Selected stock price target news of the day - August 14th, 2024

By: Matthew Otto

TELA Bio Reports Q2 2024 Revenue Growth Despite Missing Estimates and Facing Operational Challenges

TELA Bio reported its second-quarter 2024 earnings, revealing a revenue growth of 11% year-over-year, reaching $16.1 million. However, this figure fell short of the consensus estimate of $18.45 million. Also reported a Q2 EPS of ($0.51), which was $0.05 below the analyst estimate of ($0.46).

Despite these financial shortfalls, TELA Bio faced challenges, including a ransomware attack at one of its fastest-growing GPO customers, which impacted approximately 150 hospitals and reduced surgeries for nearly a month, leading to an estimated revenue loss of $1.25 to $1.75 million. Another cybersecurity incident at a large single hospital customer further reduced revenue by $250,000.

Looking ahead, TELA Bio maintained its full-year 2024 revenue guidance of $74.5 to $76.5 million, aligning closely with the consensus estimate of $75.407 million. TELA Bio saw a 29% year-over-year increase in units sold for its OviTex hernia repair product, particularly in configurations used in inguinal hernia repairs.

International sales also contributed to growth, with European revenue rising to $2.4 million in Q2 2024, up from $1.5 million in the same quarter of 2023. Gross margin for the quarter was slightly down at 69%, compared to 70% in the prior year. Despite a 14% increase in sales and marketing expenses, TELA Bio expects operating losses and net losses to decline throughout 2024, supported by revenue share payments from the divestiture of NIVIS.

Analysts Adjust Price Targets After Q2 2024 Earnings Miss

- Lake Street analyst Frank Takkinen maintained a Buy rating while lowering the price target from $14 to $8.

- Canaccord Genuity analyst Caitlin Cronin also reiterated a Buy rating, however, the price target is adjusted down from $14 to $12.

- JMP Securities analyst David Turkaly kept a Market Outperform rating, yet lowered the price target from $15 to $12.

- Piper Sandler analyst Matt O’Brien maintained an Overweight rating, but reduced the price target from $10 to $8.

Which Analyst has the best track record to show on TELA?

Analyst Matt O’brien (PIPER SANDLER) currently has the highest performing score on TELA with 5/11 (45.45%) price target fulfillment ratio. His price targets carry an average of $4.23 (73.31%) potential upside. TELA Bio stock price reaches these price targets on average within 53 days.

Y-mAbs Therapeutics Misses Q2 Earnings Estimates, Lowers FY2024 Revenue Guidance

Y-mAbs Therapeutics reported its financial results for the second quarter of 2024, posting a Q2 EPS of ($0.21), which was $0.09 worse than the analyst consensus estimate of ($0.12). Revenue for the quarter came in at $22.8 million, just shy of the consensus estimate of $23.02 million.

Looking ahead, Y-mAbs Therapeutics provided guidance for the full fiscal year 2024, which reflects a cautious outlook. Y-mAbs now anticipates FY2024 revenue to be in the range of $87 million to $95 million, which is below the consensus estimate of $95.18 million. Additionally, Y-mAbs expects its operating expenses to remain between $115 million and $120 million for the year. Y-mAbs also indicated that its total annual cash burn is anticipated to stay within the $15 million to $20 million range.

Mixed Analyst Sentiments and Lowered Price Targets

- Canaccord Genuity’s Bill Maughan maintained a Buy rating and the price target at $26.

- Morgan Stanley’s Michael Ulz sustained an Underweight rating but reduced the price target from $12 to $11.

- BMO Capital’s Etzer Darout kept an Outperform rating, but lowered the price target from $26 to $25.

- HC Wainwright & Co.’s Robert Burns reaffirmed a Buy rating and a price target of $22.

Which Analyst has the best track record to show on YMAB?

Analyst Robert Burns (HC WAINWRIGHT) currently has the highest performing score on YMAB with 3/6 (50%) price target fulfillment ratio. His price targets carry an average of $9.81 (80.48%) potential upside. Y-mAbs Therapeutics stock price reaches these price targets on average within 178 days.

DoubleDown Surpasses Q2 2024 Expectations with Strong Revenue and Earnings Growth

DoubleDown Interactive reported its financial performance for the second quarter of 2024, showcasing an earnings per share (EPS) of $13.39, exceeding the analyst estimate of $9.71 by $3.68. Total revenue for the quarter was $88.24 million, also above the consensus estimate of $83.44 million.

DoubleDown’s social casino free-to-play games generated $80.3 million in revenue, reflecting a 7% year-over-year growth, which outpaced the overall industry’s decline as reported by Eilers & Krejcik Gaming. Additionally, DoubleDown’s iGaming business, SuprNation, contributed $7.9 million in revenue, exceeding pre-acquisition expectations. Key performance indicators for the social casino business also showed improvements, including a 27% increase in average revenue per daily active user (ARPDAU), reaching $1.33, and a 23% rise in average monthly revenue per payer to $288.

Operating expenses for the quarter were $52.0 million, up from $47.7 million in Q2 2023, partly due to the inclusion of SuprNation’s operating costs. However, sales and marketing expenses declined by 15% year-over-year to $11.1 million, indicating a more targeted approach to customer acquisition. DoubleDown’s adjusted EBITDA rose by 34% year-over-year to $37.0 million, with a margin of 41.9%, up from 36.7% in the previous year. Net income for the quarter was $33.3 million, or $13.39 per diluted share, compared to $24.4 million, or $9.83 per share, in Q2 2023.

DoubleDown ended the quarter with a balance sheet holding $339 million in cash, cash equivalents, and short-term investments, and a net cash position of $303 million. Despite earlier plans to repay a $35 million loan from its controlling shareholder, WGAMES, the company opted to extend the loan for two more years at the original interest rate of 4.6%.

Analysts Raise Price Targets Following Strong Q2 Results

- Northland Capital Markets analyst Greg Gibas maintained an Outperform rating and raised the price target from $16 to $18.

- Wedbush analyst Nick McKay also reiterated an Outperform rating and increased the price target from $14.75 to $16.25.

- B. Riley Securities analyst David Bain kept a Buy rating, while boosting the price target from $24 to $26..

Which Analyst has the best track record to show on DDI?

Analyst Nick Mckay (WEDBUSH) currently has the highest performing score on DDI with 2/2 (100%) price target fulfillment ratio. His price targets carry an average of $3.46 (39.36%) potential upside. DoubleDown Interactive stock price reaches these price targets on average within 209 days.

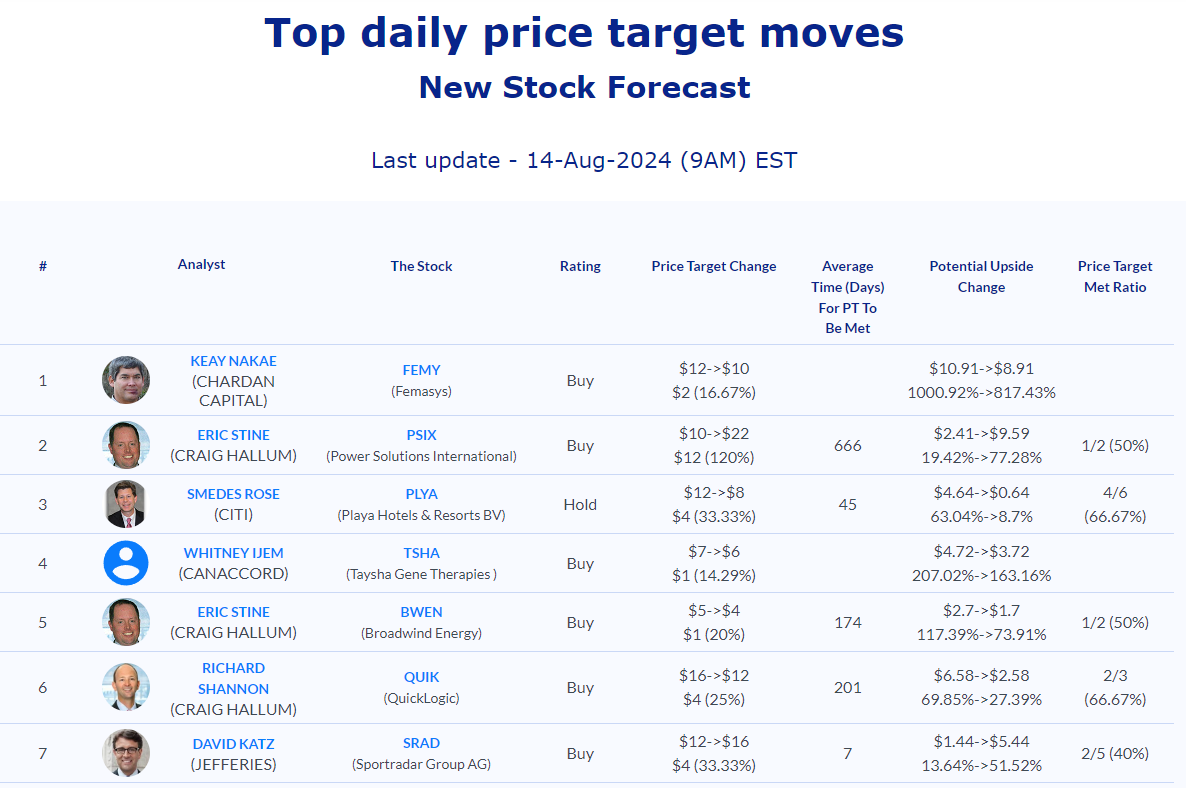

Daily stock Analysts Top Price Moves Snapshot