AnaChart Recognizes Top Analysts’ Performance in 2023

(Jan. 9, 2024, New York City). Today, AnaChart.com, a New York fintech company that tracks sell-side stock analysts’ stock picks, ranked the top eleven research analysts whose stock picks outperformed during 2023. AnaChart chose these analysts for their insightful research and consistent stock pick returns.

AnaChart’s algorithm measures each stock analyst’s recommendations and the related price return. This metric covers all the stocks that the various analysts cover.

The majority of the top analysts cover stocks within the healthcare and technology sectors. AnaChart tracks the performance of each stock research report and target price recommendation by these analysts.

AnaChart’s CEO, Joseph Kalish, said, “S&P 500 returned over 24% in 2023. Many sell-side stock analysts outperformed this rate with their stock picks. AnaChart has identified those whose research picks excelled.”

The winners for 2023 are:

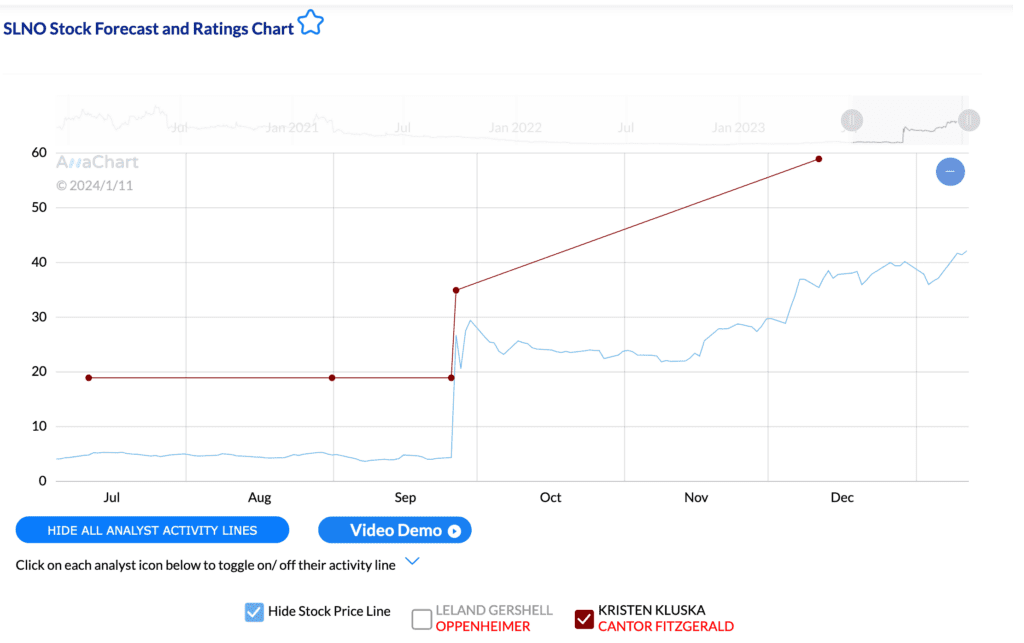

- Kristen Kluska (CANTOR FITZGERALD), Healthcare analyst, Top Pick: Soleno Therapeutics.

Ms. Kluska was the top stock picker of 2023 based on her timely reports on Soleno. Her two consecutive calls generated 280% and 42% within six months after initiating coverage on SLNO.

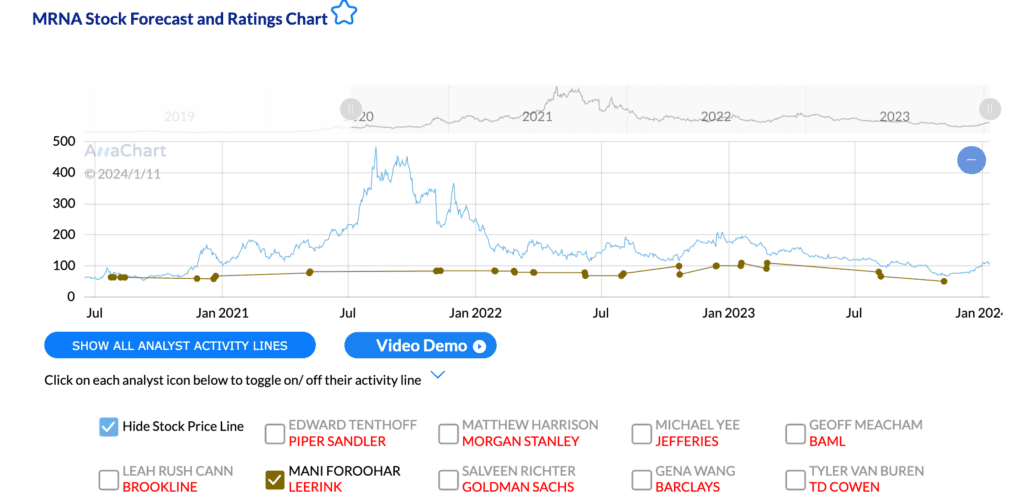

- Mani Foroohar, (SVB LEERINK), Healthcare analyst – Top Pick: Moderna.

Winner of the AnaChart Big Short awards for 2023. From 2020 through 2023, Foroohar’s positive opinion on Moderna remained firm. This bucked the consensus from other analysts. Foroohar’s price targets rose 87% from the stock’s peak price in 2021, and gained 63% during 2023.

Honorable mentions for other analysts whose stock picks have had repeated double digit returns:

- John Vinh, KEYBANK, Technology – Nvidia.

- Jason Helfstein, OPPENHEIMER, Technology- Meta Platforms.

- Mark Mahaney, EVERCORE, Technology – Duolingo.

- Peter Lawson, BARCLAYS, Healthcare – ImmunoGen.

- Chase White, COMPASS POINT, Financial Services – Marathon Digital.

- John Todaro, NEEDHAM, Technology – Coinbase Global.

- Jed Kelly, OPPENHEIMER, Consumer Cyclical – DraftKings.

- Michael Graham, CANACCORD, Consumer Cyclical – DraftKings.

- Brian Gesuale, RAYMOND JAMES, Technology – Palantir Technologies.

For further information, contact Joseph Kalish, CEO, at [email protected] or Mark Hake, CFA, Chief Strategy Officer, at [email protected].

About AnaChart: AnaChart.com is revolutionizing the fintech industry as an equity research support platform. Founded in 2020, it uses proprietary technology to track up-to-date price targets and ratings published by top sell-side stock analysts. AnaChart provides tools to improve investors’ views on stocks. It offers a basic free version covering analysts’ picks on the top 100 NASDAQ stocks, and a subscription service covering over 5,000 stocks and 4,000 sell-side analysts.