Keep Your Eye on Stock Analyst Blind Spots

By: Miriam Metzinger

Blind spots.

We all have them, although we may, by definition, may not be able to perceive them.

Since stock analysts are human they also have blind spots. This may, at first glance, seem like a liability, but you can actually profit from analyst blind spots.

Common Analyst Blind Spots

We may suspect that many analysts may suffer from excessive enthusiasm. The research backs this up. A study from Harvard Business School has long demonstrated a bullish bias. Of course, this may be due to the conflict of interest many analysts have as well as the fact that there is a scramble to predict the next upside or an up-and-coming growth stock.

Speaking of growth, a study from the University of Pennsylvania showed that the average bullish growth projection on a stock was 40% above the actual returns.

The reason for this isn’t surprising. Financial media tends to reward hype and new investors may be driven by hope. The Pennsylvania study validated a gut feeling we may have when looking at analyst estimates–growth predictions tend to be hyperbolic.

Another common mistake analysts make in general is to overlook the balance sheet when making prognostications. Looking at milestone achievements and revenues is essential, but if a company is highly leveraged, this could spell trouble.

On the other hand, paying attention to a company’s clean balance sheet can help you spot an undervalued stock that can have significant upside where competitors stumble over debt.

Bucking the Trend and Avoiding Analyst Blind Spots

Knowing that analysts as a class chronically tend to be too bullish, overestimate growth predictions and overlook balance sheets may lead us to become contrarian or bearish.

However, this knee-jerk reaction may cause us to miss legitimate trends that have viable upside. The shorts have lost their bets against trends on many occasions. We can recall the massive 2021 short squeeze on GameStop when, contrary to bearish bets, the stock shot up 62% in just a few weeks.

Tracking and Profiting from Analyst Blindspots

We are often told to avoid generalizing in our social lives. The same is true in investing. Taking a deep dive and examining where specific analysts have been correct and incorrect can allow us to see their blind spots.

For instance, it’s not uncommon to see articles in the financial media about analyst blind spots. In the SeekingAlpha article, “Altria is in Wall Street’s Blind Spot,” Sensor Unlimited states that SeekingAlpha authors, or “Main Street” analysts compared to Wall Street analysts tend to look at the longer term, the bigger picture rather than short-term gains.

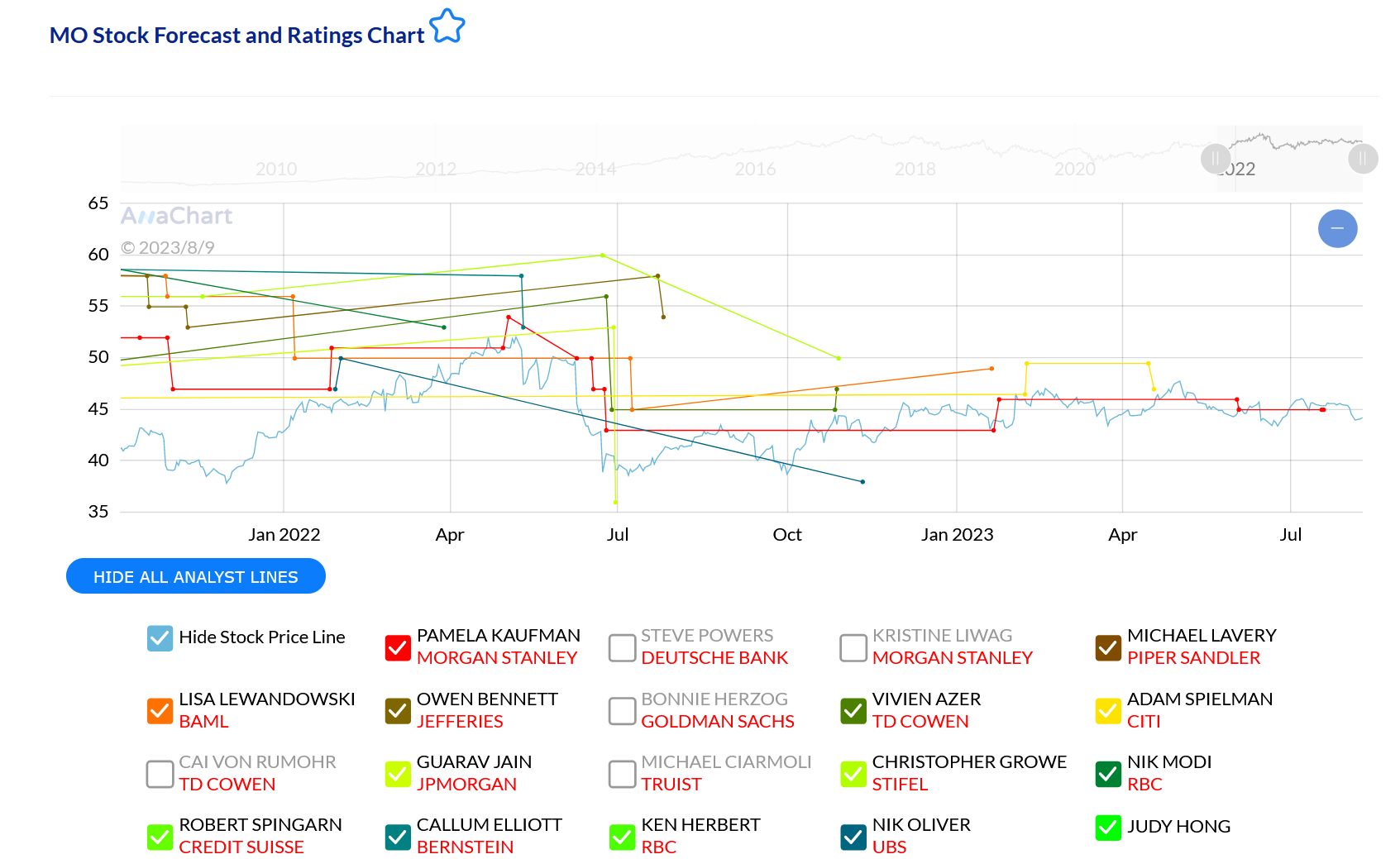

With the help of AnaChart, a potential Altria (MO) investor could test this thesis by looking at the many analysts who cover Altria and comparing Wall Street with Main Street analyst coverage.

However, to determine if this blind spot is consistent with certain analysts over time, the investor could compare analyst ratings on other stocks that provided significant upside but were underestimated with short-term bearish calls.

This information can be valuable and revealing because comparing analyst calls on similar-behaving stocks or stocks in a similar sector can reveal a bias or blind spot in specific analysts.

This investigation can provide hints on when to trust specific analysts on certain stocks and sectors and when to take their ratings with a grain of salt, or even bet against them.

AnaChart allows a deeper, more detailed view of analyst activity over time and is a crucial research tool for any investor. Sign up for a 30-Day trial and discover a whole new level of stock research.