Daily Update - February 15, 2023

Selected highlights of the day

By: Matthew Otto

Airbnb had a record-breaking fourth quarter of 2022

With revenue surpassing the forecasted mark and doubling expected profits. Adjusted Ebitda grew 52% compared to the year prior while free cash flow increased by 24%. Gross bookings climbed 20%, resulting in 88 million nights/experiences booked. For 2022 as whole, Airbnb recorded $8.4 billion in sales – an impressive 40% growth rate that resulted in its first annual profit under GAAP analysis principles ($1.9 billion).

Airbnb reported a 24% year-over-year increase in revenue for the fourth quarter, with $1.90 billion exceeding analysts’ expectations of $1.86 billion according to Refinitiv data. The company’s EPS was 48 cents whereas only 25 cents had been anticipated by experts; While net income totaled at an impressive 319 million dollars – appreciably more than their 55 million dollar figure from mere one year prior – adjusted earnings before interest, taxes, depreciation and amortization surpassed all analyst forecasts with 506 million on the StreetAccount scale alone.

- DA Davidson analyst Tom White maintained a Buy rating, and raised his price target from $132 to $145.

- Canaccord Genuity analyst Michael Graham kept a Buy rating along with an increase price target from $145 to $165.

- RBC Capital analyst Brad Erickson’s maintained a Sector Perform accompanied by raising his stock forecast from $110 to $135.

- Wolf Research’s Deepak Mathivanan reiterated a Peer Perform rating.

- Susquehanna analyst Shyam Patil had a Positive rating with upgraded the price target from $136 to $155.

- B of A Securities analyst Justin Post suggested a Neutral rating.

- Goldman Sachs analyst Eric Sheridan rated Sell but raised his price target to $98 from $87.

GlobalFoundries

Released its financial results for Fourth Quarter and Fiscal Year 2022. Significant Fourth Quarter Financial Highlights included Revenue of $2,101 million, a year-over-year increase of 14%. Additionally, there was a Gross Margin of 29.6% and an Adjusted Gross Margin of 30.1%, as well as Net Income of $668 million and Adjusted EBITDA of $821 million. Furthermore, end of period Cash, Cash Equivalents and Marketable Securities totaled $3,346 million.

For the Full Year 2022 Financial Results, highlights included noteworthy proportionate growth in Revenue to $8,108 million compared to the prior year’s result – representing a 23% increase. Overall Gross Margin amounts came in at 27.6% while Adjusted Gross Margin posted 28.4%. Net Income margin was 17.8%, with 38.1% being attributed to Adjusted EBITDA margin throughout the fiscal year being reported upon.

For the first quarter of 2021, GlobalFoundries is forecasting revenues between $1.81 billion and $1.85 billion, with adjusted profits estimated to be between 45 and 53 cents per share. Market analysts were anticipating revenue of $1.83 billion and adjusted profits of 45 cents per share. Adjusted Ebitda for the quarter is expected to lie within a range of $667 million to $722 million.

GlobalFoundries specializes in “lagging edge” semiconductor production for industrial, communications, automotive applications, as well as for PCs and handsets. While market conditions are weak in microprocessors and memory chips industries due to an abundance building up in these sectors that targets PCs and smartphones, however there still remains tight demand for the commodity parts produced by GFS which continue to remain in short supply.

- Susquehanna analyst Mehdi Hosseini maintains a Positive rating and raised his price target from $76 to $84.

- Morgan Stanley Joseph Moore maintained an Overweight rating and raised his price target from $72 to $85.

- Moving along to Loop Capital, Charles Park holds a Buy recommendation with an upward adjustment of his price target from $70 to $80.

- Credit Suisse analyst Chris Caso has set an Outperform, his price target raised from $78 to $85.

- Citigroup analyst Christopher Danely also rates a Buy with his increased price target originating from $67 to $77.

- Cowen & Co. ‘s Krish Sankar retains an Outperform rating and raised his price target from $75 to $80.

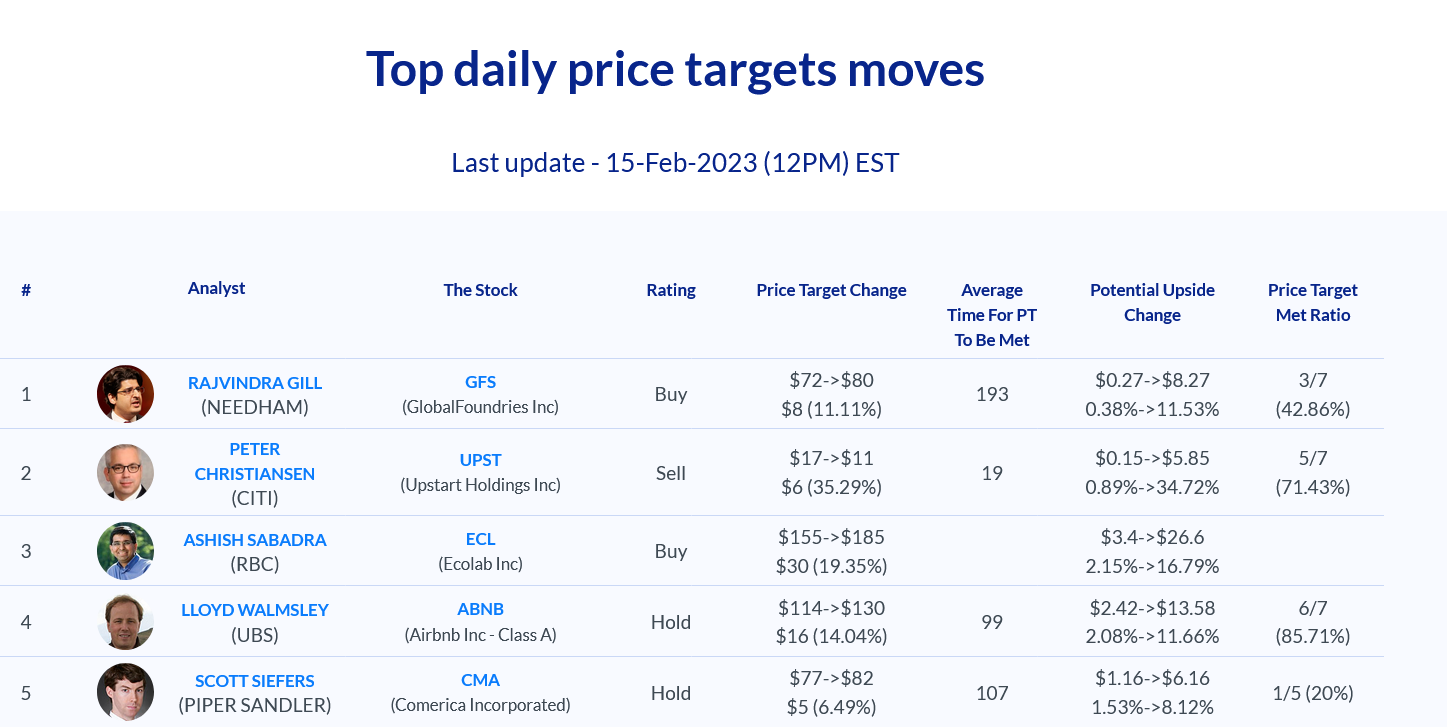

- Needham analyst Rajvindra Gill maintains a Buy rating and increases his price target from $72 to $80.

- HSBC analyst Frank Lee maintained a Hold rating, raising his price target from $55 to $65.

- Raymond James analyst Melissa Fairbanks set anOutperform rating and raised her price target up to $90 from $70.

Udemy Reports Fourth Quarter and Full Year 2022 Results

Announcing a 22% year-over-year increase in total revenue to $165.3 million, with a 4 percentage point negative impact from FX changes year-over-year. Specifically, the Enterprise segment witnessed impressive growth of 57%, accounting for $90.6 million in revenue and Annual Recurring Revenue (ARR) growth of 55% to $371.7 million, facilitated by a 115% Net Dollar Retention Rate, including 123% retention rate for Udemy Business Large Customers (i.e. customers with at least 1,000 employees). Conversely, Consumer segment revenue took a 4% dip year over year.

Udemy recently reported its financial outlook for revenue ranges coming in between $168–$172 million, and up to $730 million.

- Truist Securities Terry Tillman issued a Buy with a lowered price target from $20 to $18.

- Morgan Stanley analyst Josh Baer reduced the price target from $16 to $15 and maintained an Equal-Weight rating.

- Baird’s Rob Oliver also revised his price target from $16 to $15 while maintaining an Outperform outlook.

- Cantor Fitzgerald’s Brett Knoblauch set his price target to $18 while continuing an Overweight rating.

- Needham’s Ryan MacDonald predicted earning numbers of up to $700 million with a derived and lowered his price target from $17 to $16 while still upholding a Buy rating.

- Piper Sandler’s Arvind Ramnani trimmed the rating to Neutral while and lowered his stock forecast from $14.5 to $12.

- Jason Celino on behalf of Keybanc reduced his price target from $19 to $15 while Maintaining an Overweight.

CRDO

Credo Technology(“Credo’s”) largest customer has reduced their demand forecast for certain products due to external factors,

In reviewing the outlook ahead, Credo now anticipates fiscal fourth quarter revenue ending April 29 2023 in the range of $30 million to $32 million amidst macroeconomic headwinds. Moreover, Credo forecasts that full fiscal year revenue associated with FY 2024 remains unchanged relative to FY 2023 and estimates potential recovery either in Q4 of FY 23 or Q1 of FY 24 with an uptick in sequential performance during FY 24.

- Stifel analyst Tore Svanberg has maintained a Buy rating, but has lowered his price target from $19 to $14.

- Suji Desilva of Roth MKM has also reduced his price target from $20 to $14 while maintaining their “Buy” recommendation.

- Goldman Sachs analyst Toshiya Hari likewise continues to back a “Buy” and revised his price target downward from $19 to $14.

- Mizuho analyst Vijay Rakesh has kept a “Buy” rating and reduced his price target from $20 to $16.

- Needham analyst Quinn Bolton has reaffirmed his Buy albeit lowering his recommended price target from his $18 to $15.

- BOFA Securities’ Vivek Arya has lowered his rating from Buy to Underperform and reduced his price target from $18 to $12

- Cowen’s analyst Matthew Ramsay downgraded Outperform to Market Perform with a $11 price target.

Aptiv

Expects a growth in their revenue and operating income from 2022 to 2025. Their operating income is set to more than double, with an estimation of $3.2 billion-$3.5 billion compared to their estimated $1.26 billion commercialized in 2022. Likewise, the company forecasts an increase in total revenue of approximately one third for the same period forecasted (2025), entering values ranging between $23 billion-$24 billion. Lastly, Dublin based Aptiv Plc (a manufacturer of advanced driver assistance systems) reported global light vehicle production growth should be around 2% in 2025.

- Cowen & Co. analyst Jeffrey Osborne has given an Outperform rating and boosted his price target from $134 to $144.

- Guggenheim analyst Ronald Jewsikow has lifted his price target from $138 to $152 while maintaining a Buy rating

- Citigroup analyst Itay Michaeli raised his price target from $138 to $154 while keeping a Buy recommendation.

- Wells Fargo analyst Colin Langan upgraded the stock’s price target from $115 to $120 but maintained an Equal Weight rating.

- RBC Capital analyst Tom Narayan tweaked his price target from $126 to $128 and maintained an Outperform rating.

- Baird analyst Luke Junk also upgraded Aptiv’s price target from $135 to 141 while recommending an Outperform rating.

- Barclays analyst Dan Levy set an Overweight rating with a new price target at 150.

Restaurant Brands International

Reported fourth quarter total revenue of $1.69 billion as of Dec. 31 2022; this marks an approximate 9% rise for the company and is in line with Refinitiv’s IBES data estimates of $1.67 billion. Despite marginal results where earnings per share stood at 72 cents versus a projected 73 cents, QSR benefited from higher operating expenses in their fourth quarter. With its portfolio that encompasses popular names such as Popeyes, Burger King, Tim Hortons and Firehouse Subs, QSR expressed further organizational updates with the recent shift in leadership; incoming Chief Operating Officer Joshua Kobza will take up the role of CEO effective March 1 2021 replacing Jose Cil, who has since left his post after serving as helm since 2019. However, Cil will remain at RBI through 2021 in an advisory capacity.

- Truist Securities analyst Jake Bartlett continues to rate Restaurant Brands as a Buy while raising the price target from $71 to $73.

- Citigroup analyst Jon Tower lowered his price target from $72 to $70 and maintained their Neutral rating.

- BMO Capital analyst Peter Sklar increased the price target from $72 to $76, maintaining an Outperform rating.

- Credit Suisse analyst Lauren Silberman altered her price target from $ 69 to $74 and preserved her recommended Outperform rating.

- Oppenheimer analyst Brian Bittner raised the price target to $81 while reiterating an Outperform.

- Barclays analyst Jeffrey Bernstein adjusted the price target from $80 to $78 while keeping their Overweight rating

- Cowen & Co. analyst Andrew Charles set his Market Perform rating with a price target of $72.

- Stephens analyst Joshua Long raised his price target from $61 to $63 while Maintaining an Equal-Weight