Daily Update - April 18, 2023

Selected highlights of the day:

By: Matthew Otto

Merus N.V

Has announced interim clinical data from its ongoing phase 1/2 trial of the bispecific antibody petosemtamab in previously treated head and neck squamous cell carcinoma (HNSCC).

HNSCC is a type of cancer that begins in the squamous cells lining the moist, mucosal surfaces inside the head and neck, such as the mouth, nose, and throat. This type of cancer can occur in different areas of the head and neck, including the oral cavity, pharynx, larynx, paranasal sinuses, and nasal cavity. HNSCC is often associated with tobacco use and alcohol consumption, as well as infection with the human papillomavirus (HPV) in some cases.

As of the February 1, 2023 data cutoff date, 49 previously treated HNSCC patients were treated with petosemtamab at the recommended phase 2 dose of 1500 mg intravenously every two weeks. The interim data showed a 37% overall response rate (ORR) in 43 evaluable patients, with a 6-month median duration of response.

The bispecific antibody petosemtamab is a human IgG1 Biclonics designed to bind to cancer cells expressing epidermal growth factor receptor (EGFR) and leucine-rich repeat-containing G protein-coupled receptor 5 (LGR5). Petosemtamab continued to demonstrate a manageable safety profile. The end-of-phase meeting with the U.S. Food & Drug Administration provided clarity to a potential registration path in HNSCC.

- SVB Securities analyst Andrew Berens raised his price target from $35 to $48 and maintains an Outperform rating.

- BMO Capital analyst Etzer Darout maintains an Outperform rating and raised his price target from $47 to $49.

- HC Wainwright analyst Andrew Fein reiterates a Buy rating and keeps a $40 price target.

- Needham analyst Ami Fadia also maintains a Buy rating and raised the price target from $33 to $46.

- EF Hutton analyst Tony Butler maintains a Buy rating and maintains a $35 price target,

- Citigroup analyst Yigal Nochomovitz maintains a Buy rating and raised the price target from $38 to $47.

Prometheus Bioscience

Continues to receive wall street adjustments following yesterday’s announcement of being purchased by Merck for roughly $10.8 billion.

- Wells Fargo analyst Chris Carey downgraded from Overweight to Equal-Weight and raised the price target from $164 to $200.

- Credit Suisse analyst Tiago Fauth downgraded from Outperform to Neutral and raised the price target from $139 to $200.

- RBC Capital analyst Gregory Renza Biosciences from Outperform to Sector Perform and raised the price target from $140 to $200.

- Piper Sandler analyst Yasmeen Rahimi Biosciences from Overweight to Neutral and raised the price target from $138 to $200.

MGM Resorts

Has announced last week that Japan’s Ministry of Land, Infrastructure, Transport and Tourism has officially certified the Area Development Plan submitted by Osaka Prefecture/City and Osaka IR KK, a joint venture between MGM Resorts Japan and ORIX Corporation.

The certification is one of the final steps in the licensing process under Japan’s Integrated Resort Development Act, paving the way for MGM Resorts Japan and ORIX to finalize agreements with Osaka Prefecture/City on the construction of a new approximately $10 billion development project.

Yesterday,

- JMP Securities analyst Jordan Bender reiterated MGM with a Market Outperform and a $60 price target.

Today,

- Morgan Stanley analyst Stephen Grambling has maintained an Equal-Weight rating on and raised his price target from $46 to $47.

- Truist Securities analyst Barry Jonas has kept his Buy rating on and raised the price target from $54 to $57.

Looking at the chart on AnaChart it is visible that although all analysts that cover the stock have kept their price target above the stock price analyst Barry Jonas of Truist had success with timing his stock predictions the hospitality and gambling giant.

M&T Bank

Has reported its results of operations for the quarter ended March 31, 2023. According to the report, diluted earnings were $4.01 in the first quarter of 2023, compared with $2.62 in the year-earlier quarter and $4.29 in the fourth quarter of 2022 but beating the analyst estimate of $3.95 by $0.06. Net income was $702 million in the recent quarter, $362 million in the first quarter of 2022 and $765 million in the final 2022 quarter. The revenue for the quarter was $2.41 billion, which also exceeded the consensus estimate of $2.39 billion

However, M&T’s estimated Common Equity Tier 1 ratio was 10.15% at March 31, 2023, compared with 10.44% at the end of last year which might highlight an increase in risky assets on the bank’s balance sheet.

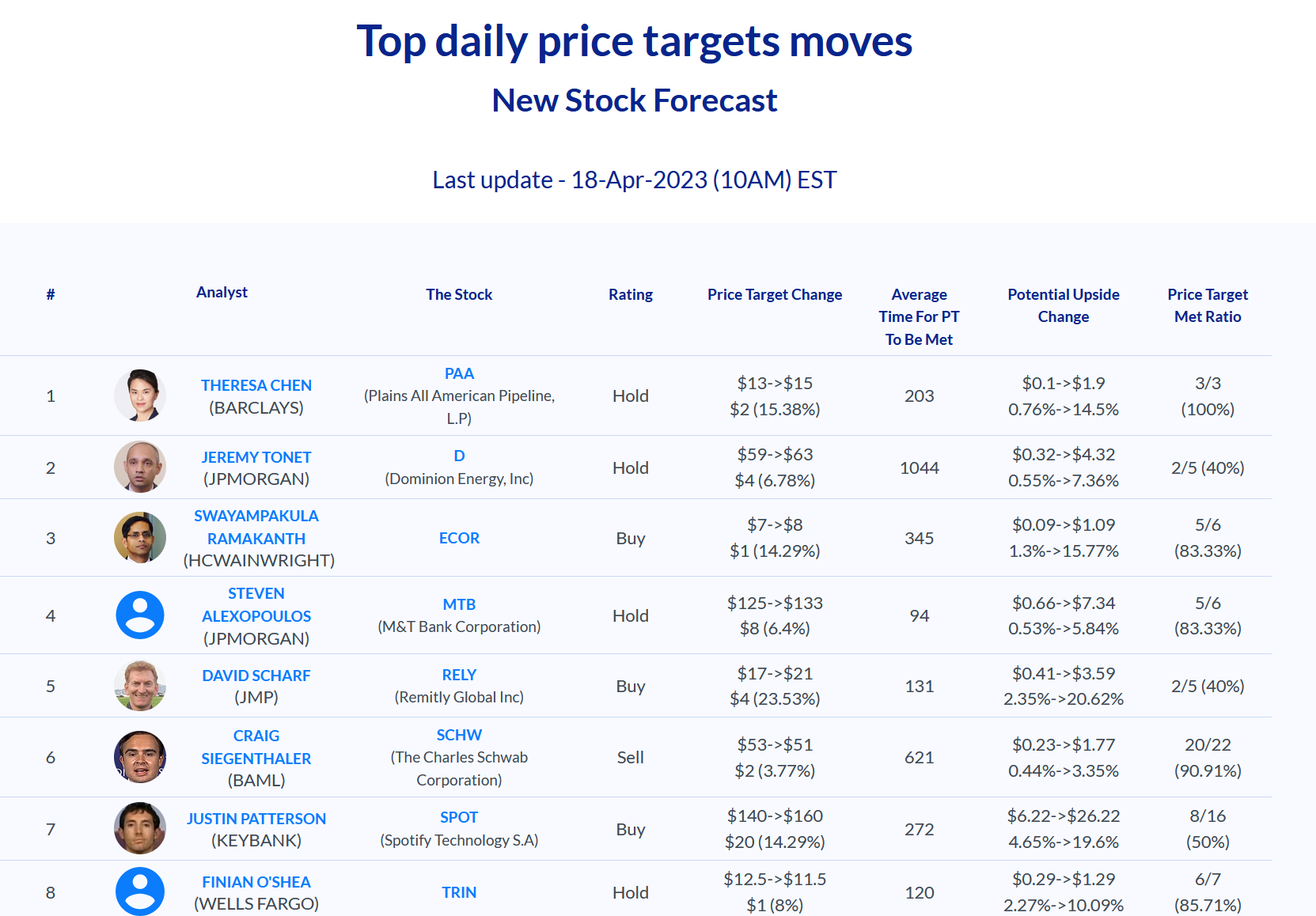

- JP Morgan analyst Steven Alexopoulos maintains a Neutral rating on MTB but raises the price target from $125 to $133.

- Wells Fargo analyst Christopher Spahr maintains an Equal-Weight rating but lowers the price target from $155 to $145.

- BofA Securities analyst Ebrahim Poonawala raises the price target to $145.

- DA Davidson analyst Peter Winter lowers it to $138.

- Odeon Capital analyst Dick Bove keeps a Buy rating but lowers the price target to $143 from $170.85

ALl the analyst covering the stock have kept their price target above the stock price since the beginning of 2021.