Daily Update - Dec 14, 2022

Selected stock price news highlights of the day

By: Matthew Otto

Moderna teams up with Merck

Moderna and Merck have announced the successful clinical trial results of their jointly-developed mRNA cancer vaccine, mRNA-4157/V940. When combined with KEYTRUDA® (pembrolizumab), this personalized treatment demonstrated a statistically significant reduction in disease recurrence or death among stage III/IV melanoma patients at high risk following complete resection. This marks an exciting milestone in cancer care treatments as it is not only the first investigational mRNA approach to achieve these groundbreaking outcomes but also opens doorways for exploring opportunities into other tumor types through planned Phase 3 studies slated for 2023.

The results thus far are extremely encouraging, offering hope to those affected by melanoma and other forms of cancer. Stéphane Bancel from Moderna expressed optimism regarding this development: “mRNA has been transformative in fighting COVID-19; now it appears that we can use it to make an impact in randomized clinical trials involving melanoma.”

- Geulah Livshits lowered to Neutral from Buy, but increased her 12-month target for the stock price to $191 from $186 citing that the potential in the news had already been materialized.

BellRing

BRBR got positive views for its position in creating nutrition shakes with generation Z and hence a strong cash flow and as such an ideal candidate to be bought.

- Matt McGinley from Needham assigned the stock a $32 price target and Buy rating.

- Brian Holland initiates coverage with the stock at a $31 price target alongside an Outperform rating.

Essex Property

- Got downgraded by KeyBanc’s Jordan Snadler from Overweight to Sector Weight

- RBC’s Brad Hefferen lowered his price target as well to $250 From $265 while maintaining an Outperform Rating.

- Janney Montgomery Scott analyst Robert Stevenson downgrades Essex Property Trust from Buy to Neutral.

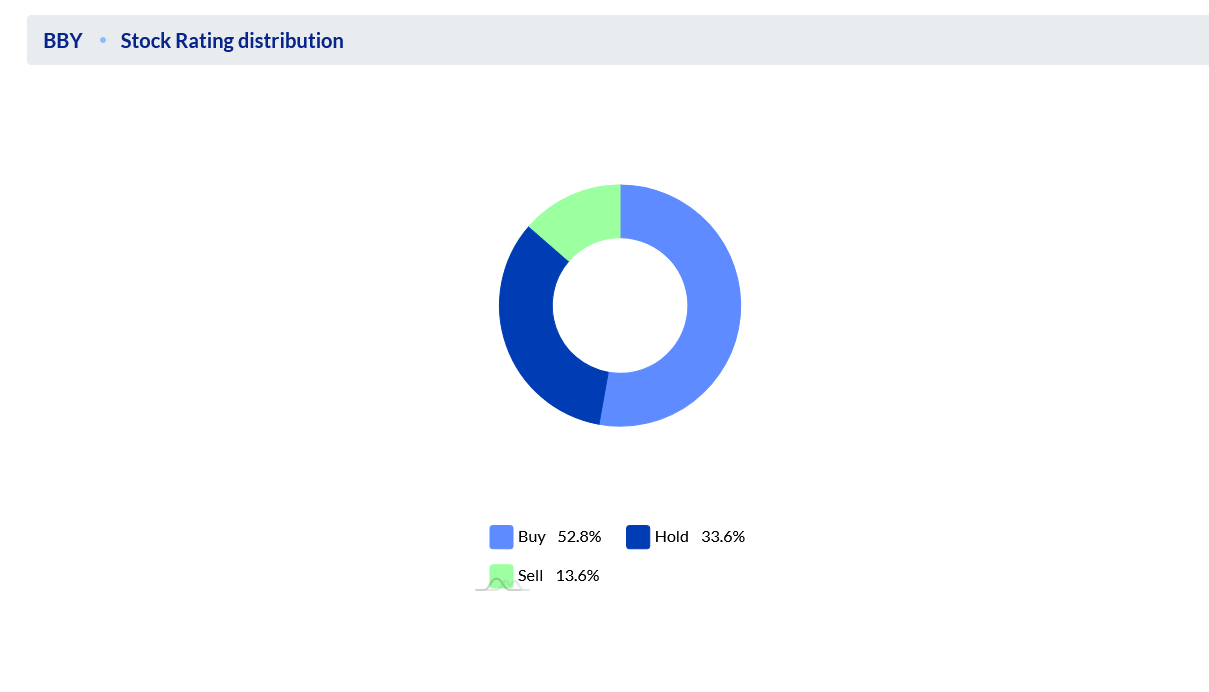

BAML analyst Elizabeth Suzuki

- Struck a pessimistic note on Best Buy and AutoZone today, downgrading the BBY to Underperform and slashing her 12-month price target by more than $10. Citing lackluster spending in the consumer electronics sector in light of an uncertain economic climate, she advised investors should proceed with caution before investing heavily in BBY shares for the foreseeable future.

- The analyst had changed her view on the stock to a more pessimistic trend after being optimistic on the consumer giant for over two years. AZO has been lowered from Neutral to Underperform and her stock forecast $80 to $69.

Wells Fargo adjusts lower on DLR

- Digital Realty Trust was lowered by Wells Fargo’s Eric Luebchow from Overweight to Equal Weight and the price target lowered from $120 to 115. Luebchow has been chasing the stock down since it had its peak at the beginning of the year at $170.