Selected stock price target news of the day - May 28th, 2025

By: Matthew Otto

Okta Tops Q1 Estimates but Signals Slower Growth Ahead in FY26 Outlook

Okta reported financial results for the first quarter of fiscal 2026, posting earnings per share of $0.86, beating the analyst consensus of $0.77. Revenue rose 12% year-over-year to $688 million, ahead of the $680.33 million estimate. Subscription revenue grew 12% to $673 million.

Remaining performance obligations (RPO) increased 21% year-over-year to $4.084 billion, while current RPO, expected to be recognized over the next 12 months, grew 14% to $2.227 billion. Operating income rose to $184 million, or 27% of total revenue, compared to 22% a year earlier. Net income improved to $158 million, with diluted earnings per share up from $0.65 in the prior year. Operating cash flow reached $241 million, while free cash flow totaled $238 million—both equal to 35% of revenue.

For the second quarter, Okta expects revenue between $710 million and $712 million, and earnings per share of $0.83 to $0.84. For the full fiscal year 2026, Okta projects revenue of $2.85 billion to $2.86 billion, in line with the $2.86 billion consensus, and earnings per share of $3.23 to $3.28, above the $3.2 average analyst estimate.

Analysts Mostly Positive Despite Some Price Target Cuts Following Q1 Results

- WestPark Capital analyst Casey Ryan kept a Buy rating and a price target of $140.

- Needham analyst Mike Cikos maintained a Buy rating while increasing the price target from $115 to $125.

- Evercore ISI analyst Kirk Materne raised the price target from $122 to $130.

- KeyBanc analyst Eric Heath lowered the price target from $155 to $140.

- TD Cowen analyst Shaul Eyal raised the price target from $110 to $115.

- Jefferies analyst Brent Thill trimmed the price target from $135 to $130.

- Loop Capital analyst Yun Kim reaffirmed a Buy rating and the price target at $140.

- Truist Securities analyst Joel Fishbein Jr. kept a Hold rating with a $100 price target.

- Guggenheim analyst John DiFucci cut the price target from $140 to $138.

Which Analyst has the best track record to show on OKTA?

Analyst Mike Cikos (NEEDHAM) currently has the highest performing score on OKTA with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $27.84 (31.94%) potential upside. Okta stock price reaches these price targets on average within 41 days.

DICK’S Sporting Goods Beats Q1 Estimates and Maintains Full-Year Guidance

DICK’S Sporting Goods reported first-quarter earnings per share of $3.37, exceeding the analyst estimate of $3.20 by $0.17. Revenue for the quarter reached $3.17 billion, also ahead of the $3.12 billion consensus.

Comparable sales increased 4.5%, driven by both higher average ticket and transaction volume. Operating margin was 11%, and net income totaled $264 million. DICK’S opened six new stores—two House of Sport and four Field House locations—and invested $265 million in gross capital expenditures, a 68% increase year over year. Share repurchases rose to $299 million, up 163% from the same quarter last year, while inventory levels increased 12% to $3.57 billion.

For fiscal year 2026, DICK’S reaffirmed its guidance, projecting earnings per share in the range of $13.8 to $14.4, compared to the consensus estimate of $14.34. Revenue is expected between $13.6 billion and $13.9 billion, closely aligned with the $13.86 billion analyst forecast. DICK’S declared a quarterly dividend of $1.2125 per share and reiterated plans to acquire Foot Locker in a transaction valued at approximately $2.4 billion.

Analysts Reaffirm Bullish Stance Following Q1 Beat

- Telsey Advisory Group analyst Joseph Feldman maintained an Outperform rating and the price target at $220.

- DA Davidson analyst Michael Baker reiterated a Buy rating and a $273 price target.

Which Analyst has the best track record to show on DKS?

Analyst Anthony Chukumba (LOOP CAPITAL) currently has the highest performing score on DKS with 13/13 (100%) price target fulfillment ratio. His price targets carry an average of $-4.02 (-2.18%) potential downside. DICK’S Sporting Goods stock price reaches these price targets on average within 79 days.

Salesforce to Acquire Informatica to Expand Enterprise Data and AI Capabilities

Salesforce has entered into an agreement to acquire Informatica for approximately $8 billion in equity value, net of its existing stake. The all-cash deal is expected to close in early fiscal year 2027, which begins February 1, 2026. Approximately 63% of Informatica’s voting shares have approved the transaction through written consent, eliminating the need for a broader shareholder vote.

Salesforce will finance the acquisition using a mix of available cash and newly issued debt. This is Salesforce’s largest transaction since acquiring Slack Technologies for $27.7 billion in 2021, and follows previous deals including Tableau Software for $15.7 billion in 2019.

The acquisition adds Informatica’s portfolio of data integration, governance, metadata management, and Master Data Management (MDM) to Salesforce’s existing data infrastructure. Informatica currently serves over 5,000 customers, including 84 of the Fortune 100, and reported $1.6 billion in revenue for fiscal year 2023.

Analysts Maintain Positive Outlook Amid Acquisition News

- WestPark Capital analyst Curtis Shauger reiterated a Buy rating and the price target at $320.

- Needham analyst Scott Berg reaffirmed a Buy rating and a price target of $400.

- Loop Capital analyst Yun Kim maintained a Hold rating and a $300 price target.

- Morgan Stanley analyst Keith Weiss reiterated an Overweight rating and a $393 price target.

Which Analyst has the best track record to show on CRM?

Analyst Gil Luria (D.A. DAVIDSON) currently has the highest performing score on CRM with 10/11 (90.91%) price target fulfillment ratio. His price targets carry an average of $-36.26 (-15.35%) potential downside. Salesforce stock price reaches these price targets on average within 43 days.

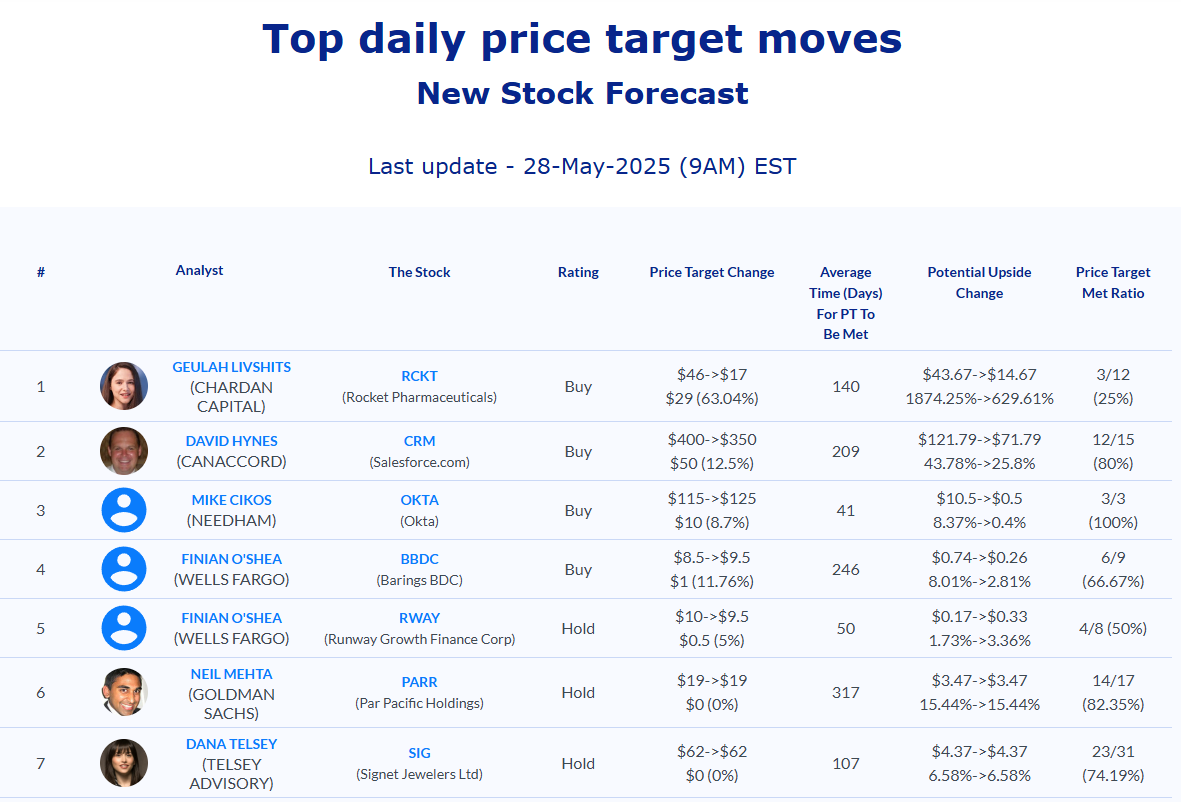

Daily stock Analysts Top Price Moves Snapshot