Daily Update - February 10, 2023

Selected highlights of the day

By: Matthew Otto

LYFT

Despite their robust increase of 21% year-over-year, Lyft provided disappointing first quarter guidance. The company revealed that for the fourth quarter, it suffered a loss after factoring in a $375 million addition to its insurance reserves. This proved to be substantial, given that consensus estimates were around $1.16 billion for the December quarter–and Lyft reported revenue of only $12 billion.

The decision to increase these reserves was done to “reduce the risk of insurance related volatility” in upcoming periods, according to the company’s presentation to shareholders. However, many shares still hesitated when these results were released due to continued uncertainty associated with these reserved allocations. Adjusting for such non-GAAP factors meant that Adjusted EBITDA registered as negative -$416MM compared toFY 2021’s figure of –$157MM . Q4 highlighted further gains: Lyft yielded 12% more relative 3Q revenues with their closing number reaching an impressive $1.2B.

- Morgan Stanley analyst Brian Nowak has maintained Lyft with an Equal-Weight, and lowered his price target from $17 to $11.

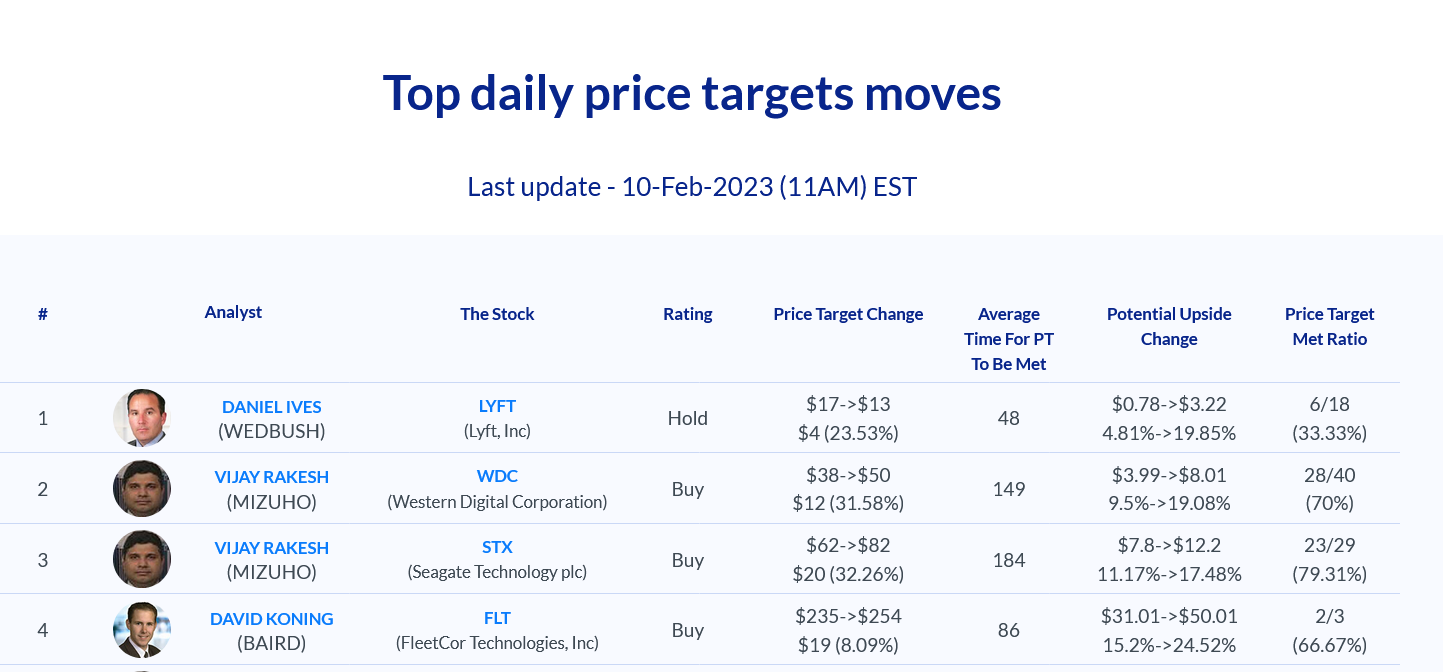

- Wedbush’s Daniel Ives also revised his price target from its prior value of $17 to $13 while implementing a Downgrade from Outperform to Neutral.

- JP Morgan analyst Doug Anmuth also followed suit and revised his price target from of $29 to $15 and reducing his rating from Overweight to Neutral.

- Piper Sandler’s Alexander Potter maintained his Overweight rating; however, slightly altering the price target from $16 to $15.

- Loop Capital’s Rob Sanderson decreased his price target from$17 to $10 and downgraded a Buy to Hold rating.

CyberArk

Have announced their fourth quarter and full year financial results for the year 2022During this period, the Subscription portion of Annual Recurring Revenue (ARR) was $364 million showing a 99% increase compared to the year prior. A 45% increase in Total ARR that now stands at $570 million. The Subscription revenue totals $280.6 million during the same period, demonstrating a growth rate of 108% Year-over-Year. This also holds true for the Total Revenue which was $591.7 million showing substantial 18% Year-Over-Year growth. Last but not least, Net Cash Provided by Operating Activities for the full year is reported to be at 49.7 million for 2022.

Moving on to more detailed discussions about the quarterly performance Investor must appreciate said leaps in its numbers especially staggering subscription revenue that escalated 86 percent from last years’ figure which amounted to 47.6 million going up to 88.5 million whereas little showed an overall decrease hovering Maintenance and Professional Services revenue which registered as 66, 1 million as opposed to 65, 1 during fourth quarter of 2021.

- DA Davidson analyst Rudy Kessinger held a Buy rating for CyberArk Software, raising his price target from $175 to $185.

- Citigroup’s Fatima Boolani also supported the software with a Buy and hiked her stock forecast from $155 to $175.

- Canaccord Genuity analyst Michael Walkley’s raised his price target from $165 to $174 while confirming a Buy recommendation.

- Mizuho Gregg Moskowitz’s price target went up to $175 with reiterating a Buy rating.

- Morgan Stanley’s analysis results reiterate Overweight courtesy of Hamza Fodderwala calibrating the figure anywhere from$160 to$173.

- Barclays Saket Kalia moved her price target from $150 to $158 , keeping her Overweight rating unaltered.

- Needham Alex Henderson set Buy rating and raised her price target from $170 to $180.

Globus is buying NuVasive

Yesterday, Globus Medical, a medical device company, announced an all-stock transaction with a value of $3.1 billion for the acquisition of NuVasive – which produces technology for spine surgeries.

Various analysts have downgraded their appraisals concerning the acquisition.

- Piper Sandler’s Matt O’Brien has shifted his recommendation to Neutral from the previous Overweight status.

- Wells Fargo analyst Vik Chopra revised his stock target price from $82 to $67 while Downgrading Overweight to Equal Weight.

- Truist Securities Richard Newitter adjusted his price target to $70 while additionally Downgrading his rating from Buy to Hold.

- Loop Capital’s Jason Wittes dropped his forecast from his original $90 to $70 as well as reducing its rating from Buy to Hold.

- BTIG’s Ryan Zimmerman moved from Buy to a Neutral rating.

Coursera

Delivered its fourth quarter Financial Results for the 2022 fiscal year.Revenue increased 24% from the prior year to $205.6 million and total revenue for the full year surpassed $523.8 million, a 26% increase from $415.3 million in 2021.

Gross profit totaled $331.5 million for FY22, up 33% from 2019; representing 63.3% of its annual revenue. Non-GAAP figures amounted to $334.6 million gross profit from 63.9% of total revenue that year.

Net losses rounded out at $(175.4) million or (33.5) % of revenue, versus $(145.2) in the previous year; while non-GAAP figures reported a loss of $(53.4)million or 10.2 % of total top line revenue compared with ($52.4)million or 12.6% of revenue in the prior year.

- Morgan Stanley analyst Josh Baer maintained Coursera’s Overweight rating, increasing his price target from $17 to $18.

- Cantor Fitzgerald analyst Brett Knoblauch decreased his price target from $17 to $16 while additionally downgrading his previous Overweight rating to Neutral.

- Needham analyst Ryan MacDonald similarly bumped up his price target to $19 and retained its Buy rating.

- Telsey Advisory Group’s Sarang Vora raised his price target to $20 with an Outperform rating.

- Keybanc analyst Jason Celino adjusted his price target from $16 to $19 and sustained his previous Overweight estimation compared to the others.

PYPL

Paypal revenue in the fourth quarter of 2022 came in at $7.38 billion, according to the data from financial market data analyst Refinitiv. This figure was under analysts’ predictions of $7.39 billion. PayPal CEO Dan Shulman also announced that he aims to step down in 2023.. On a comparable FX-neutral (FXN) basis, Net revenues increased by 7% and 9%, demonstrating a feat seldom seen since before the pandemic. Moreover, looking at GAAP EPS of $0.81, compared to last year’s corresponding quarter’s figure of $0.68, PayPal showed itself growing steadily once more. Non-GAAP EPS also hit $1.24 compared to the previous year’s Q4 figure at $1.11,

- Oppenheimer analyst Dominick Gabriele reasserted an Outperform rating for PayPal Holdings, simultaneously raising his price target from $85 to $90.

- Mizuho analyst Dan Dolev raised his price target of $100, while reiterating his Buy rating.

- Canaccord Genuity analyst Joseph Vafi kept Buy rating and a $160 price target.

- JP Morgan’s Tien-Tsin Huang maintains his Overweight rating and adjusts his price target from $95 to $103.

- Piper Sandler analyst Kevin Barkersets a Neutral rating on PayPal while reducing his own stock prediction from $85 to $82.

Wishing you a good weekend.