Selected stock price target news of the day - August 22, 2023

By: Matthew Otto

Zoom’s Q2 Earnings Release Highlights Financial Growth and Strategic Momentum

Despite challenges in the market, Zoom’s total revenue demonstrated a 4% year-over-year increase, reaching $1.139 billion versus the consensus estimate of $1.11 billion in the second quarter of fiscal year 2024. The company’s Enterprise business segment notably contributed to this growth, accounting for 58% of the total revenue, marking a 10% rise from the previous year.

Zoom reported a non-GAAP gross margin of 80.3%, reflecting an improvement from 78.9% in the same quarter of the previous year. The company’s commitment to optimizing usage across public cloud and co-located data centers played a significant role in this margin expansion. Moreover, non-GAAP operating income displayed a growth of 17% year-over-year, reaching $462 million, with an operating margin of 40.5%, showcasing an enhancement from the previous year’s 35.8%.

Zoom’s financial outlook for the full fiscal year 2024 demonstrated the company’s confidence and raised its revenue guidance to a range of $4.485 billion to $4.495 billion, representing a 2% year-over-year growth or 3% in constant currency terms. Zoom also provided non-GAAP earnings per share guidance of $4.63 to $4.67 based on approximately 308 million shares outstanding.

Analysts Express Varied Views Following Earnings Report

- Needham analyst Ryan Koontz maintained a Hold rating.

- RBC Capital analyst Rishi Jaluria reiterated an Outperform rating and a $95 price target.

- Baird analyst William Power maintained an Outperform rating, but lowered the price target from $95 to $90.

- Wells Fargo analyst Michael Turrin kept an Equal-Weight rating and lowered the price target from $80 to $75.

- Bernstein analyst Peter Weed reiterated a Market Perform rating and downgraded the price target from $92 to $82.

Analyst James Fish (PIPER SANDLER) currently has the highest performing score on ZM with 14/26 (53.85%) price target fulfillment ratio. His price targets carry an average of $30.65 (13.84%) potential upside. Zoom Video Communications stock price reaches these price targets on average within 57 days.

Fabrinet Reports Financial Results for Q4 Fiscal Year 2023 Amid Industry Dynamics

Fabrinet has announced its financial results for the fourth quarter and fiscal year 2023, which ended on June 30. The company reported revenue growth, with fourth-quarter revenue reaching $655.9 million against the consensus estimate of $641.43 million, marking a 12% increase compared to the same period the previous year. The year’s total revenue surpassed $2.6 billion, reflecting a 17% year-over-year growth. Fabrinet’s ability to maintain double-digit operating margins throughout the year contributed to its non-GAAP earnings per share of $7.67, an impressive 25% increase from the fiscal year 2022.

The optical communications sector played a role in Fabrinet’s financial performance. While telecom revenue faced challenges due to inventory adjustments, datacom revenue experienced an outstanding 107% growth compared to the previous year, driven by an 800-gig AI data center transceiver program for a major customer. The company also emphasized its strategic partnerships with industry giants, with Cisco, Lumentum, Nvidia, and Infinera each contributing over 10% to its revenue.

Analysts Remain Bullish with Increased Price Targets and Buy Ratings

- HC Wainwright & Co. analyst Matthew Caufield reiterated a Buy rating and a $28 price target.

- Needham analyst Alex Henderson maintained a Buy rating and raised the price target from $150 to $165.

- JPMorgan analyst Samik Chatterjee raised his price target to $174.

- Northland Capital Markets analyst Tim increased his price target to $150.

Analyst Troy Jensen (LAKE STREET) currently has the highest performing score on FN with 20/20 (100%) price target fulfillment ratio. His price targets carry an average of $9.74 (23.24%) potential upside. Fabrinet stock price reaches these price targets on average within 264 days

Macy’s Adapts to Shifting Consumer Trends Amid Quarterly Results

Macy’s CEO, Jeff Gennette, affirmed the company’s conservative full-year guidance. The forecast predicts a decline of 6% to 7.5% in comparable owned-plus-licensed sales compared to the previous year. Adjusted earnings per share anticipated to range between $2.70 and $3.20. While facing pressure from various factors such as rising credit card balances and evolving spending habits, Macy’s is focusing on adapting its inventory to cater to consumer preferences, with emphasis on products like fragrances, beauty items, and brands like Under Armour and Nike.

Despite the challenges, Macy’s demonstrated a better-than-expected performance in the fiscal second quarter. Earnings per share were reported at 26 cents adjusted, exceeding the estimated 13 cents, and revenue stood at $5.13 billion, surpassing the anticipated $5.09 billion. The company experienced a net loss of $22 million for the quarter, compared to a net income of $275 million in the previous year. The decline in sales primarily stemmed from an 8% drop in store sales and a 10% decline in digital sales. The challenging sales environment led to a 7.3% decrease in comparable sales on an owned-plus-licensed basis, slightly worse than the projected 6.5% decline.

Analyst Reiterated Market Perform Rating for Macy’s

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and price target at $16.

Analyst Michael Binetti (CREDIT SUISSE) currently has the highest performing score on M with 14/22 (63.64%) price target fulfillment ratio. Her price targets carry an average of $6.31 (23.21%) potential upside. Macy’s stock price reaches these price targets on average within 270 days

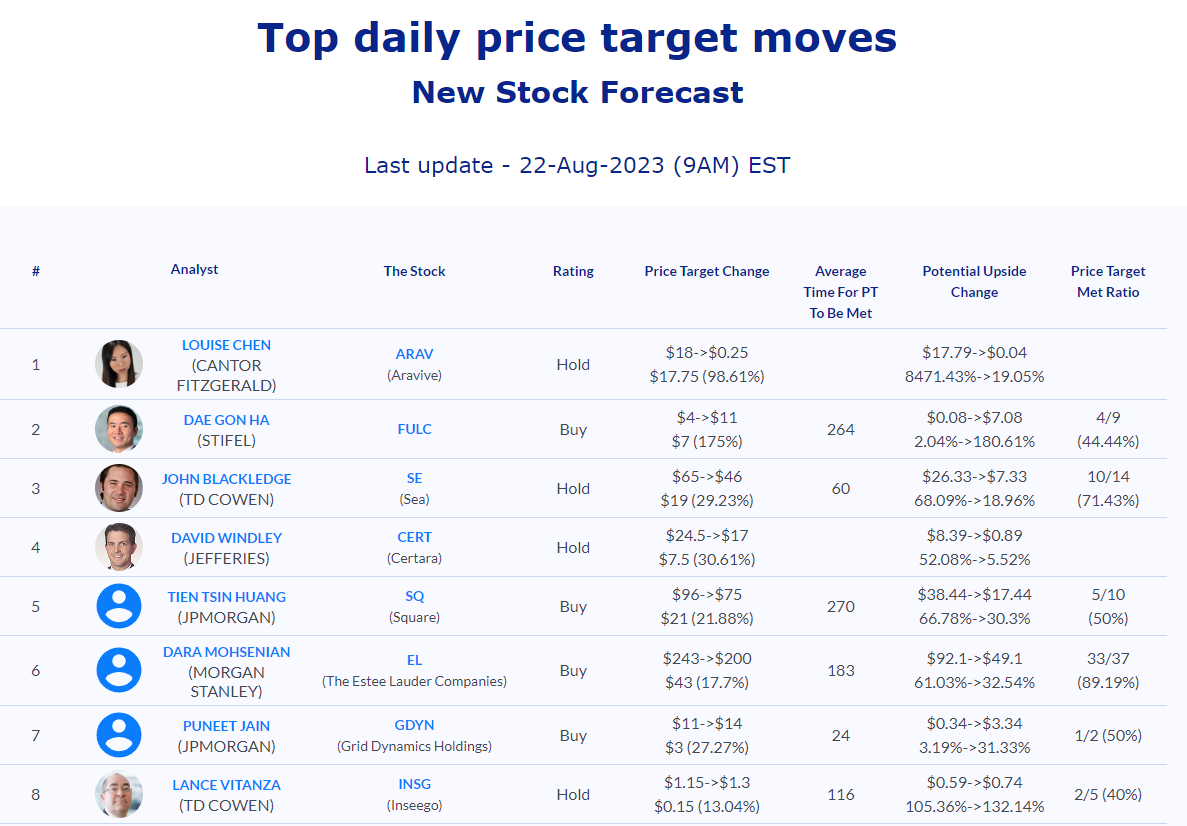

Daily stock Analysts Top Price Moves Snapshot