Selected stock price target news of the day - April 1st, 2024

By: Matthew Otto

Cintas Fiscal 2024 Q3 Earnings Reported Growth and Revenue

Cintas has reported fiscal 2024 third-quarter earnings, with total revenue surging by 9.9% to $2.41 billion compared to the previous year. This growth was underpinned by operational performance across various segments, including Uniform Rental and Facility Services, which saw a 7.1% organic growth rate, and First Aid and Safety Services, achieving an 11.5% growth.

Gross margin reached 49.4%, marking an increase of 220 basis points from the prior year, while operating income soared by 16.6% to hit $520.8 million. Diluted earnings per share experienced an uptick of 22.3%, reaching $3.84.

Furthermore, Cintas deployed over $1.4 billion of capital across priorities such as capital expenditures, acquisitions, dividends, and buybacks. Cash flow increased by 32.8% to support these initiatives, underscores its financial stability and growth potential.

Looking forward, Cintas remains bullish on its outlook, raising its annual revenue expectations to a range of $9.57 billion to $9.6 billion, and its diluted EPS expectations to a range of $14.80 to $15 for fiscal 2024.

Analysts Raise Price Targets Amid Positive Outlook

- Deutsche Bank analyst Faiza Alwy maintained a Hold rating and raised the price target from $629 to $726.

- Goldman Sachs analyst George Tong reiterated a Buy rating and increased the price target from $673 to $765.

- RBC Capital analyst Ashish Sabadra reiterated an Outperform rating and increased the price target from $675 to $725.

- Truist Securities analyst Jasper Bibb maintained a Buy rating and raised the price target from $660 to $775.

- UBS analyst Joshua Chan kept a Buy rating and upgraded the price target from $680 to $790.

Which Analyst has the best track record to show on CTAS?

Analyst Seth Weber (WELLS FARGO) currently has the highest performing score on CTAS with 14/14 (100%) price target fulfillment ratio. His price targets carry an average of $57.53 (10.32%) potential upside. Cintas stock price reaches these price targets on average within 103 days.

Sprinklr Reports Q4 and Full Year 2024 Financial Results, Projects Steady Growth for FY 2025

Sprinklr reported financial results for the fourth quarter and full fiscal year 2024 during its recent earnings call. In Q4, Sprinklr achieved a 17% year-over-year increase in total revenue, reaching $194.2 million, with subscription revenue up by 19% to $177 million.

Sprinklr attained $32.4 million in non-GAAP operating income, resulting in a 17% non-GAAP operating margin for the quarter. Despite encountering renewal pressure, the company maintained a steady subscription revenue base net dollar expansion rate of 118%.

Looking forward to fiscal year 2025, Sprinklr provided guidance projecting a 12% year-over-year growth in total revenue for Q1, estimating it to be in the range of $194 million to $195 million, with subscription revenue expected to reach $177.5 million to $178.5 million. For the full fiscal year, Sprinklr anticipates subscription revenue growth of 11%, aiming for it to be in the range of $740.5 million to $741.5 million, and total revenue growth of 10%, projected to be in the range of $804.5 million to $805.5 million.

Analysts Provide Mixed Assessments Following Recent Updates

- Wells Fargo analyst Michael Berg maintained an Equal-Weight rating and raised the price target from $12 to $14.

- Cantor Fitzgerald analyst Brett Knoblauch reiterated an Overweight rating and a $16 price target.

- Oppenheimer analyst Brian Schwartz maintained a Perform rating.

Which Analyst has the best track record to show on CXM?

Analyst Michael Turrin (WELLS FARGO) currently has the highest performing score on CXM with 6/9 (66.67%) price target fulfillment ratio. His price targets carry an average of $0.3 (2.56%) potential upside. Sprinklr stock price reaches these price targets on average within 18 days.

Franklin Covey Reports Subscription Sales Amidst Fiscal Q2 Performance Review

Franklin Covey Co. revealed its fiscal performance for the second quarter of 2024, reporting consolidated revenue at $61.3 million, slightly down from the previous year’s $61.8 million. Despite this, subscription and subscription services sales surged to $50.3 million for the quarter, marking a 5% increase over the same period last year. Over the rolling four quarters ended February 29, 2024, these sales reached $227.3 million.

Cash flows from operating activities saw a surge to $30.2 million compared to $11.2 million in fiscal 2023. Additionally, liquidity stood at over $103 million, comprising $40.9 million in cash reserves and no utilization of the $62.5 million credit facility.

Looking forward, Franklin Covey expects Adjusted EBITDA for fiscal 2024 to be approximately $54.5 million, sitting at the lower end of its previously forecasted range.

Analysts Maintain Outperform Rating Despite Lowered Price Targets

- Northland Capital Markets analyst Nehal Chokshi maintained an Outperform rating and lowered the price target from $100 to $95.

- Barrington Research analyst Alexander Paris reiterated an Outperform rating and decreased the price target from $55 to $45.

Which Analyst has the best track record to show on FC?

Analyst Alexander Paris (BARRINGTON) currently has the highest performing score on FC with 10/17 (58.82%) price target fulfillment ratio. His price targets carry an average of $15.11 (37.88%) potential upside. Franklin Covey Company stock price reaches these price targets on average within 290 days.

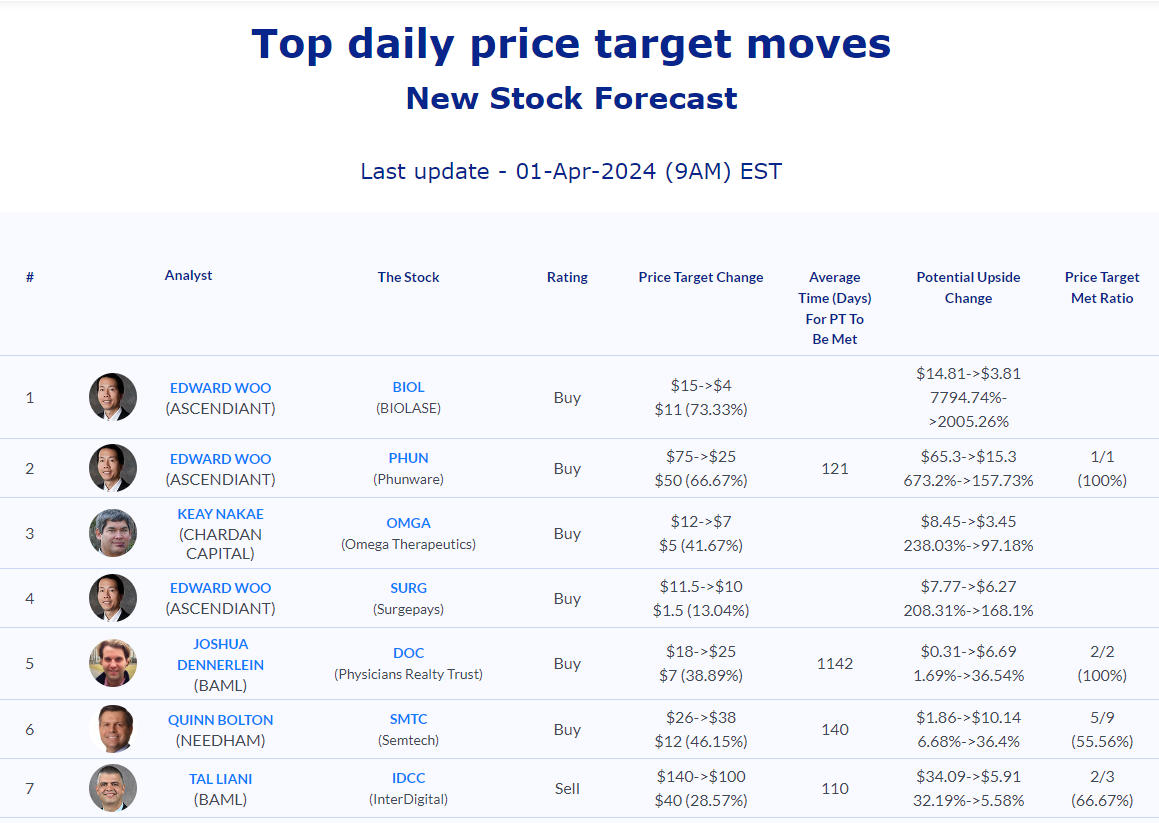

Daily stock Analysts Top Price Moves Snapshot