Daily Update - April 20, 2023

Selected highlights of the day

By: Matthew Otto

The first-quarter earnings report for Tesla

Showed a decline in its automotive gross profit margins, mainly due to pricing strategies. The average price per vehicle sold decreased from $54,400 in Q1 2022 to $47,200 in Q1 2023, leading to a decline in gross profit margin per vehicle sold from $15,700 to $8,600 during the same period.

The decline in gross profit margins is a concern for investors, who were expecting better results. The non-automotive business, on the other hand, showed positive results, with gross profit margins up about 10 percentage points year over year, and service revenue at an all-time high of $1.8 billion.

Tesla CEO Elon Musk said he was more focused on vehicle autonomy and putting more Tesla vehicles on the road to generate more profit from selling autonomous driving software to all of them. Despite the decline in margins, Musk said orders still exceed supply, and the company could produce up to 2 million vehicles this year, with Wall Street expecting about 1.8 million deliveries for 2023.

- Piper Sandler analyst Brad Milsaps decreased his price target from $32 to $31 while maintaining an Overweight rating.

- JP Morgan analyst Ryan Brinkman lowered his price target from $120 to $115 while maintaining an Underweight rating.

- Mizuho analyst Vijay Rakesh decreased his price target from $250 to $230 while maintaining a Buy rating.

- RBC Capital analyst Tom Narayan lowered the price target to $212.

- Canaccord Genuity analyst George Gianarikas lowered it to $257

- Morgan Stanley analyst Adam Jonas lowered it to $200.

- Mizuho Securities analyst Vijay Rakesh lowered it to $230.

- BofA Securities analyst John Murphy raised the price target to $225, but maintained a Neutral rating.

Opinion on the car manufacturer very much between the fifty plus analyst that are actively covering the stock with their price targets are the stock price.

F5 Networks

Has reported 11% revenue growth in the second quarter of fiscal year 2023, with revenue of $703 million compared to $634 million in the same period last year. Global services revenue grew 8%, while product revenue grew 14%, with systems revenue growing 43%. The company reported GAAP net income of $81 million and non-GAAP net income of $154 million for the quarter.

F5 expects low-to-mid single-digit revenue growth for fiscal year 2023 due to macroeconomic uncertainty, with non-GAAP operating margins of around 30% and non-GAAP earnings growth of 7%-11%. The company also plans to repurchase at least $250 million worth of shares during the third quarter of fiscal year 2023.

- Credit Suisse analyst Sami Badri has lowered the price target from $166 to $155, while maintaining a Neutral rating.

- Piper Sandler analyst James Fish has lowered the price target from $156 to $143, while maintaining a Neutral rating.

- Barclays analyst Tim Long has downgraded from Overweight to Equal-Weight and lowered the price target from $166 to $140.

- Keybanc analyst Thomas Blakey has maintained an Overweight rating for the company and kept the price target at $179, down slightly from $182.

- Morgan Stanley analyst Meta Marshall lowered the price target on F5 Networks to $165, without indicating whether the rating was changed.

- JPMorgan analyst Samik Chatterjee maintained a Neutral rating on F5 Networks) while lowering the price target from $161 to $148.

All the analysts that cover F5 have their price target above the stock price which represents a belief that the stock has potential upside. These views are carried since the beginning of the year when the stock price dropped from $247 to current value of $139.

Las Vegas Sands

Reported better-than-expected earnings and revenue in the first quarter, with CEO Robert Goldstein citing a “robust recovery” in travel and tourism spending in the region. The company’s revenue increased by 125% to $2.12 billion, beating analysts’ estimates of $1.85 billion, while adjusted earnings of 28 cents per share exceeded expectations of 20 cents per share. Melco Resorts & Entertainment, Wynn Resorts, and MGM Resorts, all of which operate in Macau,

- JP Morgan analyst Joseph Greff raised his price target for Las Vegas Sands from $69 to $71 while maintaining an Overweight rating.

- Barclays analyst Brandt Montour increased his price target from $64 to $69 while maintaining an Overweight rating.

- Deutsche Bank analyst Carlo Santarelli raised his price target from $69 to $74 and maintained a Buy rating on the stock.

- Credit Suisse analyst Ben Combes raised the price target for Las Vegas Sands from $62 to $67 while maintaining an Outperform rating.

- Stifel analyst Steven Wieczynski also raised the price target to $73.

- Jefferies analyst David Katz increased the price target from $66 to $69 and maintained a Buy rating.

All analyst have that cover the stock their price target above the stock price for the casinos operator.

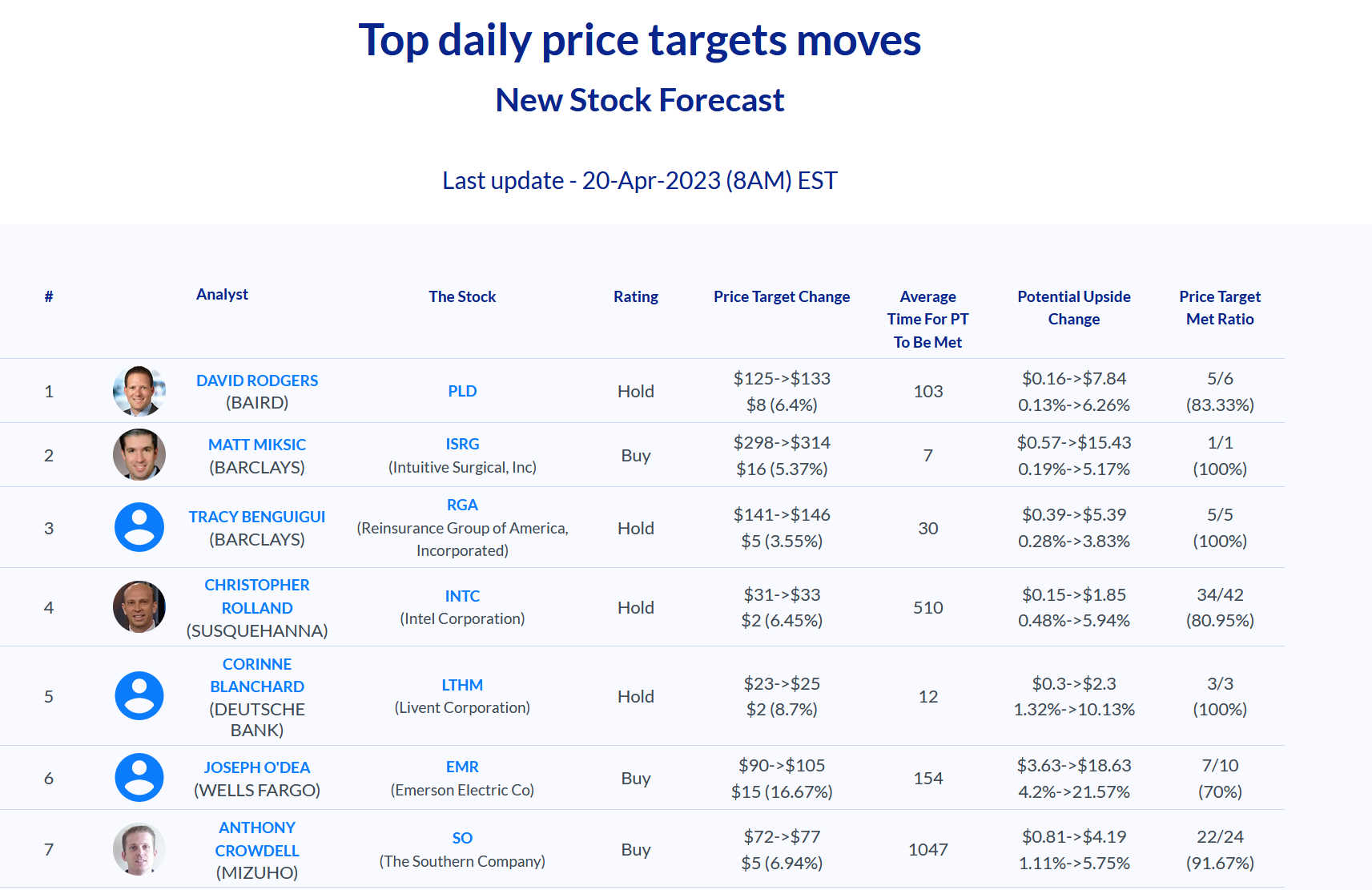

Seen above is a screenshot of the top daily biggest price target moves on AnaChart April 20 2023