes that allowing Microsoft to acquire a strong position in the cloud gaming market risks undermining innovation crucial to the development of opportunities. The CMA is particularly concerned that Microsoft could make Activision’s games exclusive to its cloud gaming platform, Xbox Game Pass, and cut off distribution to other key industry players. Microsoft plans to appeal the decision, while CEO of Activision Blizzard, Bobby Kotick, says the company has already begun the work to appeal to the UK Competition Appeals Tribunal.

Wall Street Action

- Piper Sandler’s Brent Bracelin reiterates his Overweight rating and raises the price target from $290 to $348.

- Raymond James’ Andrew Marok affirms his Outperform rating and increases the price target from $310 to $320.

- Wedbush’s Daniel Ives reiterates his Outperform rating and boosts the price target from $315 to $325.

- Citigroup’s Tyler Radke maintains his Buy rating and lifts the price target from $332 to $340.

- Morgan Stanley’s Keith Weiss maintains his Overweight rating and raises the price target from $307 to $335.

- Credit Suisse’s Sami Badri upholds his Outperform rating and raises the price target from $285 to $350.

- BMO Capital’s Keith Bachman upgrades his rating on Microsoft from Market Perform to Outperform and raises the price target from $325 to $347.

- Macquarie’s Sarah Hindlian upgrades her rating on Microsoft from Neutral to Outperform and raises the price target from $260 to $325.

- Oppenheimer’s Timothy Horan maintains his Outperform rating and increases the price target from $310 to $330.

- Wells Fargo’s Michael Turrin maintains his Overweight rating and raises the price target from $320 to $345.

- MoffettNathanson’s Sterling Auty maintains his Market Perform rating and increases the price target from $263 to $306.

- Stifel’s Brad Reback reiterates his Buy rating and increases the price target from $310 to $320.

- Mizuho’s Gregg Moskowitz maintains his Buy rating and increases the price target from $315 to $325.

- Wolfe Research’s Alex Zukin upholds his Outperform rating and raises the price target from $330 to $350.

- JP Morgan’s Mark Murphy maintains his Overweight rating and increases the price target from $305 to $315.

- Barclays’ Raimo Lenschow maintains his Overweight rating and raises the price target from $310 to $336.

- Jefferies’ Brent Thill maintains his Buy rating and increases the price target from $325 to $350.

- UBS’ Karl Kierstead raises Microsoft’s price target from $280 to $300.

- Goldman Sachs’ Kash Rangan raises Microsoft’s price target from $330 to $335.

Microsoft stock is still recovering from 2022 with this year all the analysts covering the stock besides one having their price target above the stock price.

Alphabet

Q1 earnings reported Q1 earnings of $1.17 per share, exceeding the consensus estimate of $1.08, while its revenue of $69.79 billion beat expectations of $68.89 billion according to FactSet., with the company announcing an additional $70 billion in stock buybacks.

CEO Sundar Pichai highlighted the company’s investments in AI and the potential for innovation during the earnings call, while CFO Ruth Porat said the results reflected ongoing headwinds due to a challenging economic environment.

Google advertising revenue slightly declined to $54.55 billion, while the cloud segment grew 28% to $7.41 billion.

Wall Street Action

- Truist Securities analyst Youssef Squali raised the price target to $122 and has a Buy rating.

- Roth MKM analyst Rohit Kulkarni has a Buy rating and raised the price target to $134.

- Piper Sandler analyst Thomas Champion raised the price target to $128 and has an Overweight rating.

- RBC Capital analyst Brad Erickson has an Outperform rating and raised the price target to $132.

- JMP Securities analyst Andrew Boone has a Market Outperform rating and a $132 price target.

- Morgan Stanley analyst Brian Nowak raised the price target to $140 and has an Overweight rating.

- Raymond James analyst Aaron Kessler has an Outperform rating and raised the price target to $130.

- Credit Suisse analyst Stephen Ju has an Outperform rating and lowered the price target to $135.

- Evercore ISI Group analyst Mark Mahaney raised the price target to $130 and has an Outperform rating.

- Needham analyst Laura Martin has a Buy rating and a $115 price target.

- Keybanc analyst Justin Patterson has an Overweight rating and raised the price target to $122.

- Rosenblatt analyst Barton Crockett raised the price target to $312

All analyst covering GOOGL have their confidence in the stock and the price targets above the stock price raging between $115 and $160

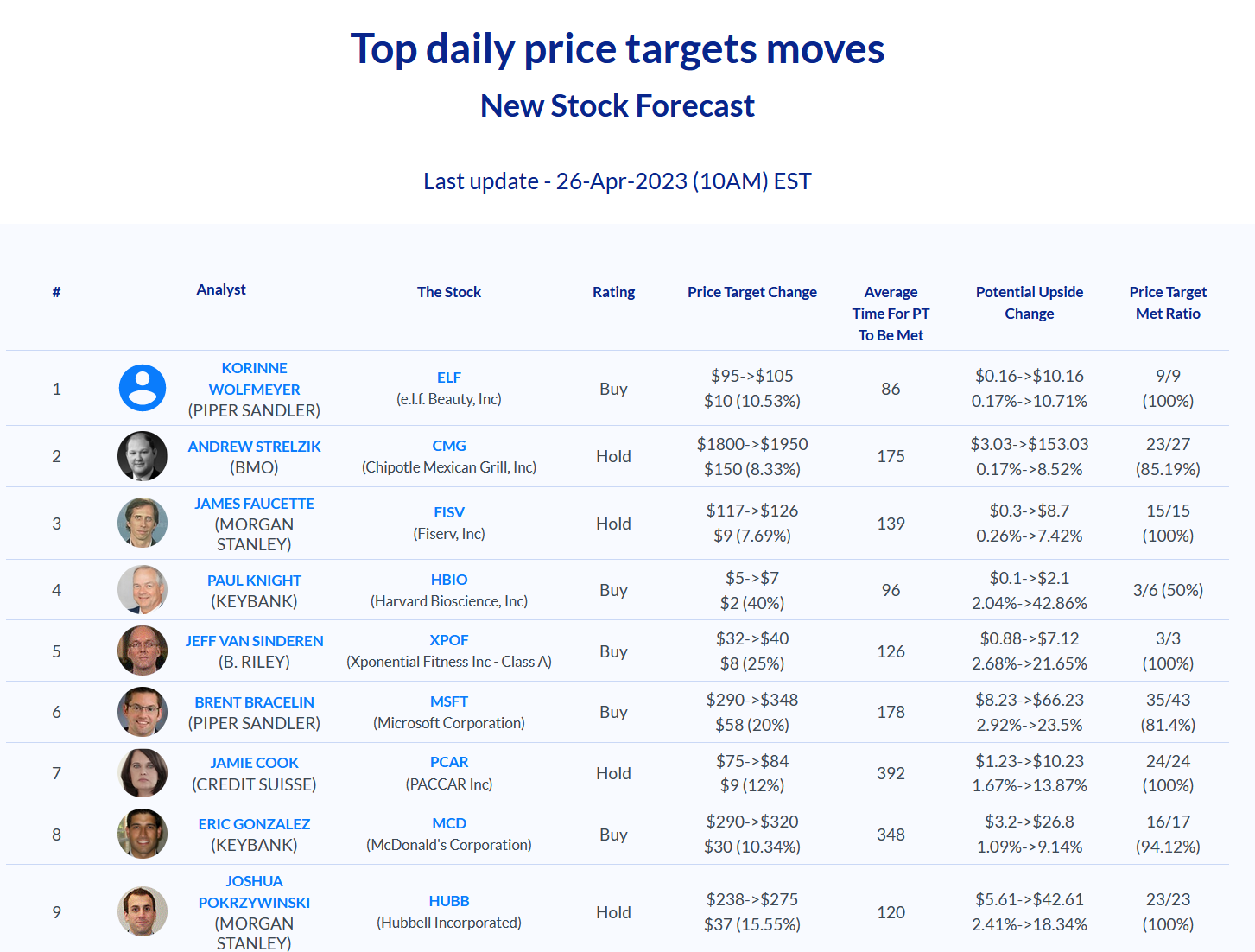

Above is a snapshot of the top daily stock price target moves on AnaChart