Selected stock price target news of the day - August 16, 2023

By: Matthew Otto

Home Depot Exceeds Expectations On Sales Decline

Home Depot held its Second Quarter 2023 Earnings Conference Call, reporting a 2% decrease in net sales from the same period last year. The company’s comparable sales also declined by 2% in the quarter, though this result exceeded earlier estimates of a 4.1% decline. In the United States, comparable sales saw a similar 2% decrease, surpassing the anticipated decline of 3.6%. Despite the overall decline, Home Depot’s net sales reached $42.9 billion, slightly above the estimated figure of $42.1 billion. Earnings per share (EPS) for the quarter were $4.65, down from $5.05 in the same period the previous year, but higher than the expected EPS of $4.46.

The company remains committed to its outlook for fiscal year 2023, anticipating comparable sales to remain within the range of -2% to -5%. It also expects the EPS for the fiscal year to decrease between -7% and -13% compared to the previous year. The company also has invested approximately $1 billion in annualized compensation, resulting in improved attrition rates and more consistent staffing levels.

Analysts Raise Price Targets and Maintain Positive Ratings Amidst Growth Expectations

- Wells Fargo analyst Zachary Fadem maintained an Overweight rating and raised his price target from $345 to $360.

- Barclays analyst Seth Sigman Kept an Equal-Weight rating and increased his price target from $310 to $333.

- JP Morgan analyst Christopher Horvers reiterated an Overweight rating and raised his price target from $321 to $335.

- Goldman Sachs analyst Kate McShane sustained a Buy rating and upgraded her price target from $330 to $350.

- Telsey Advisory Group analyst Joseph Feldman retained a Market Perform rating and raised his price target from $315 to $335.

Analyst Zachary Fadem (WELLS FARGO) currently has the highest performing score on HD with 19/22 (86.36%) price target fulfillment ratio. His price targets carry an average of $40.96 (17.80%) potential upside. Home Depot stock price reaches these price targets on average within 178 days.

Paysafe Q2 2023 Performance with Revenue Growth and Strategic Initiatives

Paysafe has announced its financial results for the second quarter of 2023, reporting EPS of $0.56, $0.26 better than the analyst estimate of $0.30. Year-over-year revenue increase of 6%, amounting to $402 million, with a 5% growth on a constant currency basis. Notably, Paysafe’s Merchant Solutions segment saw a resilient 6% growth, driven by its SMB market and expansion in e-commerce, particularly in the North American iGaming sector. The Digital Wallets segment also reported a 5% growth, attributed to enhanced user engagement and strategic product innovations.

The company’s approach to cross-selling into existing customer bases has yielded results, as evidenced by the 37 enterprise deals and nearly 150 cross-selling wins achieved in the quarter. Moreover, Paysafe’s commitment to geographical expansion is paying off, with successful integrations of regional payment methods in various markets, such as MB Way in Portugal and Pix transaction in Brazil. These efforts, coupled with the introduction of network tokenization for improved security, have propelled Paysafe’s revenue growth and overall market presence..

Analysts Adjust Price Targets: Diverse Ratings and Targets Reflect Market Outlook

- RBC Capital analyst Daniel Perlin maintained a Sector Perform rating and raised the price target from $17 to $19.

- Susquehanna analyst James Friedman held a Neutral rating and increased the price target from $15 to $16.

- BMO Capital analyst James Fotheringham reiterated an Outperform rating but lowered the price target from $80 to $64.

- Credit Suisse analyst Timothy Chiodo sustained an Underperform rating and increased the price target from $14.5 to $15.

Analyst Timothy Chiodo (CREDIT SUISSE) currently has the highest performing score on PSFE with 4/13 (30.77%) price target fulfillment ratio. His price targets carry an average of $17.61 (20.21%) potential upside. Paysafe stock price reaches these price targets on average within 7 days

Sea Limited Achieves Q2 2023 Financial Results: Growth and Profits Surge

Sea Limited has announced financial results for the second quarter of 2023, reporting EPS of $0.54, $0.12 worse than the analyst estimate of $0.66. The company’s total GAAP revenue surged by 5% year-on-year, reaching $3.1 billion. A turnaround was observed in the adjusted EBITDA, which stood at $510 million, an improvement compared to the adjusted EBITDA loss of $506 million during the same period last year.

Sea’s e-commerce arm, Shopee, played a role in driving the company’s positive performance. Shopee reported a substantial increase in GAAP marketplace revenue, by 28% year-on-year to $1.9 billion. The platform’s core marketplace revenue, driven by advertisement uptake and commission rates, reached $1.2 billion, reflecting a 38% surge compared to the previous year. Shopee’s efficient operational strategies and improved monetization efforts led to an adjusted EBITDA of $150 million, a turnaround from the $648 million adjusted EBITDA loss in Q2 2022. Additionally, Sea’s digital entertainment segment, Garena, exhibited growth, with quarterly active users and paying users experiencing an uptick.

Furthermore, SeaMoney, the company’s digital financial services arm, also reported a GAAP revenue surging by 53% year-on-year to $428 million. Notably, the segment achieved an adjusted EBITDA of $137 million, marking a progress from the $112 million adjusted EBITDA loss reported during the same quarter in 2022. This growth was attributed to expanding product offerings and synergies within the broader ecosystem.

Analysts Adjust Ratings and Price Targets Amidst Market Changes

- Bernstein analyst Venugopal Garre maintained an Outperform rating yet lowered the price target from $90 to $70.

- BofA Securities analyst Sachin Salgaonkar reiterated a Neutral rating and reduced the price target from $73 to $53.

- Citigroup analyst Alicia Yap downgraded from Buy to Neutral and set a $50 price target.

Analyst John Blackledge (COWEN) currently has the highest performing score on SE with 10/14 (71.43%) price target fulfillment ratio. Her price targets carry an average of $41.71 (31.42%) potential upside. Sea Limited stock price reaches these price targets on average within 60 days

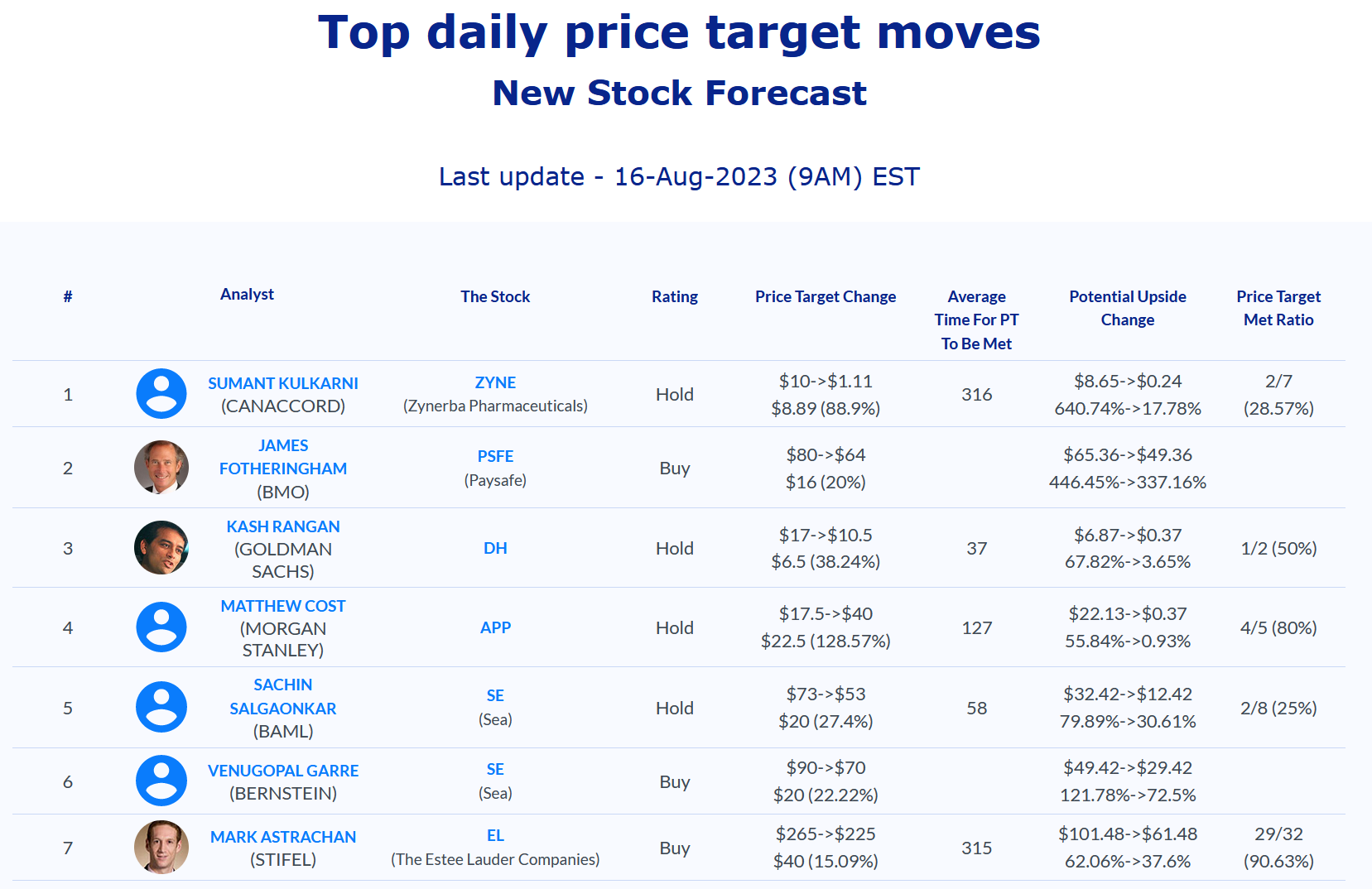

Daily stock Analysts Top Price Moves Snapshot