Selected stock price target news of the day - March 6th, 2024

By: Matthew Otto

CrowdStrike Surges: Exceeds Expectations with Financial Performance

CrowdStrike performance was underscored by its adjusted earnings per share of 95 cents, compared to analyst expectations of 82 cents. Furthermore, CrowdStrike reported revenues of $845 million, surpassing consensus estimates of $839 million, reflecting a year-over-year growth trajectory.

In addition, CrowdStrike’s net income for the period ending January 31 surged to $54 million, a contrast from the $48 million loss reported in the same period last year. A full-year revenue of $3 billion, representing a 36% year-over-year increase.

Looking ahead, CrowdStrike provided guidance for the upcoming fiscal quarter, with projected revenue expected to range between $902 million and $906 million. Furthermore, CrowdStrike anticipates earnings per share for the period to be between 89 cents and 90 cents, above analyst expectations.

CrowdStrike emphasized on achieving $10 billion in annual recurring revenue by 2030. With the company already reaching $3.4 billion in annual recurring revenue as of January.

Analysts Bullish: Price Targets Raised Across the Board

- Baird analyst Shrenik Kothari maintained an Outperform rating and raised the price target from $281 to $350.

- Mizuho analyst Gregg Moskowitz reiterated a Buy rating and increased the price target from $360 to $390.

- HSBC analyst Stephen Bersey reiterated a Buy rating and increased the price target from $411 to $412.

- Barclays analyst Saket Kalia maintained an Overweight rating and raised the price target from $340 to $400.

- Keybanc analyst Eric Heath maintained an Overweight rating and raised the price target from $375 to $430.

- Canaccord Genuity analyst Michael Walkley kept a Buy rating and upgraded the price target from $300 to $400.

- Guggenheim analyst John Difucci reiterated a Buy rating and increased the price target from $358 to $424.

- Wells Fargo analyst Andrew Nowinski kept an Overweight rating and upgraded the price target from $380 to $435.

- Jefferies analyst Joseph Gallo kept a Buy rating and upgraded the price target from $375 to $400.

- Wedbush analyst Taz Koujalgi maintained an Outperform rating and increased the price target from $278 to $350.

Which Analyst has the best track record to show on CRWD?

Analyst Keith Bachman (BMO) currently has the highest performing score on CRWD with 7/7 (100%) price target fulfillment ratio. His price targets carry an average of $9.92 (3.81%) potential upside. CrowdStrike Holdings stock price reaches these price targets on average within 31 days.

Target Circle 360: A Paid Membership Program Set to Disrupt E-Commerce Landscape

Target revolutionized its customer engagement strategy with the launch of Target Circle 360, a subscription-based program set to debut in early April at an annual fee of $99. During the promotional period lasting until May 18, Target is offering an enticing discounted rate of $49 per year.

This move comes as Target’s fiscal fourth-quarter earnings, reported on Tuesday, surpassed Wall Street’s expectations. Target has faced a decline in comparable sales for three consecutive quarters. Target’s free Target Circle loyalty program already boasts a membership base of over 100 million, and Target is aiming to tap into this customer pool by offering unlimited free same-day delivery for orders exceeding $35.

To power its home deliveries, Target will leverage Shipt, a company it acquired in 2017 for $550 million. This strategic move is expected to invigorate Target’s e-commerce business by eliminating delivery fees, potentially addressing the decline in digital sales, which saw a 0.7% year-over-year drop in the fiscal fourth quarter.

Analysts Sees Positive Outlook as Price Targets Surge

- Goldman Sachs analyst Kate McShane maintained a Buy rating and increased the price target from $176 to $194.

- Barclays analyst Seth Sigman reiterated an Equal-Weight rating and raised the price target from $142 to $169.

- Guggenheim analyst Robert Drbul kept a Buy rating and boosted the price target from $160 to $190.

- Wells Fargo analyst George Kelly kept an Overweight rating and lifted the price target from $165 to $190.

- HSBC analyst Daniela Bretthauer upgraded from Hold to Buy and raised the price target from $140 to $195.

- Morgan Stanley analyst Simeon Gutman maintained an Overweight rating and increased the price target from $165 to $190.

- UBS analyst Michael Lasser maintained a Buy rating and the price target at $174.

Which Analyst has the best track record to show on TGT?

Analyst Simeon Gutman (MORGAN STANLEY) currently has the highest performing score on TGT with 22/29 (75.86%) price target fulfillment ratio. His price targets carry an average of $23.93 (16.96%) potential upside. Target stock price reaches these price targets on average within 187 days.

Nordstrom Beats Q4 Earnings Estimates but Falls Short on Fiscal 2024 Guidance

Nordstrom reported its latest earnings, surpassing expectations with adjusted earnings of $0.96 per share for the fiscal fourth quarter, outpacing estimates of $0.88 per share. Nordstorm’s gross profit also saw an uptick, rising by 1.25 percentage points to reach 34.4%, attributed to reduced markdowns and lower occupancy costs.

Nordstrom anticipated full-year revenue growth to range between a 2% decline and a 1% increase year-over-year, along with an earnings per share projection of $1.65 to $2.05, well below analysts’ forecasts.

Nordstrom’s struggles with full-year guidance overshadowed its revenue growth in Q4, which reached $4.4 billion, marking a 2.2% increase compared to the previous year. Notably, while sales at Nordstrom’s banner stores experienced a 3% decline, the off-price segment, Nordstrom Rack, saw a 14.6% surge in sales, indicating consumer preference for value-oriented purchases during the holiday season.

Analysts Maintain Ratings and Adjusted Price Targets

- Barclays analyst Paul Kearney maintained an Underweight rating and raised the price target from $14 to $15.

- BofA Securities analyst Lorraine Hutchinson reiterated an Underperform rating and increased the price target from $13 to $15.

- Citigroup analyst Paul Lejuez reiterated a Neutral rating and lowered the price target from $21 to $20.

- JP Morgan analyst Matthew Boss maintained an Underweight rating and raised the price target from $14 to $15.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and lifted the price target from $17 to $19.

Which Analyst has the best track record to show on JWN?

Analyst Brooke Roach (GOLDMAN SACHS) currently has the highest performing score on JWN with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $1.97 (14.04%) potential upside. Nordstrom stock price reaches these price targets on average within 10 days.

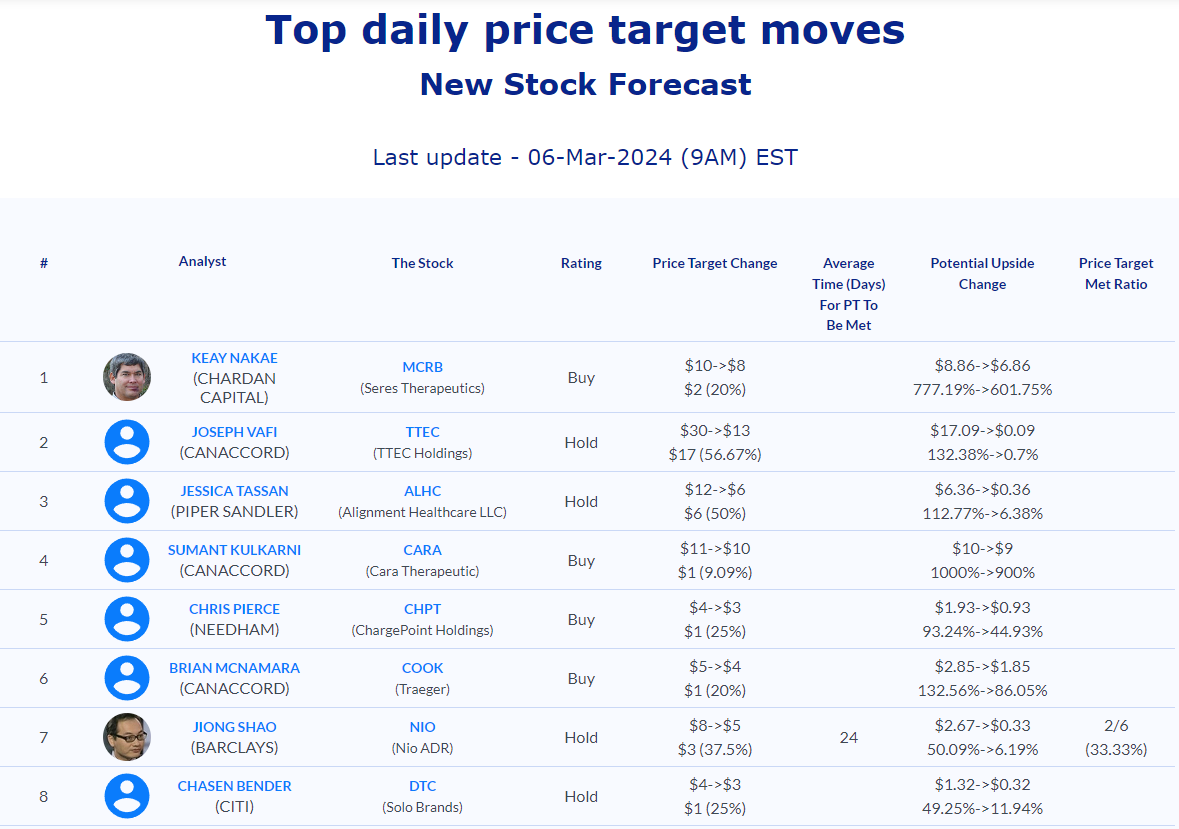

Daily stock Analysts Top Price Moves Snapshot