Selected stock price target news of the day - January 12th, 2024

By Matthew Otto

Coinbase: ETF Approval Sparks Volatility and Opportunities

Coinbase Global experienced a rollercoaster of market activity as the Securities and Exchange Commission’s approval of the first spot Bitcoin exchange-traded funds sent shockwaves through the cryptocurrency broker’s stock. Analysts remain divided on the outlook for Coinbase, with some, like Moshe Katri of Wedbush, optimistic about the company’s potential to benefit from its role as a custodian for the approved ETFs, while others, including Dan Dolev from Mizuho Securities, express skepticism, citing concerns about potential fee pressures and increased competition in the evolving cryptocurrency landscape.

The SEC’s nod to Bitcoin ETFs is seen as a pivotal moment that could usher in a fresh wave of investor interest in cryptocurrencies. The approval is anticipated to attract retail and institutional investors to platforms like Coinbase. The regulatory green light provides a regulated avenue for investors to engage with Bitcoin, potentially leading to increased competition, fee pressures, and a reshuffling of the crypto capital landscape.

Analyst Perspectives Diverge as Price Targets Vary

- Wedbush analyst Moshe Katri maintained an Outperform rating and raised the price target from $110 to $180.

- Mizuho Securities analyst Dan Dolev set an Underperform rating and a $54 price target.

- BofA Securities analyst Jason Kupferberg raised the price target from $66 to $79.

Which Analyst has the best track record to show on COIN?

Analyst Richard Repetto (PIPER SANDLER) currently has the highest performing score on COIN with 11/13 (84.62%) price target fulfillment ratio. His price targets carry an average of $-8.04 (-9.13%) potential downside. Coinbase Global stock price reaches these price targets on average within 154 days.

Mastercard’s Small Business AI: Empowering Entrepreneurs Globally

Mastercard is spearheading a groundbreaking initiative to bolster small businesses worldwide through the development of Mastercard Small Business AI. Data indicates that eight out of ten small businesses operate without employees and 88% recognizing the value of mentorship. Mastercard Small Business AI endeavors to cater to the unique challenges faced by entrepreneurs. In addition to Mastercard’s extensive repository of content, a diverse global media coalition, including Blavity Media Group, Group Black, Newsweek, and TelevisaUnivision, will contribute licensed business content to the Generative AI tool, fostering a wealth of resources for small business owners.

The Mastercard Small Business AI tool is designed to address the overwhelming nature of today’s data-driven business environment. Aimed at providing always-on assistance, the tool is particularly relevant for the vast majority of small businesses operating without a dedicated workforce. The Generative AI features incorporated into the tool aim to create a conversational and inclusive user experience, ensuring that entrepreneurs receive tailored advice and guidance. With 53 million U.S. consumers reached across linear and digital platforms, TelevisaUnivision joins the global media coalition alongside other prominent partners, contributing to the tool’s diverse content offering.

Analysts Offer Varied Views, Adjusting Ratings and Price Targets

- Goldman Sachs analyst Matthew O’Neill maintained a Buy rating and increased the price target from $433 to $482.

- Oppenheimer analyst Dominick Gabriele upgraded from Perform to Outperform and set a new price target of $510.

Which Analyst has the best track record to show on MA?

Analyst Josh Beck (KEYBANK) currently has the highest performing score on MA with 13/15 (86.67%) price target fulfillment ratio. His price targets carry an average of $46.79 (11.90%) potential upside. Mastercard stock price reaches these price targets on average within 145 days.

Bank of America Faces Earnings Decline, Struggles with One-Time Charges in Q4 2023

Bank of America reported declining fourth-quarter earnings. The bank’s adjusted earnings per share stood at 70 cents, surpassing the expected 68 cents. Revenue reached $22 billion, although the comparability to analyst estimates remains unclear. The decline in net income to $3.1 billion, down more than 50% from a year ago, was attributed to significant one-time charges, including a $1.6 billion pretax charge linked to the transition away from the London Interbank Offered Rate. Additionally, a special $2.1 billion fee from the Federal Deposit Insurance Corp., tied to the failures of Silicon Valley Bank and Signature Bank, further impacted the bank’s financials.

Revenue from consumer banking experienced a 4% dip to $10.3 billion, but sales and trading revenue saw a 3% increase, reaching $3.6 billion. The provision for credit losses amounted to $1.1 billion, reflecting an increase of $12 million from the same quarter last year. The bank’s net interest income decreased by 5% to $13.9 billion, impacted by higher deposit costs and lower deposit balances, offsetting higher asset yields. Bank of America, once anticipated to benefit from higher interest rates, faced challenges due to investments in low-yielding, long-dated securities during the Covid pandemic, which lost value as interest rates climbed.

Analysts Boosts Price Targets for Bank of America

- JPMorgan analyst Vivek Juneja maintained an Overweight rating and increased the price target from $34 to $35.

- Jefferies analyst Ken Usdin reiterated a Hold rating and raised the price target from $29 to $36.

Which Analyst has the best track record to show on BAC?

Analyst Scott Siefers (PIPER SANDLER) currently has the highest performing score on BAC with 2/3 (66.67%) price target fulfillment ratio. His price targets carry an average of $-1.11 (-3.88%) potential downside. Bank of America stock price reaches these price targets on average within 4 days.

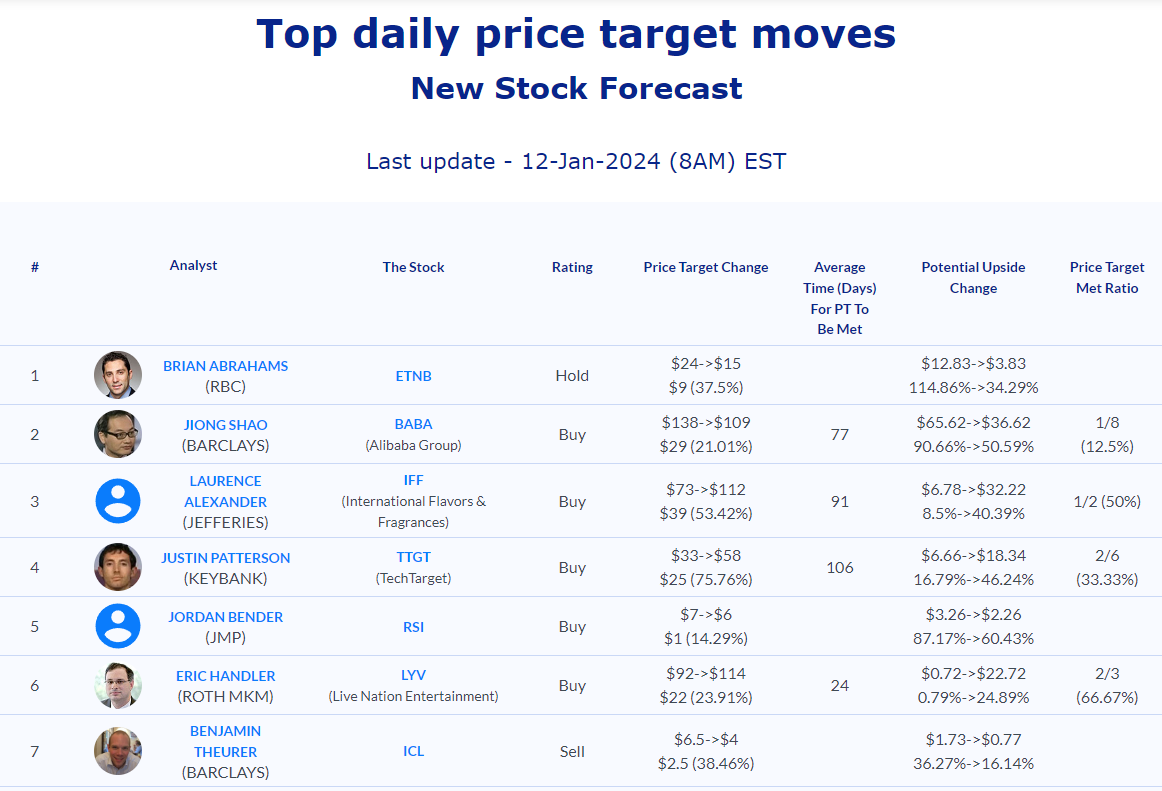

Daily stock Analysts Top Price Moves Snapshot