Selected stock price target news of the day - November 15th, 2024

By: Matthew Otto

CyberArk Exceeds Q3 Expectations, Raises Q4 Guidance Amid Strong Growth in ARR and Revenue

CyberArk Software announced its Q3 2024 financial results with earnings per share (EPS) for the quarter of $0.94, exceeding the consensus estimate of $0.46 by $0.48. Total revenue reached $240.1 million, surpassing the analyst estimate of $234.1 million and marking a 26% year-over-year increase.

Subscription Annual Recurring Revenue (ARR) grew by 46% year-over-year to $735 million, driving total ARR to $926 million, up 31%. Subscription revenue climbed 43% year-over-year to $175.6 million. GAAP operating losses narrowed to $(11.1) million, while non-GAAP operating income more than doubled to $35.4 million. CyberArk also reported GAAP net income of $11.1 million, reversing a loss of $(14.6) million in the prior year, and non-GAAP net income surged to $45.1 million.

CyberArk raised its guidance for Q4 2024, projecting EPS of $0.65 to $0.75, well above the consensus estimate of $0.55, and revenue between $297 million and $303 million, compared to the consensus forecast of $259.1 million. For the full year, CyberArk expects total revenue in the range of $983 million to $989 million, representing growth of 31% to 32%. ARR is anticipated to reach $1.153 billion to $1.163 billion by year-end, reflecting nearly 50% growth.

Analysts Raise Price Targets Following Q3 Performance and Upbeat Guidance

- RBC Capital analyst Matthew Hedberg maintained an Outperform rating while raising the price target from $328 to $358.

- Canaccord Genuity analyst Kingsley Crane reiterated a Buy rating and lifted the price target from $310 to $330.

- Truist Securities analyst Ki Bin Kim reiterated a Buy rating as the price target climbs from $300 to $350.

- UBS analyst Roger Boyd maintained a Buy rating yet increased the price target from $340 to $360.

- Cantor Fitzgerald analyst Jonathan Ruykhaver reiterated an Overweight rating and a $335 price target.

- Stifel analyst Adam Borg kept a Buy rating and raised the price target from $306 to $335.

- Wells Fargo analyst Andrew Nowinski maintained an Overweight rating while boosting the price target from $300 to $350.

- Barclays analyst Saket Kalia reiterated an Overweight rating and raised the price target from $330 to $335.

- Keybanc analyst Eric Heath maintained an Overweight rating as the price target increased from $340 to $355.

- Susquehanna analyst Shyam Patil kept a Positive rating and raised the price target from $320 to $345.

Which Analyst has the best track record to show on CYBR?

Analyst Shaul Eyal (OPPENHEIMER) currently has the highest performing score on CYBR with 14/15 (93.33%) price target fulfillment ratio. His price targets carry an average of $60.5 (20.20%) potential upside. CyberArk Software stock price reaches these price targets on average within 291 days.

Cisco Raises Guidance Despite Revenue Decline and Mixed Quarterly Results

Cisco Systems reported fiscal Q1 earnings with adjusted earnings per share that came in at $0.91, surpassing the $0.87 consensus, while revenue totaled $13.84 billion, slightly higher than the $13.77 billion expected. However, revenue dropped 6% year-over-year from $14.7 billion, and net income fell to $2.71 billion, or $0.68 per share, compared to $3.64 billion, or $0.89 per share, a year earlier.

Networking revenue declined 23% to $6.75 billion, narrowly missing the $6.8 billion consensus. Security revenue doubled to $2.02 billion, exceeding the $1.93 billion estimate, while collaboration revenue of $1.09 billion fell short of the $1.04 billion forecast.

Cisco raised its full-year guidance, projecting adjusted earnings per share of $3.60 to $3.66 and revenue between $55.3 billion and $56.3 billion, up from prior estimates of $3.52 to $3.58 EPS on $55 billion to $56.2 billion revenue. Cisco also reported $300 million in AI-related orders in Q1, with expectations to surpass $1 billion in AI orders for the fiscal year.

Analysts Adjust Ratings and Price Targets Following Quarterly Results

- Citigroup analyst Atif Malik maintained a Buy rating while increasing the price target from $62 to $64.

- BofA Securities analyst Tal Liani reiterated a Buy rating and raised the price target from $60 to $72.

- UBS analyst David Vogt kept a Neutral rating but raised the price target from $55 to $62.

- Wells Fargo analyst Aaron Rakers maintained an Equal-Weight rating and adjusted the price target from $57 to $60.

- Barclays analyst Tim Long reaffirmed an Equal-Weight rating while lifting the price target from $49 to $56.

- Morgan Stanley analyst Meta Marshall stuck with an Overweight rating and raised the price target from $58 to $62.

- Piper Sandler analyst James Fish maintained a Neutral rating and increased the price target from $52 to $57.

Which Analyst has the best track record to show on CSCO?

Analyst James Fish (PIPER SANDLER) currently has the highest performing score on CSCO with 27/27 (100%) price target fulfillment ratio. His price targets carry an average of $3.47 (7.15%) potential upside. Cisco Systems stock price reaches these price targets on average within 313 days.

Hut 8 Reports Q3 2024 Revenue of $43.7 Million and Key Operational Updates

Hut 8 reported its results for the third quarter ending September 30, 2024 with an earnings per share (EPS) of $0.01, alongside revenue of $43.7 million, reflecting a 101% increase from $21.7 million in the prior year period.

Revenue components included $11.6 million from Digital Asset Mining, $20.8 million from Managed Services, and $3.4 million from High-Performance Computing operations. Adjusted EBITDA for the quarter was $5.6 million, and net income increased to $0.9 million, reversing a net loss of $4.4 million from Q3 2023.

Hut 8 mined 234 Bitcoin at an average revenue per Bitcoin of $61,025 and a cost to mine of $31,482, achieving a 94% gross margin per Bitcoin mined. As of September 30, 2024, Hut 8 held 9,106 Bitcoin in reserve, valued at approximately $576.5 million, and had total cash of $72.9 million.

Operational advancements in the quarter included a strategic partnership with BITMAIN to develop and host approximately 15 EH/s of next-generation ASIC miners, which is expected to generate $135 million in annual colocation revenue when fully ramped. Hut 8 also converted a $37.9 million loan into equity, reducing future interest expenses by over $17 million.

Analysts Raise Price Targets Following Q3 2024 Performance

- Canaccord Genuity analyst Joseph Vafi maintained a Buy rating and increased the price target from $22 to $32.

- HC Wainwright & Co. analyst Mike Colonnese held a Buy rating while lifting the price target from $26 to $35.

- Craig-Hallum analyst George Sutton continued with a Buy rating and raised the price target from $15 to $32.

- Benchmark analyst Mark Palmer reiterated a Buy rating and hiked the price target from $17 to $32.

- Needham analyst John Todaro kept a Buy rating and adjusted the price target from $21 to $32.

Which Analyst has the best track record to show on HUT?

Analyst George Sutton (CRAIG HALLUM) currently has the highest performing score on HUT with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $3.02 (25.21%) potential upside. Hut 8 stock price reaches these price targets on average within 90 days.

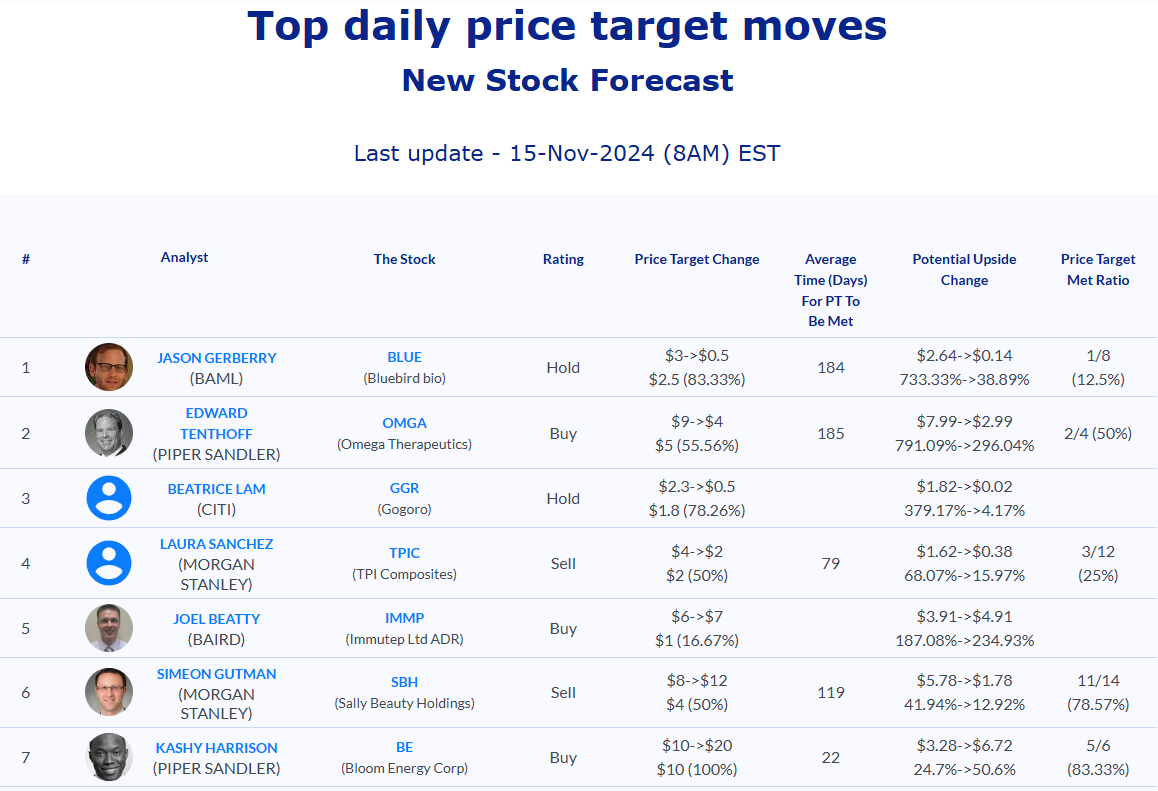

Daily stock Analysts Top Price Moves Snapshot