Daily Update - April 10, 2023

Selected highlights of the day:

By: Matthew Otto

Exxon in talks to buying Pioneer

Exxon Mobil has had preliminary talks with Pioneer Natural Resources about a possible acquisition of the U.S. fracking giant. Discussions have been informal, but after posting record profits in 2022, Exxon is flush with cash and exploring options that could reshape the U.S. oil and gas industry while pushing Exxon deeper into West Texas shale.

Exxon executives have also discussed a potential tie-up with at least one other company. Any deal, if it happens, likely wouldn’t come together until later this year or next year, and talks may not morph into formal negotiations at all, or Exxon may pursue another company. Pioneer has a market cap of around $49 billion, and an acquisition of the company would likely be Exxon’s largest since its mega-merger with Mobil in 1999.

- Stifle analyst Derrick Whitfield set his price target to $286.

Tupperware might go under

Tupperware disclosed a going-concern warning, the company stated that it is working with financial advisors to improve capital structure and better position the business going forward. The firm has been struggling recently, and the warning follows a securities filing from last month that said some recent financial statements should be restated and no longer relied upon.

Tesla boosts production

Tesla plans to build a new factory in Shanghai to produce 10,000 Megapacks per year, which are batteries used for utility-scale storage applications to store electricity generated by renewable power assets such as wind turbines and solar arrays.

The new factory will add to Tesla’s battery-storage capacity and strengthen its presence and investment in China. Tesla deployed about 6.5 gigawatt hours of battery storage capacity in 2022, up about 64% from 2021, and its non-automotive sales and gross profit, which includes storage, amounted to about $10 billion and $500 million in 2022.

- Wolfe Research’s Rod Lache reiterated a Peer Perform rating

- Bernstein’s Toni Sacconaghi reiterated an Underperform rating with a $150.00 price target.

- Morgan Stanley’s Adam Jonas reiterated an Overweight rating with a $220.00 price target.

Keefe, Bruyette & Woods analyst Steven Kwok downgraded Square from Outperform to Market Perform with a price target of $75.00. The analyst noted that Square is feeling pressure from a growing list of small risks, which led to the downgrade.

Micron is facing decreased competition

Samsung Electronics announced its plan to make significant cuts to chip production due to a global demand slump. The announcement followed Micron’s own cuts to production and capital expenditures, as well as SK Hynix’s reduction in capital expenditure for 2023. According to Citi analysts, Samsung’s cut is a “huge positive” for the DRAM industry, accounting for roughly half the entire market, and with Micron and Hynix’s cuts, a DRAM recovery is expected in the second half of 2023.

- Goldman Zacks analyst Toshiya Hari upgraded his stock forecast to $70.00 from the previous target of $64.00 while keeping his Buy Rating.

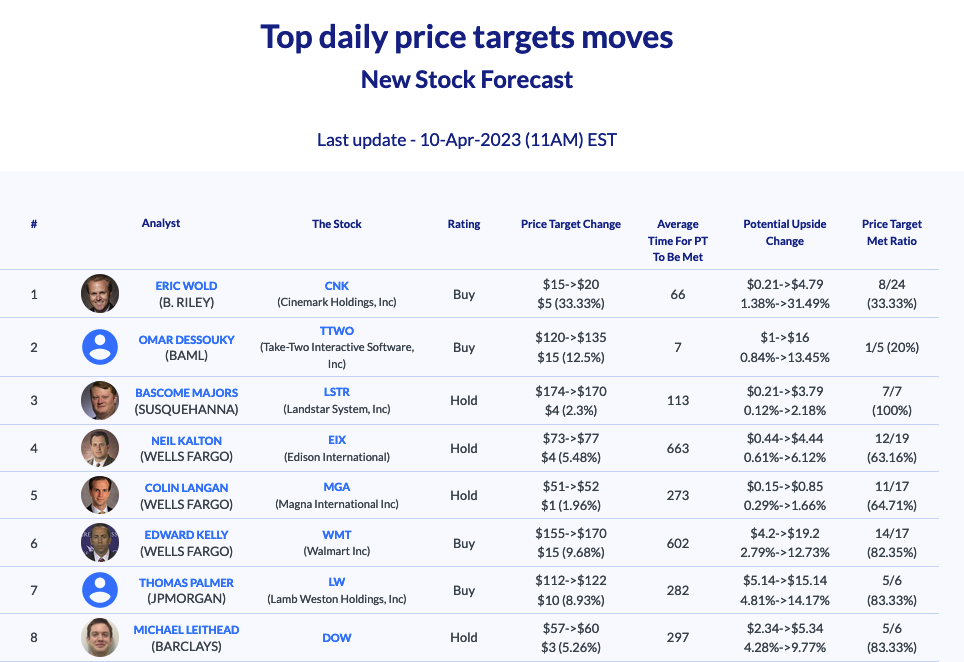

- Wells Fargo analyst Ed Kelly raised Walmart’s price target to $170 due to his optimistic outlook on the company’s e-commerce growth prospects.

- Credit Suisse analyst Karen Short also raised Walmart’s price target to $170, citing positive sentiment towards the company’s e-commerce business, strong financial position, and cash flow generation.

- Morgan Stanley analyst Simeon Gutman reiterated an Equalweight rating with a $160 price target for Walmart.

Walmart has filed a lawsuit against Capital One Financial (COF) with the goal of ending their credit-card partnership. The lawsuit is based on Walmart’s claim that Capital One did not fulfill certain service obligations.

- Wells Fargo analyst Edward Kelly raised Walmart’s price target to $170

- Credit Suisse analyst Karen Short also raised Walmart’s price target to $170,

- Morgan Stanley analyst Simeon Gutman reiterated an Equal Weight rating with a $160 price target for Walmart.

Going to the movies has never been so popular

Cinemark Holdings announced that it experienced its highest single day of attendance since Christmas Day 2019 on April 8, 2023. The success was driven by the record-breaking opening of The Super Mario Bros. Movie, the biggest worldwide opening ever for an animated film, as well as a strong opening for Amazon Studios’ Air and continued performances from films such as John Wick: Chapter 4, Dungeons & Dragons: Honor Among Thieves, and Scream VI.

- B.Riley analyst Wric Wold raised his price target to $20 from $15 and kept his Buy rating