Daily Update - February 21, 2023

Selected highlights of the day

By: Matthew Otto

DraftKings

Has reported better-than-expected revenue for the fourth quarter of 2022, with sales of $855 million, compared to the $801 million predicted by Wall Street. The company also reported a loss of 53 cents a share, with an increase in average monthly payers up by 31% to 2.6 million. The firm has expanded its Sportsbook and iGaming products into new jurisdictions, leading to an increase in player retention. For the full year 2022, DraftKings reported a loss per share of $3.16 on revenue of $2.24 billion, surpassing expectations. DraftKings has raised its 2023 revenue guidance to a midpoint of $2.95 billion, up from $2.9 billion, and expects to report a smaller loss than it forecasted in November 2021. CEO Jason Robins said the company will focus on revenue growth and expense management to accelerate its adjusted Ebitda growth in 2023. DraftKings is now live with mobile sports betting in 20 states, which together represent 42% of the US population.

- Craig-Hallum analyst Ryan Sigdahl maintained the Buy recommendation on DraftKings and raised the price target from $21 to $27.

- JMP Securities analyst Jordan Bender increased their price target from $145 to $220 while maintaining their Market Outperform rating.

- Truist Securities analyst Barry Jonas upped the price target from $15 to $23 while retaining a Hold recommendation.

- Oppenheimer analyst Jed Kelly changed their outlook on the stock to Outperform and revised their price target from $23 to $28.

- Canaccord Genuity analyst Michael Graham kept a Buy rating but slightly increased the outlook’s price target from $28 to $30.

- Needham analyst Bernie McTernan retained their Buy recommendation and boosted the price target from $20 up to $28.

Agricultural machinery company Deere has delivered a “beat-and-raise” quarter

Exceeding Wall Street’s expectations and reporting an increase in earnings per share for the first quarter of the fiscal year 2023. The company reported earnings of $6.55 per share from $11.4 billion in equipment sales, compared to expectations of $5.57 per share from $11.3 billion in equipment sales. Deere’s first-quarter earnings were up from $2.92 per share and $8.5 billion in equipment sales for the same period a year ago. Deere’s CEO, John May, credited the company’s success to favorable market fundamentals, healthy demand, solid execution by employees and suppliers, and an improved operating environment. The company has raised its net income guidance for fiscal 2023 from $8 billion-$8.5 billion to $8.75 billion-$9.25 billion, which is more than the $300 million beat on first-quarter earnings estimates. Deere expects sales in its agricultural machinery business to rise about 20% in fiscal 2023 while the overall industry rises about 5% to 10%. The company also expects sales in its construction business to outpace the industry, rising 10% to 15%.

- Morgan Stanley analyst Dillon Cumming has maintained an Overweight rating with the price target was raised from $522 to $537.

- Argus Research analyst John Eade increased the price target from $475 to $485, while still Maintaining a Buy rating.

- DA Davidson analyst Michael Shlisky also saw an upgrade of his price target, moving it from $520 up to $537 with a Buying rating.

- Wells Fargo analyst Seth Weber maintained an Overweight rating

- Baird analyst Mircea Dobre affirmed an Outperform rating and raised his aim price target from $500 to $512.

- Bernstein Chad Dillard pegged a Market Perform rating while up sizing his target price from $364 to $398.

Apellis Pharmaceuticals

A bio pharmaceutical company that focuses on developing therapies for complement-mediated diseases got the U.S. Food and Drug Administration (FDA) has granted approval for SYFOVRE™ (pegcetacoplan injection) as the first and only treatment for geographic atrophy (GA) secondary to age-related macular degeneration (AMD). GA is a leading cause of blindness that affects more than one million people in the U.S. and five million people worldwide. SYFOVRE has demonstrated a well-established safety profile following approximately 12,000 injections over 24 months, and it is expected to be available through specialty distributors and specialty pharmacies nationwide by the beginning of March. A decision on a marketing authorization application for SYFOVRE is expected from the European Medicines Agency in early 2024, and a marketing application has also been submitted to Health Canada.

- Stifel analyst Annabel Samimy has maintained her Buy rating on and increased her price target from $65 to $75.

- Baird analyst Colleen Kusy raised her price target from $90 to $105, whilst remaining in her Outperform rating.

- Citigroup analyst Yigal Nochomovitzf adjusted his price target upward from $86 to $91 and retained with a Buy position.

- HC Wainwright & Co. Analyst Douglas Tsao remained with the Buy rating and a $87 price target.

- Needham Analyst Joseph Stringer upgraded his target price from of $70 to $80, while reiterating a Buy.

Tomorrow, Nvidia will release its fourth-quarter fiscal year 2023 results.

- Oppenheimer’s Patrick Scholes is holding onto his Outperform rating and raising his estimated price target from $225 to $250.

- Joseph Moore with Morgan Stanley is raising his price target from $175 to $246 and maintaining an Equal-Weight rating.

- Stifel’s Ruben Roy lifting his target from $175 to $207 while still upholding a Hold status.

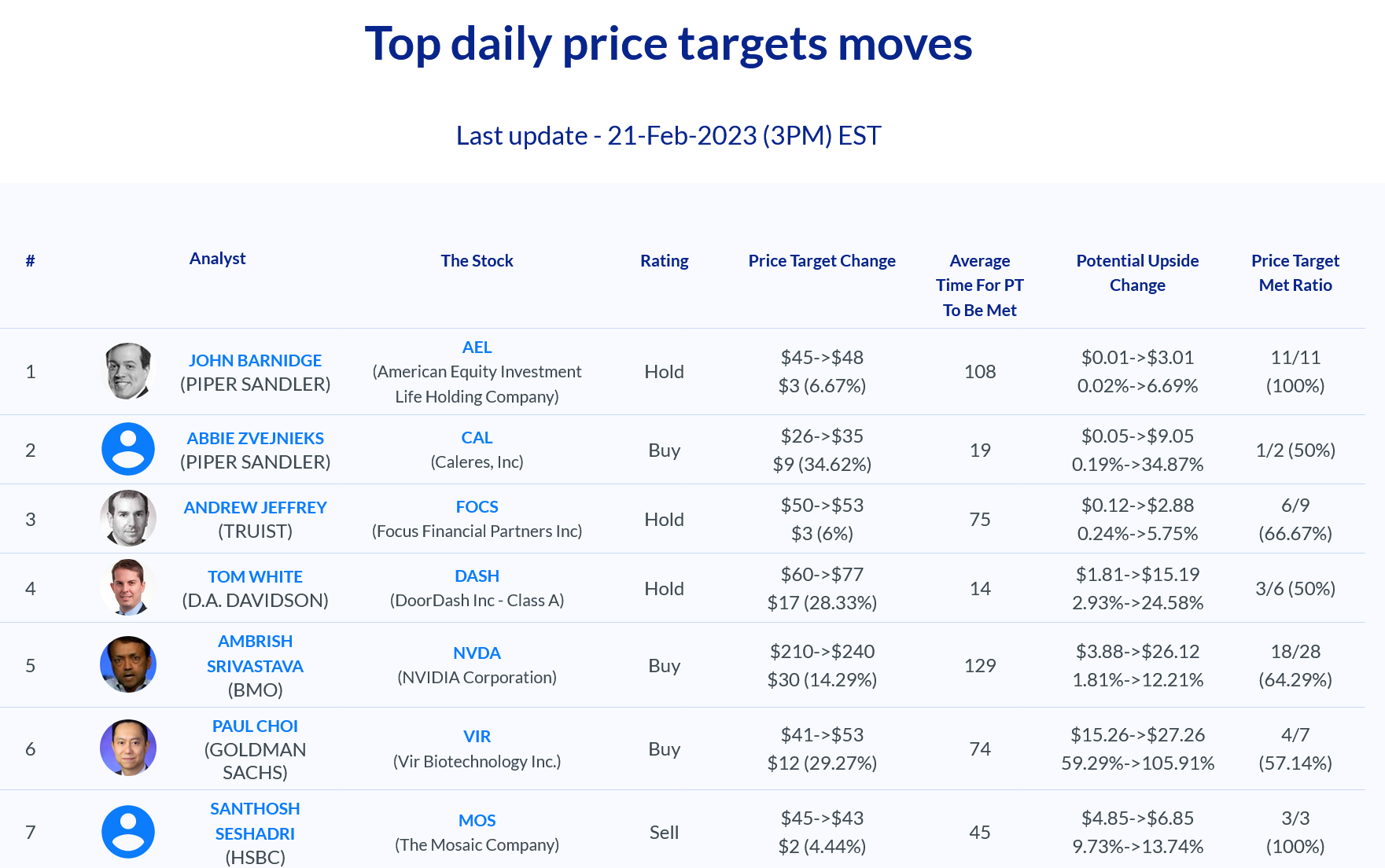

- BMO Capital’s Ambrish Srivastava reiterated his Outperform designation and increased his stock forecast from $210 to $240.

TVTX

Last week The U.S. Food and Drug Administration (FDA) has granted accelerated approval to Travere Therapeutics for its drug FILSPARI (sparsentan), the first non-immunosuppressive therapy for reducing proteinuria in adults with primary IgA nephropathy who are at risk of rapid disease progression. IgA nephropathy is a rare kidney disease and a leading cause of kidney failure. FILSPARI is a once-daily oral medication that targets two critical pathways in the disease progression of IgAN. The approval is based on interim results from the ongoing Phase 3 PROTECT head-to-head trial that demonstrated a rapid and sustained reduction in proteinuria versus active control, irbesartan. Ligand Pharmaceuticals, which partnered with Travere Therapeutics for the development of FILSPARI, is entitled to receive a net $15.3 million milestone and net royalties of 9% on future global net product sales of sparsentan.

- Piper Sandler analyst Do Kim has upgraded his outlook to Overweight while raising the price target from $42 to $46.

- Wedbush analyst Laura Chico, meanwhile, set her price target at $30 while upgrading the rating of Neutral to Outperform.

- Barclays analyst Carter Gould kept his rating at Overweight and revised the prior price target of $37 to $31.

- HC Wainwright & Co. analyst Ed Arce raised the price target from $36 to $40 while maintaining a Buy rating.

AMC Networks

Reported adjusted earnings of $2.52 a share on revenue of $965 million in the fourth quarter of 2022, beating estimates and sending the stock up more than 20%. The company added 700,000 new streaming subscribers in the quarter, taking its year-end total to 11.8 million. Despite declining advertising revenue, content licensing revenue surged 152% to $300 million and streaming revenue jumped 41%. AMC Networks plans to focus on maximizing the value of its content, reducing costs, and driving cash flow. The company recently named Kristin Dolan as its new CEO and confirmed plans to cut around 20% of its US staff.

- Thomas Yeh, an analyst at Morgan Stanley, has an Equal Weight rating. Moreover, he has revised the price target from $19 to a higher $24.