Selected stock price target news of the day - September 17th, 2024

By: Matthew Otto

Tesla Vehicle Deliveries Decline 7% in First Half of 2024, Analysts Anticipate Q3 Recovery

Tesla delivered approximately 831,000 vehicles in the first half of 2024, a 7% decrease from the 894,000 vehicles delivered during the same period in 2023. In Q2 2024 alone, Tesla delivered around 410,000 vehicles, falling short of expectations, which had been set closer to 420,000.

Despite these setbacks, analysts expect an improvement in the third quarter, with projected deliveries of 460,000 vehicles, marking a 6% increase compared to the 434,000 delivered in Q3 2023.

Tesla’s production numbers for 2024 also reflect this trend, with approximately 875,000 vehicles produced in the first half, down 5% year over year from the 921,000 produced in the first half of 2023. Tesla’s Model Y continues to be the company’s best-selling vehicle, accounting for over 60% of total deliveries.

Despite the recent dip, analysts remain optimistic about Tesla’s ability to meet its annual delivery target of 1.8 million vehicles.

Analysts Offer Diverging Ratings Amid Mixed Delivery Outlook

- Cantor Fitzgerald analyst Andres Sheppard reiterated a Neutral rating and a $245 price target.

- Canaccord Genuity analyst George Gianarikas maintained a Buy rating and the price target at $254.

- Guggenheim analyst Ronald Jewsikow maintained a Sell rating; however, raised the price target from $134 to $153.

Which Analyst has the best track record to show on TSLA?

Analyst Andres Sheppard (CANTOR FITZGERALD) currently has the highest performing score on TSLA with 9/15 (60%) price target fulfillment ratio. His price targets carry an average of $28.73 (13.28%) potential upside. Tesla stock price reaches these price targets on average within 15 days.

Nuvalent Reports Promising Trial Results for Lung Cancer Drugs, Analysts Highlight Potential

Nuvalent presented updates on two of its experimental lung cancer treatments, zidesamtinib and NVL-655, at the European Society for Medical Oncology Congress in Barcelona. 44% of patients with ROS1-positive non-small cell lung cancer (NSCLC) responded to zidesamtinib in an ongoing trial. Similarly, 38% of patients with ALK-positive NSCLC responded to NVL-655 in a separate trial. Both studies involve patients whose cancers had previously resisted other treatments, and Nuvalent anticipates concluding both trials by next year.

Analysts responded positively to these developments. Leerink Partners’ Andrew Berens noted that the data support a best-in-class profile for NVL-655, which targets ALK gene mutations commonly found in NSCLC. Berens also pointed out that the expedited trial timeline could accelerate the drug’s movement into earlier treatment stages. Piper Sandler analyst Christopher Raymond echoed this view, projecting significant market potential for NVL-655 and zidesamtinib. Raymond added that Nuvalent is well on its way to unlocking the multibillion-dollar potential of NVL-655, with zidesamtinib expected to reach several hundred million dollars in value.

Analyst Upgrades and Price Target Revisions Reflect Positive Trial Results

- Guggenheim analyst Kelsey Goodwin maintains a Buy rating on Nuvalent and raises the price target from $99 to $105.

- Wedbush analyst David Nierengarten keeps an Outperform rating on Nuvalent and increases the price target from $99 to $115.

- BMO Capital analyst Etzer Darout holds an Outperform rating for Nuvalent, with the price target rising from $102 to $132.

- Stifel analyst Bradley Canino retains a Buy rating on Nuvalent and lifts the price target from $115 to $135.

Which Analyst has the best track record to show on NUVL?

Analyst Etzer Darout (BMO) currently has the highest performing score on NUVL with 4/5 (80%) price target fulfillment ratio. His price targets carry an average of $16.64 (19.49%) potential upside. Nuvalent stock price reaches these price targets on average within 149 days.

Merit Medical Systems Announces Acquisition of Cook Medical’s Lead Management Portfolio

Merit Medical Systems has entered into a definitive agreement to acquire Cook Medical’s lead management product portfolio for a cash consideration of approximately $210 million. The transaction is scheduled to close in the fourth quarter of 2024, subject to customary closing conditions, including regulatory approvals under the Hart-Scott-Rodino Antitrust Improvements Act.

Cook Medical’s lead management business, with a 34-year history, includes a comprehensive range of medical devices and accessories used in procedures for replacing or removing pacemaker and implantable cardioverter-defibrillator (ICD) leads. The acquisition is projected to generate approximately $40 million in additional annual revenue starting from fiscal year 2025. Following the acquisition, Merit expects its combined annualized revenue from electrophysiology and CRM to exceed $100 million.

Analysts Adjust Ratings and Price Targets Following Announcement

- Wells Fargo analyst Larry Biegelsen maintained an Equal-Weight rating, while raising the price target from $85 to $103.

- BofA Securities analyst Craig Bijou continued with a Neutral rating, yet increased the price target from $92 to $103.

- Needham analyst Mike Matson reiterated a Buy rating and the price target at $105.

Which Analyst has the best track record to show on MMSI?

Analyst Mike Matson (NEEDHAM) currently has the highest performing score on MMSI with 21/22 (95.45%) price target fulfillment ratio. His price targets carry an average of $9.19 (9.59%) potential upside. Merit Medical Systems stock price reaches these price targets on average within 273 days.

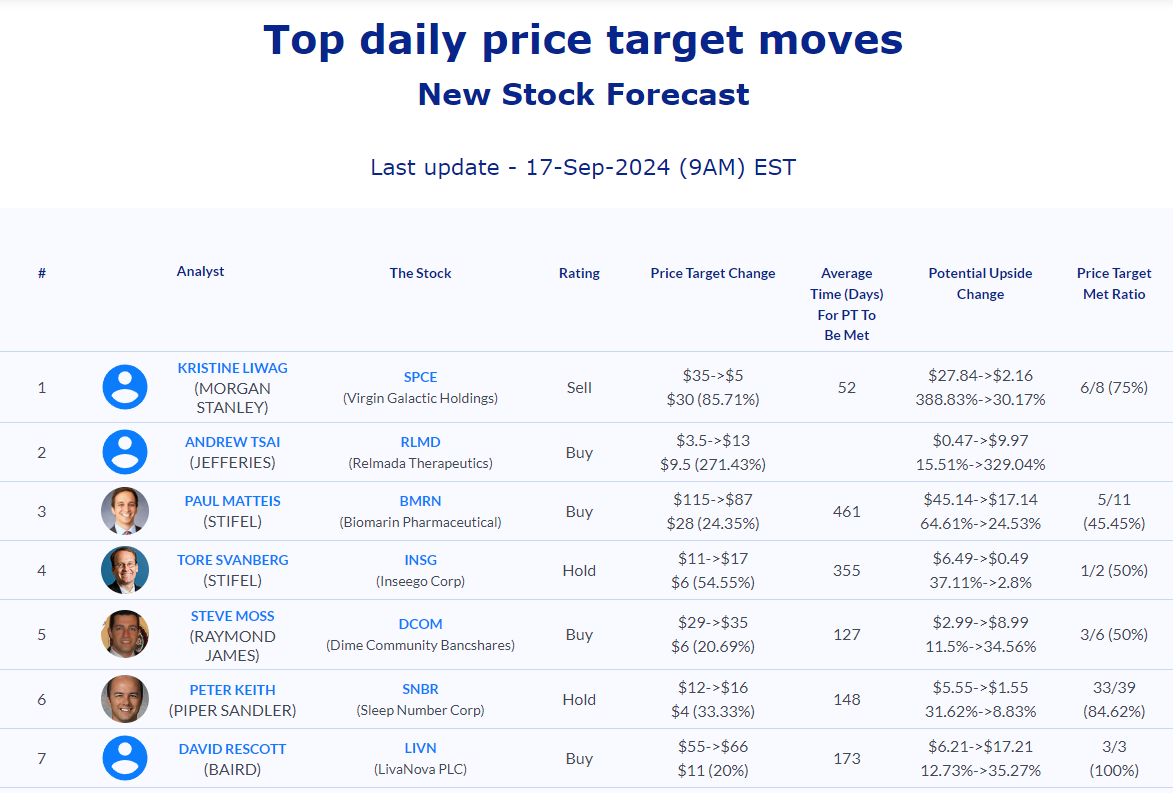

Daily stock Analysts Top Price Moves Snapshot