Daily Update - February 14, 2023

Selected highlights of the day

By: Matthew Otto

Monday.com

Reported its fourth quarter revenue at $149.9 million, a 57% expansion from the fourth quarter a year earlier. Estimates from FactSet detailed projections of $141.6 million, a modest miss but an impressive figure nonetheless. The company additionally challenged the consensus opinion when they registered diluted earnings per share of 44 cents, compared to the 26 cents loss per share during the same period last year.

Moving onto 2023, Monday shared that it plans total sales to range between $688 million and $693 million, superseding analysts expectations and outgrowing last year’s earnings by a considerable margin of $519 milion. This momentous leap was further validated by a recently formed partnership with Appfire, “the world’s largest enterprise collaboration app provider” as reveals by Monday himself press release.

MNDY concluded financial reporting for its fiscal year 2022, where revenue grew to $519.0 million — an increase of 68% from the previous year, or 71% on an FX-adjusted basis. GAAP operating losses reached $152.0 million compared to $126.1 million in fiscal 2021; this resulted in a negative GAAP operating margin of 29%, which is a 10% improvement from the 41% margin reported the previous year. Additionally, non-GAAP operating losses amounted to $47.1 million, representing a decrease from the 2021 total of $52.6 million; this negative non-GAAP operating margin of 9% also improved on last year’s 17%. Furthermore, GAAP net loss per basic and diluted share was reported as $2.99 — down 35% when compared to prior fiscal year’s figures of $4.53; additionally, non-GAAP net loss per basic and diluted share stood at $0.73, a 45% reduction over last year’s results of $ 1.33 per share.

Wall Street Action

- Loop Capital analyst Mark Schappel has issued a Buy rating and raised his price target from $140 to $180.

- DA Davidson’s Robert Simmons expressed raised his price target to $160, while keeping his Neutral rating.

- Oppenheimer’s George Iwanyc boosted his target to $160 and reaffirmed his rating as Outperform.

- Canaccord Genuity’s David Hynes increased his target price to $160 and maintained his Buy rating.

- J. Derrick Wood from Cowen increased his price target from $165 to $175 and kept his Outperform.

- Fred Lee from Credit Suisse increased his price target to $170 and held an Outperform rating.

- Goldman Sachs Kash Rangan set at $210 a Buy rating.

- Citigroup analyst Steven Enders maintained his Buy rating for Monday.com and raised the price target from $132 to $169.

- Needham’s Scott Berg upped the price target from $130 to $230 while reiterating a Buy rating.

- Piper Sandler’s Brent Bracelin raised his price target from $130 to $185 and maintained an Overweight rating.

- Keybanc’s Jason Celino upgraded Monday.com stock with a price target of $180 up from $156 paired with an Overweight rating.

Arista Networks

Released its financial results for the fourth quarter and year end 2022. Revenue saw a large increase of 48.6%, coming in at $4,381.3 million. Additionally, both GAAP gross margin and non-GAAP gross margin saw small declines compared to 2021 at 61.1% and 61.9% respectively. Revenues of GAAP net income saw large increases from 2021’s figures of $840.9 million, with 4th quarter 2022 reaching a reported $1352.4 million or $4.27 per diluted share—an amount significantly higher than fiscal year 2021’s number of 2.63 per diluted share when considering non-GAAP measures too, netting an income of 1,448.3 million or 4.58 per diluted share–another notable improvement compared to fiscal year 2021’s rate at 2.87 per diluted share as reported by Arista Networks Inc..

Arista provides routers, as well as other networking gear, to cloud providers. Microsoft and Meta Platforms are their two largest customers – with 25.5% of revenue coming from the latter and 15% representing Microsoft’s contribution in the last quarter. This only serves to emphasize Arista would continue to benefit from the large increase in cloud computing demand.

In an investors’ call, supervisors stated that “cloud titans” now account for almost half of total sales, with a robust triple digit increment observed during this period compared to the fourth quarter.

Outlook

For the first quarter of operating, gross margins are estimated to reach up to 60%, wherein it is forecasted that non GAAP operating margin will be lower than 42.6%. Furthermore, estimations have been simplified even further – as potential income earning is predicted at $ 1.21 billion for Street consensus according to projections by leading experts for dollar expenditure of $ 1.25 and $ 1 .325 billion more.

- Morgan Stanley analyst Meta Marshall maintains Arista Networks’s rating at a Equal Weight and increases his price target from $130 to $140.

- Loop Capital Fahad Najam increasing his price target from $181 to $188 and maintaining a current Buy rating.

- Wells Fargo analyst Aaron Rakers bumps up his previous $160 to a new price target of $170 while holding an Overweight rating.

- Cowen & C0 expert Paul Silverstein moves his price target from $212 to $225 while keeping it an Outperform.

- Credit Suisse analyst Sami Badri adjusts the previous stock forecast of $140 up to $146 with a rating staying as Neutral.

- Rosenblatt’s Mike Genovese keeps his ratings as a Buy but moves his price up to $175.

- Needham Alex Henderson upgrades from 155$ up to 165$.

- Barclays Tim Long sticks with an Overweight and raises his price target from 165$ to 177$.

- JMP Securities’ Erik Suppiger rates a Market Outperform and is raising his price target from 135 $to 165$.

Fidelity Information Services

Announced full-year 2023 expectations with earning of $5.70 to $6 a share, which is lower than previously estimated consensus of $6.57 per share. In the fourth quarter, FIS reported preliminary results with adjusted earnings per share (EPS) decreasing 11% to $1.71 and slightly higher than FactSet estimations at $1.70. Furthermore, they reported revenues of $3.71 billion, beating analyst expectations by during the same period at $3.69 billion at Markets Insider reports that this news followed a strategic review in December under new Chief Executive Officer Stephanie Ferris and may help them target towards obtaining investment goals expecting to split his company’s business within a year while still maintaining his commercial relationship building “aggressive growth.”

- Truist Securities analyst Andrew Jeffrey maintains Fidelity with a Hold and lowers the price target from $70 to $65.

- Citigroup’s Ashwin Shirvaikar reduced his price target from $85 to $70 and Downgraded his Buy rating to Neutral.

- Credit Suisse’s Timothy Chiodo also reduced his price target from $85 to $75 and Downgraded his Outperform rating to Neutral.

- Wells Fargo’s Jeff Cantwell lowered his price target from $67 to $65 andkept the Underweight rating unchanged.

- Baird’s David Koning decreased his price target from $84 to $80 while maintaining an Outperform recommendation.

- Barclays’ Ramsey El-Assal amended his price target from $73 to $68 while retaining an Equal-Weight rating.

- Morgan Stanley’s James Faucette modified his price target from $73 to $79 while Upgrading his rating from Equal-Weight to Overweight.

- RBC Capital analyst Daniel Perlin has maintained his Outperform rating for Fidelity and lowers the price target from $93 to $81.

- Raymond James’ John Davis lowered his price target from $86 to $83 and left a Strong Buy rating.

Lattice Semiconductor

Disclosed results in his Fourth Quarter and Full Year 2022 reports, with revenue increasing 28.1% compared to the previous year. Gross margin also expanded significantly to 69.4/70%, while net income improved substantially at $0.37/$0.49 per diluted share for Q4 2022 on a GAAP/Non-GAAP basis respectively – representing an increase of 85% from what was reported for Q4 2021 ($0 .20 /$ 0 .32). Further improvements of 88 % , as Net Income rose from $ 0 . 67 and 1 . 06 Per Diluted Share (on GAAP & Non–GAAP Basis) to reach $ 1:27 And 17 5 Respectively. Looking ahead,the Business Outlook is optimistic,with expectations set between 175 Million – 185 Million For The First quarter Of 2023.

Analyst sentiment surrounding Lattice Semiconductor has been overwhelmingly positive

- Cowen & Co.’s Matthew Ramsay upgrading his appraisal to Outperform and raising the price target from $87 to $95.

- Stifel’s Ruben Roy followed suit by increasing his stock forecast from $60 to $71 while maintaining Hold rating.

- Susquehanna’s Christopher Rolland who upgraded his valuation estimate from $75 to $95 and stayed with a Positive rating.

- Rosenblatt analyst Hans Mosesmann had a target price of $110 and a Buy rating.

- Benchmark analyst David Williams maintains a Buy and raised the price target from $65 to $95.

- Keybanc John Vinh set a $100 price target and an Overweight rating.

Cadence

Achieved higher growth in revenue and net income for 2022 compared to 2021. Revenue increased by 20%, from $2.988 billion to total of $3.562 billion, while the operating margin moved up four percentage points from 26% to 30%. Net income totaled a sum of $849 million or $3.09 per share on a diluted basis for that year as well – over 21% higher than its reported value just one year prior ($696M/$2:50 PS). Similarly strong performance was seen during the fourth quarter, with revenues reaching up 11% at nearly half a trillion dollars ($900m), along with increases both in terms of operating margins (23%) and netted profits (240$ millions; 0:88 EPS).

Cadence’s outlook for FY 2023 is promising, with total revenue expected to reach between $4.00 and 4.06 billion on a GAAP basis; yearly operating margins of 30.5-32% are also predicted alongside net income per diluted share equalling up to $3.34 – based upon non-GAAP measures this value rises as high as $5 per dilutive share along with an increased operational margin range of 40%-42%.

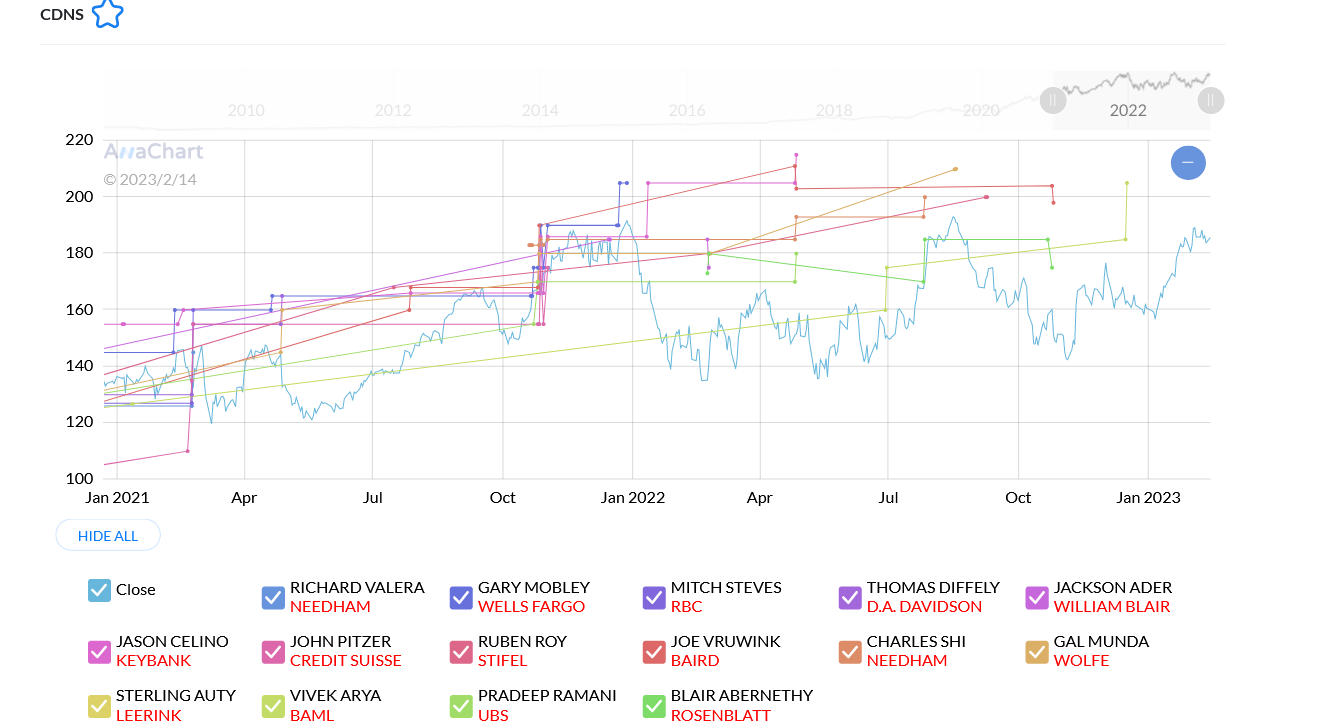

Analysts have significantly increased his price targets for Cadence Design Systems:

- Wells Fargo’s Gary Mobley raised his target from $205 to $215

- Baird’s Joe Vruwink increased his from $206 to $215.

- Rosenblatt Blair Abernethy set a Buy rating and upgraded his stock forecast to $200 from $175.

- Needham Charles Shi also raised his forecast to $235.

- BofA Securities Vivek Arya upgraded his price target to $225.

- Keybanc Jason Celino raised his price target to $225.