Selected stock price target news of the day - January 11th, 2024

By: Matthew Otto

Juniper Networks’ $14B Acquisition by HPE Reshapes Networking Future

Juniper Networks finds itself at the center of a transformative $14 billion all-cash acquisition by Hewlett Packard Enterprise, marking a development in the U.S. networking market. This strategic move positions Juniper and its suite of networking solutions as a pivotal player in the industry’s evolution.

HPE’s acquisition underscores the confidence in Juniper’s potential, with a keen eye on integrating Juniper’s Mist offering, known for its innovative use of artificial intelligence to enhance wireless access. Mist’s capabilities include real-time packet capture for efficient issue resolution, location-based services for accurate positioning and tracking, and self-healing features that automatically detect and mitigate network anomalies. Additionally, Mist facilitates user engagement through personalized experiences and analytics, making it a comprehensive and intelligent platform for organizations seeking to optimize and streamline their wireless networks.

Mixed Analyst Sentiments for Juniper Networks

- Jefferies analyst George Notter downgraded from Buy to Hold rating and raised the price target from $35 to $40.

- Morgan Stanley analyst Meta Marshall upgraded from Underweight to Equal-Weight rating and set a $40 price target.

- Barclays analyst Tim Long downgraded from Overweight to Equal-Weight rating.

- Raymond James analyst Simon Leopold shifted from Outperform to Market Perform.

Which Analyst has the best track record to show on JNPR?

Analyst Samik Chatterjee (JPMORGAN) currently has the highest performing score on JNPR with 10/11 (90.91%) price target fulfillment ratio. His price targets carry an average of $2.74 (10.43%) potential upside. Juniper Networks stock price reaches these price targets on average within 280 days.

KB Home Q4 2023 Performance Amid Market Challenges

KB Home reported financial results for the fourth quarter of fiscal year 2023, with total revenues reaching $1.7 billion compared to consensus of $1.62 billion. Diluted earnings per share standing at $1.85. The company’s outperformance in closings, totaling over 3,400 homes, was attributed to improved build times and a robust backlog of committed buyers. KB Home delivered more than 13,200 homes throughout 2023, generating revenues of $6.4 billion and achieving diluted earnings above $7 per share. Noteworthy operational achievements include a reduction in build times, resulting in an average savings of about $18,000 per home compared to peak costs in August 2022.

KB Home’s mortgage joint-venture, KBHS Home Loans, showcased 87% of mortgages funded during the quarter financed through the joint venture. The company’s land position stood at approximately 56,000 lots at quarter-end, with 40,800 lots owned. The company’s ending backlog for the first quarter of 2024 comprises more than 5,500 homes, valued at approximately $2.7 billion.

Analyst Mixed Ratings Reflect Diverse Market Perspectives

- Goldman Sachs analyst Susan Maklari maintained a Neutral rating and raised the price target from $55 to $61.

- Seaport Global analyst Kenneth Zener downgraded from Buy to Neutral.

- Wedbush analyst Jay McCanless raised the price target to $60.

- Evercore ISI analyst Stephen Kim reiterated an Outperform rating and increased the price target to $76.

- RBC Capital analyst Mike Dahl increased the price target to $63.

- Deutsche Bank analyst Joe Ahlersmeyer raised the price target to $50.

Which Analyst has the best track record to show on KBH?

Analyst Deepa Raghavan (WELLS FARGO) currently has the highest performing score on KBH with 2/2 (100%) price target fulfillment ratio. Her price targets carry an average of $3.89 (7.61%) potential upside. KB Home stock price reaches these price targets on average within 31 days.

Meta Fined $160,000 Daily by Turkish Competition Authority

The Turkish Competition Authority has announced a daily fine of $160,000 on Meta Platforms. This penalty is a consequence of Meta’s failure to provide sufficient documentation related to a previous investigation into the online video advertising market in 2022.

As part of the investigation, Meta was required to submit a document outlining compliance measures to address its violation of the law and to restore competition in the market. The Turkish Competition Board found Meta’s submitted compliance measures inadequate and, as a result, decided to impose a daily fine starting from December 12. This fine will continue until Meta submits a final compliance solution that meets the board’s requirements.

The Turkish Competition Authority had already fined Meta $11.6 million for violating competition law last 2022. Meta has expressed disagreement with the Turkish Competition Authority’s findings but has stated its commitment to cooperating with them to resolve the matter promptly.

Analysts Raises Price Target and Maintained its Rating

- Mizuho analyst James Lee maintained a Buy rating and raised the price target from $400 to $470.

Which Analyst has the best track record to show on META?

Analyst Thomas Champion (PIPER SANDLER) currently has the highest performing score on META with 16/19 (84.21%) price target fulfillment ratio. His price targets carry an average of $66.65 (23.11%) potential upside. Meta Platforms stock price reaches these price targets on average within 179 days.

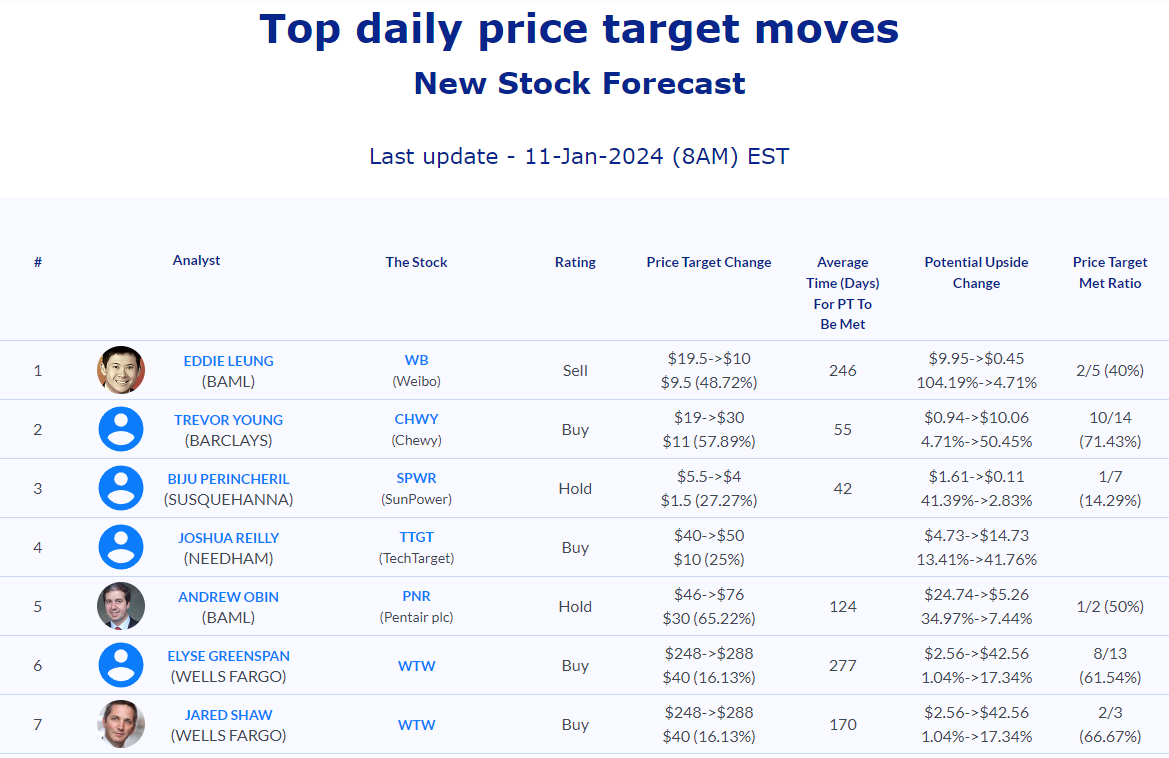

Daily stock Analysts Top Price Moves Snapshot