Selected stock price target news of the day - April 22nd, 2024

By: Matthew Otto

Synovus’ First Quarter 2024 Earnings: Navigating Challenges with Strategic Growth

Synovus has released its first-quarter 2024 earnings report, reporting a diluted EPS of $0.78 and an adjusted EPS of $0.79. Though impacted by a $13 million incremental FDIC special assessment, reducing reported and adjusted EPS by $0.07. Loan growth in key commercial segments, with growth in middle-market, corporate and investment banking, and specialty lending, totaling $287 million during the quarter. However, period-end loan growth remained flat.

Furthermore, Synovus exhibited core deposit growth of $165 million sequentially in the first quarter, with total reported non-interest revenue of $119 million and adjusted non-interest revenue of $117 million, declining $10 million or 8% from the previous quarter. Capital position strengthened, with the preliminary common equity Tier 1 ratio reaching 10.38% and total risk-based capital at 13.31%.

Analysts React with Price Target Adjustments After Q1 2024 Results

- Keefe, Bruyette & Woods analyst Brady Gailey downgraded from Outperform to Market Perform and the price target from $46 to $38.

- Piper Sandler analyst Brad Milsaps maintained an Overweight rating yet lowered the price target from $46 to $42.

- RBC Capital analyst Jon Arfstrom reiterated an Outperform rating and decreased the price target from $44 to $41.

- DA Davidson analyst Kevin Fitzsimmons reiterated a Buy rating but lowered the price target from $45 to $43.

- Barclays analyst Jared Shaw kept an Equal-Weight rating and downgraded the price target from $42 to $39.

- Goldman Sachs analyst Ryan Nash maintained a Neutral rating yet lowered the price target from $46 to $41.

- Wells Fargo analyst Timur Braziler maintained an Overweight rating but lowered the price target from $42 to $40.

Which Analyst has the best track record to show on SNV?

Analyst Manan Gosalia (MORGAN STANLEY) currently has the highest performing score on SNV with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $1.76 (4.99%) potential upside. Synovus Financial Corp stock price reaches these price targets on average within 29 days.

D.R. Horton’s Q2 Fiscal 2024 Earnings Call: Insights into Growth and Market Strategies

D.R. Horton unveiled its second-quarter financial results for fiscal 2024, reporting a 14% increase in consolidated revenues, reaching $9.1 billion. Pre-tax income surged by 23% to $1.5 billion. Noteworthy is the 14% uptick in net sales orders, totaling 26,456 homes, underscoring sustained market confidence and D.R. Horton’s adeptness in meeting evolving housing demands.

D.R. Horton’s consolidated liquidity stood at $5.7 billion, comprising $3.1 billion in cash and $2.6 billion in available credit facilities. Additionally, investments totaling $2.4 billion in lot development and land acquisition initiatives during the quarter.

Analysts Offer Mixed Views Following Q2 Earnings Call

- BTIG analyst Carl Reichardt maintained a Buy rating and lowered the price target from $169 to $168.

- BofA Securities analyst Rafe Jadrosich reiterated a Buy rating yet decreased the price target from $182 to $168.

- RBC Capital analyst Mike Dahl maintained an Underperform rating but downgraded the price target from $142 to $141.

- Jefferies analyst Collin Verron kept a Hold rating and raised the price target from $141 to $153.

Which Analyst has the best track record to show on DHI?

Analyst Susan Maklari (GOLDMAN SACHS) currently has the highest performing score on DHI with 10/11 (90.91%) price target fulfillment ratio. His price targets carry an average of $18.34 (11.86%) potential upside. D.R. Horton stock price reaches these price targets on average within 139 days.

Glacier Bancorp’s Q1 Earnings Call Highlights: Key Figures and Strategic Moves

Glacier Bancorp’s first-quarter earnings report reveals an increase in its net interest margin, reaching 2.59% as a percentage of earning assets on a tax equivalent basis, up from the previous quarter’s 2.56%. Loan yields also saw an uptick, climbing to 5.46%, reflecting a 12-basis point increase from the prior quarter and a 44-basis point surge from the previous year’s first quarter. Interest income for the quarter amounted to $279 million, marking a 2% increase over the prior quarter and a 20% jump compared to the same period last year.

Glacier Bancorp’s loan portfolio expanded by $534 million or 3% during the quarter, reaching a total of $16.7 billion, while total deposits increased by $498 million or 3%, totaling $20.4 billion. Additionally, Glacier Bancorp reported a $32.6 million net income for the current quarter, representing a decrease of $21.7 million or 40% from the prior quarter’s net income of $54.3 million. This decrease was attributed to factors including a $13.3 million credit loss expense related to the acquisition of Wheatland Bank, acquisition-related expenses, and increased expenses from the Federal Deposit Insurance Corporation special assessment.

Analyst Actions: Ratings and Price Targets Adjusted

- DA Davidson analyst Jeff Rulis maintained a Buy rating and adjusted the price target downward from $48 to $45.

- Truist Securities analyst Brandon King maintained a Hold rating and revised the price target down from $42 to $40.

- Stephens & Co. analyst Andrew Terrell reiterated an Equal-Weight rating and a $44 price target.

Which Analyst has the best track record to show on GBCI?

Analyst David Feaster (RAYMOND JAMES) currently has the highest performing score on GBCI with 2/4 (50%) price target fulfillment ratio. His price targets carry an average of $5.74 (14.26%) potential upside. Glacier Bancorp stock price reaches these price targets on average within 71 days.

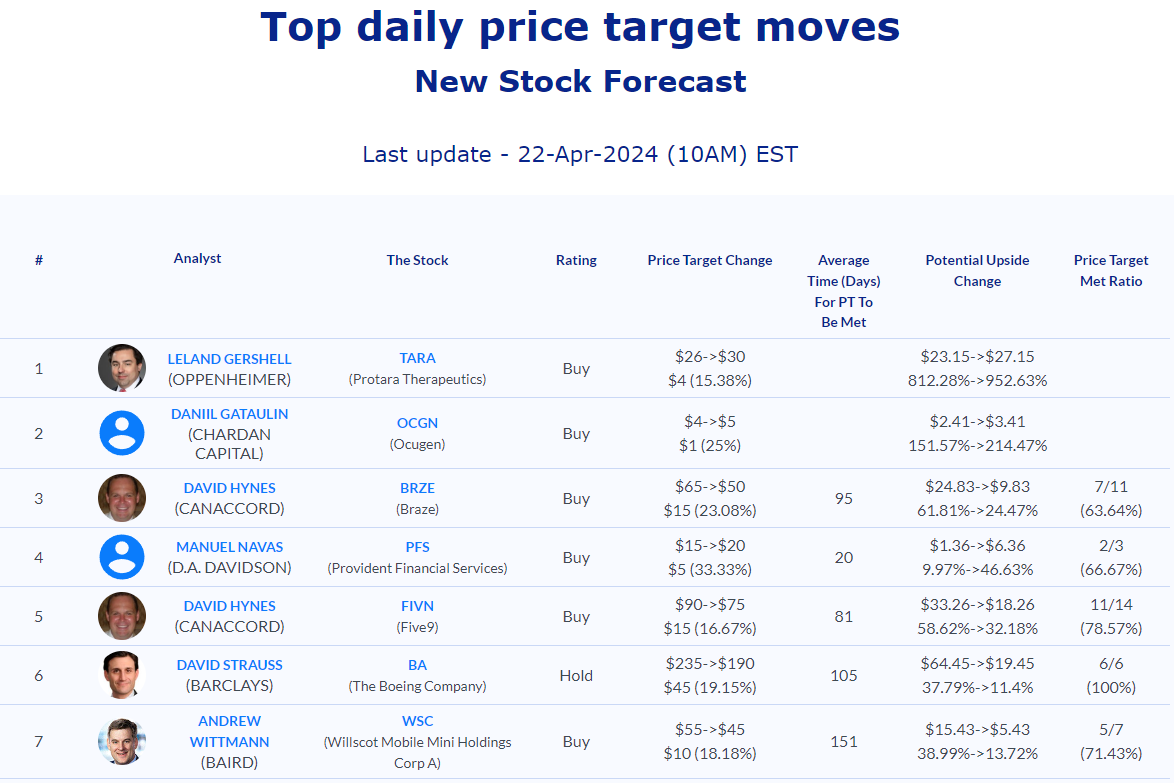

Daily stock Analysts Top Price Moves Snapshot