Daily Update - Dec 23, 2022

Selected highlights of the day

By: Matthew Otto

As we enter the end year holiday season there isn’t that much news to share.

Paychex reported strong second quarter results this December 22

With service revenue increasing to $1.2 billion, a positive growth of 7% from the prior year period. This was highlighted further by Management Solutions’ 8% increase to $895.3 million and PEO and Insurance Solutions’ 4% increase to $273.3 million. This growth was largely due to increases in the number of average worksite employees as well as general wage rate increases across the board totaling a 7% growth in expenses to $718.0 million. However, even with the cost growth, operating income still managed to rise 7%, to $472.3 million compared to the same time last year; ultimately reinforcing Paychex’s stability despite already intense competition in their industry sector.

- Analyst Tien-Tsin Huang from JP Morgan lowered his prediction to $119 with an Underweight

- James Faucette of Morgan Stanley decreased it to $125 keeping his Underweight

- Ramsey El-Assal of Barclays dropped his stock forecast to $115 with an Underweight rating.

- Samad Samana of Jefferies adjusted his estimated to $120 and a Hold rating.

CarMax announced its results for their third quarter of fiscal 2023

Reporting net revenues at $6.5 billion – a 23.7% decrease compared to the previous year’s outcome. Used units sold saw even steeper declines, falling by close to 21%. Despite this drop in volume and unit prices being $165 lower than during last year’s record-breaking 3Q period, wholesale gross profits per unit remained strong at an impressive $966 due largely to strength in margin management from retail selectivity efforts made by Carmax executives.

A decrease in sales for their Third Quarter of Fiscal 2023, which was attributed to both the market depreciation and efforts to deliberately slow purchases. CarMax Auto Finance experienced lowered income due increased provisions on loan losses from Tier 2 and 3 originations as well as an increase in average managed receivables. As result, net earnings per share dropped significantly compared with last year’s quarter at $0.24 vs $1.63 respectively.

- Oppenheimer’s Brian Nagel reduced his valuation from $100 to $75 while maintaining an “Outperform” rating.

- Evercore ISI Group analyst Michael Montani lowered his forecast to just above the mid-$50s, and still maintained its existing “In-Line” status.

- John Murphy slashed his initial projection for this stock nearly 50% in total – lowering it all the way down to under $50 and keeping an “Underperform” standing.

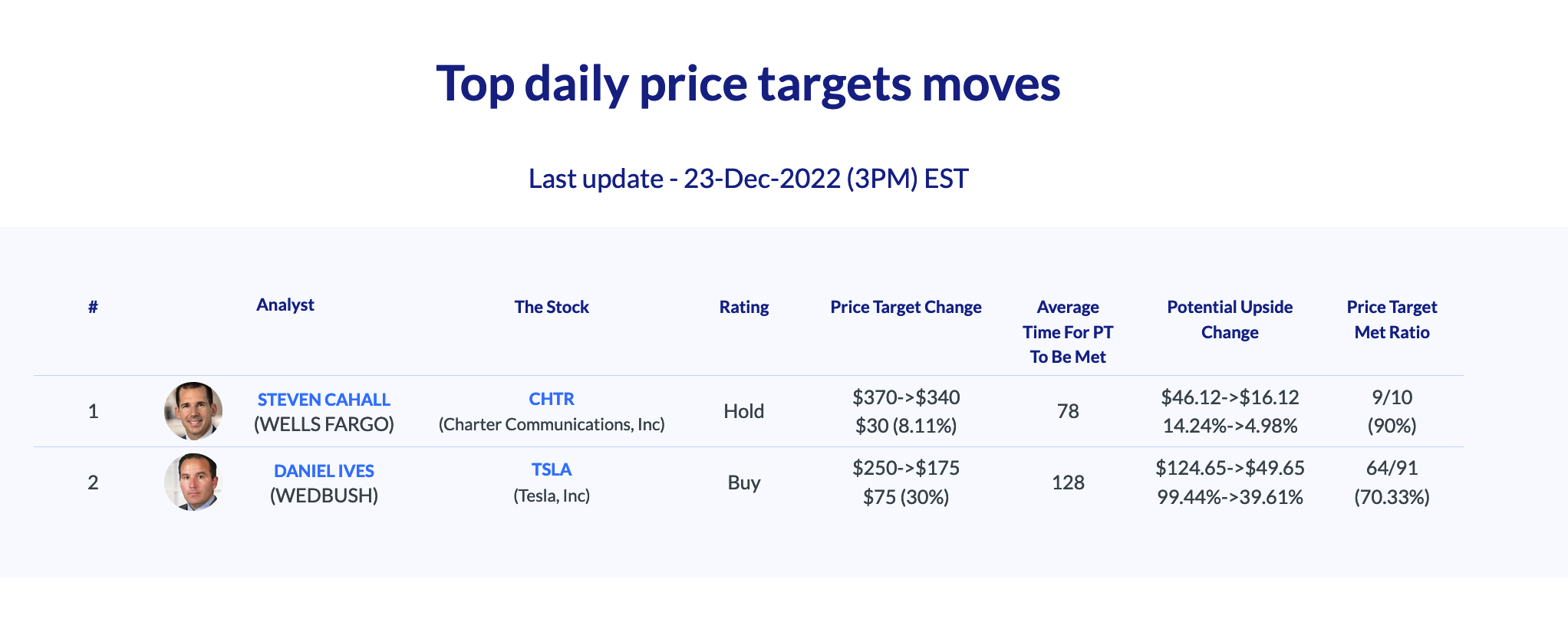

Ives adjusts Tesla lower

2021 has been a year of unprecedented success for TSLA, and renowned Wedbush analyst Daniel Ives was at the forefront.

- Ives lowered today his price target from $250 to $175 – yet still holds an Outperform rating.