Daily Update - April 21, 2023

Selected stock price target highlights of the day:

By: Matthew Otto

Procter & Gamble

(P&G) beat earnings expectations for its third quarter, reporting net earnings of $1.37 per share, up 3% from the same period in the previous year. Net sales rose 4% to $20.1 billion, driven by a 10% rise in prices, partially offset by a fall in shipment volumes. P&G raised its outlook for organic sales growth for fiscal year 2023 to around 6%, up from a previous range of 4% to 5%.

P&G raised its guidance for fiscal 2023 all-in sales to grow approximately one percent versus the prior fiscal year, and its outlook for organic sales growth to approximately six percent versus the prior fiscal year. The company also expects its diluted net earnings per share growth to be in-line to up four percent versus fiscal 2022.

However, P&G noted that its current fiscal 2023 outlook includes headwinds of approximately $1.3 billion after-tax due to unfavorable foreign exchange rates and $2.2 billion due to higher commodity and material costs, which are expected to be a $3.5 billion after-tax headwind to fiscal 2023 earnings versus fiscal 2022.

P&G also increased its expected share repurchases to $7.4 billion to $8 billion from the previously guided $6 billion to $8 billion.

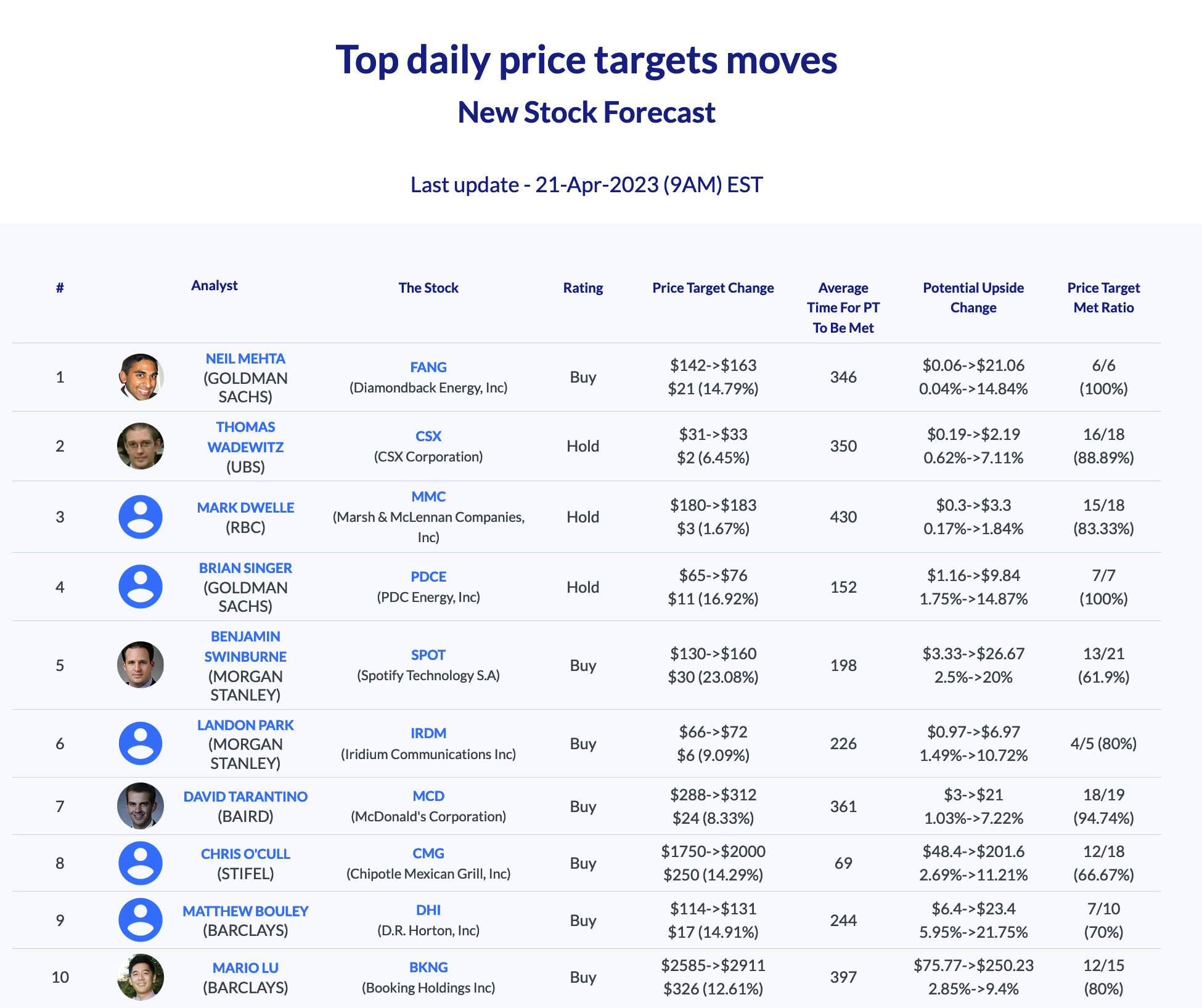

Yesterday two analyst changed their stock forecasts on P&G:

- Morgan Stanley analyst Stephen Byrd kept an Equal-Weight rating but had raised the price target from $13 to $15 on the PG&E Corporation (PCG).

- Jefferies analyst Kevin Grundy has raised the price target for Procter & Gamble (PG) to $171

As you can see in the snapshot below, Kevin Grundy has consistently predicted the stock price rise PG in the last four years.

CSX

Reported yesterday strong first-quarter financial results with revenue reaching $3.71 billion, a 9% increase year-over-year, analysts polled by Refinitiv had expected CSX to report earnings of 43 cents per share and $3.58 billion in revenue for the first quarter. The growth was driven by solid volume growth in merchandise and coal, higher fuel surcharge, and pricing gains. Operating income increased 14% compared to the prior year, with an operating ratio of 60.5%, and diluted EPS increased 23% from the first quarter of 2022.

Despite lower volumes shipped, a strong industrial demand has allowed railroad companies to raise prices, boosting their profits. CSX’s ONE CSX initiatives are driving positive engagement among employees and customers, lifting service performance, and providing exciting opportunities to win business and move more freight while maintaining a fundamental commitment to safe operations.

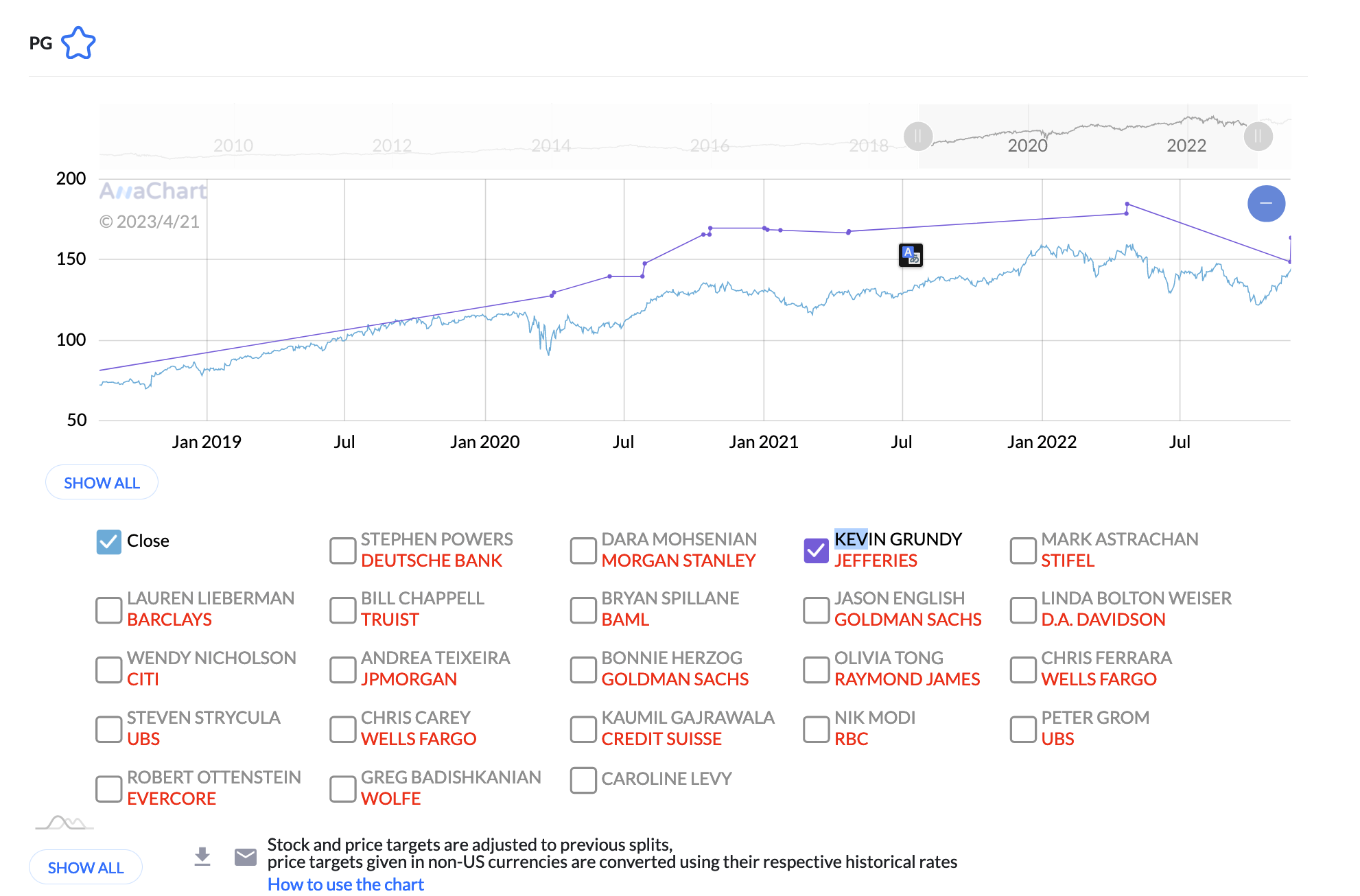

Wall Street Action

- RBC Capital’s Walter Spracklin upgraded to Outperform and increased his price target from $32 to $33.

- Morgan Stanley’s Ravi Shanker raised his price target from $24 to $26 while maintaining an Equal-Weight rating. Shenkar is the only analyst that his price target is below the stock price on CSX as you can see in the snapshot below.

- Raymond James’ Patrick Brown reiterated his Outperform rating and raised the price target from $34 to $35.

- Citigroup’s Christian Wetherbee increased his price target from $32 to $33 while maintaining a Neutral rating.

- Credit Suisse’s Ariel Rosa reiterated his Outperform rating and kept the price target at $37.

- UBS’s Thomas Wadewitz raised the price target from $31 to $33 while maintaining a Neutral rating.

- Susquehanna’s Bascome Majors raised the price target from $32 to $34 while maintaining a Neutral rating.

- Stifel’s Benjamin Nolan maintained a Buy rating and increased the price target from $35 to $37.

- BMO Capital’s Fadi Chamoun increased the price target to $37 from $35.

- JPMorgan’s Brian Ossenbeck raised his price target to $35 from $34.

- Stephens’ Justin Long raised the price target to $36 from $35.

- Evercore ISI’s Jonathan Chappell raised the price target to $34 from $33.

- BofA Securities’ Ken Hoexter lifted the target price to $36 from $33.

D.R. Horton

Has reported its financial results for the second quarter of fiscal year 2023. The company’s net income attributable to D.R. Horton was $942.2 million a decrease of 34% from the same quarter of the previous year. Consolidated revenues were $8.0 billion, and home sales revenues were $7.4 billion on 19,664 homes closed, sales of $7.97 billion topped estimates for $6.45 billion

Net sales orders decreased by 5% to 23,142 homes, with an order value of $8.6 billion. The company’s return on equity (ROE) was 27.2%, and homebuilding return on inventory (ROI) was 35.1% for the trailing twelve months ended March 31, 2023.

Based on the current market conditions and the company’s results for the first half of the year, D.R. Horton has provided fiscal 2023 guidance, including consolidated revenues in a range from $31.5 billion to $33.0 billion, and homes closed between 77,000 and 80,000 homes.

Wall Street Action

- B of A Securities analyst Rafe Jadrosich keeps a Buy rating and raises the price target to $122.

- RBC Capital analyst Mike Dahl maintains an Underperform rating but lifts the price target to $98.

- Goldman Sachs analyst Susan Maklari maintains a Neutral rating and upgrades the price target to $110.

- UBS analyst John Lovallo maintains a Buy rating and lifts the price target to $134.

- JMP Securities analyst Aaron Hecht maintains an Outperform rating and raises the price target to $130.

- Barclays analyst Matthew Bouley maintains an Overweight rating and shifts up the price target to $131.

- BTIG analyst Carl Reichardt upgrades the price target to $139.

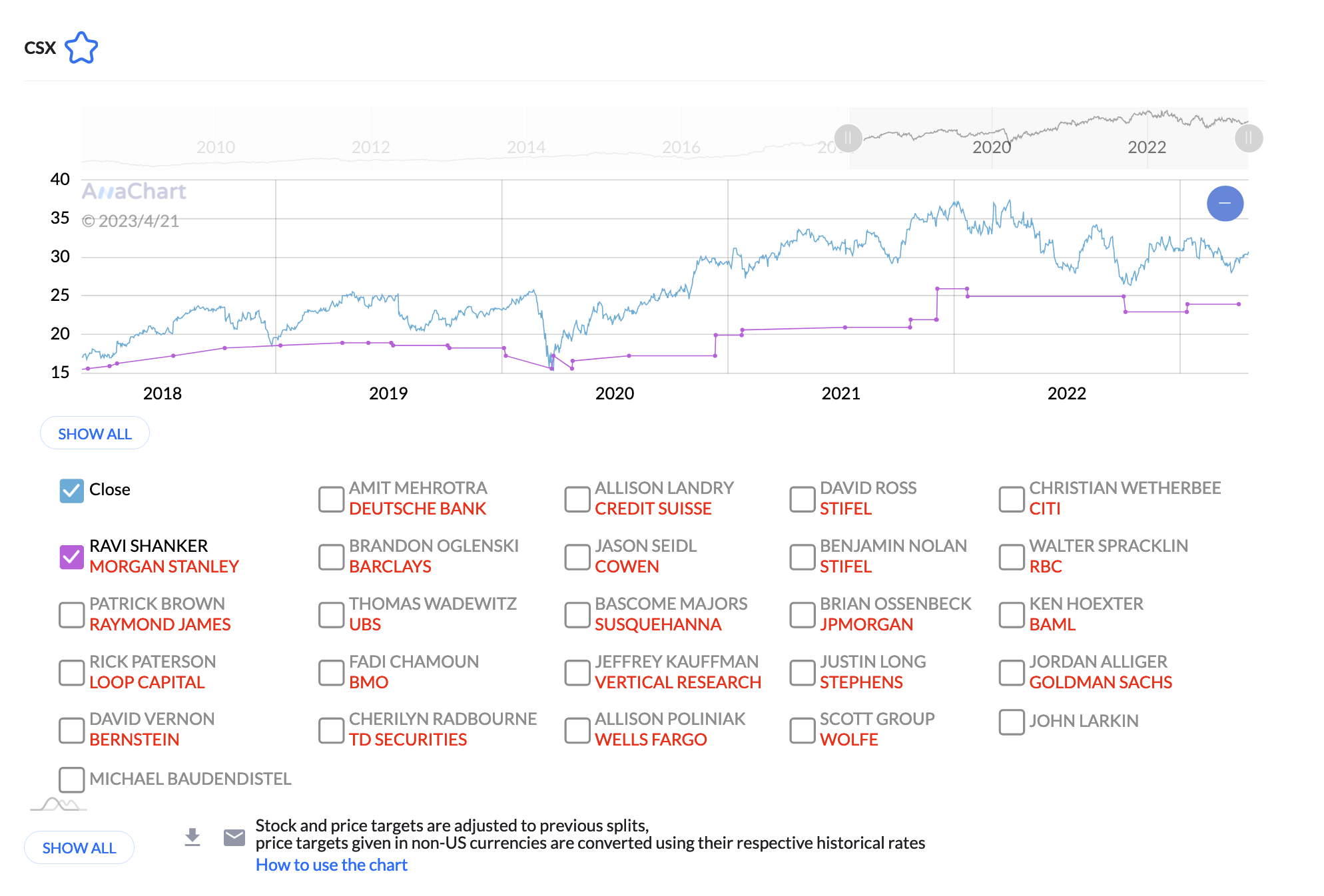

Below is a snapshot of the top daily stock price target moves on AnaChart.