Selected stock price target news of the day - April 4th, 2025

By: Matthew Otto

Guess? Beats Q4 Expectations but Issues Weak FY2026 Guidance

Guess? reported fourth quarter results, with earnings per share of $1.48, beating analyst estimates by $0.05. Revenue for the quarter reached $932.3 million, up 5% from the prior year and above the $920.9 million consensus.

For the full fiscal year, revenue grew 8% to $3.0 billion, driven in part by the acquisition of rag & bone. However, net income fell sharply to $60.4 million, or $0.77 per share, compared to $201.6 million, or $2.52 per share, in the previous year. Adjusted earnings for the year came in at $1.96 per share, down from $3.17. Operating income also declined, falling to $132.5 million from $222.2 million a year ago.

Looking ahead, Guess? issued guidance for fiscal 2026 expecting full-year earnings per share between $1.32 and $1.76, well below the Wall Street consensus of $2.07. Revenue is forecast to increase between 3.9% and 6.2%, following this year’s 8% gain. For the first quarter, Guess? expects revenue growth of 5.8% to 7.5%, but projects a loss of $35 million to $30 million. First-quarter earnings per share are expected to be between a loss of $0.75 and $0.66. For the full year, operating income is projected between $133 million and $165 million.

Analysts Weigh In After Q4 Results and FY2026 Guidance

- Small Cap Consumer Research analyst Eric Beder reiterated a Buy rating and a price target of $23.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and a $13 price target.

Which Analyst has the best track record to show on GES?

Analyst Mauricio Serna (UBS) currently has the highest performing score on GES with 4/8 (50%) price target fulfillment ratio. His price targets carry an average of $1.81 (17.76%) potential upside. Guess? stock price reaches these price targets on average within 71 days.

I-Mab Reports 2024 Financial Results and Provides Pipeline Updates

I-Mab reported its financial results for the year ended December 31, 2024, and provided updates on its clinical pipeline. The Phase 1b combination trial of givastomig in first-line gastric cancer has shown momentum, with topline dose escalation data from 17 patients expected in 2H 2025. Gastric cancer remains a global health concern, with over 1 million new cases and approximately 769,000 deaths annually.

For the year ended December 31, 2024, I-Mab reported a net loss from continuing operations of $49.7 million, compared to a loss of $82.2 million in 2023. Research and development expenses totaled $21.8 million for 2024, up from $21.4 million in 2023, driven primarily by increased spending on givastomig. Administrative expenses increased to $29.7 million, from $28.2 million in 2023.

I-Mab recognized a gain of $34.4 million from the divestiture of its Greater China assets, completed in April 2024. I-Mab also recorded a net loss for the full year of $22.2 million, an improvement from the $207.7 million loss in 2023.

Analyst Ratings Reflect Confidence Despite Target Adjustments

- Needham analyst Gil Blum reiterated a Buy rating and a $4 price target.

- HC Wainwright & Co. analyst Andrew Fein maintained a Buy rating but lowered the price target from $8 to $7.

Which Analyst has the best track record to show on IMAB?

Analyst Andrew Fein (HC WAINWRIGHT) currently has the highest performing score on IMAB with 1/7 (14.29%) price target fulfillment ratio. His price targets carry an average of $6.97 (676.70%) potential upside. I-Mab stock price reaches these price targets on average within 85 days.

Acuity Reports Q2 Fiscal 2025 Results: Revenue Growth and Strong Adjusted EPS

Acuity achieved net sales of $1.0 billion in the second quarter of fiscal 2025, marking an 11.1% increase compared to the prior year. Revenue came in slightly below consensus estimates, with analysts expecting $1.03 billion.

Despite a decrease in operating profit to $110.2 million, down 6.7%, Acuity reported an adjusted operating profit of $162.9 million, reflecting a 16.3% increase. Operating profit as a percentage of net sales declined 200 basis points to 11.0%, while adjusted operating profit margin improved by 70 basis points to 16.2%. Diluted earnings per share (EPS) were $2.45, down 13.7% year-over-year, though adjusted diluted EPS grew by 10.4% to $3.73, matching analyst expectations. Acuity also completed the acquisition of QSC during the quarter, contributing to revenue growth and expanding the portfolio in intelligent building and audiovisual solutions.

Segment performance varied across Acuity’s divisions. Acuity Brands Lighting (ABL) saw a slight decrease in net sales, down 0.3% to $840.6 million, while operating profit increased by 3.4% to $130.3 million. Adjusted operating profit for ABL grew by 3.6%, reaching $141.3 million. In contrast, Acuity Intelligent Spaces (AIS) reported a sales surge of 151.8%, totaling $171.5 million, which includes $95.1 million from QSC. While AIS’s operating profit rose by 8.8% to $9.9 million, its adjusted operating profit increased 55.3% to $32.0 million.

Analyst Ratings and Price Target Changes Following Q2 2025 Report

- Baird analyst Timothy Wojs maintained a Neutral rating but lowered the price target from $310 to $295.

- Wells Fargo analyst Joseph O’Dea kept an Equal Weight rating yet reduced the price target from $290 to $257.

Which Analyst has the best track record to show on AYI?

Analyst Timothy Wojs (BAIRD) currently has the highest performing score on AYI with 32/33 (96.97%) price target fulfillment ratio. His price targets carry an average of $42.18 (15.75%) potential upside. Acuity stock price reaches these price targets on average within 448 days.

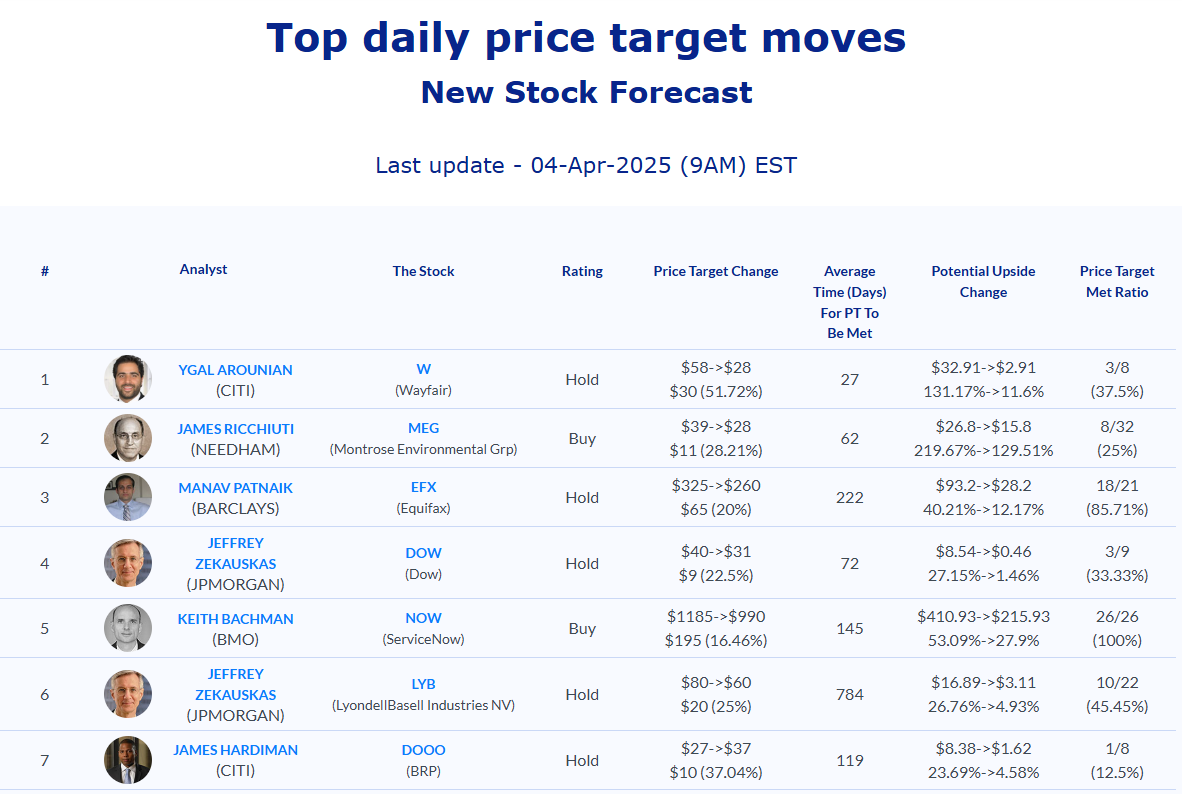

Daily stock Analysts Top Price Moves Snapshot