Selected stock price target news of the day - October 8th, 2025

By: Matthew Otto

Arrowhead Seeks Approval to Test Dual-Gene RNAi Therapy for Mixed Hyperlipidemia

Arrowhead Pharmaceuticals announced that it has filed a request with the New Zealand Medicines and Medical Devices Safety Authority (Medsafe) to begin a Phase 1/2a clinical trial for ARO-DIMER-PA, an investigational RNA interference (RNAi) therapy designed to address mixed hyperlipidemia and atherosclerotic cardiovascular disease (ASCVD).

The proposed study, to be reviewed by the Standing Committee on Therapeutic Trials, will enroll up to 78 adult participants. It will be conducted as a randomized, double-blind, placebo-controlled, dose-escalating trial to assess the safety, tolerability, and pharmacological effects of ARO-DIMER-PA on low-density lipoprotein cholesterol (LDL-C) and triglycerides (TGs) following both single and multiple doses. Early findings from the trial are expected by 2026.

ARO-DIMER-PA is the first known RNAi candidate to silence two genes simultaneously—proprotein convertase subtilisin kexin type 9 (PCSK9) and apolipoprotein C3 (APOC3)—using Arrowhead’s proprietary TRiM™ technology. In preclinical studies with dyslipidemic nonhuman primates, ARO-DIMER-PA lowered serum PCSK9 levels by roughly 80%, APOC3 by 75%, LDL-C by 70%, and triglycerides by about 60%.

Mixed hyperlipidemia, which involves elevated LDL-C and TGs, affects an estimated 30–40% of adults globally, equivalent to around 1 billion people. In the United States, approximately 90 million adults are affected, and about 28 million live with atherosclerotic cardiovascular disease. ASCVD remains the leading cause of death worldwide, responsible for roughly 17.9 million deaths each year and accounting for about 32% of all global mortality.

Analysts Adjust Price Targets While Maintaining Positive Outlook

- HC Wainwright & Co. analyst Patrick R. Trucchio reiterated a Buy rating and a $80 price target.

Which Analyst has the best track record to show on ARWR?

Analyst Shawn Egan (CITI) currently has the highest performing score on ARWR with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $1.72 (11.26%) potential upside. Arrowhead Pharmaceuticals stock price reaches these price targets on average within 54 days.

Ionis Pharmaceuticals Showcases Expanding RNA Medicine Portfolio and 2026 Launch Pipeline

Ionis Pharmaceuticals shared updates during its 2025 Innovation Day in New York City, highlighting progress in developing RNA-based medicines for people with serious diseases. The company has launched two new drugs within nine months—TRYNGOLZA® (olezarsen) for a rare fat disorder called familial chylomicronemia syndrome (FCS), and DAWNZERA™ (donidalorsen) for hereditary angioedema (HAE), a condition that causes painful swelling attacks.

Ionis plans two more product launches in 2026. FCS is very rare, affecting only about 1 to 2 people per million, while severe high triglycerides (sHTG)—the next condition Ionis is targeting—affects around 3 to 5 million people worldwide. In late-stage studies, olezarsen helped patients lower their triglyceride levels by as much as 72% and reduced the risk of acute pancreatitis by 85%. The company expects to seek additional U.S. FDA approval for olezarsen by the end of 2025.

Ionis also shared new progress in brain and genetic diseases. Its upcoming treatment zilganersen aims to treat Alexander disease, a rare and fatal brain disorder that affects about 500 to 1,200 people globally, while another drug, ION582, is being developed for Angelman syndrome, a severe developmental condition that impacts roughly 20,000 to 40,000 people in the U.S. alone. The company plans to file for FDA approval of zilganersen in early 2026 and start a larger Phase 3 study for ION582 that same year.

Financially, Ionis reported about $2 billion in cash and expects to become cash-flow positive by 2028. With multiple new drugs expected to reach the market soon, Ionis estimates its medicines could generate more than $5 billion in yearly revenue, including contributions from partnerships with major pharmaceutical companies such as GSK, Novartis, AstraZeneca, and Roche.

Analysts Boost Ionis Pharmaceuticals Ratings and Lift Price Targets by 62%

- JP Morgan analyst Jessica Fye upgraded from Neutral to Overweight while raising the price target from $49 to $80.

- HC Wainwright & Co. analyst Mitchell S. Kapoor reiterated a Buy rating and a $95 price target.

Which Analyst has the best track record to show on IONS?

Analyst Debjit Chattopadhyay (GUGGENHEIM) currently has the highest performing score on IONS with 4/4 (100%) price target fulfillment ratio. His price targets carry an average of $32.29 (101.83%) potential upside. Ionis Pharmaceuticals stock price reaches these price targets on average within 360 days.

Eli Lilly’s Omvoh Shows 4-Year Success in Helping Ulcerative Colitis Patients Stay in Long-Term Remission

Eli Lilly has announced new long-term results showing that its ulcerative colitis treatment, Omvoh (mirikizumab-mrkz), helped most patients maintain lasting relief from symptoms for up to four years. In the LUCENT-3 Phase 3 clinical study, about 78% of patients who were in remission after one year stayed in corticosteroid-free remission through the fourth year.

The same percentage—78%—maintained overall clinical remission, and 81% continued to show healing in the colon based on endoscopic results. In addition, 90% of participants reported remission on quality-of-life measures, and 93% experienced major improvement in bowel urgency—one of the most disruptive symptoms of ulcerative colitis.

Ulcerative colitis is a chronic inflammatory bowel disease that affects nearly 3 million adults in the United States and over 5 million people worldwide, often causing abdominal pain, diarrhea, and fatigue. The new findings suggest that a large share of these patients could potentially benefit from long-term Omvoh therapy, particularly those with moderate to severe forms of the disease who have not responded to previous biologic treatments. In the trial, about 12% of participants experienced serious side effects, while 7% stopped treatment because of them—figures consistent with prior safety studies.

Lilly’s researchers noted that these results make Omvoh the first IL-23p19 inhibitor proven to provide sustained, steroid-free remission for several years, offering new hope for those living with this lifelong digestive condition.

Guggenheim Lifts Eli Lilly Price Target to, Keeps Buy Rating

- Guggenheim analyst Seamus Fernandez maintained a Buy rating and raised the price target from $875 to $948.

Which Analyst has the best track record to show on LLY?

Analyst Terence Flynn (MORGAN STANLEY) currently has the highest performing score on LLY with 22/25 (88%) price target fulfillment ratio. His price targets carry an average of $183.13 (21.80%) potential upside. Eli Lilly stock price reaches these price targets on average within 173 days.

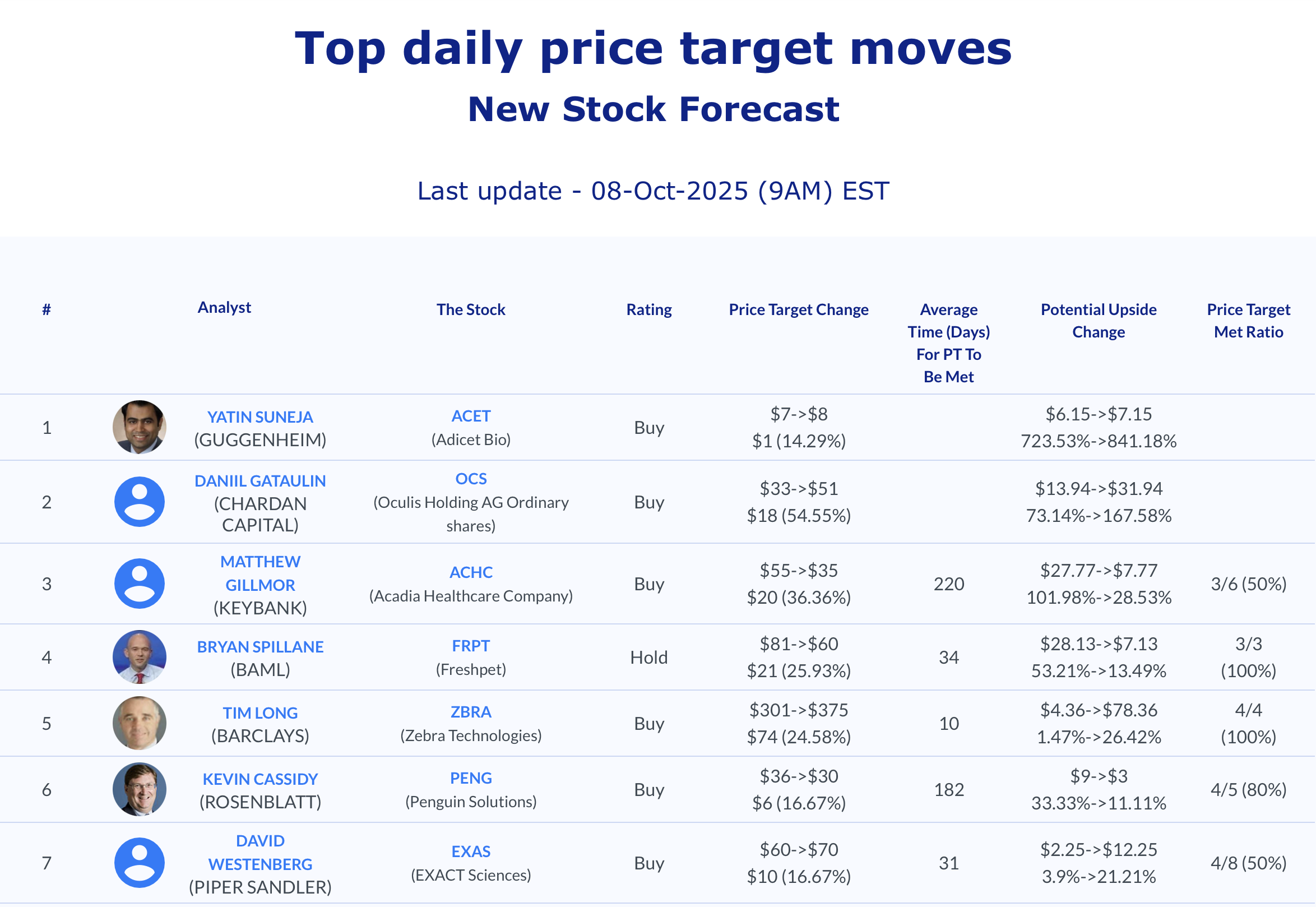

Daily Stock Analysts Top Price Moves Snapshot