Selected stock price target news of the day - May 15th, 2025

By: Matthew Otto

Cisco Beats Q3 Estimates, Lifts Outlook on Strong AI Infrastructure Momentum

Cisco Systems delivered results for its fiscal third quarter, with adjusted earnings per share of $0.96, $0.04 above the consensus estimate of $0.92. Revenue reached $14.15 billion, ahead of both the $14.04 billion analyst forecast and the $12.7 billion posted a year earlier—an 11% year-over-year increase.

Net income rose to $2.49 billion, or $0.62 per share, compared with $1.89 billion, or $0.46 per share, in the prior-year period. Networking revenue grew 8% to $7.07 billion, surpassing StreetAccount’s estimate of $6.81 billion. Security revenue surged 54% to $2.01 billion, driven in part by the integration of Splunk, although it came in below the $2.17 billion consensus.

For Q4 2025, Cisco expects EPS between $0.96 and $0.98, compared to the consensus estimate of $0.95. Revenue is forecast at $14.5 billion to $14.7 billion, slightly above the expected $14.52 billion.

For the full fiscal year 2025, Cisco projects EPS of $3.77 to $3.79, ahead of the $3.72 consensus, and revenue between $56.5 billion and $56.7 billion versus the $56.4 billion estimate. CEO Chuck Robbins said Cisco is ahead of schedule on its AI infrastructure goals, reporting over $600 million in orders this quarter and bringing the fiscal year total to over $1.25 billion—surpassing the $1 billion mark one quarter early.

Analyst Price Target Hikes Following Strong Q3 and Guidance

- Barclays analyst Tim Long maintained an Equal-Weight rating but lifted the price target from $61 to $66.

- JP Morgan analyst Samik Chatterjee reiterated an Overweight rating and increased the price target from $70 to $73.

- Wells Fargo analyst Aaron Rakers upgraded from Equal-Weight to Overweight and the price target from $72 to $75.

- Citi analyst Atif Malik kept a Buy rating and boosted the price target to $71 from $68.

- Evercore ISI analyst Amit Daryanani raised the price target from $67 to $72.

Which Analyst has the best track record to show on CSCO?

Analyst Tim Long (BARCLAYS) currently has the highest performing score on CSCO with 21/22 (95.45%) price target fulfillment ratio. His price targets carry an average of $-2.84 (-4.45%) potential downside. Cisco Systems stock price reaches these price targets on average within 535 days.

Jack in the Box Reports Q2 2025 Results Amid Sales Declines and Impairment Charges

Jack in the Box reported financial results for the second quarter ended April 13, 2025, highlighting declines in same-store and systemwide sales across both the Jack in the Box and Del Taco brands. Same-store sales decreased 4.4%, with franchise locations down 4.5% and company-owned units down 4%. Systemwide sales declined 4.9%. Del Taco same-store sales declined 3.6%, with a 4.2% decline in franchise locations and a 1.7% drop in company-operated stores; systemwide sales fell 4.5%.

Restaurant-level margin at Jack in the Box was $18.7 million, or 19.6%, down from $23.3 million, or 23.6%, in the prior year. Del Taco restaurant-level margin was $6.1 million, or 12.8%, compared to $11.4 million, or 16.8%, last year. Net restaurant count decreased by seven for Jack in the Box and increased by two for Del Taco.

For the quarter, Jack in the Box reported operating EPS of $1.2, exceeding the analyst consensus estimate of $1.07 by $0.13. Total revenue was $336.7 million, which came in below the consensus estimate of $345.76 million and declined 7.8% from $365.3 million in the prior year, largely due to Del Taco refranchising activity.

Jack in the Box posted a GAAP diluted loss per share of ($7.47), reflecting a $203.2 million non-cash goodwill and intangible impairment charge related to Del Taco. Net loss was $142.2 million, versus net income of $25 million a year earlier. Adjusted EBITDA came in at $66.5 million, down from $75.7 million. SG&A expense increased to $35.5 million due to changes in the value of corporate-owned life insurance policies.

Analysts Adjust Price Targets Following Q2 Miss and Impairment Charge

- Loop Capital analyst Alton Stump maintained a Buy rating but trimmed the price target from $65 to $61.

- Barclays analyst Jeffrey Bernstein continued with Equal-Weight rating and reduced the price target from $24 to $23.

- TD Securities analyst Andrew Charles reiterated a Hold rating and a $31 price target.

Which Analyst has the best track record to show on JACK?

Analyst Andrew Charles (TD SECURITIES) currently has the highest performing score on JACK with 19/37 (51.35%) price target fulfillment ratio. His price targets carry an average of $5.25 (20.39%) potential upside. Jack in the Box stock price reaches these price targets on average within 185 days.

Global-e Posts Q1 Growth but Narrow Losses Persist Amid Market Uncertainty

Global-e Online announced its financial results for the first quarter of 2025, reporting a revenue of $189.9 million, surpassing the consensus estimate of $187.75 million. This is driven by $84.0 million in service fees and $105.9 million in fulfillment services.

Gross Merchandise Value increased 34% year over year to $1.24 billion, while gross profit rose 31% to $86.3 million. Operating profit before certain costs reached $31.6 million, compared to $21.3 million in the prior year, and the net loss narrowed to $17.9 million from $32.1 million a year earlier. Earnings per share for the quarter was ($0.11), beating analyst expectations by $0.02. Gross margin remained steady at 45.4%.

Looking ahead, Global-e expects Q2 revenue between $204 million and $211 million, slightly below the consensus estimate of $212.3 million. For the full year, revenue is projected between $917 million and $967 million, which is above the consensus forecast of $938.8 million.

Analysts Price Targets Decline Despite Mixed Q1 2025 Results

- Wells Fargo analyst Andrew Bauch continued as Overweight but lowered the price target from $45 to $40.

- Benchmark analyst Mark Zgutowicz maintained a Buy rating but adjusted the price target down from $55 to $52.

- Needham analyst Scott Berg reiterated a Buy rating and the price target at $40.

Which Analyst has the best track record to show on GLBE?

Analyst James Faucette (MORGAN STANLEY) currently has the highest performing score on GLBE with 13/14 (92.86%) price target fulfillment ratio. His price targets carry an average of $8.76 (23.52%) potential upside. Global-e Online stock price reaches these price targets on average within 156 days.

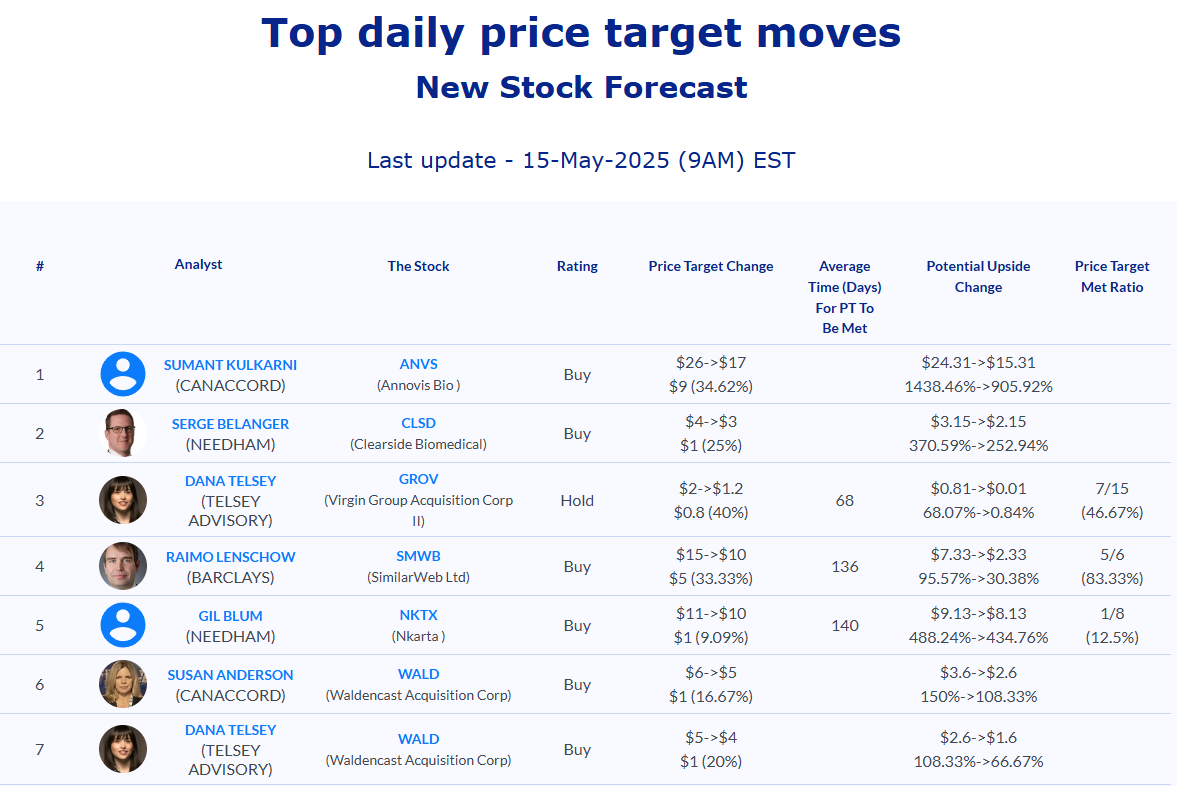

Daily stock Analysts Top Price Moves Snapshot