Selected stock price target news of the day - August 19th, 2025

By: Matthew Otto

Palo Alto Networks Posts Revenue Growth and Issues Strong Fiscal 2026 Outlook

Palo Alto Networks reported fiscal fourth quarter 2025 revenue of $2.5 billion, a 16% increase from $2.2 billion in the prior-year period and in line with Wall Street’s consensus estimate. Earnings came in at $0.95 per share, exceeding the analyst estimate of $0.89 by $0.06. Net income was $253.8 million, or $0.36 per share, compared with $357.7 million, or $0.51 per share, a year earlier.

For the full fiscal year, revenue grew 15% to $9.2 billion. Palo Alto also highlighted growth in key metrics, with Next-Generation Security annual recurring revenue rising 32% to $5.6 billion and remaining performance obligations increasing 24% to $15.8 billion.

For fiscal first quarter 2026, Palo Alto expects revenue between $2.45 billion and $2.47 billion, in line with consensus of $2.45 billion. Earnings per share are projected between $0.88 and $0.90, above analysts’ estimate of $0.86.

For the full fiscal year 2026, Palo Alto guided revenue of $10.475 billion to $10.525 billion, compared with consensus of $10.44 billion, and projected earnings of $3.75 to $3.85 per share, ahead of the $3.69 estimate. Remaining performance obligations are expected to reach up to $18.7 billion, while security ARR is forecast to grow to as much as $7.1 billion.

Analysts Update Palo Alto Networks Ratings with 2.6% Average Price Target Increase

- Barclays analyst Saket Kalia maintained an Overweight rating while raising the price target from $210 to $215.

- WestPark Capital analyst Casey Ryan reiterated a Hold rating.

- BofA Securities analyst Tal Liani upgraded from Neutral to Buy but kept the price target unchanged at $215.

- Needham analyst Mike Cikos reiterated a Buy rating and a $230 price target.

- UBS analyst Roger Boyd lifted the price target from $185 to $200.

Which Analyst has the best track record to show on PANW?

Analyst Stephen Bersey (HSBC) currently has the highest performing score on PANW with 2/4 (50%) price target fulfillment ratio. His price targets carry an average of $-12.27 (-7.29%) potential downside. Palo Alto Networks stock price reaches these price targets on average within 4 days.

Blink Charging Misses EPS Expectations While Revenue Tops Analyst Forecasts

Blink Charging reported second-quarter 2025 revenues of $28.7 million, representing a 38% sequential increase compared to $20.8 million in the first quarter of the year and above the consensus estimate of $25.2 million.

The revenue performance reflected a 73% rise in product revenues to $14.5 million and an 11% gain in service revenues to $11.8 million. Year-over-year, total revenues declined 14% from $33.3 million as product revenues fell 39%, though service revenues grew 46% to $11.8 million. Other revenues, including warranty fees and grants, reached $2.4 million, up 34% sequentially and 47% from the prior year.

Gross profit stood at $2.1 million, or 7% of revenues, down from $10.7 million, or 32% of revenues, a year earlier, largely due to $6.4 million in adjustments tied to obsolete inventory and equipment.

Blink posted a net loss of $32 million, or $0.31 per share, compared with a loss of $20.1 million, or $0.20 per share, in the second quarter of 2024. On an adjusted basis, Q2 EPS was ($0.26), missing analyst expectations of ($0.16) by $0.1. Operating expenses totaled $34.3 million, including $10.1 million in largely one-time charges.

Analysts Maintain Mixed Views on Blink with No Price Target Adjustments

- HC Wainwright & Co. analyst Sameer Joshi reiterated a Buy rating and the price target at $5.

- Needham analyst Chris Pierce kept a Hold rating.

- Benchmark analyst Mickey Legg reaffirmed a Buy rating and a $2 price target.

Which Analyst has the best track record to show on BLNK?

Analyst Stephen Gengaro (STIFEL) currently has the highest performing score on BLNK with 5/9 (55.56%) price target fulfillment ratio. His price targets carry an average of $0.25 (33.33%) potential upside. Blink Charging stock price reaches these price targets on average within 14 days.

NRx Pharmaceuticals Reports Expanded Fast Track Designation and Advances in Clinical Programs

NRx Pharmaceuticals reported a net loss of $17.6 million for the quarter ended June 30, 2025, compared with a net loss of $7.9 million in the same quarter of 2024. Loss from operations was $3.7 million, narrowing from $7.1 million in the prior-year quarter. The company ended the quarter with approximately $2.9 million in cash and cash equivalents.

The U.S. Food and Drug Administration recently granted NRX-100, a preservative-free intravenous ketamine, an expanded Fast Track Designation for all forms of depression and related disorders. This broadened the drug’s potential scope from bipolar depression alone, which affects more than 7 million Americans, to an estimated 13 million people each year who experience suicidal ideation across depressive disorders. Of these, about 1.5 million attempt suicide annually, and one American dies by suicide every 11.

NRx filed an Abbreviated New Drug Application for NRX-100 to enter the $750 million generic ketamine market, while also pursuing approval in the innovative depression treatment segment, where a ketamine-based therapy generated $1.3 billion in 2024 sales but does not carry an indication for suicidality. Additional regulatory activities included the submission of more than 80,000 pages of data to support an Accelerated Approval application for NRX-101, an oral therapy targeting suicidal bipolar depression and akathisia.

Through its HOPE Therapeutics subsidiary, NRx advanced acquisitions of clinics projected to generate about $15 million in revenues in 2025, with ongoing negotiations targeting expansion to a network that could support approximately $100 million in forward pro forma revenue by year-end.

D. Boral Capital Reiterates Buy Rating and The Price Target

- D. Boral Capital analyst Jason Kolbert maintained a Buy rating and a $31 price target.

Which Analyst has the best track record to show on NRXP?

Analyst Edward Woo (ASCENDIANT) currently has the highest performing score on NRXP with 2/3 (66.67%) price target fulfillment ratio. His price targets carry an average of $43.94 (2133.01%) potential upside. NRx Pharmaceuticals stock price reaches these price targets on average within 137 days.

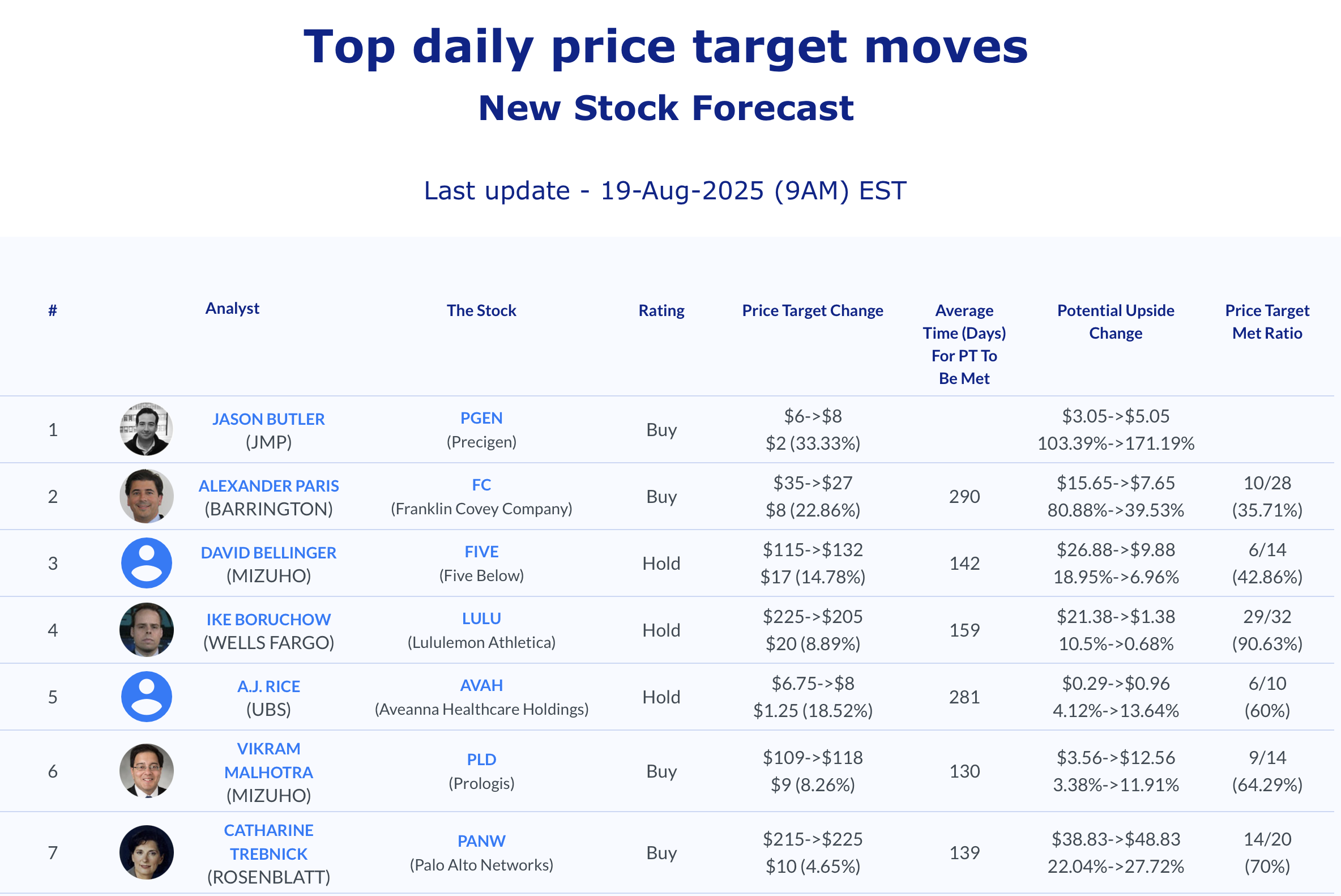

Daily Stock Analysts Top Price Moves Snapshot