Selected stock price target news of the day - August 07, 2023

By: Matthew Otto

Fortinet’s Offers Investment Opportunity Amidst Macroeconomic Concerns

Fortinet experienced a setback following concerns over macroeconomic conditions. This has triggered discussions among market analysts, with Guggenheim stepping in to offer a perspective. Quoted on Barron’s, Guggenheim’s Raymond McDonough suggested that the market’s response was an overreaction and presented a buying opportunity for savvy investors.

Despite the recent downturn, Guggenheim remains optimistic about Fortinet’s long-term prospects. McDonough dismissed notions of structural impairment or deteriorating competitive positioning. Instead, he attributed the slowdown to a natural phase of “digestion” after two years of growth. This period of consolidation is seen as a necessary step for the company to build upon its existing technology and allow customers to recalibrate their IT budgets. McDonough’s insight underscores the belief that this phase is temporary and that Fortinet’s growth trajectory is likely to regain momentum by 2024.

Guggenheim’s confidence in Fortinet’s potential prompted a revision of its rating from Neutral to Buy, accompanied by a new price target of $70. This endorsement aligns with the sentiments expressed by other analysts, who also recognized the temporary nature of Fortinet’s challenges. However, McDonough cautioned that there might still be some revenue disappointments in the second half of the current year, as the company navigates the transitional period of product digestion, which typically lasts around 8 quarters.

Analysts Adjust Price Targets for Fortinet Amid Market Fluctuations

- BMO Capital’s Keith Bachman maintained Market Perform and lowered the price target to $72 from $88.

- Morgan Stanley’s Hamza Fodderwala maintained an Overweight and decreased the price target to $80 from $84.

- Barclays’ Saket Kalia reiterated Overweight and lowered the price target to $71 from $86.

- Wells Fargo’s Andrew Nowinski reiterated Overweight and drops the price target to $85 from $90.

- Baird’s Shrenik Kothari remained with an Outperform and lowered the price target to $84 from $93.

- Raymond James’ Adam Tindle remained with an Outperform, decreasing the price target to $70 from $75.

- TD Cowen’s Shaul Eyal downgrades to Market Perform and the price target to $70 from $90.

Analyst Adam Tindle (RAYMOND JAMES) currently has the highest performing score on FTNT with 14/15 (93.33%) price target fulfillment ratio. His price targets carry an average of $5.95 (12.98%) potential upside. Fortinet stock price reaches these price targets on average within 159 days.

Airbnb Reports Q2 2023 Results and Outlines Strategic Priorities for Future Growth

In the Airbnb Q2 2023 earnings conference call, the company reported EPS of $0.98, $0.18 better than the analyst estimate of $0.80. Also experienced over 115 million nights and experiences booked, generating revenue of $2.5 billion against the consensus estimate of $2.42 billion, marking an 18% YoY increase. Impressively, net income reached $650 million, reflecting a net income margin of 26%, the highest for a second quarter. Additionally, free cash flow was reported at $900 million, up 13% YoY, contributing to a trailing 12-month free cash flow of $3.9 billion.

Brian Chesky, CEO, highlighted three significant trends driving Airbnb’s performance. First, there’s a continued strong demand for guest bookings, with a notable 11% increase in nights and experiences booked compared to the previous year. Secondly, guests are traveling farther, with cross-border bookings rising by 16% YoY. Particularly encouraging is the recovery of Asia Pacific, which saw an 80% increase in inbound international travel. Thirdly, there’s a growing trend of longer stays on Airbnb, with flexible living and working arrangements driving an 18% share of total nights booked for long-term stays.

The company’s financial guidance for Q3 2023 expects a revenue to reach $3.3 to $3.4 billion, representing YoY growth of 14% to 18%. The anticipated growth in revenue is expected to surpass the growth in nights and experiences booked, owing to resilient Average Daily Rates (ADR) and favorable foreign exchange rates. The company aims to achieve a record-high Adjusted EBITDA, with a margin that exceeds the previous year.

Analysts Adjust Airbnb Price Targets and Ratings

- DA Davidson analyst Tom White reiterated a Buy rating and raised the price target from $140 to $162.

- TD Cowen analyst Kevin Kopelman maintained an Outperform rating and lowered the price target from $158 to $145.

- Wells Fargo analyst Ken Gawrelski maintained an Underweight rating and raised the price target from $99 to $114.

- Baird analyst Colin Sebastian reiterated Neutral rating and increased price target from $120 to $140.

- Credit Suisse analyst Stephen Ju remains in Neutral rating and upgrades price target from $150 to $165.

- Goldman Sachs analyst Eric Sheridan maintained a Sell rating and raised the price target from $97 to $117.

- Mizuho analyst James Lee reiterated Neutral rating and increased price target from $145 to $150.

- Needham analyst Bernie McTernan reiterated Buy rating and a $160 price target.

- Barclays analyst Mario Lu maintained an Equal-Weight rating and raised the price target from $136 to $141.

Analyst Tom White (DAVIDSON) currently has the highest performing score on ABNB with 7/12 (58.33%) price target fulfillment ratio. His price targets carry an average of $27.65 (19.07%) potential upside. Airbnb stock price reaches these price targets on average within 105 days.

Block’s Q2 2023 Earnings Call shows Steadfast Progress

Block reported second-quarter 2023 EPS of $0.39, $0.03 better than the analyst estimate of $0.36. Revenue for the quarter came in at $5.53 billion versus the consensus estimate of $5.1 billion.

The company also reported a 27% year-over-year increase in gross profit, reaching $1.87 billion. The company demonstrated profitability, with adjusted EBITDA more than doubling year-over-year. Amrita Ahuja, CFO, elaborated on the performance of Square and Cash App, showcasing their contributions to the company’s growth. Square’s gross profit was $888 million, up 18% year-over-year, with particular growth in its banking products. Cash App generated $968 million in gross profit, a 37% increase year-over-year, with growth in active users and monetization. The company shared forward-looking insights for July, projecting a continued growth trajectory.

Analysts Offer Diverse Outlook on Block’s Future

- Mizuho analyst Dan Dolev Maintained a Buy and Raised Price Target from $85 to $90.

- Canaccord Genuity analyst Joseph Vaf: Reiterated a Buy and a $90 Price Target.

- Truist Securities analyst Andrew Jeffrey Maintained a Buy and Lowers Price Target from $90 to $85.

- Morgan Stanley analyst James Faucette Maintained an Equal-Weight and Decreases Price Target from $70 to $69.

- Stephens analyst Charles Nabhan Reiterated an Overweight and Lowers Price Target from $90 to $80.

- RBC Capital analyst Daniel Perlin: Reiterated an Outperform and a $90 Price Target.

- Credit Suisse analyst Timothy Chiodo Maintained an Outperform and a $100 Price Target.

- Needham analyst Mayank Tandon Remained with a Buy rating and Raised Price Target from $80 to $82.

Analyst Josh Beck (KEYBANK) currently has the highest performing score on SQ with 31/38 (81.58%) price target fulfillment ratio. His price targets carry an average of $24.04 (29.98%) potential upside. Block stock price reaches these price targets on average within 174 days.

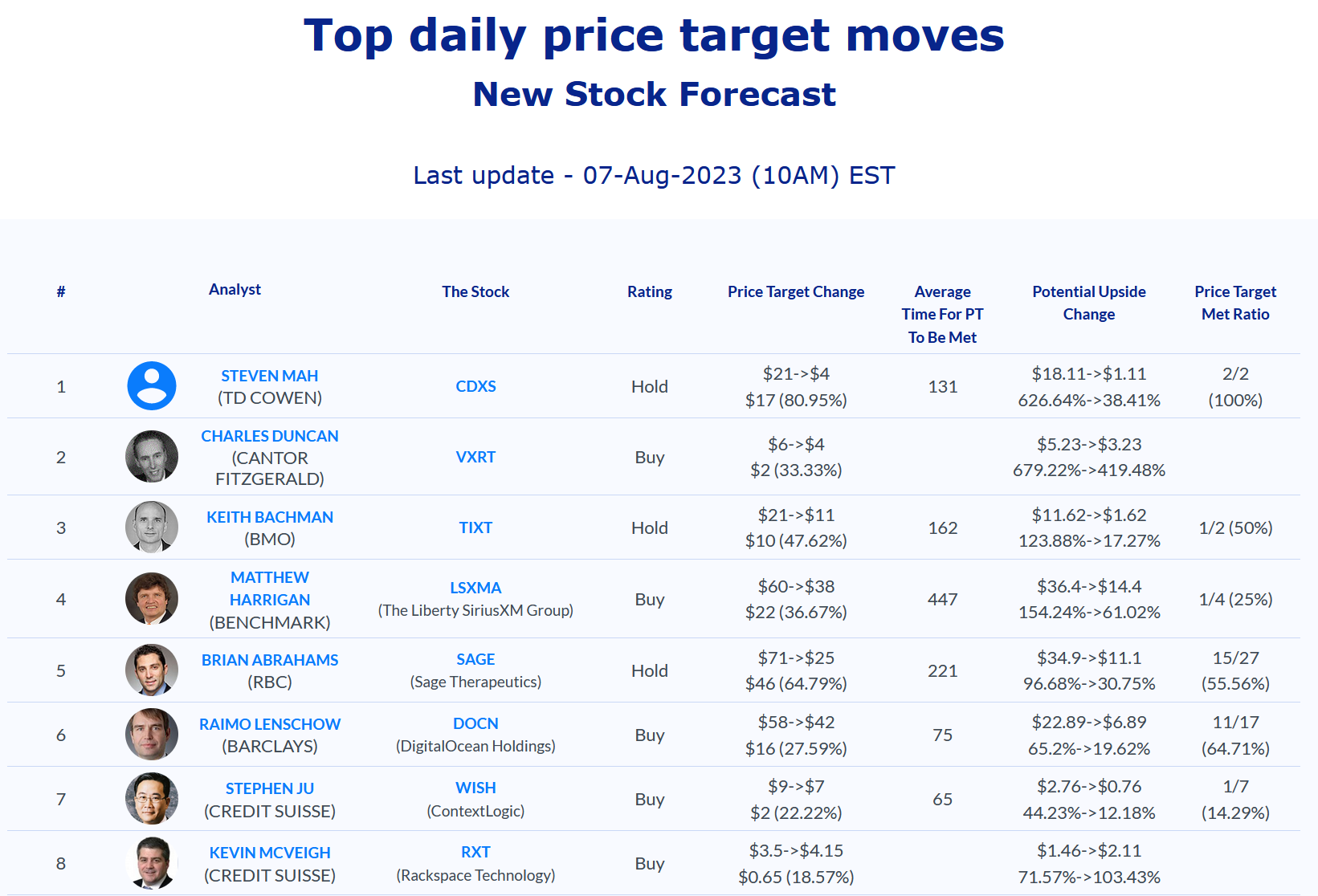

Daily stock Analysts Top Price Moves Snapshot