Selected stock price target news of the day - July 26, 2023

By: Matthew Otto

Alphabet Posts Strong Q2 Results

Alphabet, Google’s parent company, has posted strong results for Q2 2023, reporting earnings per share of $1.44, significantly outperforming analyst expectations of $1.34. The company reported total revenues of $74.6 billion, exceeding the expected $72.85 billion. Specific sectors such as Google Search and YouTube showed a substantial uptick, with revenues of $42.63 billion (a 4.8% increase) and $7.67 billion (a 4.4% increase), respectively. However, the Google Network sector reported a revenue drop of 5% to $7.85 billion.

Google Cloud stood out as a high performer this quarter, with a 28% rise in revenues to $8.03 billion. It also recorded a record operating income of $395 million, showing resilience by bouncing back from an operating loss of $590 million in the same quarter the previous year.

During the earnings call, Pichai emphasized Alphabet’s investments in artificial intelligence (AI). The company is expecting AI to drive growth in search advertising revenue and expand the potential of its cloud business

Ruth Porat’s Role Transition

Alphabet also announced that Ruth Porat, currently Chief Financial Officer, would be stepping into a new role as Chief Investment Officer of Alphabet and Google in September. Porat will oversee Alphabet’s Other Bets portfolio and continue her role as CFO until a suitable replacement is found.

Analysts Approve Google Going into AI

- JMP Securities analyst Andrew Boone holds steady with a Market Outperform rating and adjusts the price target upward from $132 to $138.

- Needham analyst Laura Martin sustains a Buy rating, increasing her price target from $115 to $140.

- Keybanc analyst Justin Patterson continues to support Alphabet with an Overweight rating, lifting the price target from $140 to $145.

- Wolfe Research analyst Deepak Mathivanan keeps an Outperform rating, pushing his price target up from $140 to $150.

- Truist Securities analyst Youssef Squali escalates his price target to $160.

- Canaccord Genuity analyst Maria Ripps bumps his price target up to $155.

- Jefferies analyst Brent Thill hikes Alphabet’s price target to $165.

- RBC Capital analyst Brad Erickson enhances his price target to $155.

Analyst Alan Gould (LOOP CAPITAL) has currently the highest performing score on GOOGL with 16/6 (100%) price target fulfillment ratio. His price targets carry on average an $9.33 (11.44%) potential upside. Alphabet stock price reaches these price targets on average within 72 days.

Biogen Reaffirms Full Year Guidance, Reduces of 1,000 Jobs

Biogen announced its Q2 2023 financial results, reporting revenue of $2,456 million versus the consensus estimate of $2,370 million and GAAP and Non-GAAP diluted EPS of $4.07 and $4.02 respectively, $0.24 better than the analyst estimate. The company’s newly launched Alzheimer’s drug, LEQEMBI, a monoclonal antibody medication used for the treatment of Alzheimer’s disease, which is expected to contribute significantly to its growth, following its launch in the U.S.

Key developments include the commencement of the “Fit for Growth” program, aimed at achieving approximately $1 billion in gross operating expense savings by 2025, a net reduction of 1,000 headcount, representing 11% of its workforce, and the extension of TECFIDERA regulatory market protection in the E.U. until February 2025. In addition, new data underline the potential benefits of SPINRAZA for the treatment of spinal muscular atrophy in infants and toddlers, One in every 6,000 babies is born with SMA. The firm also reports a nearly complete R&D pipeline prioritization, allowing for greater focus on high-value opportunities.

Despite a 5% decline in second-quarter revenue compared to the same period last year, the company reaffirmed its full-year guidance for 2023.

Wall Street Reaction Is Mixed

- Wedbush analyst Laura Chico maintains a Neutral position with a lowered price target from $269 to $268.

- BMO Capital analyst Evan Seigerman holds an Outperform rating, albeit with a lowered price target from $357 to $347.

- HC Wainwright analyst Andrew Fein reiterates a Buy and a price target of $325.

- Needham analyst Ami Fadia also maintains a Buy, raising the price target from $320 to $323.

- Morgan Stanley analyst Matthew Harrison has raised the price target to $363.

- RBC Capital analyst Brian Abrahams has raised the price target to $379.

Analyst Brian Skorney (BAIRD) has currently the highest performing score on BIIB with 13/17 (76.47%) price target fulfillment ratio. His price targets carry on average an $25.22 (9.40%) potential upside. Biogen stock price reaches these price targets on average within 201 days

Spotify’s Q2 User Growth Exceeds Estimates but Revenue Falls Short

Music streaming giant Spotify has surpassed estimates in Q2 for both its monthly active users and premium subscribers, despite missing the mark on revenue projections. Here are some key takeaways from their Q2 report:

- User Growth: Spotify’s monthly active users rose to 551 million, surpassing the company’s own guidance and analysts’ forecast of 526.8 million. This marks the sixth consecutive quarter of robust user growth for the company. Furthermore, the premium subscribers, a critical component of Spotify’s revenue, increased by 17% to 220 million, beating estimates of 216.6 million.

- Revenue: Despite the impressive user growth, Spotify reported quarterly revenue of 3.18 billion euros ($3.51 billion), falling slightly short of analysts’ estimates of 3.21 billion euros. CEO Daniel Ek believes revenue growth will follow user growth, a pattern they’ve seen repeatedly at Spotify.

- Price Increases: Spotify recently raised prices for its premium plans in several countries, a change that is expected to minimally impact revenue this quarter but will start to take effect from September. CFO Paul Vogel anticipates the full effect of the price increase to be felt in Q4.

- Future Expectations: Looking ahead, Spotify projects that premium subscribers will reach 224 million this quarter, with revenue estimated at 3.3 billion euros. These expectations are slightly above analysts’ predictions of 222.4 million subscribers but slightly below the forecasted revenue of 3.40 billion euros.

Analysts Reaction is Mostly Positive

- Credit Suisse analyst Douglas Mitchelson reiterates a Neutral rating and a $120 price target.

- Deutsche Bank analyst Benjamin Black upgraded from Hold to Buy, setting a new price target at $180.

- Barclays analyst Mario Lu maintains an Overweight rating and raises the price target from $180 to $182.

- Goldman Sachs analyst Eric Sheridan continues to hold a Neutral rating, raising the price target from $156 to $163.

- Macquarie analyst Tim Nollen lowered Spotify’s price target to $185.

- Rosenblatt analyst Barton Crockett raised Spotify’s price target to $150.

Analyst Andrew Marok (RAYMOND JAMES) has currently the highest performing score on SPOT with 4/4 (100%) price target fulfillment ratio. His price targets carry on average an $20.15 (19.49%) potential upside. Spotify stock price reaches these price targets on average within 124 days.

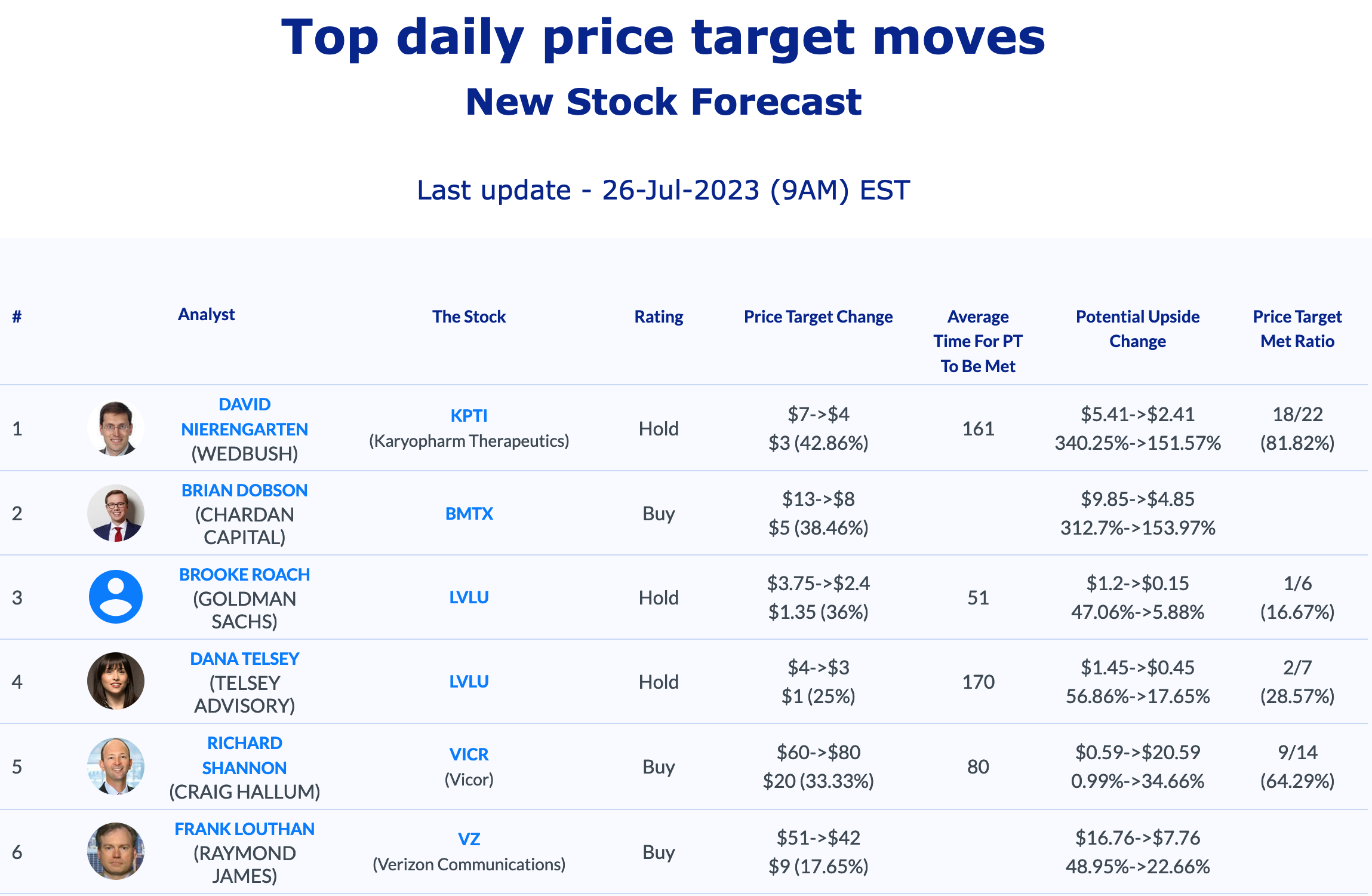

Daily stock Analysts Top Price Moves Snapshot