Selected stock price target news of the day - November 22nd, 2023

By: Matthew Otto

Autodesk Q3 Results Surpassing Revenue and Profit Expectations

Autodesk has reported financial results for its fiscal third quarter, ended in October. The company’s revenue of $1.41 billion marked a 10% increase from the same period last year, surpassing the consensus estimate of $1.39 billion. Adjusted profits exceeded expectations at $2.07 per share, compared to the consensus of $1.99 per share.

The architecture, engineering, and construction segment stood out with a 17% revenue growth, reaching $675 million and contributing to Autodesk’s overall performance. Looking ahead to the fiscal fourth quarter, the company forecasts revenue between $1.42 billion and $1.44 billion, aligning closely with the Street consensus of $1.43 billion. Adjusted profit expectations for the quarter range from $1.91 to $1.97 per share, slightly below the consensus of $2.01 per share. For the entire fiscal year ending January 2024, Autodesk anticipates a 9% increase in revenue, raising the range to $5.45 billion to $5.465 billion, with a corresponding adjustment in the non-GAAP profit guidance to $7.43 to $7.49 per share. The company also revised its free-cash-flow guidance to between $1.2 billion and $1.26 billion, reflecting increased confidence in its financial outlook.

Analyst Varied Perspectives on Price Targets Reflect Market Sentiment

- Keybanc analyst Jason Celino reiterated an Overweight rating and lowered the price target from $250 to $245.

- Piper Sandler analyst Clarke Jeffries downgraded from Overweight to Neutral and the price target from $240 to $215.

- Citi analyst Tyler Radke maintained a Buy rating and reduced the price target from $261 to $243.

- Barclays analyst Salveen Richter lowered the price target to $230.

Which Analyst has the best track record to show on ADSK?

Analyst Kenneth Wong (OPPENHEIMER) currently has the highest performing score on ADSK with 5/8 (62.5%) price target fulfillment ratio. His price targets carry an average of $45.57 (26.73%) potential upside. Autodesk stock price reaches these price targets on average within 213 days.

BellRing Brands Fiscal Performance with 25% Growth in Q4 Net Sales

BellRing Brands has reported financial results for the fourth quarter of fiscal 2023, with net sales reaching $473 million versus the consensus estimate of $463 million, marking a 25% growth over the previous year. The company’s adjusted EBITDA also saw a 23% increase, reaching $99 million, with an adjusted EBITDA margin of 20.8%. Premier Protein, one of BellRing’s flagship brands, played a pivotal role in this success. It achieved a 30% growth in net sales, driven by a 36% increase in shake consumption. Dymatize, another key brand, faced a challenging prior-year comparable but still maintained its presence in domestic mainstream channels. It balances the slight dip in net sales with growth in other areas.

For the full fiscal year of 2023, BellRing Brands reported net sales of approximately $1.7 billion, representing a 22% increase over the previous year. The company’s gross profit reached $530 million, growing by 26%, and gross profit margins increased by 100 basis points, driven by pricing strategies mitigating input cost inflation. BellRing Brands’ adjusted EBITDA for the fiscal year climbed to $338 million, with a margin of 20.3%. The company remains optimistic about the future, forecasting a net sales growth between 10% and 15% for fiscal 2024, accompanied by adjusted EBITDA growth ranging from 6% to 15%.

Analysts Express Confidence in BellRing Brands, Reiterates Ratings

- Needham analyst Matt McGinley reiterated a Buy rating and a price target of $52.

- Stephens & Co. analyst Jim Salera maintained an Equal-Weight rating and a price target of $47.

Which Analyst has the best track record to show on BRBR?

Analyst Pamela Kaufman (MORGAN STANLEY) currently has the highest performing score on BRBR with 14/14 (100%) price target fulfillment ratio. Her price targets carry an average of $3.89 (15.19%) potential upside. BellRing Brands stock price reaches these price targets on average within 118 days.

Lowe’s Faces Decline Amidst DIY Spending Slowdown

Lowe’s Companies faces a challenging economic landscape as it anticipates a larger-than-expected drop in annual same-store sales. The company, heavily reliant on the do-it-yourself segment which constitutes 75% of its revenue, is grappling with a decline in consumer spending on home improvement projects. This trend has resulted in a 7.4% drop in same-store sales for the third quarter, exceeding analysts’ expectations.

Despite easing supply chain costs leading to a third-quarter profit beat, Lowe’s has revised its annual earnings target downward. The company faces stiff competition from its larger rival, Home Depot, which benefits from a customer base primarily composed of Pro-customers like builders and contractors. In response to the challenging market conditions, Lowe’s is strategically focusing on same-day delivery services and offering holiday deals on key products, such as power tools and appliances, to attract price-conscious shoppers. The company now expects a 5% decline in full-year comparable sales, a stark contrast to its previous outlook of a 2% to 4% drop.

Analyst Perspectives Diverge as Price Targets Reflect Varied Outlooks

- Truist Securities analyst Scot Ciccarelli maintained a Buy rating and the price target at $235.

- Barclays analyst Matthew McClintock lowered the price target to $203.

- HSBC analyst Daniela Bretthauer raised the price target to $216.

- Bernstein analyst Dean Rosenblum reiterated an Outperform rating and adjusted the price target from $282 to $235.

Which Analyst has the best track record to show on LOW?

Analyst Laura Champine (LOOP CAPITAL) currently has the highest performing score on LOW with 17/17 (100%) price target fulfillment ratio. Her price targets carry an average of $22.42 (21.61%) potential upside. Lowe’s Companies stock price reaches these price targets on average within 219 days.

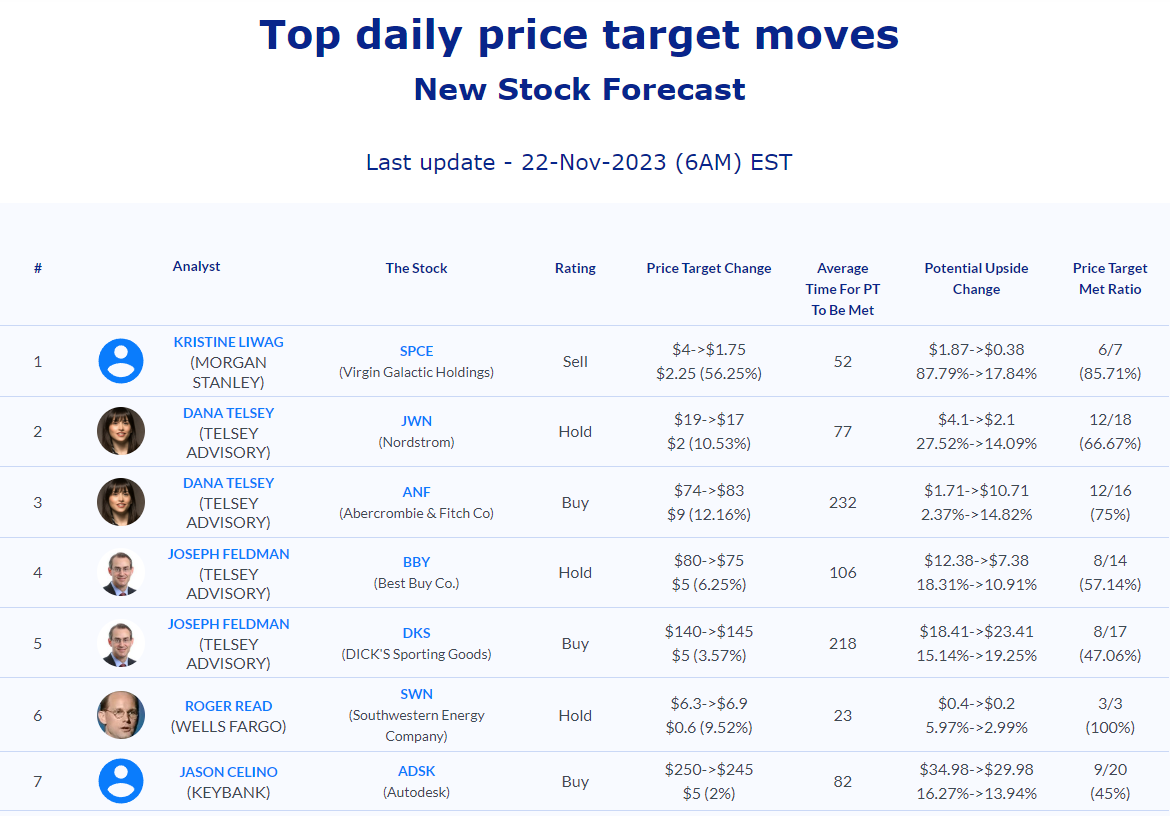

Daily stock Analysts Top Price Moves Snapshot