Selected stock price target news of the day - August 8th, 2025

By: Matthew Otto

Crocs Reports Q2 2025 Results with Record Gross Profit Amid Impairment Charges

Crocs reported second quarter 2025 revenue of $1.15 billion, up 3.4% year-over-year (2.7% in constant currency), exceeding the consensus estimate of $1.14 billion. Direct-to-consumer sales increased 4%, while wholesale revenues rose 2.8%.

Crocs posted adjusted EPS of $4.23, $0.21 above the analyst estimate of $4.02. Gross margin improved to 61.7% from 61.4%. Noncash impairment charges of $737 million, including $430 million for the HEYDUDE trademark and $307 million for goodwill, drove selling, general, and administrative expenses to $1.14 billion from $356 million, or 98.9% of revenue versus 32% a year earlier. This resulted in a loss from operations of $428 million, compared to operating income of $326 million last year, and a diluted loss per share of $8.82 versus earnings of $3.77.

On an adjusted basis, operating income was $309 million, down 5%, with a margin of 26.9%. Crocs repurchased 1.3 million shares for $133 million and reduced debt by $105 million during the quarter, ending with $201 million in cash and $1.38 billion in total borrowings.

By brand, Crocs revenues rose 5% to $960 million, with direct-to-consumer sales up 3.4% and wholesale up 6.8%. North America revenues fell 6.5% to $457 million, while international sales increased 18.1% to $502 million. HEYDUDE revenues declined 3.9% to $190 million, with direct-to-consumer up 7.6% but wholesale down 12.4%. Inventory stood at $405 million, up from $377 million a year earlier, and capital expenditures were $32 million compared to $33 million last year.

For the third quarter of 2025, Crocs expects revenues to decline 9% to 11% year-over-year and projects an adjusted operating margin of 18% to 19%, including an anticipated 170-basis-point negative impact from announced and pending tariffs.

Analysts Adjust Ratings and Price Targets Following Q2 Results

- BofA Securities analyst Christopher Nardone maintained a Buy rating but lowered the price target from $135 to $99.

- Stifel analyst Jim Duffy downgraded from Buy to Hold and the price target from $127 to $85.

- Barclays analyst Adrienne Yih downgraded from Overweight to Equal-Weight and the price target from $119 to $81.

Which Analyst has the best track record to show on CROX?

Analyst Jay Sole (UBS) currently has the highest performing score on CROX with 19/21 (90.48%) price target fulfillment ratio. His price targets carry an average of $21.05 (18.97%) potential upside. Crocs stock price reaches these price targets on average within 82 days.

The Trade Desk Reports 19% Revenue Growth in Second Quarter 2025

The Trade Desk reported second quarter 2025 revenue of $694 million, an increase of 19% from $585 million in the same period last year and above the consensus estimate of $685.54 million. Earnings per share for the quarter were $0.41, exceeding the analyst estimate of $0.4 and up from $0.39 a year earlier.

Net income was $90 million, compared to $85 million in the prior-year quarter, with earnings before interest, taxes, depreciation, and amortization of $271 million, representing 39% of revenue. For the first six months of 2025, revenue reached $1.31 billion, up 22% year over year, while net income totaled $141 million versus $117 million in the first half of 2024. Customer retention remained above 95% for the quarter, consistent with the past 11 years.

For the third quarter of 2025, Trade Desk expects revenue of at least $717 million, above the consensus estimate of $716.2 million, and earnings before interest, taxes, depreciation, and amortization of approximately $277 million.

Analysts Adjust Ratings and Price Targets Following Q2 Results

- BMO Capital analyst Brian Pitz maintained an Outperform rating while reducing the price target from $115 to $98.

- Piper Sandler analyst Matt Farrell maintained a Neutral rating but trimmed the price target from $65 to $64.

- BofA Securities analyst Jessica Reif Ehrlich downgraded from Buy to Neutral and the price target from $130 to $55.

Which Analyst has the best track record to show on TTD?

Analyst Mark Zgutowicz (BENCHMARK) currently has the highest performing score on TTD with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $-8.23 (-27.68%) potential downside. The Trade Desk stock price reaches these price targets on average within 82 days.

Microchip Technology Reports First-Quarter Fiscal 2026 Results, Beats EPS and Revenue Estimates

Microchip Technology reported Q1 EPS of $0.27, compared with the analyst estimate of $0.24. Revenue was $1.08 billion, higher than the consensus estimate of $1.05 billion. This represented a 10.8% increase from the prior quarter, though a 13.4% decline from the same period last year, and was above the company’s earlier guidance midpoint of $1.06 billion.

Gross margin was 54.3%, while operating income was $222.3 million, representing 20.7% of revenue. Net income was $154.7 million, compared with $289.9 million a year earlier.

Microchip attributed its performance to customer inventory reductions and improved efficiency. Inventory levels fell by $124.4 million, with distribution inventory days at 29 and total balance sheet inventory days at 214. Operating expenses were $362.1 million, or 33.7% of revenue, versus $353 million, or 28.4% of revenue, in the prior-year quarter.

For Q2 fiscal 2026, Microchip Technology expects EPS of $0.3 to $0.36, compared with the consensus of $0.31, and revenue of $1.11 to $1.15 billion, versus the consensus estimate of $1.13 billion. The midpoint of the outlook implies revenue growth of about 5%. Capital expenditures are projected between $35 million and $40 million for the quarter.

Analysts Revise Ratings and Targets Following Q1 Results

- Piper Sandler analyst Harsh Kumar maintained an Overweight rating and increased the price target from $65 to $80.

- Needham analyst N. Quinn Bolton kept a Buy rating while lifting the price target from $66 to $77.

- TD Cowen analyst Joshua Buchalter trimmed the price target from $75 to $60.

Which Analyst has the best track record to show on MCHP?

Analyst Timothy Arcuri (UBS) currently has the highest performing score on MCHP with 2/3 (66.67%) price target fulfillment ratio. His price targets carry an average of $4.67 (8.44%) potential upside. Microchip Technology stock price reaches these price targets on average within 130 days.

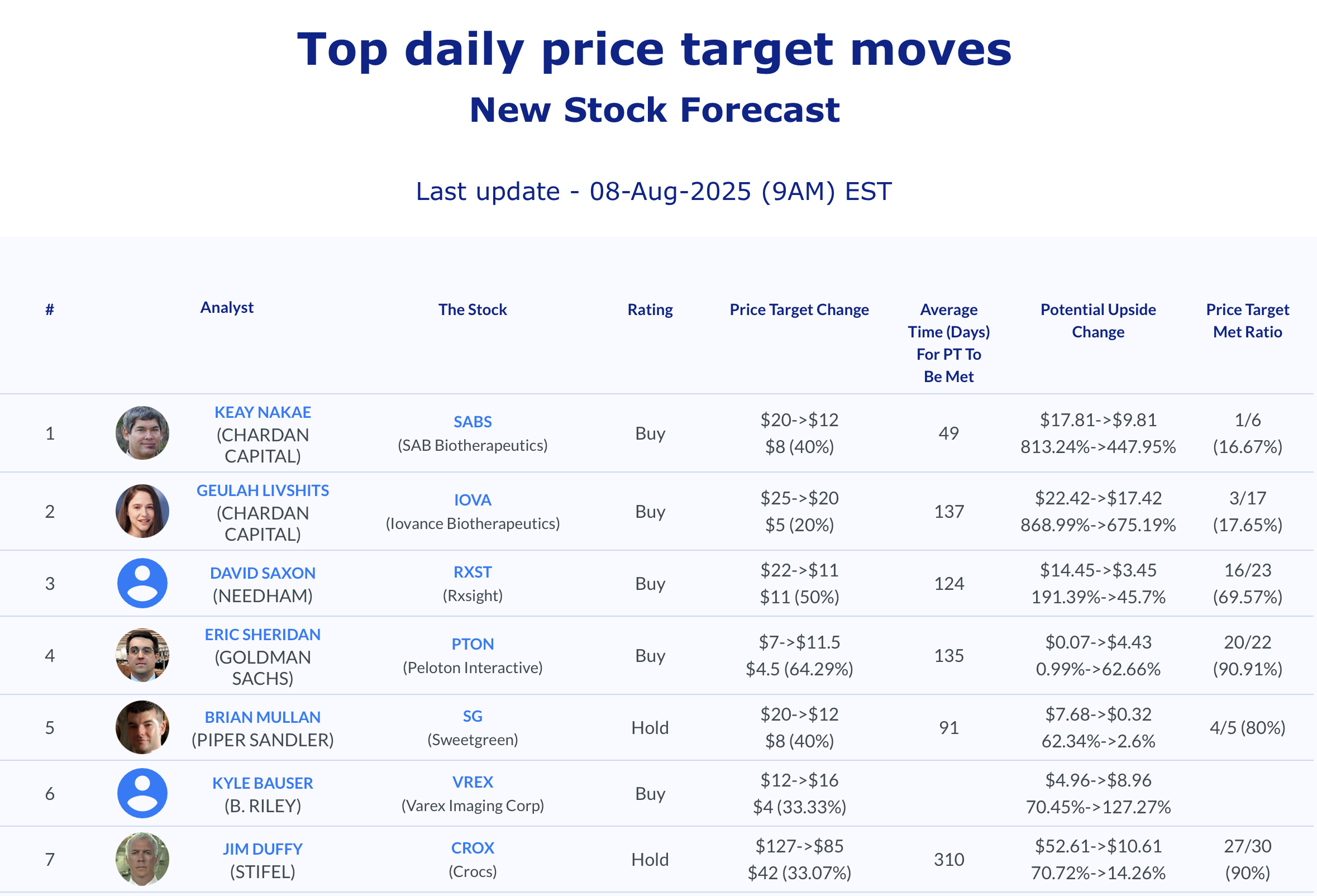

Daily Stock Analysts Top Price Moves Snapshot