Selected stock price target news of the day - January 30th, 2025

By: Matthew Otto

Meta Reports Strong Q4 Results Amid Strategic AI Investments and 2025 Forecast Adjustments

Meta Platforms reported fourth-quarter 2024 revenue of $48.4 billion, surpassing analysts’ expectations of $47.0 billion. For the full year, revenue reached $164.50 billion, marking a 22% year-over-year increase.

Ad impressions grew 6% and 11% year-over-year for the fourth quarter and full year, respectively, while the average price per ad rose by 14% and 10% during the same periods. Meta’s fourth-quarter expenses totaled $25.02 billion, which included a $1.55 billion favorable impact from reduced legal liabilities. Meta’s cash and marketable securities stood at $77.81 billion, while long-term debt was $28.83 billion as of December 31, 2024.

Looking ahead, Meta anticipates first-quarter 2025 revenue between $39.5 billion and $41.8 billion, falling short of analysts’ average forecast of $41.72 billion. Meta expects full-year 2025 expenses between $114 billion and $119 billion, with capital expenditures projected between $60 billion and $65 billion.

Analysts Raise Price Targets Amid Positive Outlook

- Piper Sandler analyst Thomas Champion maintained an Overweight rating while increasing the price target from $670 to $775.

- Barclays analyst Ross Sandler kept an Overweight rating and raised the price target from $630 to $705.

- Wells Fargo analyst Ken Gawrelski retained an Overweight rating and boosted the price target from $685 to $752.

- Pivotal Research analyst Jeffrey Wlodarczak maintained a Buy rating and lifted the price target from $800 to $875.

- Needham analyst Laura Martin reiterated an Underperform rating.

- Mizuho analyst James Lee held onto an Outperform rating yet raised the price target from $675 to $750.

- Baird analyst Colin Sebastian kept with an Outperform rating while adjusting the price target upward from $680 to $750.

Which Analyst has the best track record to show on META?

Analyst Thomas Champion (PIPER SANDLER) currently has the highest performing score on META with 21/24 (87.5%) price target fulfillment ratio. His price targets carry an average of $50.72 (8.19%) potential upside. Meta Platforms stock price reaches these price targets on average within 234 days.

Brinker Reports Strong Q2 Performance, Exceeding Expectations; Raises FY2025 Guidance

Brinker International reported its financial results for the second quarter of fiscal 2025, posting earnings per share (EPS) of $2.80, $1.24 higher than the analyst estimate of $1.56. Revenue for the quarter reached $1.36 billion, surpassing the consensus estimate of $1.19 billion.

Company sales totaled $1,346.1 million, reflecting a 26.5% increase from $1,063.7 million in the same period last year. Total revenues grew by $284.1 million year-over-year to $1,358.2 million. Operating income increased to $156.0 million, or 11.5% of total revenues, up from 5.8% in Q2 fiscal 2024. Net income climbed to $118.5 million, or $2.61 per diluted share, compared to $42.1 million, or $0.94 per diluted share, in the prior year.

Chili’s was the standout performer, with comparable restaurant sales rising 31.4%, driven by a 19.9% increase in guest traffic. In contrast, Maggiano’s experienced a modest 1.8% growth in comparable sales, largely due to higher menu prices.

Looking ahead, Brinker raised its full-year fiscal 2025 guidance, forecasting EPS of $7.50 to $8.00, ahead of the consensus estimate of $6.44. Brinker expects total revenue for the year to fall between $5.15 billion and $5.25 billion, above the consensus estimate of $4.902 billion. Capital expenditures are projected to range from $240.0 million to $260.0 million.

Analysts Adjust Price Targets Following Performance

- Barclays analyst Jeffrey Bernstein maintained an Equal-Weight rating and raised the price target from $150 to $190.

- Wedbush analyst Nick Setyan reiterated a Neutral rating, with an increased price target from $140 to $185.

- BofA Securities analyst Katherine Griffin lifted the price target from $167 to $195.

- Goldman Sachs analyst Christine Cho raised the price target to $208.

- Citi analyst Jon Tower maintained a Neutral stance but increased his price target from $166 to $185.

Which Analyst has the best track record to show on EAT?

Analyst John Ivankoe (JPMORGAN) currently has the highest performing score on EAT with 17/18 (94.44%) price target fulfillment ratio. His price targets carry an average of $-2.71 (-2.64%) potential downside. Brinker International stock price reaches these price targets on average within 434 days.

Levi Strauss Reports Strong Q4 Performance but Issues Cautious FY 2025 Guidance

Levi Strauss reported its fourth quarter for fiscal year 2024, with net revenues increasing by 12% to $1.8 billion, surpassing analysts’ expectations of $1.77 billion. Organic net revenues grew by 8%, excluding the impact of foreign exchange and divested businesses.

Levi Strauss experienced growth across all key regions, with the Americas up 12% on a reported basis, Europe up 15%, and Asia rising by 9%. The Direct-to-Consumer (DTC) segment posted a 19% increase in net revenues, accounting for 45% of total organic sales, driven by higher e-commerce growth.

Gross margin rose 350 basis points to 61.3%, contributing to operating margin expansion, which reached 11.5% compared to 9.2% in the prior year. Adjusted diluted earnings per share (EPS) increased by 14%, from $0.44 to $0.50, although it was $0.02 below the analyst estimate of $0.52.

Despite the results for fiscal year 2024, Levi Strauss issued conservative guidance for fiscal year 2025. It projects EPS between $1.10 and $1.25, below the consensus estimate of $1.37. Additionally, Levi expects a decline in reported net revenues between 1% and 2%, with organic revenue growth of 3.5% to 4.5%, lower than analysts’ consensus of 3.7%.

Analysts Adjust Price Targets Following Cautious FY 2025 Guidance

- Barclays analyst Paul Kearney maintained an Overweight rating but lowered the price target from $24 to $22.

- Telsey Advisory Group analyst Dana Telsey held an Outperform rating, yet decreased the price target from $26 to $23.

- Guggenheim analyst Robert Drbul reduced the price target from $24 to $20.

Which Analyst has the best track record to show on LEVI?

Analyst Matthew Boss (JPMORGAN) currently has the highest performing score on LEVI with 11/18 (61.11%) price target fulfillment ratio. His price targets carry an average of $1.46 (8.32%) potential upside. Levi Strauss stock price reaches these price targets on average within 336 days.

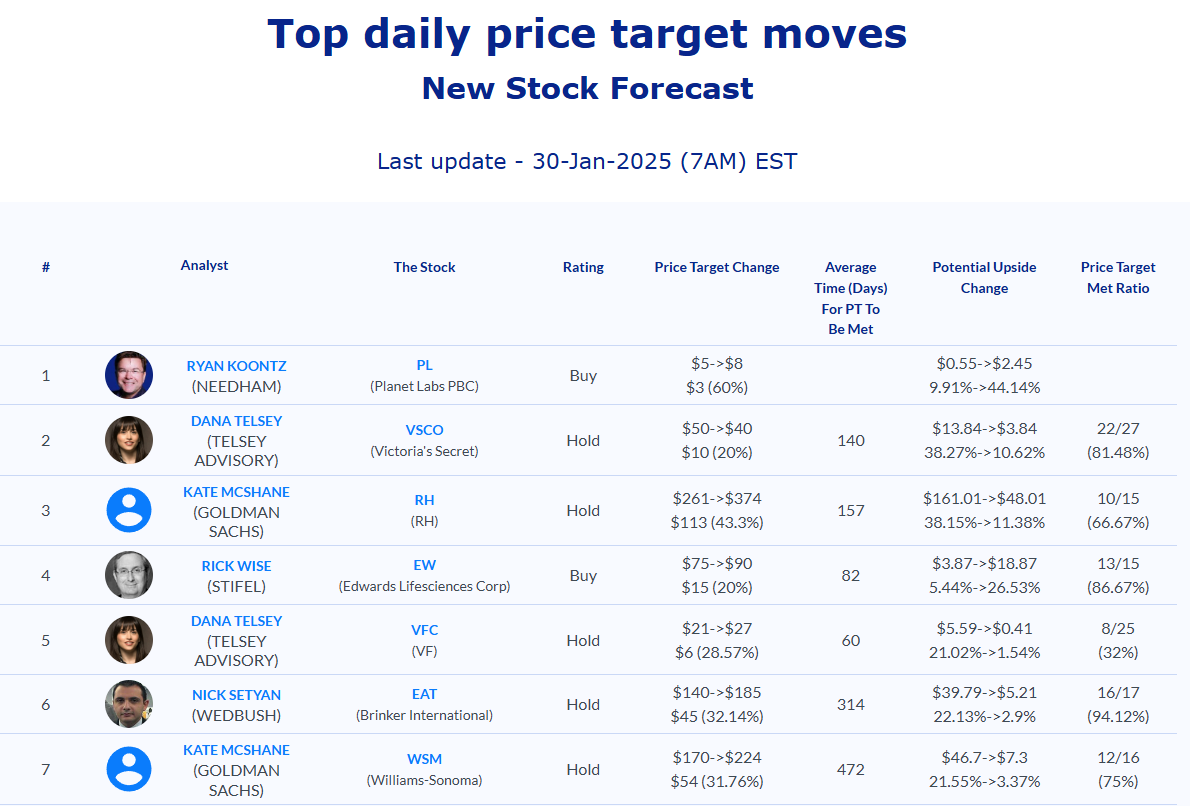

Daily stock Analysts Top Price Moves Snapshot