Selected stock price target news of the day - August 03, 2023

By: Matthew Otto

Wix Surpasses Expectations and Raises Outlook

Wix.com reported financial results for the second quarter of 2023. The company swung to a net profit earning $1.38 per share, $0.69 better than the analyst estimate of $0.57. This is excluding one-time items, compared to a loss of 14 cents per share in the same period last year. Revenue grew 13% to $390 million, beating analyst forecasts estimate of $382.6 million. The company is also gaining market share through its various partners’ businesses. Wix raised its full-year 2023 revenue estimate to $1.543 billion to $1.558 billion, representing 11-12% growth, and projected third-quarter revenue of $386 million to $391 million.

The company introduced Wix Studio, a new cornerstone product that revolutionizes the way professionals build and manage projects at scale, combining AI-powered features, design and development capabilities, and seamless workflows. Wix is at the forefront of AI technology, introducing exciting AI-driven products for all users, such as AI Site Generator and AI Assistant for Business. The company delivered consecutive quarters of accelerating profitable growth, with a non-GAAP gross margin of 68% in the second quarter, ahead of expectations. Wix aims to achieve sustained GAAP profitability in the coming years and plans to enhance shareholder value.

Wix anticipates increasing profitability throughout 2023 and beyond. The company also expects to achieve the Rule of 40 in 2025 and aims to exit 2023 with a free cash flow margin of approximately 15%.

JPMorgan Gives Raises Price Target

- JPMorgan analyst Alexei Gogolev raised Price Target to $103

Analyst Naved Khan (TRUIST) currently has the highest performing score on WIX with 17/21 (80.95%) price target fulfillment ratio. His price targets carry an average of $26.89 (24.43%) potential upside. Wix.com stock price reaches these price targets on average within 84 days.

Perion Network Reports Q2 2023 Earnings, Exceeding Analyst Expectations

Perion Network reported its financial results for the second quarter of 2023 during an earnings conference call. Tal Jacobson, the Chief Executive Officer (CEO), highlighted the company’s ability to outperform the industry, showcasing revenue growth and an impressive 45% increase in adjusted EBITDA year-over-year.

Q2 EPS of $0.84, beat the analyst estimate of $0.70. Revenue for the quarter was $178.47 million, exceeding the consensus estimate of $173.66 million, representing a 22% year-over-year growth. Adjusted EBITDA, which reached $41.2 million, up by 45% compared to the same quarter last year. Net income was $5.2 million for the quarter.

Looking ahead, Perion Network raised its annual guidance for 2023, anticipating continued growth and profitability. The company expects revenue to reach $730-750 million, representing a 16% year-over-year growth at the midpoint. Additionally, adjusted EBITDA is projected to grow by at least 26% year-over-year.

Analysts Maintains Outlook on Perion Network with Price Target Increases

- Oppenheimer analyst Jason Helfstein maintains an Outperform rating and raises his price target from $44 to $45.

- Stifel analyst Mark Kelley raised his price target to $38

Analyst Laura Martin (NEEDHAM) currently has the highest performing score on PERI with 6/15 (40%) price target fulfillment ratio. Her price targets carry an average of $6.96 (21.95%) potential upside. Perion Network stock price reaches these price targets on average within 190 days

Wingstop Reports Q2 2023 Earnings, Beats Analyst Estimates, and Raises Full-Year Guidance

Wingstop reported its fiscal second quarter 2023 earnings, showcasing performance with a 16.8% increase in domestic same-store sales growth. The company’s results were supported by transaction growth, which contributed to a 27.8% increase in system-wide sales for the quarter.

The company’s digital channels also saw further expansion, achieving a record 65.2% digital sales mix. They opened 50 net new units during the quarter, reflecting the brand’s growth and strong development pipeline. The company’s adjusted EBITDA totaled $34.4 million, which increased by 47% compared to the previous year, highlighting the strength of their asset-light model. Company also reported Q2 EPS of $0.57, $0.06 better than the analyst estimate of $0.51. Total revenue for the quarter came in at $107.2 million versus the consensus estimate of $104.23 million.

Looking ahead, Wingstop expects domestic same-store sales growth to be in the range of 10% to 12% and aims to open between 240 and 250 new units globally. The company is also focused on its supply chain strategy to mitigate food cost volatility, and their multi year sales drivers, including menu innovation, digital transformation, and data-driven marketing, are expected to support their goal of achieving AUVs north of $2 million.

Mixed Analyst Outlook on Wingstop After Q2 2023 Earnings Report

- Barclays analyst Jeffrey Bernstein Maintains Overweight rating and Lowers his price target from $240 to $220.

- Benchmark analyst Todd Brooks Upgrades from Hold to Buy and Sets his price target at $200.

- Wedbush analyst Nick Setyan Maintains Neutral rating and Reduces his price target from $185 to $180.

- TD Cowen analyst Andrew Charles Reiterates Outperform rating and his price target at $235.

- Stephens analyst Joshua Long Reiterates Overweight rating and price target at $240.

- Jefferies analyst Andy Barish Lowers price target to $150.00 from $174.00 and Maintains Underperform rating.

- BMO Capital analyst Andrew Strelzik Lowers price target to $190.

- RBC Capital analyst Christopher Carril Lowers price target to $195.

- UBS analyst Dennis Geiger Lowers price target to $190.

Analyst Jon Tower (CITI) currently has the highest performing score on WING with 20/21 (95.24%) price target fulfillment ratio. His price targets carry an average of $28.5 (25.86%) potential upside. Wingstop stock price reaches these price targets on average within 212 days.

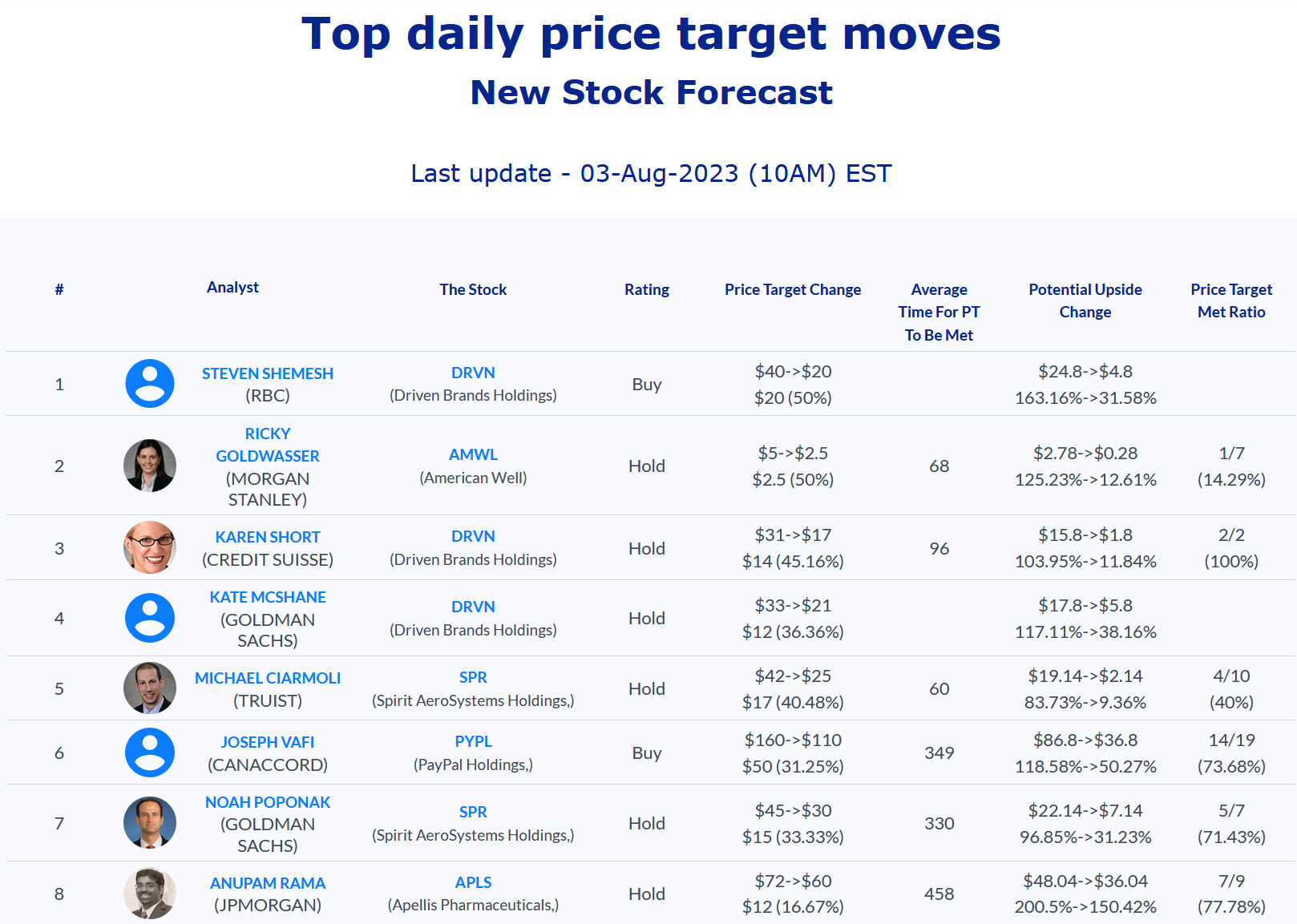

Daily stock Analysts Top Price Moves Snapshot