Selected stock price target news of the day - October 15th, 2024

By: Matthew Otto

Fastenal Exceeds Q3 EPS Expectations Amid Modest Revenue Growth and Margin Pressures

Fastenal Company announced its financial results for the third quarter of 2024, reporting an earnings per share (EPS) of $0.52, slightly exceeding analyst expectations of $0.51. Total revenue for the quarter reached $1.91 billion, consistent with consensus estimates.

Net sales increased by 3.5% year-over-year, with daily sales growth of 1.9%. Gross profit was $858.6 million, a 1.3% rise from Q3 2023, though gross margin declined to 44.9%, down from 45.9%, largely due to shifts in customer and product mix, higher import duties, and lower supplier rebates. Selling, general, and administrative (SG&A) expenses rose by 2.1% to $470.5 million, while SG&A as a percentage of net sales decreased to 24.6%.

Fastenal’s growth was supported by increased sales to larger customers and an expansion of its Onsite locations, which saw an 11.7% increase year-over-year, including 93 new signings in Q3. Additionally, eBusiness segments grew by 25.6%, representing 30.1% of total sales, while Fastenal’s Digital Footprint accounted for 61.1% of total sales.

However, challenges in gross margin persisted due to an unfavorable customer mix and higher costs. Cash flow from operations declined by 23.5%, attributed to rising inventory levels aimed at enhancing service and operational efficiency.

Analysts Adjust Price Targets, Reflecting Mixed Ratings

- Morgan Stanley analyst Chris Snyder maintained an Equal-Weight rating and raised the price target from $72 to $76.

- JP Morgan analyst Patrick Baumann reiterated a Neutral rating while increasing the price target from $70 to $72.

- Stifel analyst Brian Butler reiterated a Buy rating and lifted the price target from $80 to $86.

- Stephens & Co. analyst Tommy Moll maintained an Equal-Weight rating, but raised the price target from $56 to $75.

- Baird analyst David Manthey kept a Neutral rating and increased the price target from $67 to $80.

Which Analyst has the best track record to show on FAST?

Analyst Stephen Volkmann (JEFFERIES) currently has the highest performing score on FAST with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $0.83 (1.29%) potential upside. Fastenal Company stock price reaches these price targets on average within 44 days.

JPMorgan Reports Strong Q3 Earnings Amid Growing Geopolitical and Economic Risks

JPMorgan Chase posted its third-quarter results, reporting net interest income (NII) of $23.53 billion, surpassing the Bloomberg consensus estimate of $22.8 billion. Earnings per share (EPS) came in at $4.37, beating analyst expectations by $0.38, while total revenue for the quarter reached $42.65 billion, exceeding the consensus estimate of $41.45 billion.

However, JPMorgan expects NII to slightly decline to $22.9 billion in the upcoming quarter, which would bring the annual NII to $92.5 billion—higher than the $91.05 billion forecast by analysts.

JPMorgan’s investment banking fees surged 31%, outperforming its earlier guidance of 15%, while equities trading revenue grew by 8%. Despite this positive momentum, JPMorgan set aside $3.11 billion in provisions for potential credit losses, up from $1.38 billion a year earlier.

Meanwhile, CEO Jamie Dimon reiterated concerns about escalating geopolitical risks and their potential impact on global markets, as well as the ongoing discussions around regulatory capital requirements for large U.S. banks under the Basel III Endgame framework.

Analyst Ratings Maintained with Mixed Price Target Adjustments

- Oppenheimer analyst Chris Kotowski maintained an Outperform rating, yet lowered the price target from $234 to $232.

- Barclays analyst Jason Goldberg kept an Overweight rating and raised the price target from $217 to $257.

- RBC Capital analyst Gerard Cassidy held an Outperform rating while raising the price target from $211 to $230.

- Evercore ISI Group analyst Glenn Schorr reiterated an Outperform rating and increased the price target from $217 to $230.

Which Analyst has the best track record to show on JPM?

Analyst Keith Horowitz (CITI) currently has the highest performing score on JPM with 5/5 (100%) price target fulfillment ratio. His price targets carry an average of $4.95 (2.36%) potential upside. JPMorgan Chase stock price reaches these price targets on average within 149 days.

Boeing Plans Significant Capital Raise Amid Financial Struggles

Boeing is taking steps to strengthen its balance sheet by raising up to $25 billion through common and preferred stock, as well as debt offerings, following a filing with the Securities and Exchange Commission. The specific mix of securities has not yet been disclosed, and no new securities are currently being offered.

This marks Boeing’s first shelf registration since 2020, and Wall Street analysts speculate that a $10 billion stock offering may be forthcoming. The additional capital is seen as critical for maintaining Boeing’s investment-grade credit rating, which management has emphasized is a priority.

Amid a labor strike costing approximately $1.5 billion monthly, Boeing concluded the third quarter with around $20 billion in total liquidity, bolstered by a recent $10 billion credit agreement. However, the company faces a significant debt burden, reporting about $53 billion in long-term debt as of the end of the second quarter, with $40 billion attributed to challenges stemming from the 737 MAX crashes and the COVID-19 pandemic.

In contrast, rival Airbus ended the same quarter with approximately $10 billion in long-term debt. As Boeing prepares for possible layoffs of about 17,000 workers, these strategic financial measures and workforce adjustments are part of CEO Kelly Ortberg’s broader initiative to enhance the competitiveness and invest in new aircraft development.

Analyst Ratings Reflect Cautious Optimism and Price Target Reductions

- TD Cowen analyst Cai Rumohr maintained a Buy rating but lowered the price target from $200 to $190.

- JP Morgan analyst Seth Seifman kept an Overweight rating, while reducing the price target from $235 to $195.

- Wells Fargo analyst Matthew Akers reiterated an Underweight rating and decreased the price target from $110 to $109.

Which Analyst has the best track record to show on BA?

Analyst Ronald Epstein (BAML) currently has the highest performing score on BA with 20/33 (60.61%) price target fulfillment ratio. His price targets carry an average of $25.01 (14.29%) potential upside. The Boeing Company stock price reaches these price targets on average within 274 days.

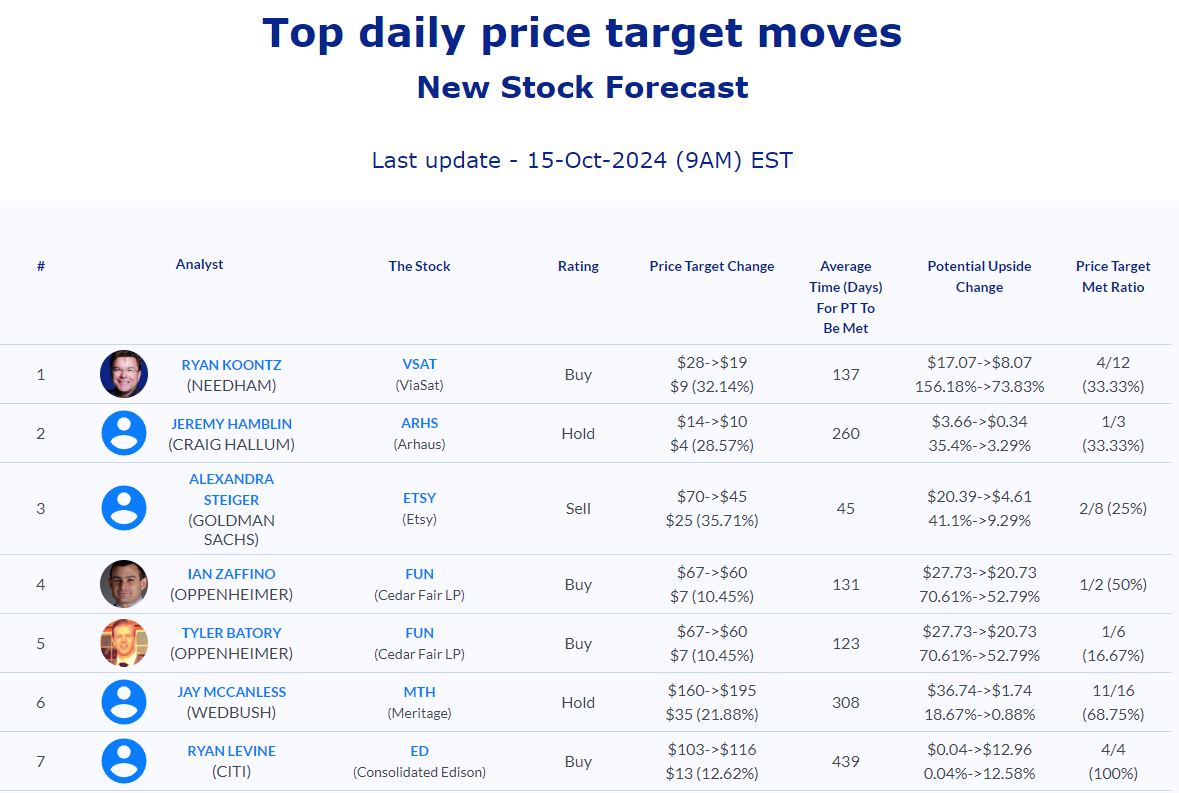

Daily stock Analysts Top Price Moves Snapshot