Selected stock price target news of the day - November 12th, 2024

By: Matthew Otto

Advanced Drainage Misses Q2 EPS and Revenue Estimates, Adjusts FY2025 Guidance Below Consensus

Advanced Drainage Systems reported mixed financial results for its fiscal second quarter ending posting earnings per diluted share of $1.70, missing the consensus estimate of $1.89 by $0.19.

Net sales held steady at $782.6 million, but this was below the $819.41 million that analysts had anticipated. Net income for the quarter declined by 4.3% year-over-year to $131.2 million. Adjusted EBITDA also saw a slight dip, standing at $245.6 million, with an EBITDA margin of 31.4%.

In its fiscal year-to-date, Advanced Drainage Systems reported a 2.5% increase in net sales to $1.6 billion, while net income fell 5.6% to $293.5 million. Demand remained in the residential and infrastructure markets, with Infiltrator sales up by 10.6% for Q2. However, international sales declined by 14.5%, contributing to a 2.9% reduction in gross profit, which reached $293.9 million.

Advanced Drainage Systems provided updated fiscal 2025 guidance, projecting full-year revenue in the range of $2.9 to $2.97 billion, which is slightly below the consensus estimate of $2.98 billion, and adjusted EBITDA between $880 million and $920 million. Total liquidity stood at $1.2 billion, and repurchased 0.4 million shares for $69.9 million during the quarter, maintaining a leverage ratio of 0.8x adjusted EBITDA.

Analysts Lower Price Targets Following Mixed Q2 Results

- Loop Capital analyst Garik Shmois maintained a Buy rating, though lowered the price target from $180 to $170.

- Keybanc analyst Jeffrey Hammond kept an Overweight rating but reduced the price target from $195 to $180.

- Barclays analyst Matthew Bouley held an Overweight stance and revised the price target from $194 to $172.

- Oppenheimer analyst Bryan Blair reaffirmed an Outperform rating while decreasing the price target from $192 to $184.

- Baird analyst Michael Halloran maintained an Outperform rating and lowered the price target from $174 to $161.

Which Analyst has the best track record to show on WMS?

Analyst Matthew Bouley (BARCLAYS) currently has the highest performing score on WMS with 22/24 (91.67%) price target fulfillment ratio. His price targets carry an average of $52.17 (36.78%) potential upside. Advanced Drainage Systems stock price reaches these price targets on average within 131 days.

DraftKings Exceeds Q3 EPS Expectations Amid 39% Revenue Growth, Adjusts FY2024 and FY2025 Guidance

DraftKings reported third-quarter 2024 revenue of $1.1 billion, marking a 39% year-over-year increase from $790 million in Q3 2023 but missing the consensus estimate of $1.11 billion. Q3 EPS was ($0.17), beating analyst expectations of ($0.42) by $0.25.

Monthly Unique Payers (MUPs) reached 3.6 million, a 55% year-over-year increase, with a 27% increase excluding the acquisition of Jackpocket. The Average Revenue per MUP (ARPMUP) was $103, a 10% decline due to the inclusion of Jackpocket customers. Excluding Jackpocket’s impact, ARPMUP would have increased by 8% compared to Q3 2023.

For fiscal year 2024, DraftKings revised its revenue guidance to a range of $4.85 billion to $4.95 billion, below the consensus estimate of $5.14 billion. Adjusted EBITDA guidance for 2024 has also been updated to $240 million to $280 million due to the impact of favorable sports outcomes for customers in early Q4 2024.

For fiscal year 2025, DraftKings forecasts revenue between $6.2 billion and $6.6 billion, with a midpoint below the consensus estimate of $6.27 billion. DraftKings anticipates Adjusted EBITDA for 2025 to range from $900 million to $1 billion.

Analysts Positive Momentum Following Strong Q3 Results

- Macquarie analyst Chad Beynon maintained an Outperform rating and raised the price target from $50 to $51.

- Barclays analyst Brandt Montour reiterated an Overweight rating while increasing the price target from $45 to $50.

- JMP Securities analyst Jordan Bender held a Market Outperform rating and raised the price target from $51 to $52.

- Needham analyst Bernie McTernan reaffirmed a Buy rating and a price target of $60.

Which Analyst has the best track record to show on DKNG?

Analyst Shaun Kelley (BAML) currently has the highest performing score on DKNG with 9/10 (90%) price target fulfillment ratio. His price targets carry an average of $13.16 (35.72%) potential upside. DraftKings stock price reaches these price targets on average within 86 days.

Agilon Health Reports Q3 Revenue Growth, Adjusts Full-Year Guidance Amid Increased Losses and Membership Growth

In the third quarter of 2024, Agilon Health reported a 28% year-over-year increase in revenue to $1.45 billion, up from $1.14 billion in Q3 2023. However, this revenue came in below the consensus estimate of $1.47 billion.

Agilon Health also posted an earnings per share (EPS) loss of $0.29, which was $0.19 below the analyst expectation of a $0.10 loss. Medicare Advantage membership rose by 37% to 525,000, while total members on the Agilon platform grew by 39% to 657,000. As a result, Agilon recorded a negative gross profit of $64 million, down from a positive $37 million in Q3 2023, and a net loss of $118 million, widening from a $31 million loss in the prior-year quarter.

Looking ahead, Agilon has adjusted its full-year 2024 guidance and expects FY2024 revenue of $6.05 to $6.06 billion, exceeding the consensus estimate of $6.02 billion. Fourth quarter revenue is anticipated to be in the range of $1.51 to $1.52 billion, surpassing the consensus forecast of $1.46 billion.

Analyst Ratings Update Amid Q3 Results and Adjusted Guidance

- TD Cowen analyst Gary Taylor maintained a Hold rating and lowered the price target from $6 to $2.

- Barclays analyst Andrew Mok kept an Underweight rating and reduced the price target from $5 to $2.

- JMP Securities analyst Constantine Davides downgraded from Market Outperform to Market Perform.

- William Blair analyst Ryan Daniels downgraded from Outperform to Market Perform.

Which Analyst has the best track record to show on AGL?

Analyst Elizabeth Anderson (EVERCORE) currently has the highest performing score on AGL with 2/6 (33.33%) price target fulfillment ratio. Her price targets carry an average of $0.85 (26.98%) potential upside. Agilon Health stock price reaches these price targets on average within 7 days.

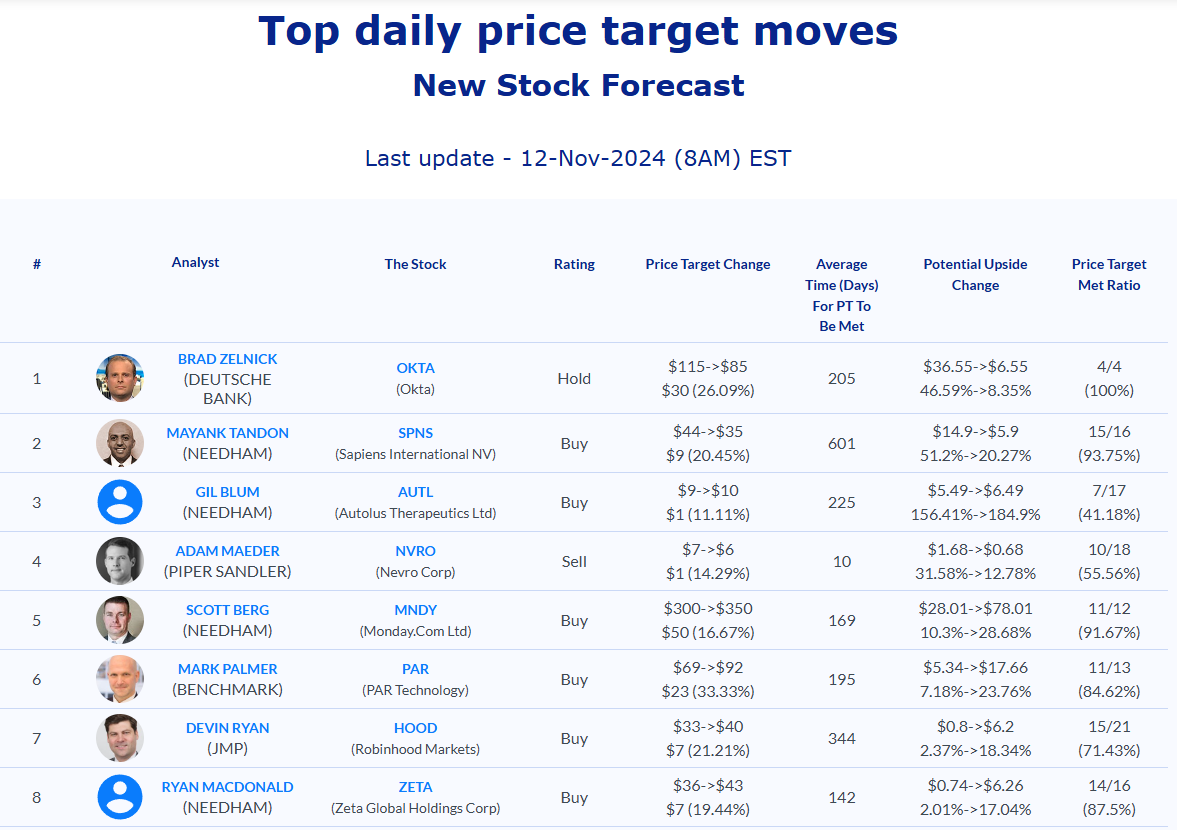

Daily stock Analysts Top Price Moves Snapshot