Selected stock price target news of the day - May 31, 2023

By Matthew Otto

Hewlett Packard Revenue Growth Misses Estimates, Profit and Margins Hit Record Highs Amid Shift to High-Margin Products

Hewlett Packard released their second quarter fiscal 2023 financial results, showing overall positive growth and promising figures. While the company missed revenue expectations, it still reported robust profit numbers and record-breaking margins.

HPE’s CEO, Antonio Neri, noted the company’s successful shift towards a higher-margin product mix. These have been driven primarily by the Intelligent Edge segment and strong demand for their AI offering. Neri stated that these factors “further strengthen the investment opportunity for our shareholders.”

In Q2, HPE posted revenue of $7 billion, up 4% from the same quarter last year. However, this fell shy of both the company’s guidance range of $7.1 billion to $7.5 billion and the street consensus at $7.3 billion. Nonetheless, adjusted profits were 52 cents a share, at the higher end of the guidance range. The non-GAAP gross margin also hit an all-time high of 36.2%.

Neri highlighted growth in the “intelligent edge” segment, which grew 50% from a year ago to $1.3 billion, and had an operating margin of 26.9%, a significant increase from 12.6% the previous year. The high-performance computing and AI segment also saw an 18% increase in revenue, reaching $840 million. This segment includes high-powered computing systems used for training AI models.

However, revenue from the “compute” segment fell by 8% to $2.8 billion, and storage revenue decreased by 3% to $1 billion.

Looking ahead to Q3 2023, HPE expects revenue to be between $6.7 billion and $7.2 billion. They also raised their full-year non-GAAP profit guidance to $2.06 to $2.14 a share, up from a prior forecast of $1.96 to $2.04 a share.

Neri stated that HPE is “uniquely positioned” to benefit from the AI trend, as it sells more high-end computing systems. The company saw strong orders in Q2 for systems from both Fortune 500 companies and “native AI companies.” It also booked a substantial order from a large cloud provider, which Neri did not disclose.

Deutsche Bank, Credit Suisse, Barclays Revise Downwards

- Deutsche Bank’s Sidney Ho reaffirms a Hold position while adjusting the price target downwards from $16 to $15.

- Shannon Cross from Credit Suisse continues with an Outperform rating, yet revises the price target from $19 to $18.

- Barclays’ Tim Long sustains an Equal-Weight stance, trimming the price target from $18 to $16.

Analyst sentiment is mixed with analyst Meta Marshall of Morgan Stanley being more bearish and Samik Chatterjee of JPMorgan bullish while the stock stays in the range of $12 to $17 in the last two years.

Ambarella’s Earnings and Forecast Fall Short of Expectations

Ambarella, Inc. announced its Q1 2024 financial results, revealing some notable declines. The company reported a revenue of $62.1 million, marking a 31% decrease from the $90.3 million registered in the same quarter of fiscal 2023. Both GAAP and non-GAAP gross margins also saw a slight decrease, standing at 60.4% and 63.1%, respectively.

The company’s net loss significantly increased to $35.9 million, or a loss per share of $0.91, compared to the net loss of $10.8 million, or $0.29 loss per share in the same period of fiscal 2023. Non-GAAP net loss stood at $6.0 million, a shift from the non-GAAP net income of $17.1 million recorded in Q1 2023.

Furthermore, Ambarella’s forecast for Q2 2024 revenue also disappointed analysts. The company expects its revenue to be between $60.0 million and $64.0 million, which is below the analyst consensus estimate of $66.9 million.

Despite these challenges, Ambarella reported that it is focusing on enhancing its CV3 platform and 3rd generation AI technology. It also announced a significant win through its partnership with Continental for a L4 commercial vehicle application.

Analysts Adjust Price Targets in Response to Weak Forecast

- Suji Desilva from Roth MKM has kept a Neutral stance, while reducing the price target from $95 to $75.

- Deutsche Bank’s Ross Seymore continues with a hold rating while trimming down the price target from $75 to $70.

- Wells Fargo’s Gary Mobley remains with an Overweight, albeit with a lowered price target from $100 to $90.

- Tore Svanberg of Stifel reaffirms his Buy rating, albeit bringing down the price target from $95 to $90.

- Quinn Bolton from Needham stands by his Buy rating, maintaining a $100 price target.

- John Vinh from Keybanc has moved Ambarella from Overweight to Sector Weight.

Ross Seymore of Deutsche Bank stood out with prudence proved to be correct in hindsight for the year of 2023.

Analysts Maintain ‘Outperform’ on Toll Brothers

Global equity markets and U.S. Treasury yields are under pressure as investors remain cautious ahead of a significant vote in the U.S. Congress on the issue of raising the country’s debt ceiling. The U.S. House of Representatives is scheduled to vote on a bipartisan deal that aims to increase the debt limit to $31.4 trillion, thus helping the government avoid a default. However, the path for the bill in the House is uncertain, given the slim majority held by Republicans and unclear support from House Democrats.

Directly correlated Toll Brothers received faith of confidence ahead of the vote.

- Analyst Jade Rahmani from Keefe, Bruyette & Woods maintains an Outperform rating while uplifting the price target to $83 from the previous $75.

- Credit Suisse’s analyst Daniel Oppenheim reaffirms his Outperform stance keeping the price target steady at $73.

Sentiment view the stock is split in the middle. Analyst Susan Maklari of Goldman Sachs is most bearish at $57, Tyler Batory of Oppenheimer has street high at $81

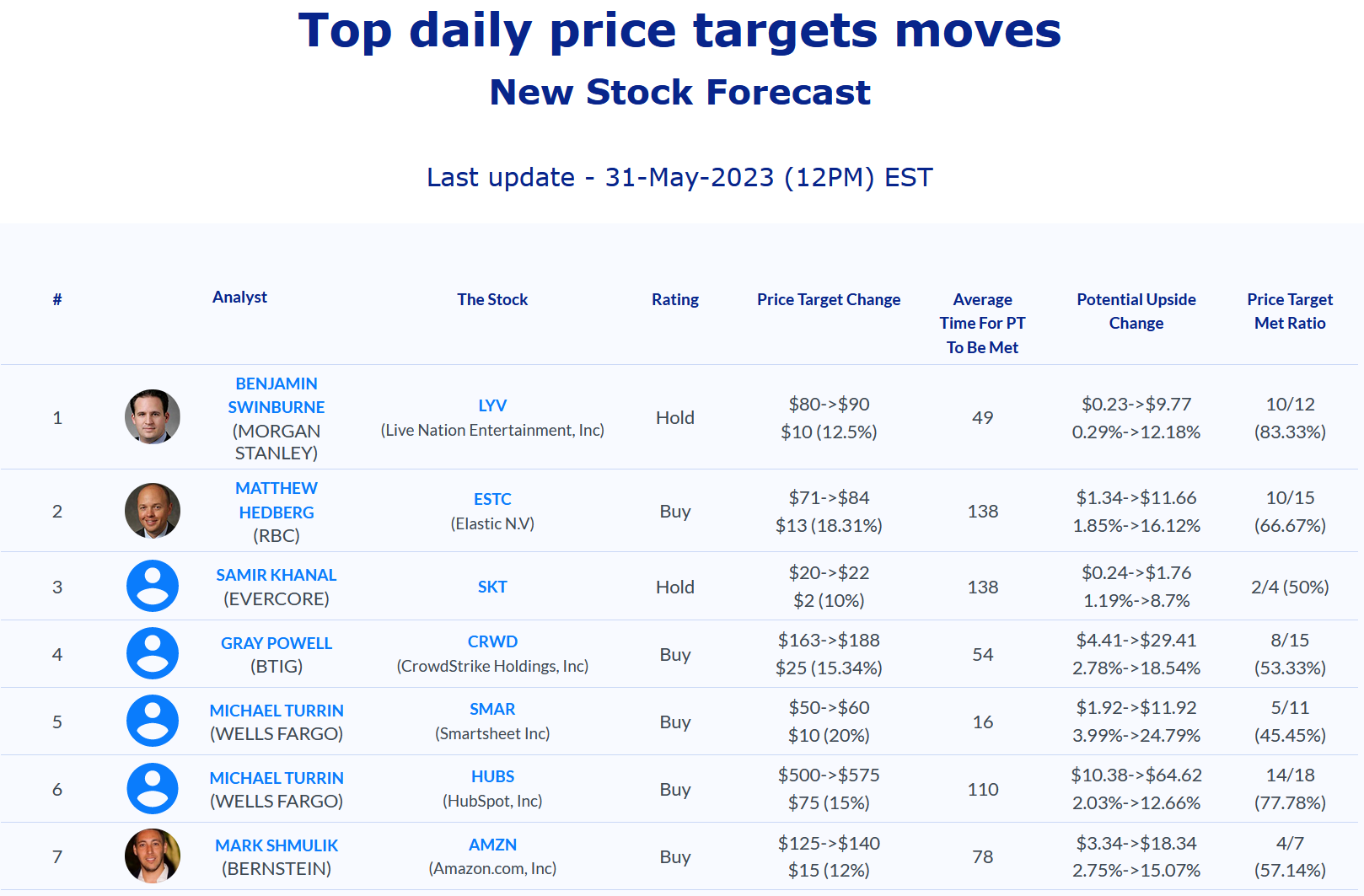

Daily stock Analysts Top Price Moves Snapshot