Selected stock price target news of the day - October 24th, 2024

By: Matthew Otto

Enphase Energy Misses Q3 Estimates, Provides Lower Q4 Revenue Guidance

Enphase Energy reported third-quarter 2024 financial results, with quarterly revenue of $380.9 million and non-GAAP earnings per share (EPS) of $0.65. The EPS figure came in $0.13 below the analyst estimate of $0.78, and revenue also fell short of the consensus estimate of $392.09 million.

Despite the miss on estimates, Enphase saw a 25% increase in revenue from the prior quarter, driven by stronger demand in the U.S. market, while European revenue declined by 15% due to softening demand. Enphase shipped 1,731,768 microinverters, equivalent to approximately 730.0 megawatts DC, and 172.9 megawatt hours of IQ Batteries during the quarter.

Enphase reported a GAAP operating income of $49.8 million and a non-GAAP operating income of $101.4 million, an improvement from the $1.8 million in GAAP operating income in Q2. However, the non-GAAP gross margin, excluding the net IRA benefit, decreased to 38.9% from 41.0% in the previous quarter. Enphase repurchased 434,947 shares for $49.8 million at an average price of $114.48 per share.

Looking ahead, Enphase provided Q4 2024 guidance, expecting revenue between $360 million and $400 million, below the analyst consensus of $435.2 million. GAAP gross margins are projected to range from 47.0% to 50.0%, driven by anticipated shipments of 1.3 million microinverters.

Analysts Lowered Price Targets Across the Board

- RBC Capital analyst Chris Dendrinos maintained a Sector Perform rating, while lowering the price target from $100 to $85.

- Canaccord Genuity analyst Austin Moeller downgraded from Buy to Hold and the price target from $140 to $95.

- JP Morgan analyst Mark Strouse kept an Overweight rating but decreased the price target from $130 to $120.

- Roth MKM analyst Philip Shen maintained a Buy rating, though lowered the price target from $130 to $100.

- Goldman Sachs analyst Brian Lee upheld a Buy rating but cut the price target from $170 to $145.

- Evercore ISI Group analyst James West maintained an Outperform rating and adjusted the price target from $133 to $125.

- Raymond James analyst Pavel Molchanov kept an Outperform rating and trimmed the price target from $140 to $130.

- Craig-Hallum analyst Eric Stine held a Buy rating and reduced the price target from $153 to $123.

Which Analyst has the best track record to show on ENPH?

Analyst Eric Stine (CRAIG HALLUM) currently has the highest performing score on ENPH with 14/18 (77.78%) price target fulfillment ratio. His price targets carry an average of $36.09 (30.87%) potential upside. Enphase Energy stock price reaches these price targets on average within 128 days.

Norfolk Southern Exceeds Q3 with Strong Revenue Growth and Improved Operating Efficiency

Norfolk Southern reported its third-quarter 2024 financial results, posting railway operating revenues of $3.1 billion, above the consensus estimate of $3.08 billion and reflecting a 3% year-over-year increase.

Adjusted income from railway operations came in at $1.1 billion, a 22% improvement from the prior year’s adjusted results. The adjusted operating ratio improved by 570 basis points to 63.4%, excluding the impact of railway line sales and restructuring charges.

Diluted earnings per share (EPS) were $4.85, while adjusted EPS was $3.25, exceeding analysts’ estimates by $0.14 and representing a 23% increase from the previous year’s adjusted figure. Norfolk Southern also benefited from two railway line sales during the quarter, generating nearly $400 million in cash proceeds and contributing $380 million in gains.

Analysts Raise Price Targets Following Q3 Results

- RBC Capital analyst Walter Spracklin maintained an Outperform rating and raised the price target from $272 to $282.

- TD Cowen analyst Jason Seidl maintained a Hold rating, while increasing the price target from $253 to $259.

- BofA Securities analyst Ken Hoexter kept a Buy rating and raised the price target from $276 to $291.

- JP Morgan analyst Brian Ossenbeck reiterated an Overweight rating and lifted the price target from $283 to $288.

- Stephens & Co. analyst Daniel Imbro reaffirmed an Equal-Weight rating and the price target at $263.

- Loop Capital analyst Rick Paterson continued with a Buy rating and boosted the price target from $285 to $287.

- UBS analyst Thomas Wadewitz maintained a Buy rating and raised the price target from $289 to $309.

- Evercore ISI Group analyst Jonathan Chappell held an Outperform rating but lowered the price target from $276 to $274.

- Wells Fargo analyst Christian Wetherbee kept an Overweight rating and increased the price target from $270 to $280.

Which Analyst has the best track record to show on NSC?

Analyst Walter Spracklin (RBC) currently has the highest performing score on NSC with 16/20 (80%) price target fulfillment ratio. His price targets carry an average of $23.5 (9.46%) potential upside. Norfolk Southern stock price reaches these price targets on average within 63 days.

Danaher Reports Strong Q3 2024 Results, Exceeding Revenue and EPS Estimates

Danaher Corporation reported third-quarter 2024 financial results posting an earnings per share (EPS) of $1.71, exceeding the analyst estimate of $1.57 by $0.14. Net earnings were $818 million, or $1.12 per diluted common share.

Revenue for the quarter reached $5.8 billion, which was higher than the consensus estimate of $5.59 billion, reflecting a 3.0% year-over-year increase. Core non-GAAP revenue grew by 0.5%. Operating cash flow for the quarter totaled $1.5 billion, with free cash flow amounting to $1.2 billion.

Looking forward, Danaher anticipates a low single-digit decline in non-GAAP core revenue for the fourth quarter of 2024. For the full year, the company expects non-GAAP core revenue to also be down low single digits year-over-year.

Analyst Ratings and Targets Reflect Positive Outlook Following Q3 Performance

- RBC Capital analyst Conor McNamara maintained an Outperform rating, but lowered the price target from $333 to $311.

- TD Cowen analyst Dan Brennan kept a Buy rating and raised the price target from $310 to $315.

- Stephens & Co. analyst Jacob Johnson reiterated an Overweight rating and a price target of $315.

- Stifel analyst Daniel Arias held a Hold rating and increased the price target from $250 to $265.

- UBS analyst Dan Leonard maintained a Buy rating, although lowered the price target from $309 to $305.

- Raymond James analyst Andrew Cooper continued with an Outperform rating, yet lowered the price target from $310 to $300.

Which Analyst has the best track record to show on DHR?

Analyst Vijay Kumar (EVERCORE) currently has the highest performing score on DHR with 4/5 (80%) price target fulfillment ratio. His price targets carry an average of $3.15 (1.15%) potential upside. Danaher Corporation stock price reaches these price targets on average within 79 days.

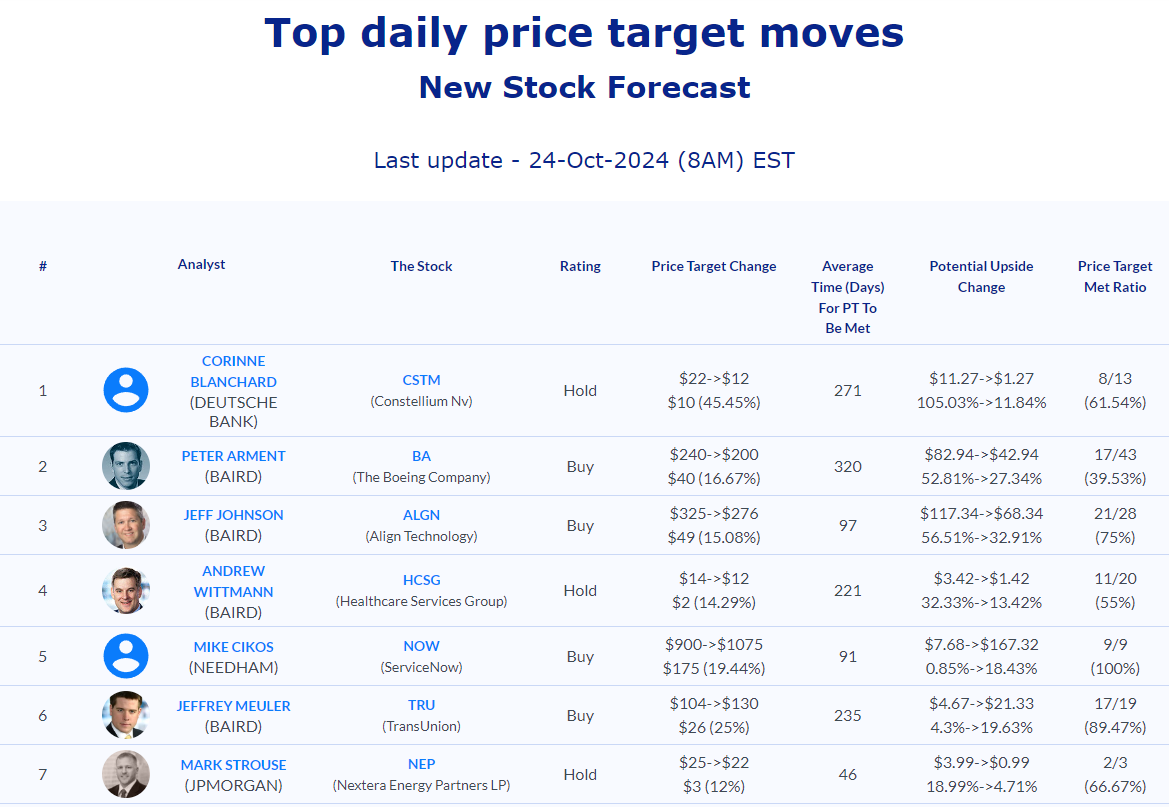

Daily stock Analysts Top Price Moves Snapshot