Selected stock price target news of the day - August 10, 2023

By Matthew Otto

UPS and Teamsters Union Forge Groundbreaking Labor Agreement

United Parcel Service CEO Carol Tomé announced that they have successfully negotiated a five-year contract with the Teamsters Union, ensuring that approximately 340,000 workers will continue their operations without the looming threat of a strike. The deal, which is currently undergoing a ratification vote by the workers and is expected to be ratified within two weeks.

Under the terms of the tentative agreement, UPS drivers are set to see an increase in their compensation. CEO Carol Tomé stated that the drivers’ average pay, including benefits such as health care and pensions, will reach up to $170,000 by the end of the five-year contract. Part-time workers will receive a boost in their wages, with a minimum hourly rate of $21. Moreover, full-time workers are expected to average $49 an hour, and the agreement’s provisions include the elimination of mandatory overtime on drivers’ days off.

Analysts Adjust Price Targets for UPS in Response to Market Trends and Outlook

- JP Morgan analyst Brian Ossenbeck remained at Neutral and increased the price target from $181 to $186.

- Barclays analyst Brandon Oglenski reiterated at Equal-Weight and raised the price target from $172 to $180.

- Oppenheimer analyst Scott Schneeberger reiterated at Outperform and increased the price target from $188 to $195.

- BMO Capital analyst Fadi Chamoun maintained at Market Perform and raised the price target from $180 to $190.

- Credit Suisse analyst Ariel Rosa maintained at Neutral and lowered the price target from $204 to $194.

Analyst Fadi Chamoun (BMO) currently has the highest performing score on UPS with 13/15 (86.67%) price target fulfillment ratio. His price targets carry an average of $14.54 (13.29%) potential upside. United Parcel Service stock price reaches these price targets on average within 344 days.

Illumina’s Earnings Outlook Adjusted Amidst Analyst Divisions and Cautious Market Sentiment

Illumina announced a revised outlook for its full-year earnings after the markets closed on Wednesday. The company now anticipates earnings in the range of 75 cents to 90 cents per share, reflecting a downward shift from the previous quarter’s projection of $1.25 to $1.50 per share. Similarly, revenue growth expectations have been tempered, with a revised estimate of approximately 1%, compared to the earlier forecast of 7% to 10% growth. The company’s Interim Chief Executive, Charles Dadswell, attributed these adjustments to cautious purchasing behavior among its clientele, particularly in the Chinese market, which is grappling with a protracted economic recovery and heightened competitive challenges. The company reported earnings of 32 cents per share, surpassing expectations, along with revenue totaling $1.18 billion, slightly higher than the projected $1.16 billion.

Analysts’ opinions on Illumina’s future appear divided, with varying ratings and outlooks. While some remain cautiously optimistic, citing the broader industry trend of prudent spending, others adopt a more skeptical stance due to continued pressures on growth and margins. Evercore ISI analyst Vijay Kumar maintained his Outperform rating and a $240 price target on the stock, expressing confidence despite the challenges. On the other hand, Citi analyst Patrick Donnelly trimmed his price target to $150 from $180 and maintained his Sell rating, citing persistent pressure on consumables growth and margins. .

Mixed Analyst Ratings Impact Illumina’s Market Standing

- Evercore ISI Group analyst Vijay Kumar maintained an Outperform rating and raised the price target from $235 to $240.

- Citi analyst Patrick Donnelly trimmed his price target to $150 from $180 and maintained a Sell rating.

- Credit Suisse analyst Dan Leonard reiterated a Neutral rating and lowered the price target from $225 to $200.

- JPMorgan analyst Rachel Vatnsdal lowered her price target to $190.

- Baird analyst Catherine Ramsey Schulte lowered his price target to $180.

Analyst Tycho Peterson (JPMORGAN) currently has the highest performing score on ILMN with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $33.76 (14.13%) potential upside. Illumina stock price reaches these price targets on average within 113 days

Disney’s Financial Landscape: Surpassing Expectations Amid Strategic Moves and Pricing Shifts

Disney announced a crackdown on password sharing, echoing a strategy Netflix recently adopted. Disney CEO Bob Iger emphasized the company’s plans to enhance monetization by addressing account sharing by 2024. Another development was the price increase for its streaming services, Disney+ and Hulu. The ad-free version of Disney+ will see a 27% price hike, reaching $13.99 per month, while Hulu without ads will increase by 20%, now priced at $17.99.

The company’s EBITDA performance, bolstered by its Parks, Experiences, and Media sector which reported revenue of $8.3 billion, reflecting an impressive 13% year-on-year increase. This growth helped counterbalance the Media and Entertainment segment’s revenue, which fell short of consensus estimates at $14 billion, showcasing the complexity of Disney’s financial positions across its various business domains.

The company reported a revenue of $22.3 billion for its fiscal third quarter, a 4% increase from the previous year. While revenue is slightly below the Wall Street consensus estimate of $22.49 billion, adjusted profits at $1.03 per share outperformed expectations by six cents.

Disney Price Targets Adjusted by Analysts Amidst Market Developments

- Rosenblatt analyst Barton Crockett revised the price target downward to $102.

- Wells Fargo analyst Steven Cahall lowered hisprice target to $146.

Analyst Matthew Thornton (TRUIST) currently has the highest performing score on DIS with 2/10 (20%) price target fulfillment ratio. His price targets carry an average of $21.97 (16.70%) potential upside. The Walt Disney Company stock price reaches these price targets on average within 25 days

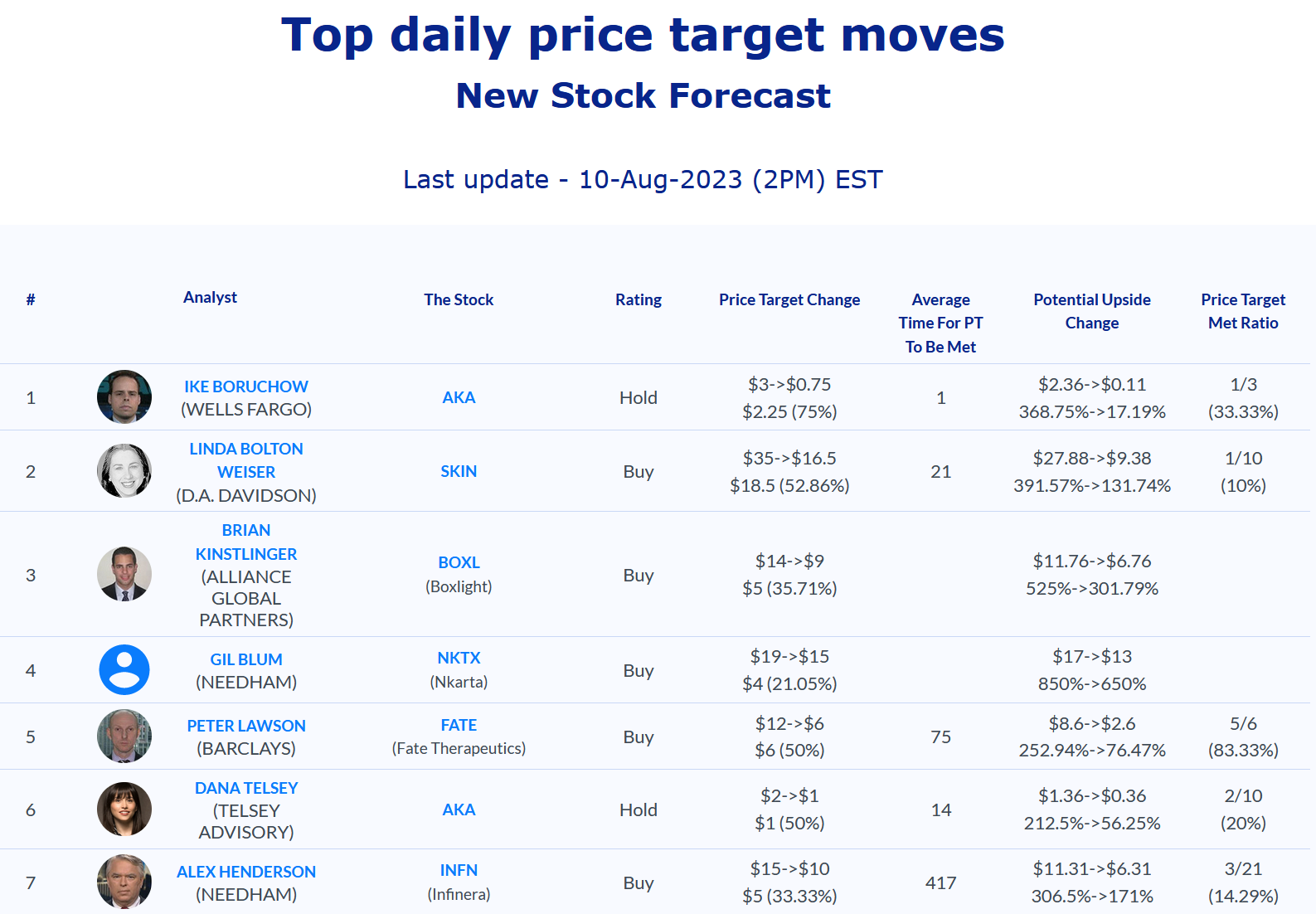

Daily stock Analysts Top Price Moves Snapshot