Selected stock price target news of the day - October 3rd, 2024

By: Matthew Otto

NIKE’s Q1 Fiscal 2025 Results Show Revenue Decline, Despite EPS Beating Expectations

NIKE reported its fiscal 2025 first-quarter financial results, posting revenues of $11.6 billion, slightly below the consensus estimate of $11.65 billion, and a 10% decrease from the prior year on a reported basis.

NIKE Direct revenues declined by 13% to $4.7 billion, while wholesale revenues decreased by 8% to $6.4 billion. Despite these declines, gross margin improved by 120 basis points to 45.4%, driven by reduced product costs and strategic pricing actions.

Net income for the quarter was $1.1 billion, down 28%, while diluted earnings per share (EPS) came in at $0.70, outperforming the analyst estimate of $0.52 by $0.18, though down 26% from the prior year.

NIKE returned approximately $1.8 billion to shareholders during the quarter, comprising $558 million in dividends, a 6% year-over-year increase, and $1.2 billion in share repurchases under its $18 billion repurchase program. Inventories stood at $8.3 billion, a 5% decrease from the previous year, while cash and equivalents, including short-term investments, rose to $10.3 billion.

Mixed Analyst Ratings with Price Target Cuts

- Barclays analyst Adrienne Yih maintained an Equal-Weight rating, yet lowered the price target from $84 to $81.

- TD Cowen analyst John Kernan maintained a Hold rating and raised the price target from $71 to $78.

- Guggenheim analyst Robert Drbul maintained a Buy rating, but lowered the price target from $115 to $110.

- Deutsche Bank analyst Krisztina Katai reiterated a Buy rating while lowering the price target from $95 to $92.

- JP Morgan analyst Matthew Boss kept a Neutral rating and reduced the price target from $80 to $77.

- Telsey Advisory Group analyst Cristina Fernandez reiterated an Outperform rating, though lowered the price target from $100 to $96.

- RBC Capital analyst Piral Dadhania maintained a Sector Perform rating but adjusted the price target down from $85 to $82.

- Evercore ISI Group analyst Michael Binetti maintained an Outperform rating and lowered the price target from $110 to $105.

- UBS analyst Jay Sole reiterated a Neutral rating and raised the price target from $78 to $82.

- Truist Securities analyst Joseph Civello kept a Hold rating, though lowered the price target from $85 to $83.

Which Analyst has the best track record to show on NKE?

Analyst Rick Patel (RAYMOND JAMES) currently has the highest performing score on NKE with 12/16 (75%) price target fulfillment ratio. His price targets carry an average of $7.8 (6.38%) potential upside. Nike stock price reaches these price targets on average within 126 days.

Paychex Beats Q1 Earnings and Revenue Estimates, Raises Fiscal 2025 Guidance

Paychex reported its earnings report, achieving an EPS of $1.16, surpassing the analyst estimate of $1.14 by $0.02. Total revenue reached $1.32 billion, slightly above the consensus estimate of $1.31 billion, marking a 3% increase from the prior year’s $1.29 billion.

Operating income rose 2% to $546.7 million, and diluted EPS increased 2% to $1.18. Growth in the company’s Management Solutions and Professional Employer Organization (PEO) services contributed to the positive results, with PEO and Insurance Solutions revenue increasing 7%.

In terms of expenses, total costs for the quarter increased by 3% to $771.8 million, mainly due to higher PEO insurance costs and investments in technology and marketing. Paychex returned $457 million to shareholders through dividends and share repurchases.

Looking ahead, the company updated its fiscal 2025 guidance, anticipating interest on funds held for clients to range between $145 million and $155 million, and other income, net, to be between $30 million and $35 million.

Analyst Increases Price Target Following Q1 Performance

- TD Cowen analyst Bryan Bergin maintained a Hold rating and raised the price target from $126 to $131.

- Stifel analyst David Grossman maintained a Hold rating while increasing the price target from $130 to $141.

- Jefferies analyst Samad Samana kept a Hold rating and raised the price target from $120 to $130.

- RBC Capital analyst Ashish Sabadra reiterated a Sector Perform rating and raised the price target from $130 to $148.

- UBS analyst Kevin McVeigh held a Neutral rating and raised the price target from $125 to $142.

- Morgan Stanley analyst James Faucette kept an Equal-Weight rating and increased the price target from $122 to $133.

Which Analyst has the best track record to show on PAYX?

Analyst Jason Kupferberg (BAML) currently has the highest performing score on PAYX with 8/11 (72.73%) price target fulfillment ratio. His price targets carry an average of $-4.84 (-4.11%) potential downside. Paychex stock price reaches these price targets on average within 155 days.

Acuity Brands Reports Strong Q4 Performance, Beating Estimates, Despite Full-Year Revenue Decline

Acuity Brands announced a 2.2% increase in net sales for the fourth quarter of fiscal 2024, totaling $1.03 billion compared to the same period last year. Reported a diluted earnings per share (EPS) of $3.77, reflecting a 43.3% increase year-over-year, while adjusted diluted EPS reached $4.30, which was $0.03 better than the analyst estimate of $4.27.

Operating profit for Q4 2024 was $157.0 million, a 43.3% increase from the prior year, representing an operating profit margin of 15.2%. For the full year, Acuity Brands posted net sales of $3.84 billion, down 2.8% from the previous year. However, diluted EPS increased to $13.44, up 24.9% compared to fiscal 2023, while adjusted diluted EPS improved by 10.7% to $15.56.

In fiscal 2024, Acuity generated $619.2 million in cash flow from operations, an increase of 7% from the previous year. The Lighting and Lighting Controls segment (ABL) reported Q4 net sales of $955.0 million, a rise of 1.1%, while the Intelligent Spaces Group (ISG) saw a 16.7% increase in net sales to $83.9 million.

For the full year, ABL net sales totaled $3.6 billion, a decline of 4.0%, but operating profit increased by 14.4% to $582.8 million. ISG’s full-year net sales grew by 15.5% to $291.9 million, with operating profit rising to $43.6 million, reflecting a 35.5% increase year-over-year.

Multiple Price Target Increases Following Strong Earnings Report

- Goldman Sachs analyst Brian Lee maintained a Neutral rating, while raising the price target from $266 to $303.

- Wells Fargo analyst Joseph O’Dea held an Equal-Weight rating and raised the price target from $289 to $305.

- Oppenheimer analyst Christopher Glynn continued with an Outperform rating and increased the price target from $315 to $370.

- Baird analyst Timothy Wojs kept a Neutral rating, but raised the price target from $280 to $318.

Which Analyst has the best track record to show on AYI?

Analyst Timothy Wojs (BAIRD) currently has the highest performing score on AYI with 31/33 (93.94%) price target fulfillment ratio. His price targets carry an average of $30.02 (12.01%) potential upside. Acuity Brands stock price reaches these price targets on average within 480 days.

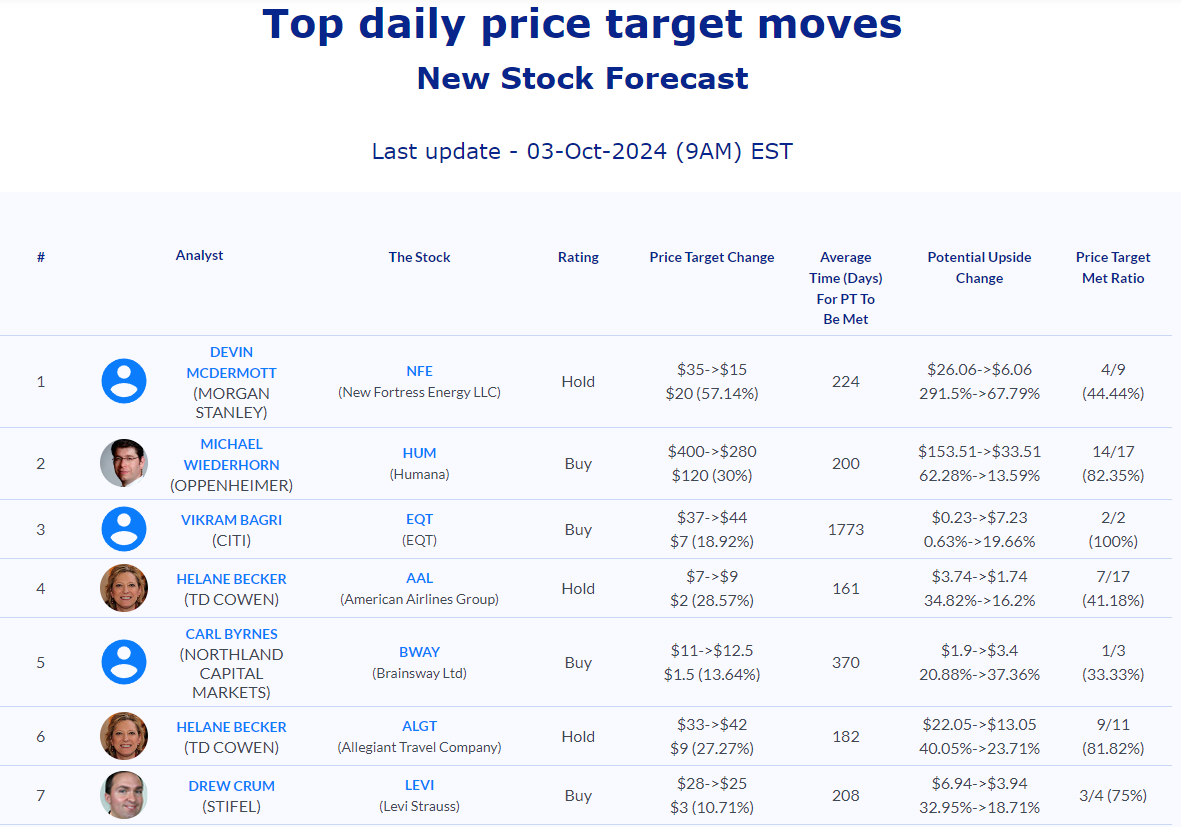

Daily stock Analysts Top Price Moves Snapshot