Selected stock price target news of the day - November 27th, 2024

By: Matthew Otto

Zoom Exceeds Expectations in Q3 FY2025 and Raises Full-Year Forecast

Zoom Communications delivered its financial results for the third fiscal quarter ended October 31, 2024, reporting adjusted earnings per share of $1.38, beating the $1.31 consensus. Revenue came in at $1.18 billion, ahead of the expected $1.16 billion. This marked a 3.6% increase year over year, driven by a 5.8% rise in enterprise revenue to $698.9 million. Net income grew to $207.1 million, or $0.66 per share, compared to $141.2 million, or $0.45 per share, a year ago.

Looking ahead, Zoom raised its full-year revenue guidance to $4.656 to $4.661 billion and adjusted EPS to $5.41 to $5.43, exceeding previous estimates. For Q4 FY2025, Zoom expects adjusted earnings of $1.29 to $1.30 per share on revenue of $1.175 to $1.180 billion, aligning closely with analyst forecasts. As of October 31, 2024, Zoom reported 192,400 enterprise customers, an increase of 800 from the prior quarter, and maintained a net dollar expansion rate of 98%.

Analysts Raise Price Targets Following Q3 Results

- Mizuho analyst Siti Panigrahi maintained an Outperform rating and raised the price target from $90 to $105.

- Benchmark analyst Matthew Harrigan kept a Buy rating while lifting the price target from $85 to $97.

- Evercore ISI Group analyst Peter Levine upgraded from In-Line to Outperform and the price target from $70 to $115.

- Bernstein analyst Peter Weed held a Market Perform rating but raised the price target from $78 to $89.

- BofA Securities analyst Nikolay Beliov maintained a Neutral rating and adjusted the price target upward from $75 to $90.

- UBS analyst Karl Keirstead reiterated a Neutral stance yet boosted the price target from $75 to $90.

- RBC Capital analyst Rishi Jaluria reaffirmed an Outperform rating and the price target at $95.

- Goldman Sachs analyst Kash Rangan kept with a Neutral rating and revised the price target from $72 to $86.

- Stifel analyst Parker Lane continued with a Hold rating but raised the price target from $70 to $90.

- Wells Fargo analyst Michael Turrin retained an Underweight rating although lifted the price target from $60 to $70.

- JMP Securities analyst Patrick Walravens reiterated a Market Perform rating.

- Piper Sandler analyst James Fish upheld a Neutral rating and increased the price target from $68 to $89.

Which Analyst has the best track record to show on ZM?

Analyst James Fish (PIPER SANDLER) currently has the highest performing score on ZM with 16/24 (66.67%) price target fulfillment ratio. His price targets carry an average of $12 (21.43%) potential upside. Zoom Communications stock price reaches these price targets on average within 98 days.

Bath & Body Works Q3 2024: Strong Results Drive Raised Full-Year Guidance

Bath & Body Works reported third-quarter 2024 earnings per diluted share (EPS) of $0.49, exceeding the analyst consensus estimate of $0.47 by $0.02. Revenue for the quarter came in at $1.61 billion, surpassing Wall Street’s expectation of $1.58 billion and reflecting a 3% increase over the $1.56 billion reported in Q3 2023. Despite a slight decrease in operating income from $221 million in Q3 2023 to $218 million this quarter, the adjusted net income for Q3 2024 was $110 million.

Bath & Body Works raised its fiscal 2024 guidance with full-year net sales now projected to decline between 1.7% and 2.5%, an improvement from the prior forecast of a 2% to 4% decline. Full-year EPS is expected to range from $3.46 to $3.59, compared to the previous guidance of $3.37 to $3.57, while adjusted EPS is anticipated between $3.15 and $3.28, up from $3.06 to $3.26. For the fourth quarter, Bath & Body Works expects net sales to decline by 4.5% to 6.5%. Fourth-quarter EPS is projected between $1.94 and $2.07.

Analyst Price Target Revisions Reflect Confidence in Post-Q3 Results

- TD Cowen analyst Gary Taylor maintained a Buy rating while increasing the price target from $40 to $42.

- Telsey Advisory Group analyst Dana Telsey kept an Outperform rating and raised the price target from $42 to $43.

- Morgan Stanley analyst Kimberly Greenberger held an Overweight rating but lifted the price target from $48 to $49.

- Deutsche Bank analyst Gabriella Carbone maintained a Buy rating and adjusted the price target from $51 to $52.

- Wells Fargo analyst Ike Boruchow kept an Equal-Weight rating yet elevated the price target from $32 to $38.

- JP Morgan analyst Matthew Boss retained a Neutral rating and raised the price target from $35 to $39.

- Barclays analyst Adrienne Yih upheld an Underweight rating while revising the price target from $28 to $34.

- Piper Sandler analyst Korinne Wolfmeyer continued with a Neutral rating and edged the price target from $35 to $36.

Which Analyst has the best track record to show on BBWI?

Analyst Kate Mcshane (GOLDMAN SACHS) currently has the highest performing score on BBWI with 2/7 (28.57%) price target fulfillment ratio. His price targets carry an average of $18 (58.06%) potential upside. Bath & Body Works stock price reaches these price targets on average within 294 days.

CrowdStrike Reports Strong Q3 Fiscal 2025 Results, Beats Expectations

CrowdStrike Holdings delivered its results for the third quarter of fiscal year 2025, with an earnings per share (EPS) of $0.93, exceeding the analyst consensus of $0.81. Total revenue for the quarter came in at $1.01 billion, beating the forecasted $982.81 million and representing a 29% year-over-year increase.

Subscription revenue reached $962.7 million, up 31% compared to the same period last year. Annual Recurring Revenue (ARR) grew by 27% year-over-year to $4.02 billion, with $153 million in net new ARR added. Despite a GAAP net loss of $16.8 million, CrowdStrike posted a non-GAAP net income of $234.3 million, reflecting an increase from the previous year. Free cash flow stood at $231 million, maintaining a free cash flow rule of 51, while cash flow from operations reached $326 million.

Looking ahead, for Q4 FY25, CrowdStrike expects EPS between $0.84 and $0.86, with revenue projected to range from $1.029 billion to $1.035 billion. For the full fiscal year 2025, CrowdStrike forecasts EPS of $3.74 to $3.76, and revenue between $3.924 billion and $3.93 billion.

Analyst Ratings Reflect Positive Outlook Following Q3 Results

- BofA Securities analyst Tal Liani maintainsed a Buy rating and raised the price target from $365 to $400.

- WestPark Capital analyst Paul Rodriguez reiterated a Hold rating.

- Baird analyst Shrenik Kothari continued with an Outperform rating and increased the price target from $375 to $390.

- Needham analyst Mike Cikos held a Buy rating and raised the price target from $360 to $420.

- HSBC analyst Stephen Bersey downgraded from Buy to Hold and set a price target of $347.

- Evercore ISI Group analyst Peter Levine maintained an Outperform rating and boosted the price target from $325 to $400.

Which Analyst has the best track record to show on CRWD?

Analyst Saket Kalia (BARCLAYS) currently has the highest performing score on CRWD with 25/26 (96.15%) price target fulfillment ratio. His price targets carry an average of $26.3 (7.61%) potential upside. CrowdStrike Holdings stock price reaches these price targets on average within 178 days.

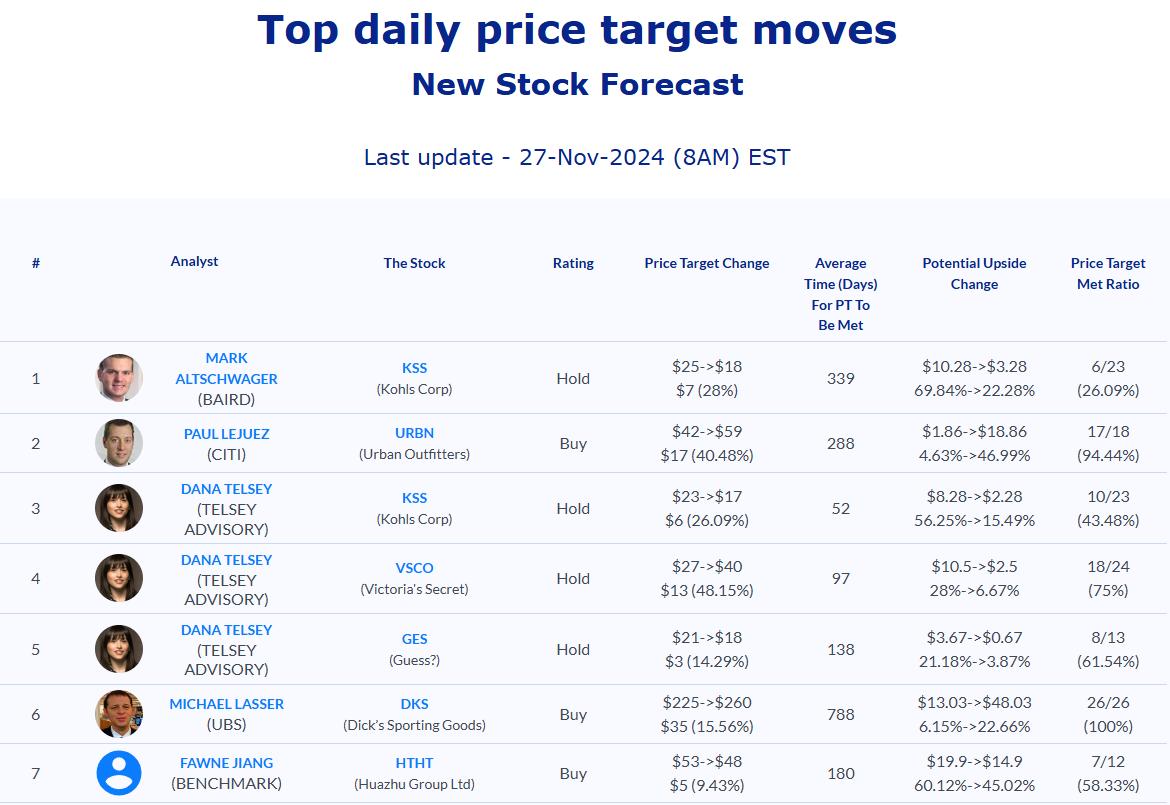

Daily stock Analysts Top Price Moves Snapshot