Selected stock price target news of the day - November 2nd, 2023

By: Matthew Otto

Estée Lauder’s Q1 2024: Sales Dip Spurs Profit Plan

In The Estée Lauder Company’s fiscal 2024 first-quarter conference call showed organic net sales declined by 11%, attributed largely to a 51% drop in global travel retail business. The Americas saw a 6% increase in organic net sales, driven by mid-single-digit growth in North America. In contrast, Asia Pacific experienced a 3% decline in organic net sales, primarily due to the slower-than-expected recovery of prestige beauty in Mainland China.

The gross margin contracted by 440 basis points, primarily influenced by under-absorption of overhead costs in manufacturing plants. Operating income witnessed an 84% decline to $108 million, resulting in an operating margin contraction from 17% to 3.1%. Despite the challenges, the company plans to accelerate and expand its profit recovery plan, aiming for $800 million to $1 billion of incremental operating profit across fiscal years 2025 and 2026.

Analyst Price Target Revisions and Downgrades

- Goldman Sachs analyst Jason English maintained a Buy rating and lowered the price target from $185 to $141.

- Telsey Advisory Group analyst Dana Telsey downgraded from Outperform to Market Perform and the price target from $210 to $115.

- RBC Capital analyst Nik Modi downgraded from Outperform to Sector Perform and the price target from $195 to $115.

Which Analyst has the best track record to show on EL?

Analyst Susan Anderson (CANACCORD) currently has the highest performing score on EL with 3/3 (100%) price target fulfillment ratio. Her price targets carry an average of $1.46 (0.40%) potential upside. The Estee Lauder Companies stock price reaches these price targets on average within 17 days.

Procore’s Q3 2023 Earnings Navigating Growth Amidst Demand Challenges

Procore’s Q3 2023 earnings call reported a 33% year-over-year revenue growth, reaching $248 million versus the estimate of $233.77 million. The company’s international revenue, though impacted by approximately 5 points due to currency headwinds, still managed a 30% year-over-year growth.

The company added 363 net new customers in Q3, signaling a slowdown compared to previous quarters, yet maintaining a healthy gross revenue retention rate of 95%. One notable highlight is Procore’s return to operating profitability, with $8 million reported in Q3, representing a 3% operating margin.

Analyst Perspectives Diverge on Procore Technologies

- Goldman Sachs analyst Kash Rangan maintained a Buy rating and lowered the price target from $85 to $74.

- Oppenheimer analyst Ken Wong downgraded from Outperform to Perform.

- Jefferies analyst Brent Thill downgraded from Buy to Hold and the price target from $90 to $55.

- Piper Sandler analyst Brent Bracelin maintained an Overweight rating and decreased the price target from $84 to $70.

Which Analyst has the best track record to show on PCOR?

Analyst Brent Bracelin (PIPER SANDLER) currently has the highest performing score on PCOR with 6/15 (40%) price target fulfillment ratio. His price targets carry an average of $22.25 (36.69%) potential upside. Procore Technologies stock price reaches these price targets on average within 96 days.

SolarEdge Q3 2023 Revenue Challenges and Strategic Adjustments

SolarEdge Technologies reported its financial results for the third quarter ending September 30, 2023. The company’s total revenues for the quarter amounted to $725.3 million versus the consensus estimate of $769.19 million, marking a 27% decrease compared to the previous quarter and a 13% decrease compared to the same period last year. Revenues from the solar business were $676 million, reflecting a 29% decline quarter-over-quarter and a 14% decrease year-over-year. Notably, the company shipped 3.3 million power optimizers and 274,000 inverters during the quarter, and the solar business saw a shift in average selling price per watt to $0.164, down 13% from the previous quarter.

The company’s regional performance revealed market challenges in Europe, particularly in Germany, which experienced a 43% decline in revenue. The U.S. market showed consistent challenges, with residential sell-through down 13% quarter-over-quarter, while commercial sell-through improved by 8%. SolarEdge is responding to the market dynamics by taking measures to adjust its cost base, discontinuing manufacturing in Mexico, reducing capacity in China, and ramping up production in the U.S.

SolarEdge aims to stabilize its revenue levels after inventory corrections, projecting a quarterly run rate of $600 million to $700 million. Despite short-term challenges, SolarEdge expressed confidence in its future growth, highlighting ongoing product developments and a share repurchase program authorization of up to $300 million through 2024.

Analysts Downgrade Amidst Concerns, Lowering Price Targets

- Goldman Sachs analyst Brian Lee maintained at Neutral and lowered the price target from $131 to $77.

- Guggenheim analyst Joseph Osha downgraded from Buy to Neutral.

- BMO Capital analyst Ameet Thakkar downgraded from Outperform to Market Perform and set a $68 price target.

- Truist Securities analyst Jordan Levy lowered from Buy to Hold and the price target from $120 to $70.

Which Analyst has the best track record to show on SEDG?

Analyst Julien Dumoulin Smith (BAML) currently has the highest performing score on SEDG with 2/4 (50%) price target fulfillment ratio. His price targets carry an average of $24.32 (6.95%) potential upside. SolarEdge Technologies stock price reaches these price targets on average within 29 days.

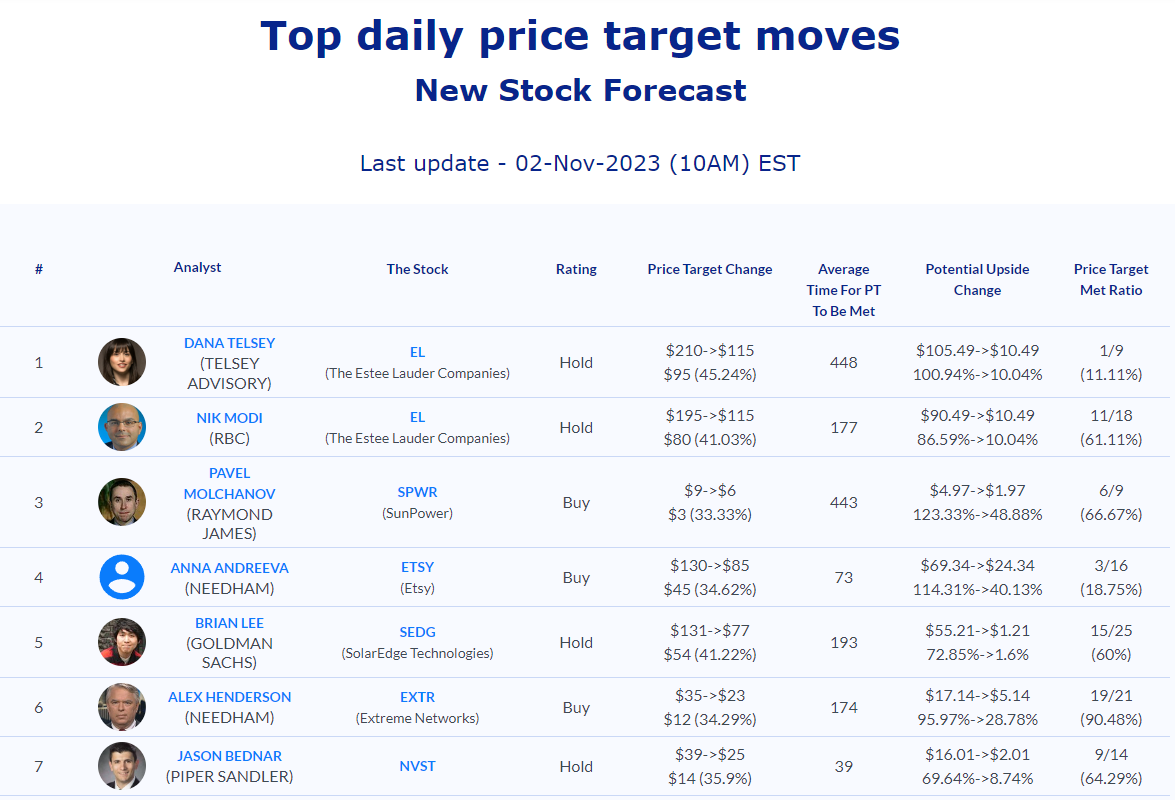

Daily stock Analysts Top Price Moves Snapshot