Selected stock price target news of the day - August 18, 2023

By: Matthew Otto

Ross Stores Q2 2023 Exceeds Expectations

Ross Stores has reported financial results for the second quarter of 2023 with a total sales of $4.9 billion, higher than the consensus estimate of $4.74 billion, an increase compared to the $4.6 billion recorded in the same period the previous year. The quarter also witnessed a 5% rise in comparable store sales, indicating customer engagement with the brand’s offerings. Earnings per share for the 13-week period ending July 29, 2023, were $1.32, $0.16 better than the analyst census estimate of $1.16, resulting in a net income of $446 million. These figures reflect an improvement from the prior year’s second-quarter earnings of $1.11 per share and $385 million in net earnings.

The company reported an improvement in merchandise margin, increasing by 200 basis points due to lower ocean freight costs. While domestic freight costs declined by 60 basis points, occupancy and distribution costs also demonstrated improvement. Although buying expenses were deleveraged by 100 basis points due to higher incentives, these gains were partially offset by increased SG&A expenses, resulting from higher labor costs and store wages.

Analysts Bullish on Ross Stores: Price Targets Raised

- BMO Capital analyst Simeon Siegel maintained an Outperform rating and raised the price target from $113 to $127.

- BofA Securities analyst Lorraine Hutchinson reiterated a Buy rating and increased the price target from $135 to $140.

- Citigroup analyst Paul Lejuez maintained a Buy rating and raised the price target from $133 to $136.

- JP Morgan analyst Matthew Boss kept an Overweight rating and upgraded the price target from $135 to $137.

- Barclays analyst Adrienne Yih reiterated an Overweight rating and raised the price target from $129 to $139.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and increased the price target from $120 to $130.

Analyst Jay Sole (UBS) currently has the highest performing score on ROST with 15/18 (83.33%) price target fulfillment ratio. His price targets carry an average of $1.16 (1.65%) potential upside. Ross Stores stock price reaches these price targets on average within 28 days.

BILL Exceeds $1 Billion in Total Revenue, Showcases Q4 Financial Performance

BILL has unveiled its compelling financial performance for the fourth quarter and the entirety of fiscal year 2023, culminating on June 30. The company achieved a milestone by surpassing $1 billion in total revenue for the fiscal year, marking a pivotal moment in its growth trajectory.

In the final quarter of fiscal year 2023, BILL demonstrated a 48% YoY increase in total revenue, accompanied by a 33% YoY rise in core revenue, comprising subscription and transaction fees. Core revenue reached $259.5 million, while total revenue for the quarter amounted to $296.0 million against the estimates of $282.15 million. This growth was reflected across multiple key financial metrics, including subscription fees of $66.9 million, up 21% YoY, and transaction fees of $192.6 million, reflecting a 38% YoY increase.

The company’s commitment to financial stability and strategic execution is further evident in its gross profit margin, which stood at 82.2% for the fourth quarter, compared to 78.3% in the same period of the previous fiscal year. BILL achieved non-GAAP gross profit of $257.2 million, equating to a commendable 86.9% non-GAAP gross margin. Furthermore, the company showcased a transformational shift towards profitability, reporting a non-GAAP net income of $69.4 million for the quarter, in stark contrast to a non-GAAP net loss of $3.3 million in the corresponding quarter of the preceding fiscal year.

Analysts Update Ratings and Price Targets Amid Shifting Market Landscape

- BMO Capital’s Daniel Jester maintained a Market Perform but lowered the price target to $116 from $120.

- Oppenheimer’s Ken Wong reiterated an Outperform and a $149 price target.

- Mizuho’s Siti Panigrahi keptNeutral but lowered the price target to $95 from $110.

- BofA Securities’ Brad Sills maintained a Buy rating and and lowered the price target to $22 from $24.

- JP Morgan’s Tien-Tsin Huang reiterated an Overweight but decreased the price target to $124 from $140.

- Keefe, Bruyette & Woods’ Sanjay Sakhrani kept a Market Perform but lowered the price target to $110 from $120.

- Needham’s Scott Berg reiterated a Buy rating and a $200 price target.

- Canaccord Genuity’s Joseph Vafi maintained a Buy rating and a $175 price target.

- Piper Sandler’s Brent Bracelin reiterated an Overweight rating and a $165 price target.

- UBS analyst Taylor McGinnis a Buy rating however he lowers the price target from $138 to $126.

Analyst Siti Panigrahi (MIZUHO) currently has the highest performing score on BILL with 4/4 (100%) price target fulfillment ratio. His price targets carry an average of $-2.09 (-1.27%) potential downside. BILL Holdings stock price reaches these price targets on average within 7 days

Applied Materials Reports Q3 2023 Financial Performance Amid Shifting Semiconductor Landscape

For the third quarter of fiscal year 2023, Applied Materials reported an EPS of $1.90, $0.16 better than the analyst estimate of $1.74. Total revenue of $6.43 billion versus the consensus estimate of $6.15 billion, an achievement in the midst of changing industry dynamics.

In terms of segment performance, the Semi Systems division reported revenue of $4.68 billion, showcasing its stability and continued market presence. Applied Global Services (AGS) stood out with record revenue surpassing $1.46 billion, marking the 16th consecutive quarter of year-over-year revenue growth. The Display segment also contributed positively, with revenue reaching $235 million.

Applied Materials generated over $2.3 billion in free cash flow, equivalent to 36% of revenue with $707 million return to shareholders in dividends and share buybacks.

Analysts Bullish on Applied Materials as Price Targets Get Raised

- Mizuho analyst Vijay Rakesh maintained a Buy and raised the price target from $152 to $158.

- JP Morgan analyst Harlan Sur reiterated an Overweight and increased the price target from $145 to $165.

- Berenberg analyst Tammy Qiu kept a Buy rating but upgraded the price target from $150 to $175.

- Morgan Stanley analyst Joseph Moore maintained an Equal-Weight and raised the price target from $125 to $139.

Analyst Blayne Curtis (BARCLAYS) currently has the highest performing score on AMAT with 17/21 (80.95%) price target fulfillment ratio. His price targets carry an average of $1.82 (14.61%) potential upside. Applied Materials stock price reaches these price targets on average within 297 days

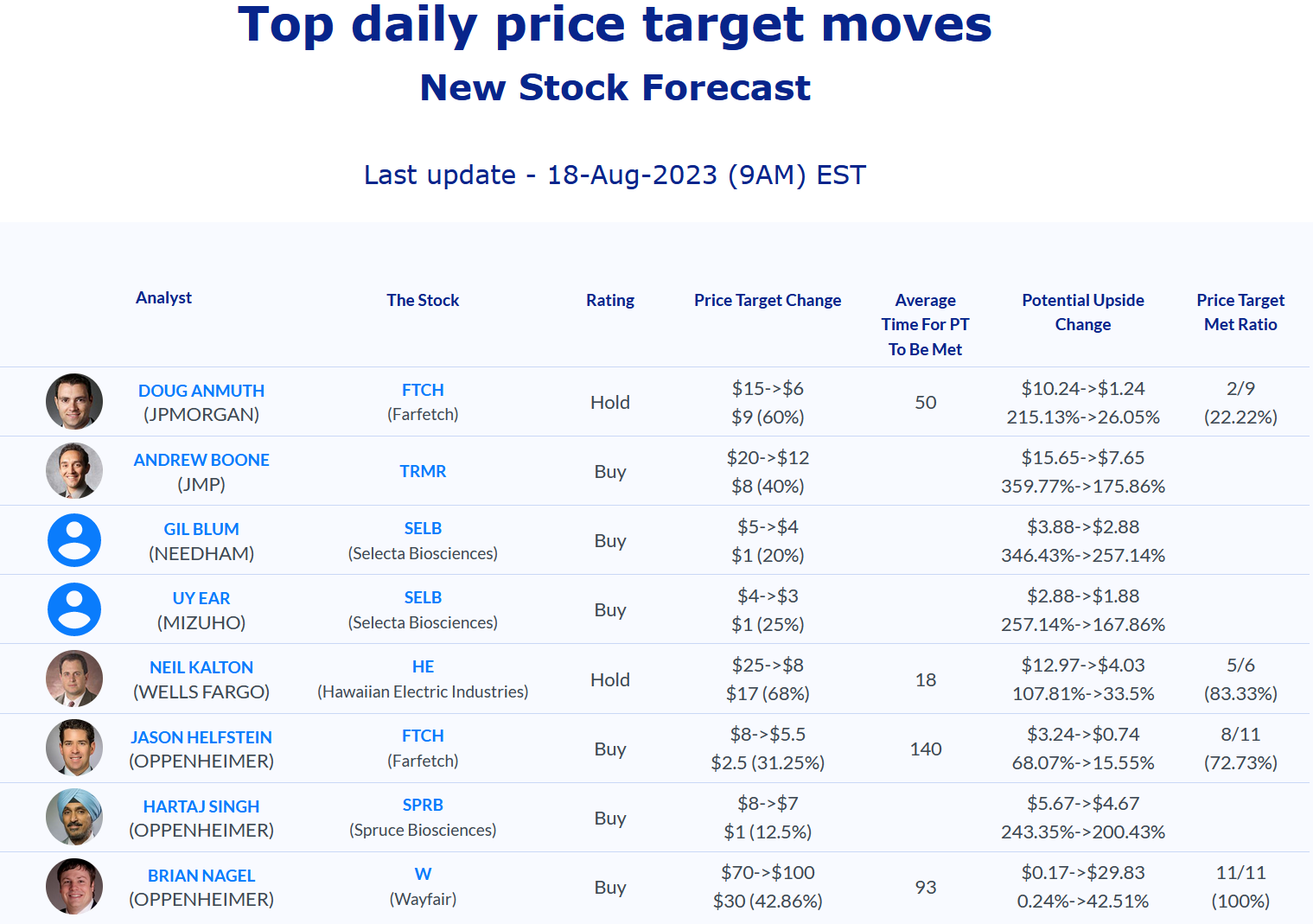

Daily stock Analysts Top Price Moves Snapshot