Daily Update - May 11, 2023

Selected stock price target highlights of the day

By Matthew Otto

TTD

The Trade Desk reported financial results for Q1 2023. The company achieved a revenue of $383 million, marking a 21% YoY increase. Net income reported was $9 million, with a GAAP diluted earnings per share of $0.02 while non-GAAP net income was $114 million, with non-GAAP diluted earnings per share of $0.23.

The Trade Desk’s customer retention remained over 95% during the first quarter, marking the company’s ninth consecutive year of such high retention. The company also continued to build support for Unified ID 2.0 (UID2), a user-friendly, privacy-focused alternative to third-party cookies. Recent partnerships and pledges of support for UID2 include NBCUniversal’s decision to implement UID2 on Peacock across all devices and consumer touchpoints.

The company also announced a CFO transition, with Laura Schenkein succeeding Blake Grayson, effective from June 1, 2023.

The company’s outlook for Q2 2023 includes at least $452 million in revenue and approximately $160 million in adjusted EBITDA. Share repurchased $293 million in the first quarter of 2023. As of March 31, 2023, the company had $407 million available and authorized for further repurchases.

Wall Street Action

- Youssef Squali from Truist Securities is holding a Buy rating while boosting the price target from $76 to $78.

- Matthew Hedberg of RBC Capital is persisting with an Outperform rating, while lifting the price target from $75 to $77.

- Laura Martin from Needham continues with a Buy rating, while elevating the price target from $68 to $75.

- Matthew Cost from Morgan Stanley is adhering to an Equal-Weight rating, but enhancing the price target from $58 to $60.

- Jason Helfstein of Oppenheimer is standing by an Outperform rating, while advancing the price target from $75 to $80, a street high.

- Justin Patterson from Keybanc is sticking with an Overweight rating, while upgrading the price target from $72 to $75.

- Mark Mahaney at Evercore ISI has raised his price target to $75 from $70 with an Outperform rating.

- Ygal Arounian from Citi has lifted the price target to $78.

- Matthew Swanson from RBC Capital has modified his price target to $77.

Looking at AnaChart we see that the stock had lost near half of its value from the ned of 2021 with most analysts carrying a positive note, Mark Zgutowicz of Benchmark carries a bearish opinion at a $38 price target and a sell rating.

DIS

The Walt Disney Company reported a surprising decline in Disney+ subscribers for the second quarter, causing its stock to fall. Subscribers for the quarter ending in March were 157.8 million, which is significantly lower than the estimated 163.5 million and 2% down from the previous quarter. This was largely due to an 8% decrease in Disney+ Hotstar subscriptions, although core Disney+ subscriptions rose by 1% to 52.9 million.

Despite the fall in Disney+ subscribers, the company’s direct-to-consumer revenue, which includes streaming, rose by 12% to $5.5 billion, and the operating loss for this segment decreased from $700 million to $200 million. The average monthly revenue per paid Disney+ subscriber also increased by 13% to $5.64, reflecting recent price increases.

Other parts of the company saw growth as well. The media and entertainment distribution segment saw a 3% increase in sales to $14.04 billion, and revenue from parks, experiences, and products rose by a significant 17% to $7.78 billion.

Revenues for both the quarter and the first half of the year have shown growth. Quarterly revenue grew by 13% and six-month revenue by 10%.

Wall Street Action

- Deutsche Bank analyst Bryan Kraft has maintained a Buy rating and lowered the price target slightly from $135 to $131.

- Loop Capital’s Alan Gould also maintains a Buy rating on Disney, but has lowered his price target from $130 to $125.

- Credit Suisse’s Douglas Mitchelson has reiterated an Outperform rating on Walt Disney and maintains his $133 price target.

Looking at AnaChart it is worth noting that not a single analyst has explicitly been bearish on the stock since the very successful call of Bernstein analyst Todd Juenger in February of 2021.

Besides Juenger, all analysts kept a bullish look on Disney while the stock lost half of its value.

IAC

Angi released its Q1 2023 financial results:

- Revenue for Q1 2023 was $392 million.

- The revenue breakdown shows that Ads and Leads revenue was $294 million, which remained flat year-over-year, while there was a 14% growth from Services and a 5% growth from Roofing.

- The operating loss decreased to $10 million compared to a loss of $34 million in Q1 2022. Adjusted EBITDA increased to $31 million compared to a loss of $3 million in Q1 2022.

- The number of Transacting Service Professionals was 206,000, and Monetized Transactions were 6.5 million in Q1 2023 (29 million for the trailing twelve months).

- For the three months ending March 31, 2023, net cash provided by operating activities increased $20 million to $19 million, and Free Cash Flow increased $35 million to a positive $7 million.

- For the full year 2023, Angi Inc. expects an operating loss between $15-$70 million and Adjusted EBITDA of $100-$130 million.

Wall Street Action

- Credit Suisse: Analyst Yoni Yadgaran raised the price target from $120 to $123 while maintaining an Outperform rating.

- Truist Securities: Analyst Youssef Squali raised the price target from $85 to $88, keeping a Buy rating.

- UBS: Analyst Kunal Madhukar elevated the price target from $54 to $61 and reiterated a Neutral rating.

- Oppenheimer: Analyst Jason Helfstein increased the price target from $70 to $75 while keeping an Outperform rating.

- Barclays: Analyst Ross Sandler raised the price target from $75 to $85, maintaining an Overweight rating.

Looking at AnaChart we see that Angi is traded at a quarter of its market share from two years ago with most analyst bullish as they have been all that time besides Kunal Madhukar of UBS.

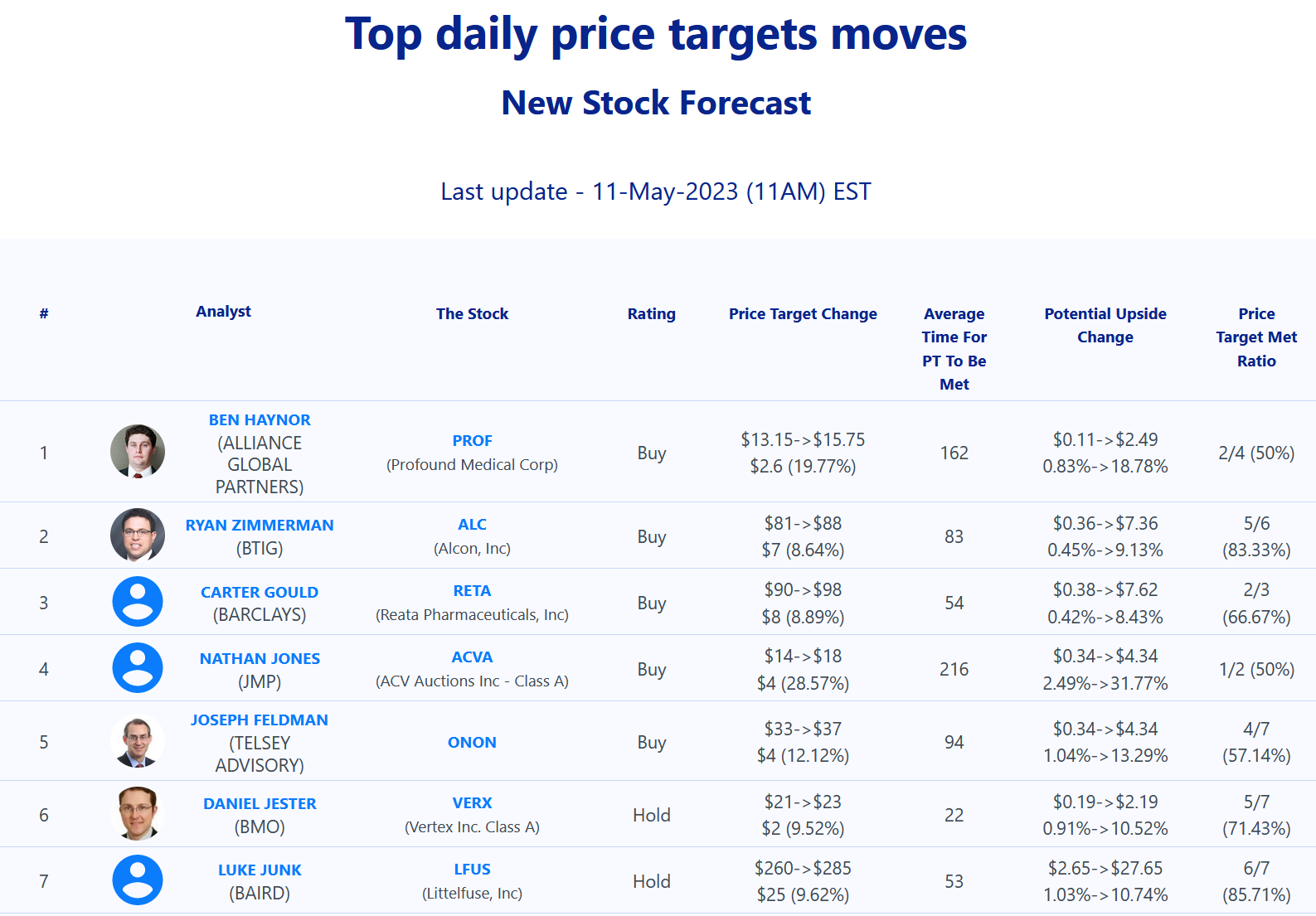

Daily stock Analysts Top Price Moves Snapshot