Selected stock price target news of the day - August 2nd, 2024

By: Matthew Otto

Tenable Misses Revenue Guidance Despite Beating Q2 EPS Estimates

Tenable announced its Q2 2024 financial results, reporting earnings per share (EPS) of $0.31, outperforming the analyst estimate of $0.24 by $0.07. Revenue for the quarter reached $221.2 million, surpassing the consensus estimate of $218.54 million and reflecting a 13% year-over-year growth. Non-GAAP income from operations was $42.8 million, surpassing the guided range midpoint by $7.8 million. Additionally, the company achieved a gross margin of 82%, up 70 basis points from the previous quarter.

Tenable’s exposure management and cloud security solutions showed growth, particularly Tenable One, which accounted for 30% of new enterprise sales in Q2, up from 26% last quarter. Cloud security offering gained momentum with six-figure wins, including deals with a Fortune 100 financial services company and a large defense contractor.

Looking ahead, Tenable provided a revenue guidance range of $222 million to $224 million for Q3 2024, below the consensus of $228.2 million, and a full-year 2024 revenue guidance range of $889 million to $895 million, below the consensus of $905 million. Also announced a full-year 2025 unlevered free cash flow target of $280 million to $290 million.

Mixed Analyst Ratings and Lowered Price Targets

- Needham analyst Mike Cikos maintained a Buy rating yet lowered the price target from $62 to $50.

- Scotiabank analyst Patrick Colville maintained a Sector Perform rating and lowered the price target from $47 to $44.

- Barclays analyst Saket Kalia reiterated an Equal-Weight rating but downgraded the price target from $57 to $49.

- Piper Sandler analyst Rob Owens kept an Overweight rating while lowering the price target from $60 to $55.

- Stifel analyst Brad Reback maintained a Buy rating, however, lowered the price target from $54 to $52.

- Canaccord Genuity analyst Michael Walkley reiterated a Buy rating and downgraded the price target from $57 to $53.

- Wells Fargo analyst Andrew Nowinski maintained an Overweight rating but raised the price target from $60 to $50.

- WestPark Capital analyst Casey Ryan downgraded from Buy to Hold.

- Truist Securities analyst Joel Fishbein reiterated a Buy rating and lowered the price target from $60 to $55.

- Susquehanna analyst Shyam Patil maintained a Positive rating while lowering the price target from $60 to $48.

Which Analyst has the best track record to show on TENB?

Analyst Joel Fishbein (TRUIST) currently has the highest performing score on TENB with 4/6 (66.67%) price target fulfillment ratio. His price targets carry an average of $9.85 (19.64%) potential upside. Tenable Holdings stock price reaches these price targets on average within 320 days.

eBay’s Q2 Performance Beats Estimates Amid Economic Challenges; Q3 Guidance Below Expectations

eBay reported results for the second quarter of 2024, posting a revenue of $2.6 billion, surpassing the consensus estimate of $2.53 billion. Additionally, eBay’s adjusted earnings per share (EPS) of $1.18 exceeded the analyst estimate of $1.13 by $0.05. The gross merchandise volume (GMV), increased by 1% to $18.4 billion in the second quarter.

Key drivers of Q2 results included a 4% GMV growth in focus categories like Motors Parts & Accessories, collectibles, and refurbished goods, outpacing the broader marketplace. Notably, eBay’s collaboration with PSA for trading cards and its expanding refurbished inventory, including new categories like golf clubs, drove growth.

Despite the upbeat second-quarter results, eBay’s third-quarter revenue forecast fell short of analysts’ expectations. eBay projects revenue for the July to September period to be between $2.5 billion and $2.6 billion, compared to the consensus estimate of $2.537 billion. The forecast for adjusted EPS in the current quarter is between $1.15 and $1.20, slightly above the consensus estimate of $1.13.

Analysts Update Ratings and Price Targets Following Q2 Results

- Susquehanna analyst Shyam Patil held a Neutral rating and increased the price target from $52 to $60.

- Citigroup analyst Ygal Arounian assigned a Buy rating and revised the price target from $64 to $65.

- Deutsche Bank analyst Lee Horowitz continued with a Buy rating while adjusting the price target from $60 to $64.

- Benchmark analyst Daniel Kurnos supported a Buy rating and updated the price target from $58 to $65.

- Evercore ISI Group analyst Mark Mahaney kept an In-Line rating while lifting the price target from $47 to $53.

- Piper Sandler analyst Thomas Champion reiterated an Overweight rating and boosted the price target from $58 to $64.

- Wells Fargo analyst Ken Gawrelski maintained an Equal-Weight rating, but reduced the price target from $57 to $55.

Which Analyst has the best track record to show on EBAY?

Analyst Doug Anmuth (JPMORGAN) currently has the highest performing score on EBAY with 4/7 (57.14%) price target fulfillment ratio. His price targets carry an average of $6.05 (11.21%) potential upside. eBay stock price reaches these price targets on average within 275 days.

Zeta Global Exceeds Q2 2024 Revenue Estimates and Increases Full-Year Revenue Guidance

Zeta Global Holdings reported financial performance for the second quarter of 2024, highlighting growth in revenue and adjusted EBITDA. Zeta achieved a revenue of $228 million, surpassing the consensus estimate of $212.44 million and reflecting a 33% increase compared to the previous year. Adjusted EBITDA reached $38.5 million, marking a 44% year-over-year growth and an adjusted EBITDA margin of 16.9%, which expanded by 130 basis points.

Despite reporting an EPS of ($0.16), in line with analyst estimates, Zeta has raised its full-year revenue guidance to a range of $920 to $930 million, exceeding the consensus estimate of $900 million.

This quarter’s achievements included the introduction of the Zeta Economic Index (ZEI). Additionally, Zeta’s partnership with Amazon’s Bedrock platform aims to enhance its AI capabilities further. Zeta also highlighted growth in its scaled customer base, with an increase in average revenue per user (ARPU) to $479,000, up 22% year-over-year.

Analysts Raise Price Targets Following Q2 Performance

- Needham analyst Ryan MacDonald maintained a Buy rating and raised the price target from $20 to $28.

- Barclays analyst Ryan Macwilliams maintained an Overweight rating but increased the price target from $18 to $28.

- Craig-Hallum analyst Jason Kreyer retained a Buy rating while raising the price target from $22 to $32.

- B. Riley Securities analyst Zach Cummins reiterated a Buy rating and lifted the price target from $24 to $30.

- RBC Capital analyst Matthew Swanson maintained an Outperform rating yet raised the price target from $23 to $29.

- Truist Securities analyst Terry Tillman reiterated a Buy rating and upgraded the price target from $23 to $30.

- Canaccord Genuity analyst David Hynes kept a Buy rating and boosted the price target from $20 to $28.

- Oppenheimer analyst Brian Schwartz maintained an Outperform rating and raised the price target from $20 to $29.

Which Analyst has the best track record to show on ZETA?

Analyst Brian Schwartz (OPPENHEIMER) currently has the highest performing score on ZETA with 5/5 (100%) price target fulfillment ratio. His price targets carry an average of $3.05 (17.99%) potential upside. Zeta Global Holdings stock price reaches these price targets on average within 399 days.

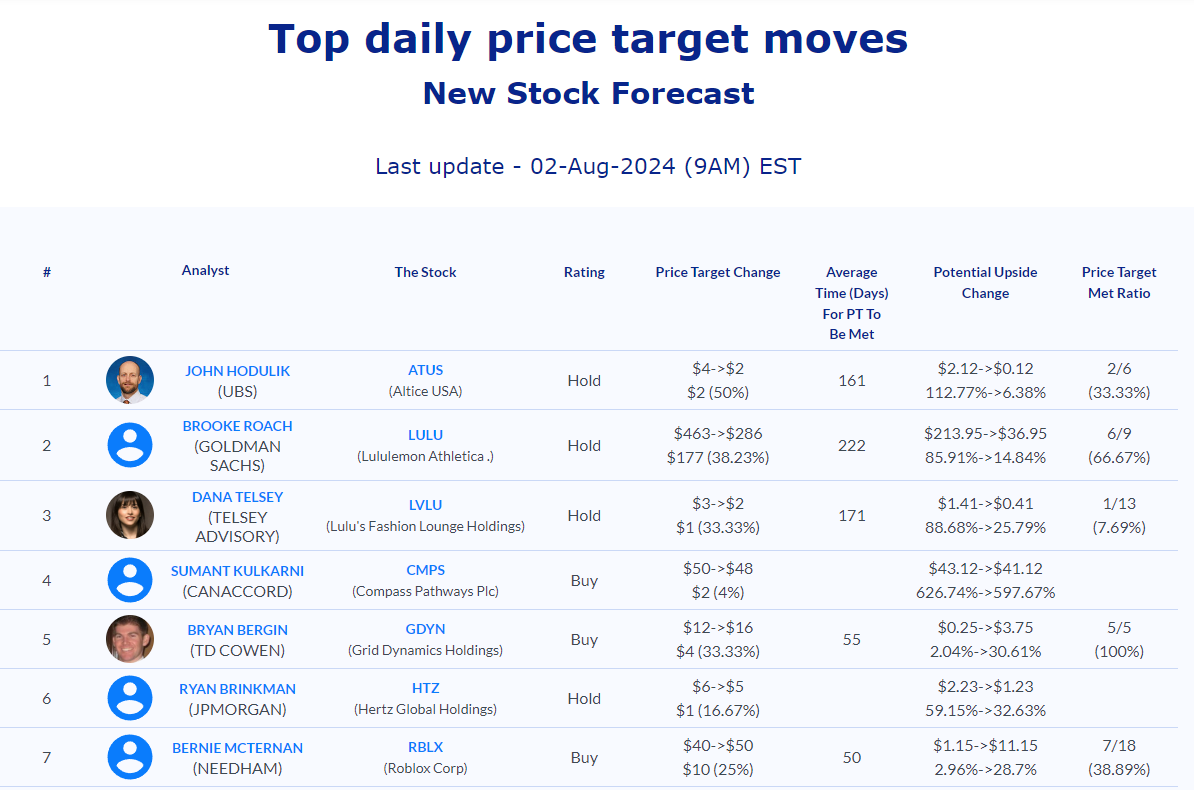

Daily stock Analysts Top Price Moves Snapshot